Score

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

China

ChinaProducts

10

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Surpassed 40.25% brokers

Securities license

Obtain 1 securities license(s)

CSRCRegulated

ChinaSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China SSE

国都证券股份有限公司

Brokerage Information

More

Company Name

GuoDu Securities Co.,Ltd

Abbreviation

国都证券

Platform registered country and region

Company address

Company website

http://www.guodu.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0%

Funding Rate

8.35%

New Stock Trading

Yes

Margin Trading

YES

| GuoDu Securities Co.,Ltd |  |

| WikiStock Rating | ⭐ ⭐ ⭐ ⭐ |

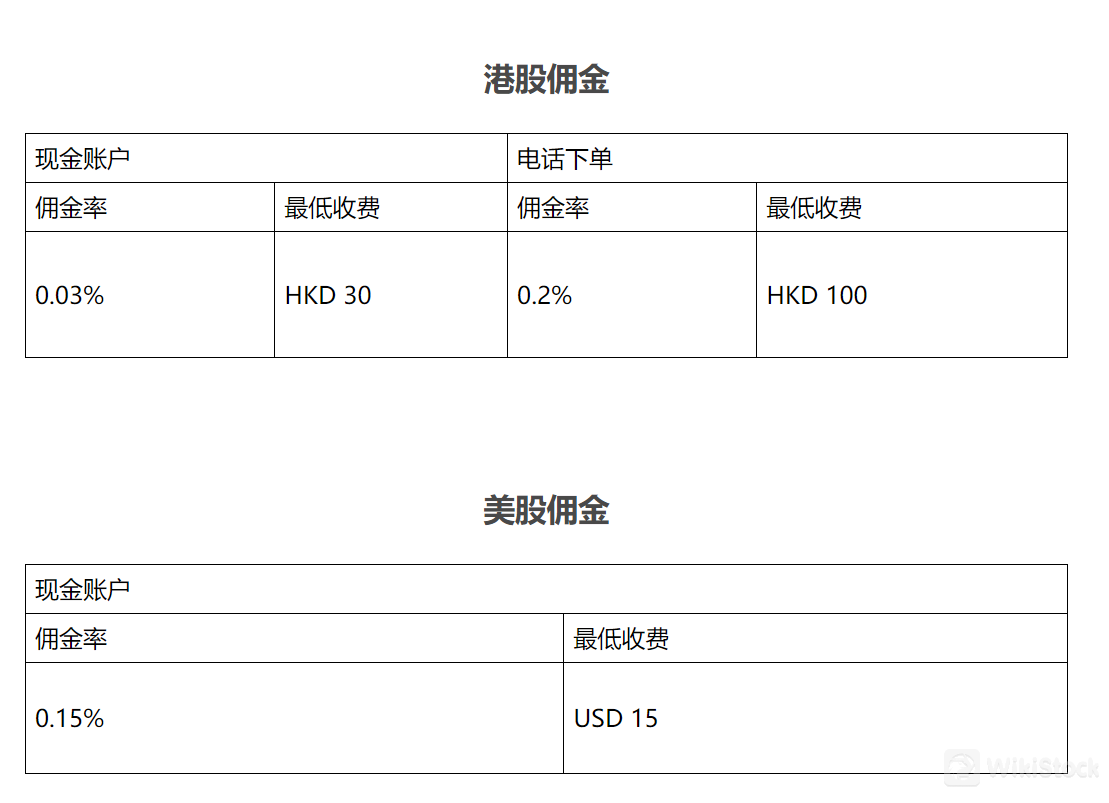

| Fees | Hong Kong stocks: 0.03% commission rate, minimum HKD 30;U.S. stocks: 0.15% commission rate, minimum USD 15 |

| Margin Interest Rates | 8.35% |

| Mutual Funds Offered | Yes |

| App/Platform | GuoDu Securities Interactive Online Trading, Quick Win Online Trading, Standalone Entrustment, VIP Management Platform, and more |

| Promotions | Not available yet |

What is GuoDu Securities Co.,Ltd?

GuoDu Securities Co., Ltd., established on December 28, 2001, with its registered address in Shenzhen, is a comprehensive securities company approved by the China Securities Regulatory Commission (CSRC). GuoDu Securities Co., Ltd. stands out for its regulatory compliance under the CSRC, offering access to IPOs and providing user-friendly trading platforms. However, it falls short by not supporting forex and cryptocurrency trading.

Pros and Cons of GuoDu Securities Co.,Ltd?

GuoDu Securities Co., Ltd. is a well-regulated brokerage firm under the authority of the China Securities Regulatory Commission (CSRC). It offers a variety of advantages, including access to IPOs and user-friendly trading platforms that enhance the overall trading experience. Additionally, their customer service is bolstered by live chat support, ensuring prompt assistance for clients.

However, it is important to note that GuoDu Securities does not support forex or cryptocurrency trading, which may be a limitation for some investors. Moreover, GuoDu Securities does not offer promotions, which further limits the incentives for potential clients to choose their services.

| Pros | Cons |

|

|

|

|

|

|

|

Is GuoDu Securities Co.,Ltd safe?

Regulations

GuoDu Securities Co., Ltd. is currently licensed by the China Securities Regulatory Commission (CSRC).

What are securities to trade with GuoDu Securities Co.,Ltd?

GuoDu Securities Co., Ltd. provides a diverse selection of trading instruments to meet the needs of investors across various markets.

Firstly, clients can trade stocks, enabling them to buy and sell shares of publicly listed companies, thereby participating in the equity markets. Additionally, the brokerage offers access to bonds, allowing investors to invest in fixed-income securities issued by governments, municipalities, or corporations, providing potential steady income streams.

Moreover, GuoDu Securities facilitates trading in mutual funds, providing investors with the opportunity to invest in professionally managed portfolios of stocks, bonds, or other securities. Furthermore, the inclusion of Hong Kong stock connect allows investors to trade shares listed on the Hong Kong Stock Exchange, providing access to companies listed in one of Asia's major financial hubs.

GuoDu Securities also offers access to the Beijing Stock Exchange, providing clients with opportunities to invest in companies listed on this exchange, which focuses on small and medium-sized enterprises (SMEs) and innovative enterprises. Additionally, the brokerage provides access to stock options, enabling investors to buy or sell a specific stock at a predetermined price within a specified time frame, offering flexibility and potential hedging strategies.

Lastly, GuoDu Securities facilitates trading in futures IB, allowing investors to speculate on the future price movements of various assets, including commodities, currencies, and stock indices.

However, it's important to note that GuoDu Securities does not offer cryptocurrency or foreign exchange trading, limiting options for investors interested in these asset classes.

GuoDu Securities Fees Review

GuoDu Securities offers a range of trading services with distinct fee structures depending on the market and method of order placement.

For Hong Kong stocks, the commission rate for a cash account is 0.03% with a minimum charge of HKD 30, while phone orders incur a commission rate of 0.20% with a minimum charge of HKD 100.

When trading U.S. stocks through a cash account, the commission rate is 0.15% with a minimum charge of USD 15.

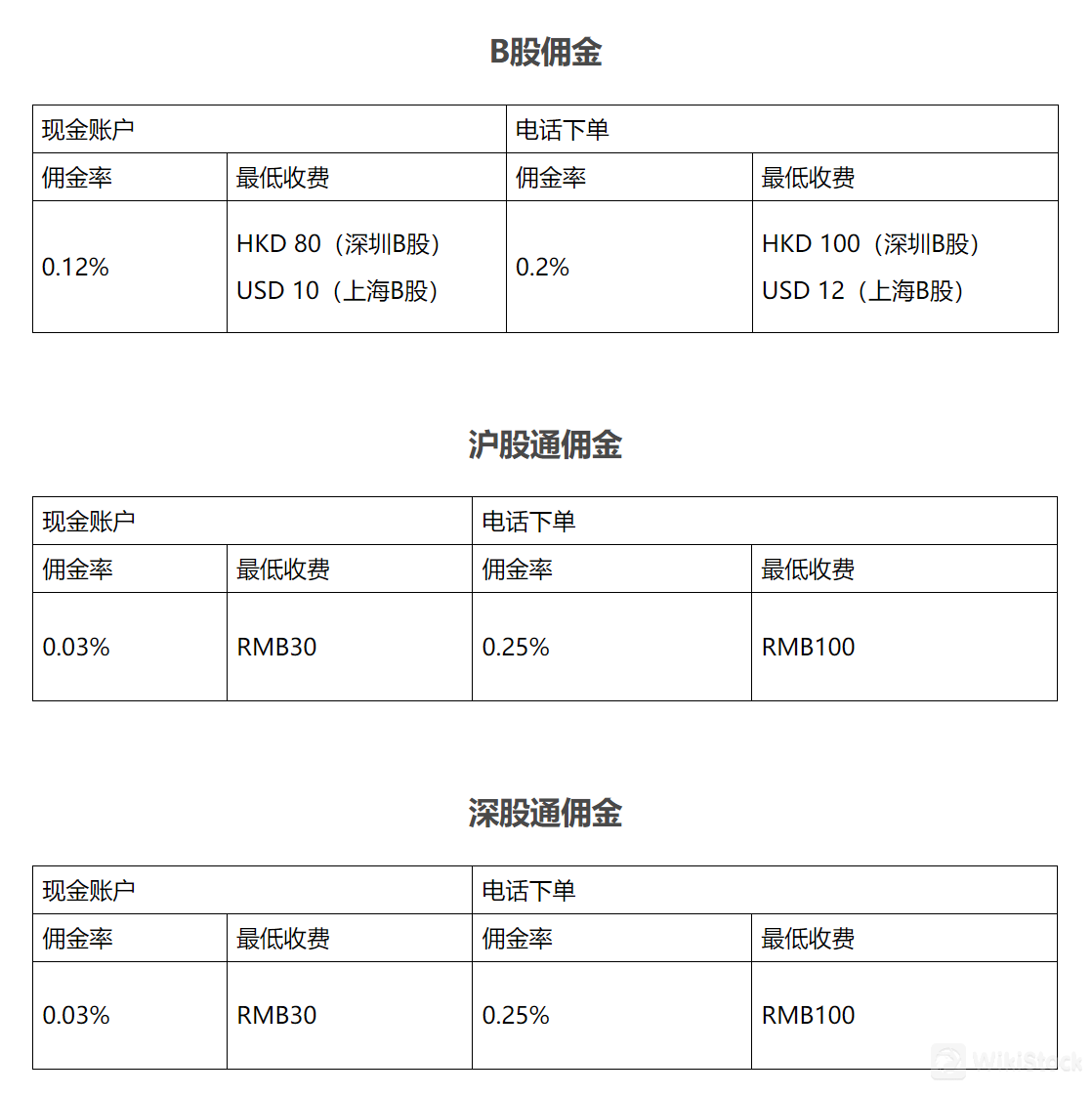

For B shares, the commission for a cash account is 0.12% with a minimum charge of HKD 80 for Shenzhen B shares and USD 10 for Shanghai B shares, whereas phone orders have a commission rate of 0.20% with a minimum charge of HKD 100 for Shenzhen B shares and USD 12 for Shanghai B shares.

For Shanghai-Hong Kong Stock Connect, the commission rate for a cash account is 0.03% with a minimum charge of RMB 30, and phone orders are charged at a rate of 0.25% with a minimum charge of RMB 100.

Similarly, for Shenzhen-Hong Kong Stock Connect, the commission for a cash account is 0.03% with a minimum charge of RMB 30, and phone orders incur a commission rate of 0.25% with a minimum charge of RMB 100.

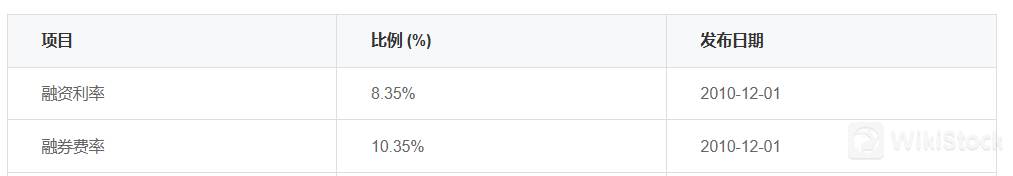

GuoDu Securities Co., Ltd. offers a margin interest rate of 8.35% and a securities lending fee rate of 10.35%. These rates represent the costs associated with borrowing funds for trading on margin and borrowing securities for short selling, respectively.

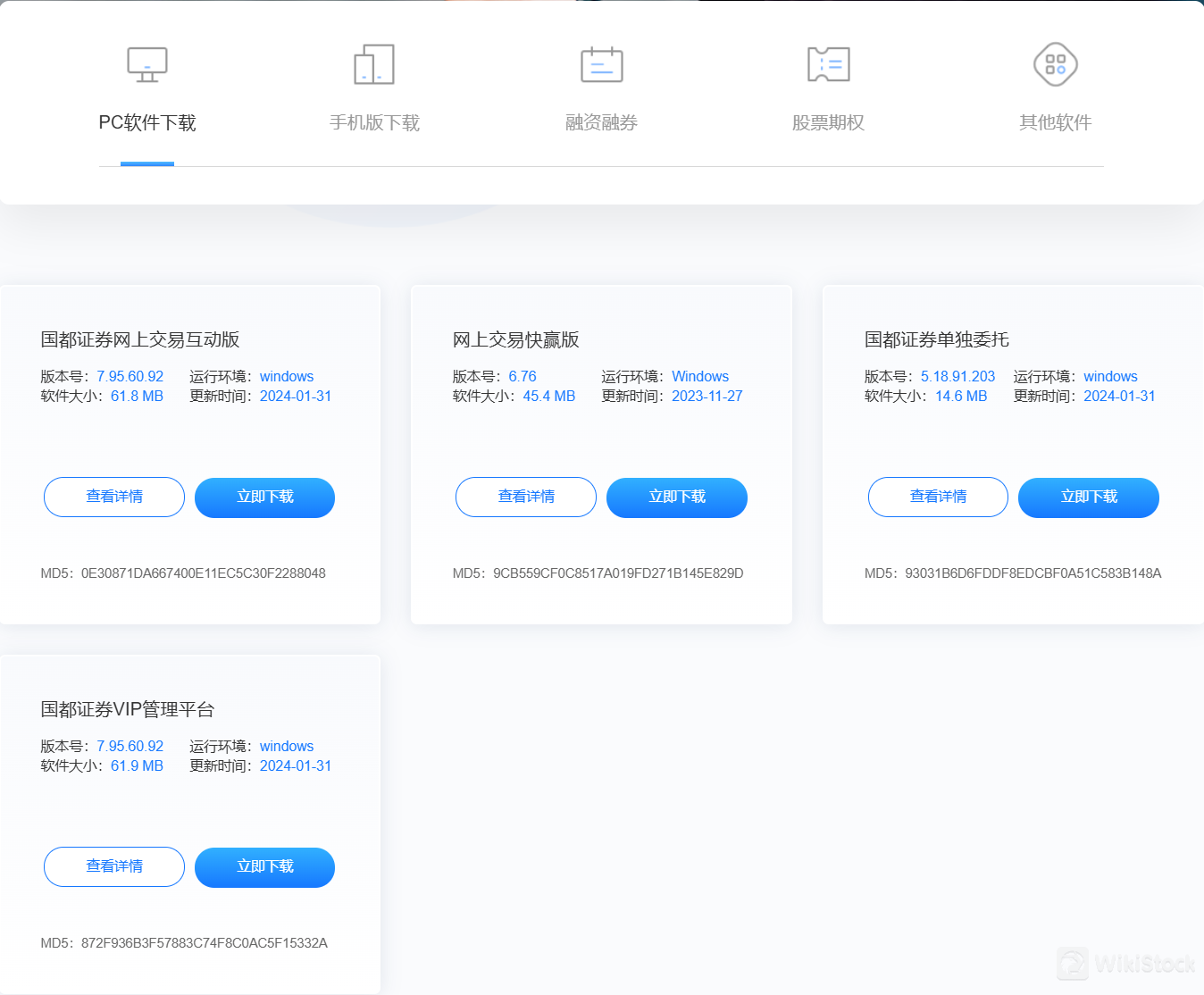

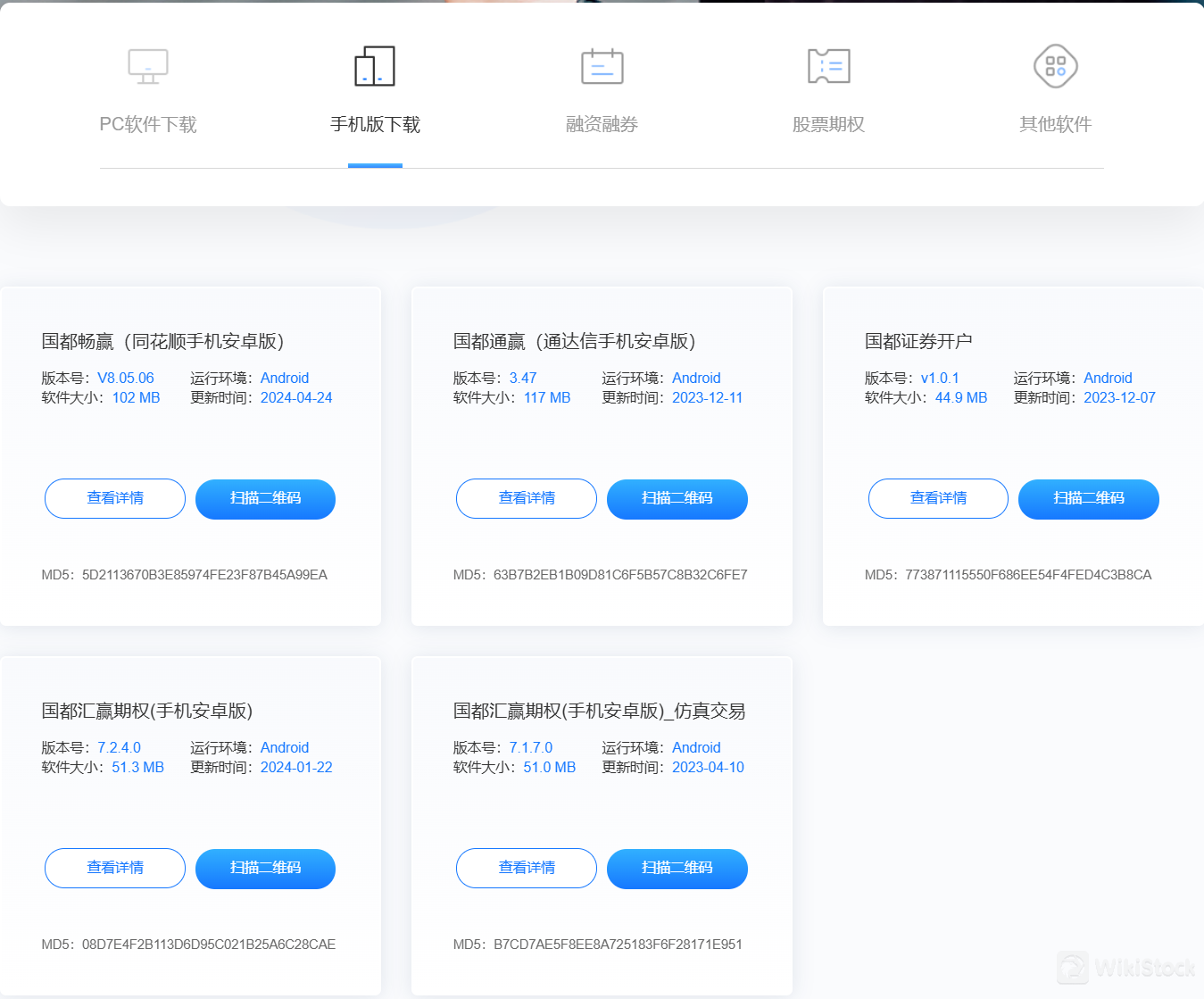

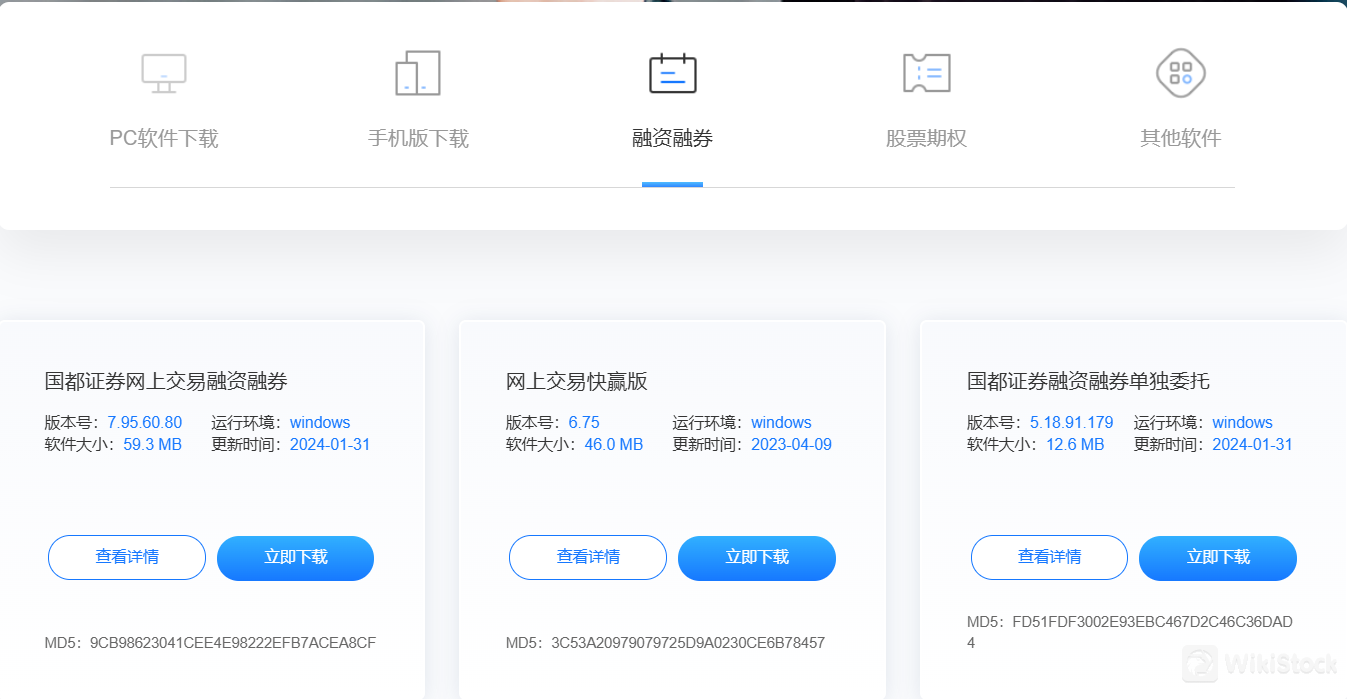

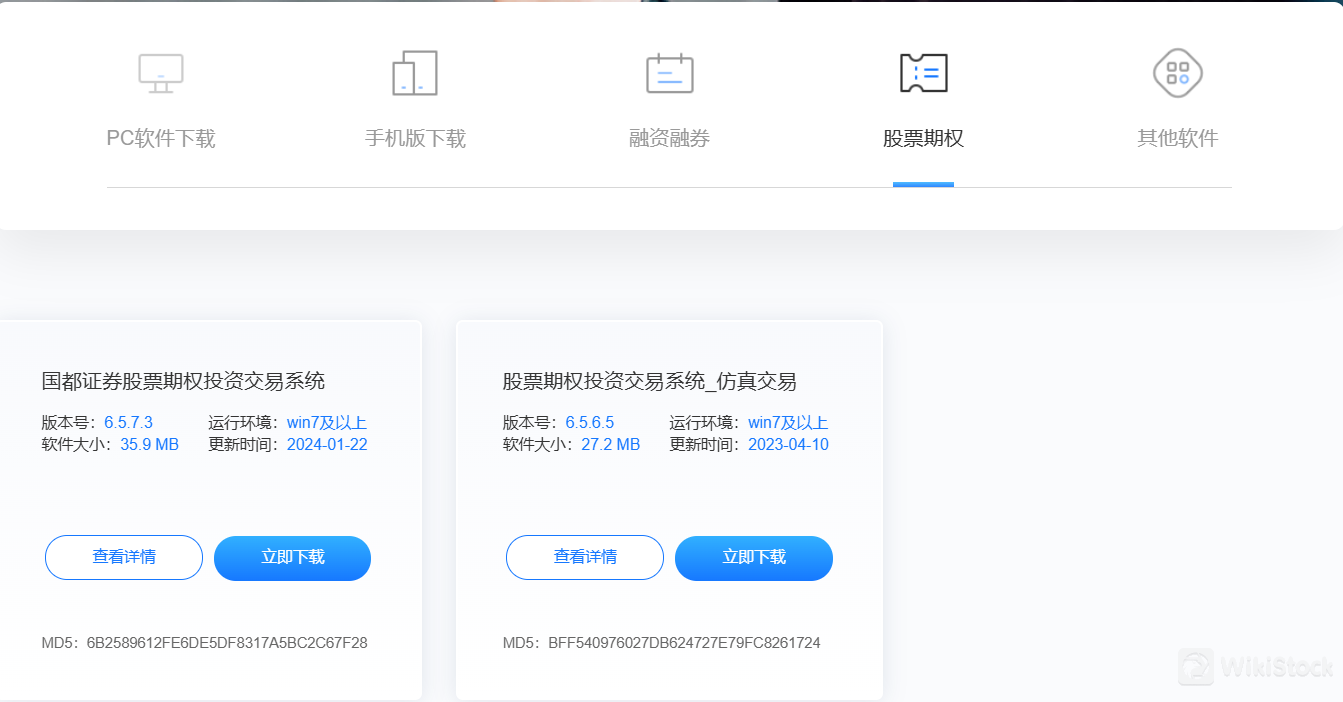

GuoDu Securities Co.,Ltd App Review

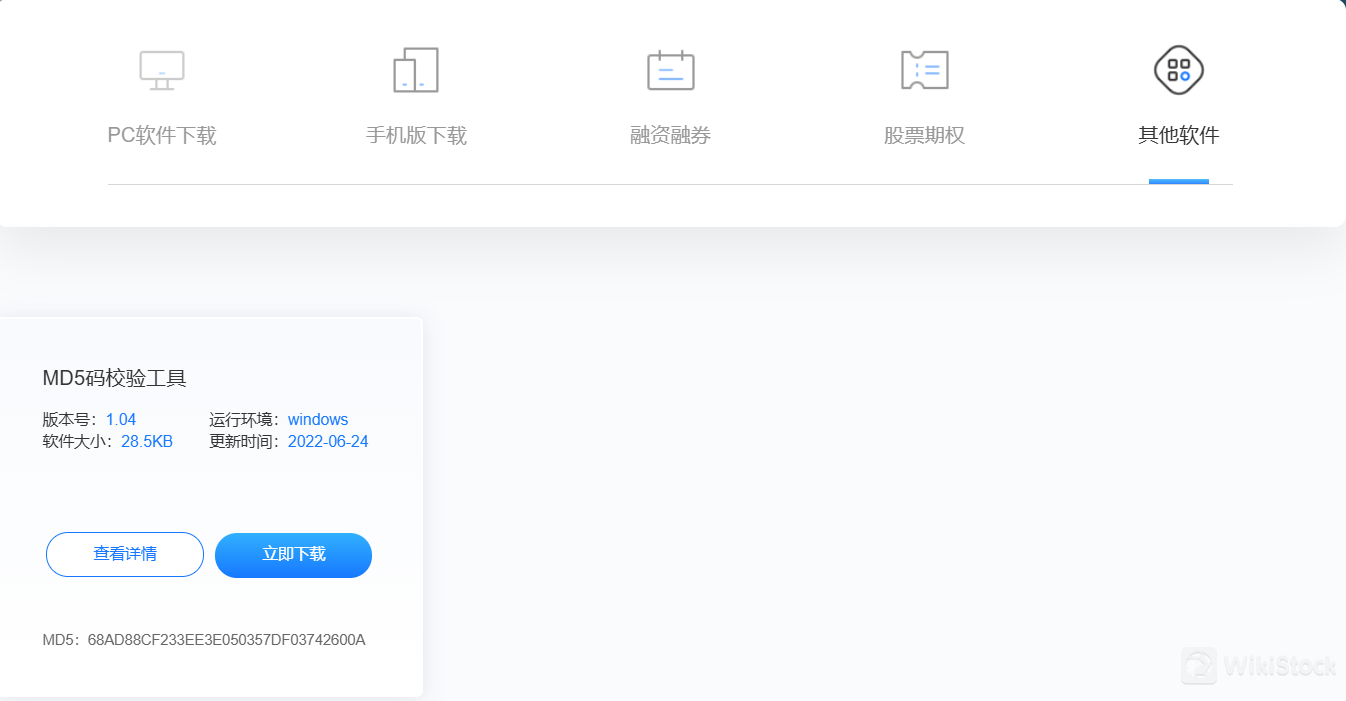

GuoDu Securities Co., Ltd. offers a range of trading platforms to meet various client needs.

For PC users, they provide the GuoDu Securities Interactive Online Trading, Quick Win Online Trading, Standalone Entrustment, and the VIP Management Platform.

Mobile users can choose from GuoDu ChangYing (TongHuaShun Android Version), GuoDu TongYing (TongDaXin Android Version), GuoDu Securities Account Opening, and GuoDu HuiYing Options (Android Version and its simulation).

Additionally, they offer financing and margin trading through the Quick Win Online Trading and Standalone Entrustment platforms, and stock options trading systems, including a simulation version. An MD5 checksum tool is also available for software verification.

Research and Education

GuoDu Securities Co., Ltd. offers a comprehensive investor education program to enhance financial literacy and investment knowledge among its clients. The program covers a broad spectrum of topics, including stocks, mutual funds, bonds, stock options, Hong Kong stock connect, anti-money laundering, suitability management, and new business ventures. To ensure investors are well-informed, the company provides various risk warnings related to new stock trading, delisting, and other potential risks.

The Investor Protection section keeps clients updated on the latest educational initiatives, new strategies in capital markets, and emphasizes the importance of understanding rules and recognizing risks. The Policies and Regulations segment offers access to relevant laws, regulatory guidelines, business rules, and account management norms.

GuoDu Securities is also committed to combating illegal securities activities by disclosing information, sharing case studies, providing educational content, and facilitating the reporting and complaint process. Additionally, the company offers a series of educational videos to make learning more accessible and engaging for investors.

The GuoDu Securities Research Institute supports the company's business by providing independent and objective analysis on macroeconomics, financial markets, industry trends, and company values. Focused on macro strategies and industry research, the institute tracks macroeconomic fundamentals and policies, offering market trend forecasts and industry allocation recommendations. It covers key sectors such as technology, consumer goods, cyclical industries, and more, providing clients with valuable research products like daily briefings, weekly reports, company earnings reviews, and investment strategy reports.

Customer Service

Customers can reach out to the nationwide customer service and complaint hotline at 400-818-8118. Additionally, complaints can be submitted via email at tousujieshou@guodu.com. The postal code for written correspondence is 100007. For more convenient and instant support, GuoDu Securities also offers customer service through their official WeChat account and live chat options. The headquarters is located at 9th floor, Guohua Investment Building, No. 3 Dongzhimen South Street, Dongcheng District, Beijing City.

Conclusion

GuoDu Securities Co., Ltd. shines with its regulatory compliance under the CSRC and its provision of user-friendly trading platforms. It is well-suited for investors seeking access to IPOs and a reliable brokerage service in the Chinese market. However, it is important to note that GuoDu Securities does not support forex or cryptocurrency trading, which may be a limitation for some investors. Moreover, GuoDu Securities does not offer promotions, which further limits the incentives for potential clients to choose their services.

FAQs

Is GuoDu Securities Co., Ltd. a safe option for trading?

GuoDu Securities Co., Ltd. is regulated by the China Securities Regulatory Commission (CSRC). However, detailed information regarding fund safety and specific safety measures is currently unavailable.

Is GuoDu Securities Co., Ltd. a suitable platform for beginners?

Yes, GuoDu Securities Co., Ltd. offers a range of trading platforms and educational resources, making it a viable option for beginners who wish to learn and engage in trading activities within the financial markets.

Is GuoDu Securities Co., Ltd. a legitimate brokerage?

GuoDu Securities Co., Ltd. holds a license issued by the China Securities Regulatory Commission (CSRC).

Risk Warning

The information presented is derived from an expert assessment of GuoDu Securities Co., Ltd.'s website data by WikiStock. It is important to note that this information may evolve over time. Additionally, it's imperative for investors to recognize that online trading carries significant risks, which could result in the complete loss of invested funds. Therefore, understanding these risks thoroughly before engaging in trading activities is essential.

Others

Registered region

China

Years in Business

1-2 years

Products

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

Lombarda China Fund Management Company

Group Company

--

国都期货有限公司

Group Company

--

国都创业投资有限责任公司

Group Company

--

国都景瑞投资有限公司

Group Company

--

中国国都(香港)金融控股有限公司

Group Company

Review

No ratings

Recommended Brokerage FirmsMore

国融证券

Score

长城国瑞证券

Score

中天证券

Score

华金证券

Score

CGWS

Score

CICC

Score

东兴证券

Score

Shengang Securities

Score

国投证券

Score

国信证券

Score