Launched in May 2000, iDealing is a leading European securities brokerage located at the heart of the City of London. We are a member of the London Stock Exchange, and are authorised and regulated by the Financial Conduct Authority (FCA). Client cash and securities that are segregated and treated as "Client Money/Assets" as per the FCA Rules are protected in that they are both held in accounts designated as belonging to "Clients". Therefore, in the event of iDealing's failure, creditors cannot make any claims against such client assets in accordance with FCA regulations.

What is iDealing.com Limited?

iDealing.com Limited is a regulated brokerage firm licensed by the Financial Conduct Authority (FCA) in the UK, ensuring adherence to strict regulatory standards and providing customers with a sense of security in their trading activities. The platform offers user-friendly trading interfaces and tailored account options to cater to investors' needs. However, it lacks access to Initial Public Offerings (IPOs), has limited customer service channels, and lacks educational resources for traders.

Pros and Cons of iDealing.com Limited?

iDealing.com Limited stands out as a regulated brokerage firm, licensed by the Financial Conduct Authority (FCA) in the UK, ensuring compliance with stringent regulatory standards. This regulatory oversight provides customers with a sense of security and trust in their trading activities. The platform boasts user-friendly trading interfaces, facilitating seamless navigation and execution of trades, enhancing the overall trading experience. Moreover, iDealing.com Limited offers a diverse range of account options, catering to the varied needs and preferences of investors. However, despite these advantages, there are notable drawbacks. The platform does not provide access to Initial Public Offerings (IPOs), limiting opportunities for traders interested in investing in newly listed stocks. Additionally, customer service channels are relatively limited, potentially hindering prompt resolution of inquiries or issues. Furthermore, there is an absence of educational resources, which may impact the ability of traders to access valuable learning materials to enhance their investment knowledge and skills.

Is iDealing.com Limited safe?

Regulation

iDealing.com Limited is presently licensed by the Financial Conduct Authority (FCA) with license number 191660.

Funds Safety

Client cash and securities that are segregated and treated as “Client Money/Assets” as per the FCA Rules are protected in that they are both held in accounts designated as belonging to “Clients”. Therefore, in the event of iDealing's failure, creditors cannot make any claims against such client assets in accordance with FCA regulations. iDealing's eligible clients are covered up to Scheme limits for eligible claims by the Financial Services Compensation Scheme (FSCS).

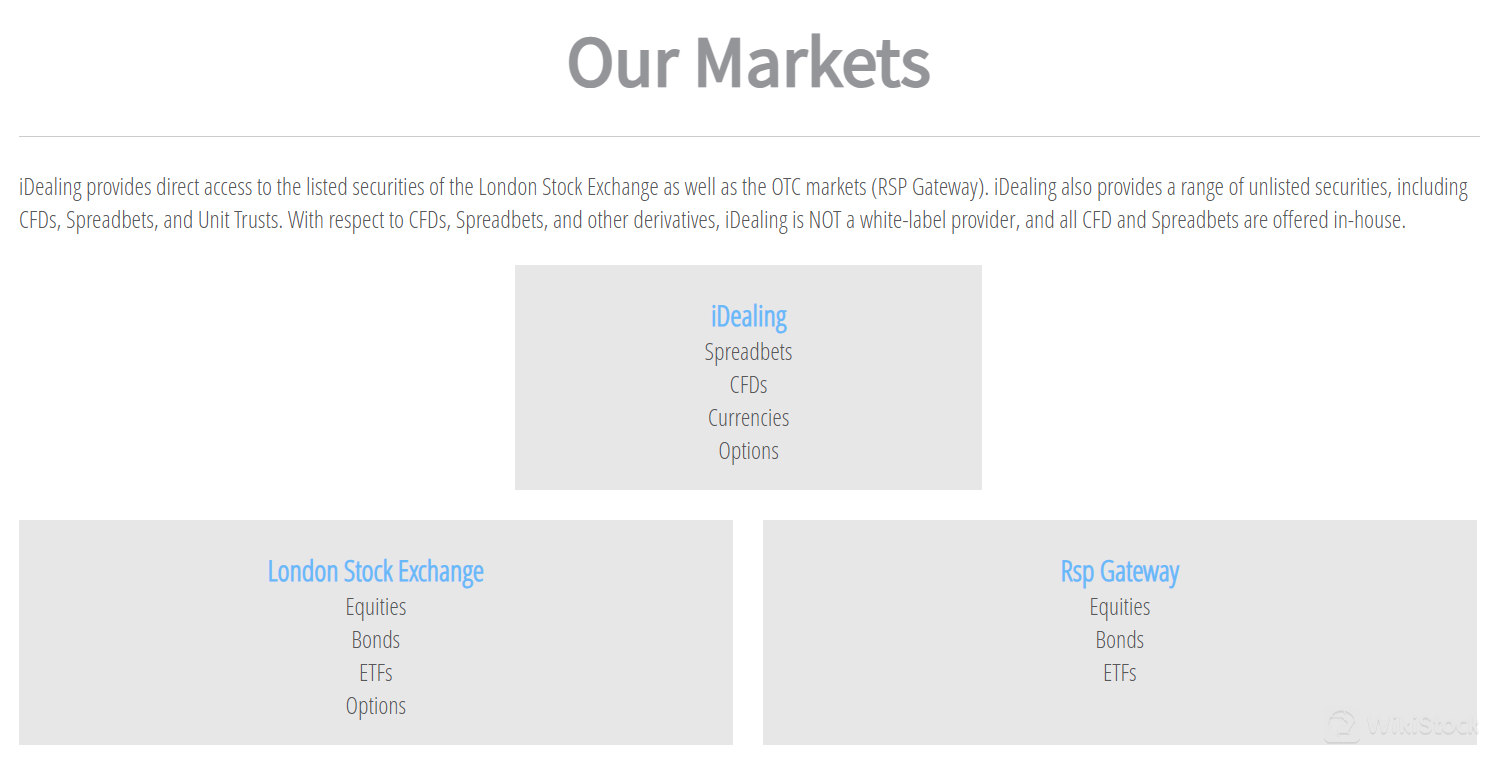

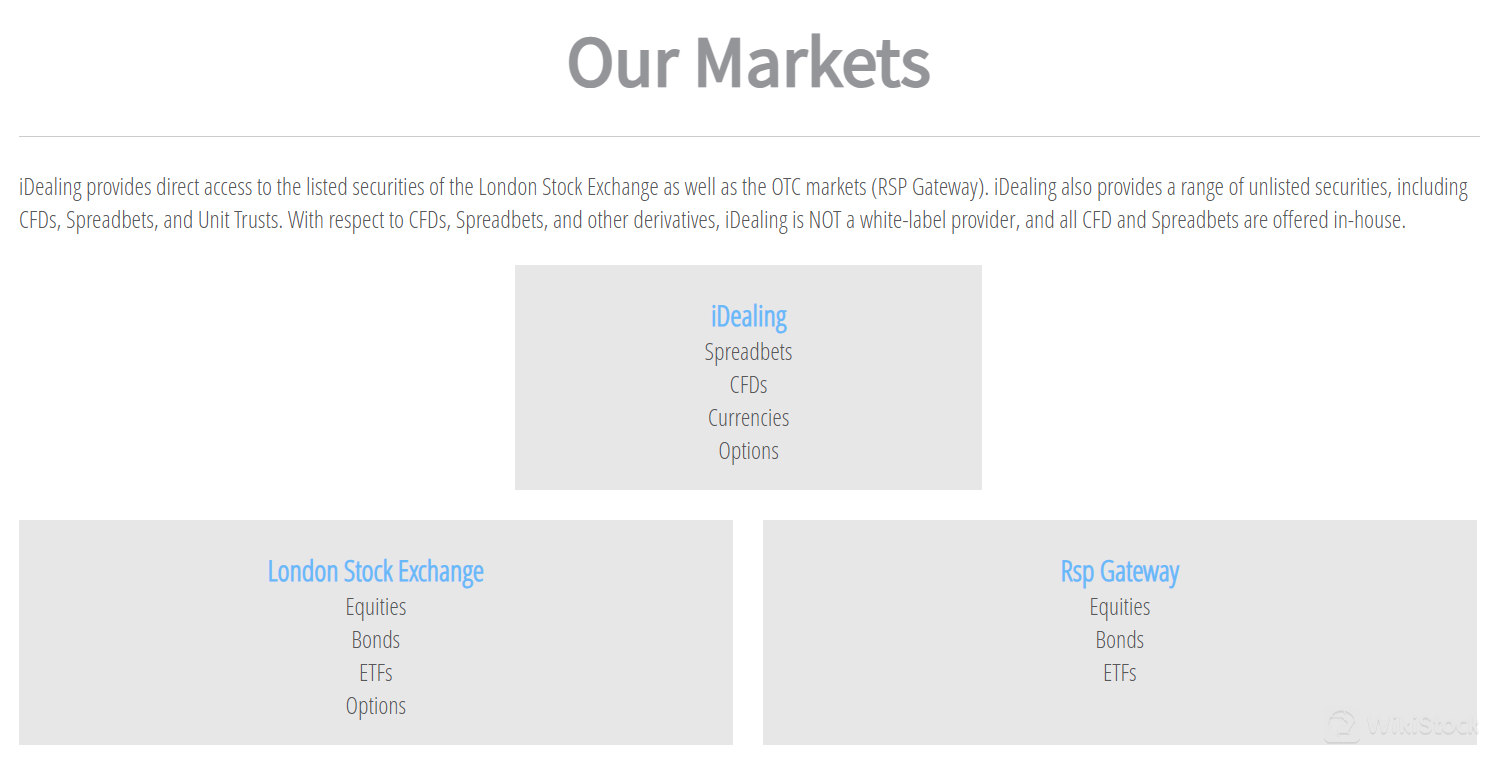

What are securities to trade with iDealing.com Limited?

iDealing.com Limited offers a variety of financial products, including Spreadbets, CFDs, Currencies, Options, Equities, Bonds, and ETFs.

iDealing.com Limited Accounts

iDealing.com Limited provides investors with a diverse selection of account types tailored to meet various financial goals and preferences. These include the Standard Account, ISA (Individual Savings Account), Margin Account, SIPP (Self-Invested Personal Pension) Account, Junior ISA, and IFISA (Innovative Finance ISA) account.

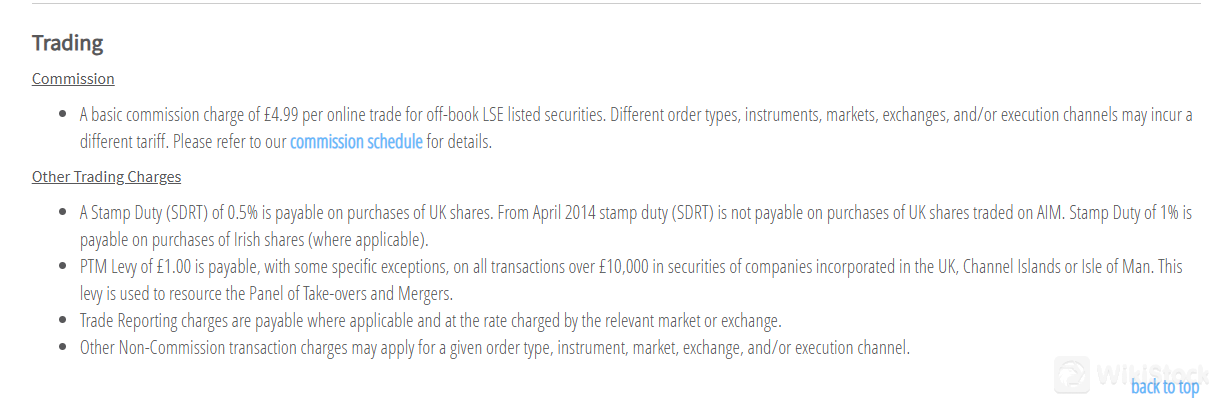

iDealing.com Limited Fees Review

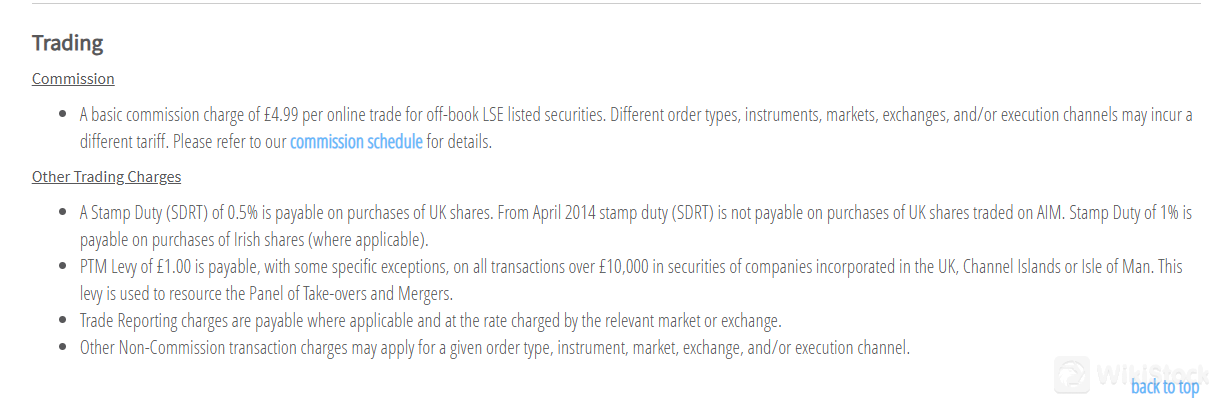

iDealing.com Limited applies the following commissions and fees:

Commission: There is a basic commission charge of £4.99 per online trade for off-book LSE listed securities. Different order types, instruments, markets, exchanges, and/or execution channels may incur different tariffs.

Stamp Duty (SDRT): A Stamp Duty (SDRT) of 0.5% is payable on purchases of UK shares. From April 2014, stamp duty (SDRT) is not payable on purchases of UK shares traded on AIM. Stamp Duty of 1% is payable on purchases of Irish shares (where applicable).

PTM Levy: A PTM Levy of £1.00 is payable, with some specific exceptions, on all transactions over £10,000 in securities of companies incorporated in the UK, Channel Islands, or Isle of Man. This levy is used to resource the Panel of Takeovers and Mergers.

Trade Reporting Charges: Trade Reporting charges are payable where applicable and at the rate charged by the relevant market or exchange.

Other Non-Commission Transaction Charges: Additional non-commission transaction charges may apply for a given order type, instrument, market, exchange, and/or execution channel.

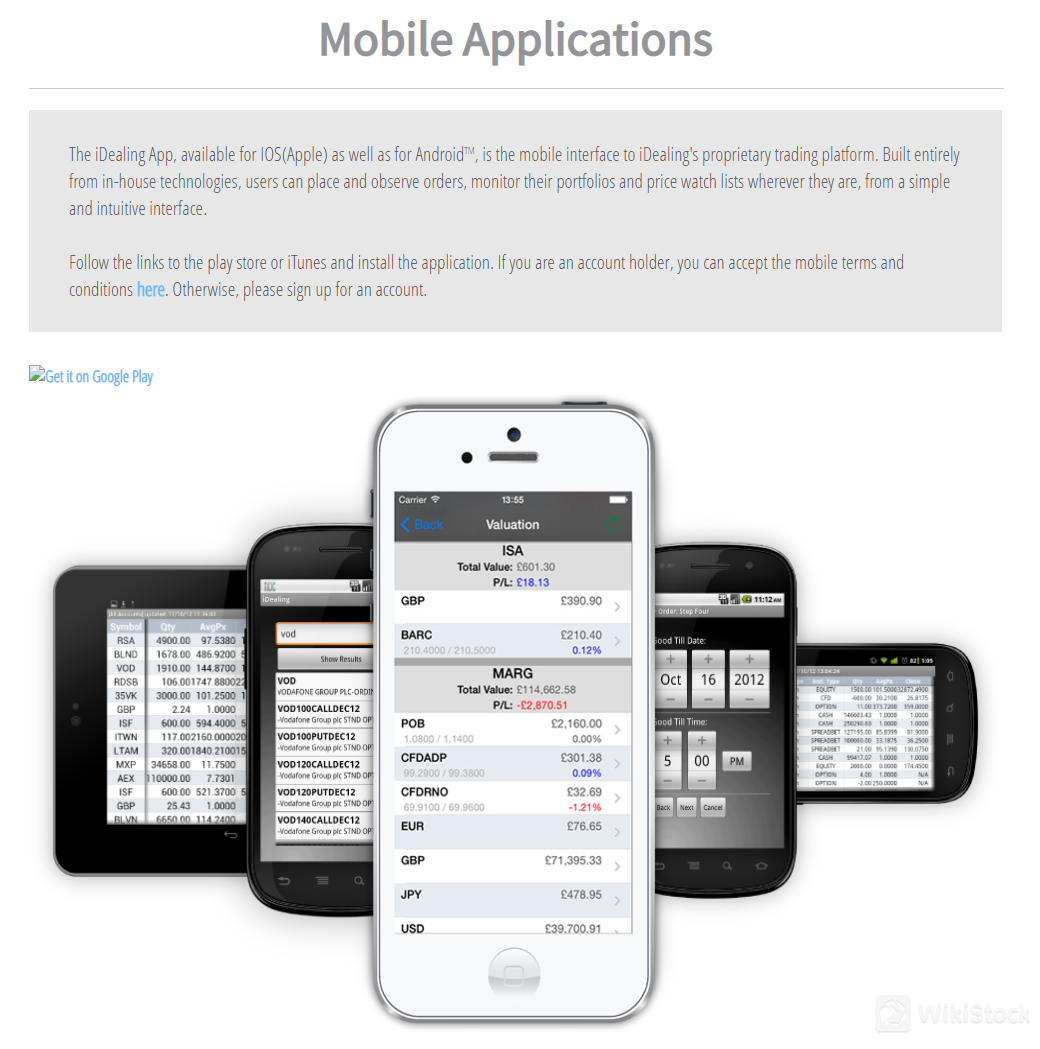

iDealing.com Limited App Review

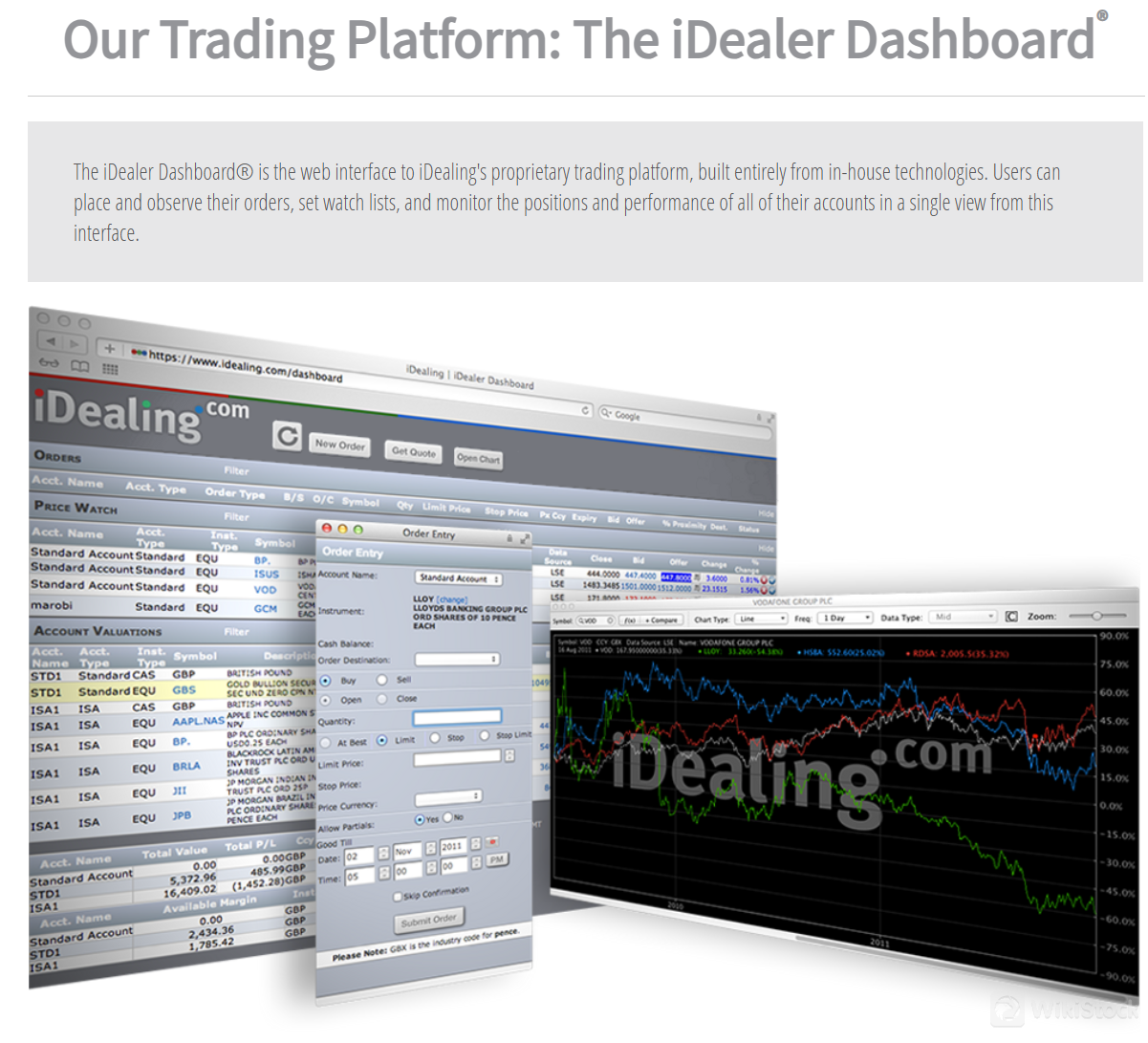

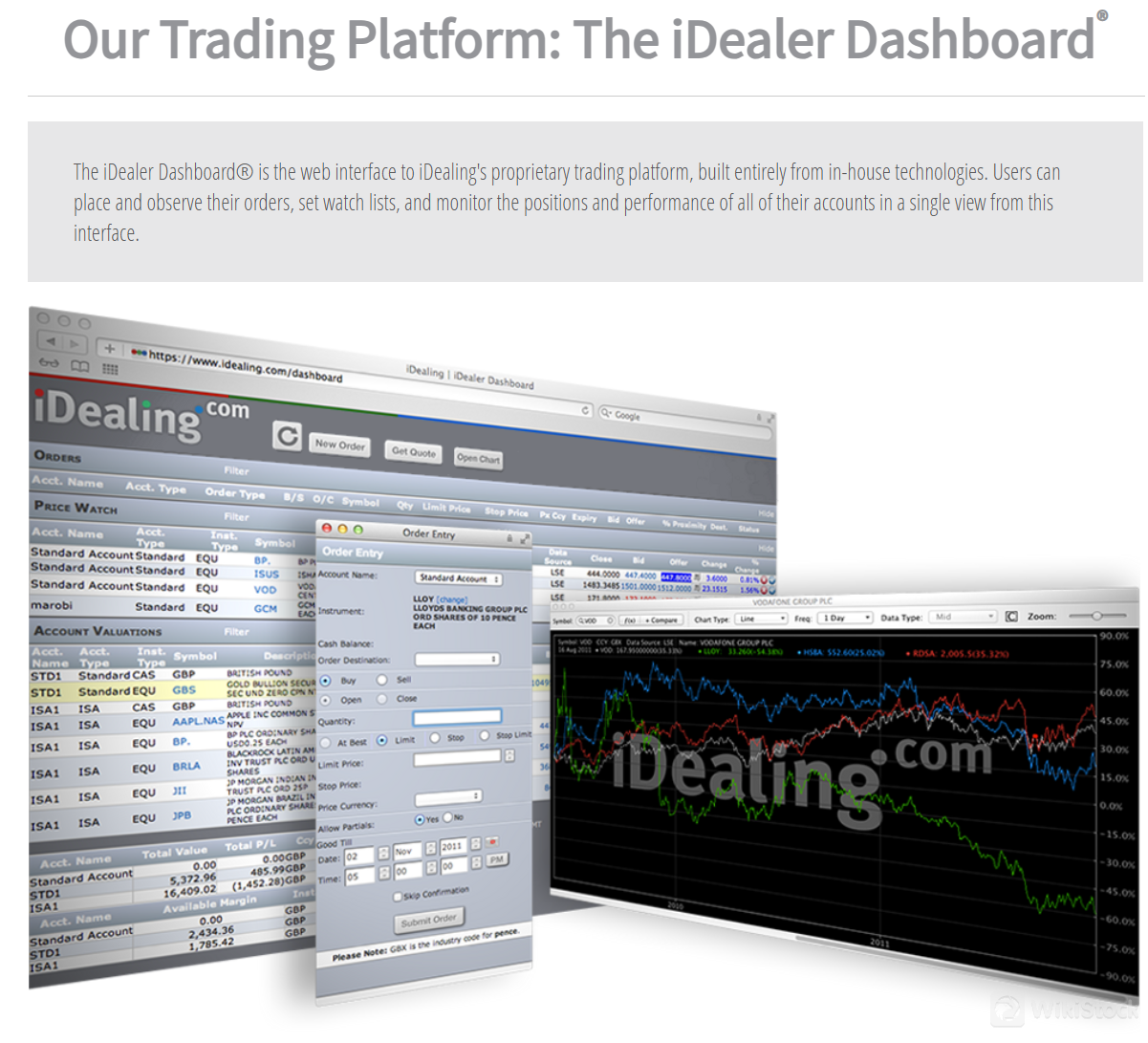

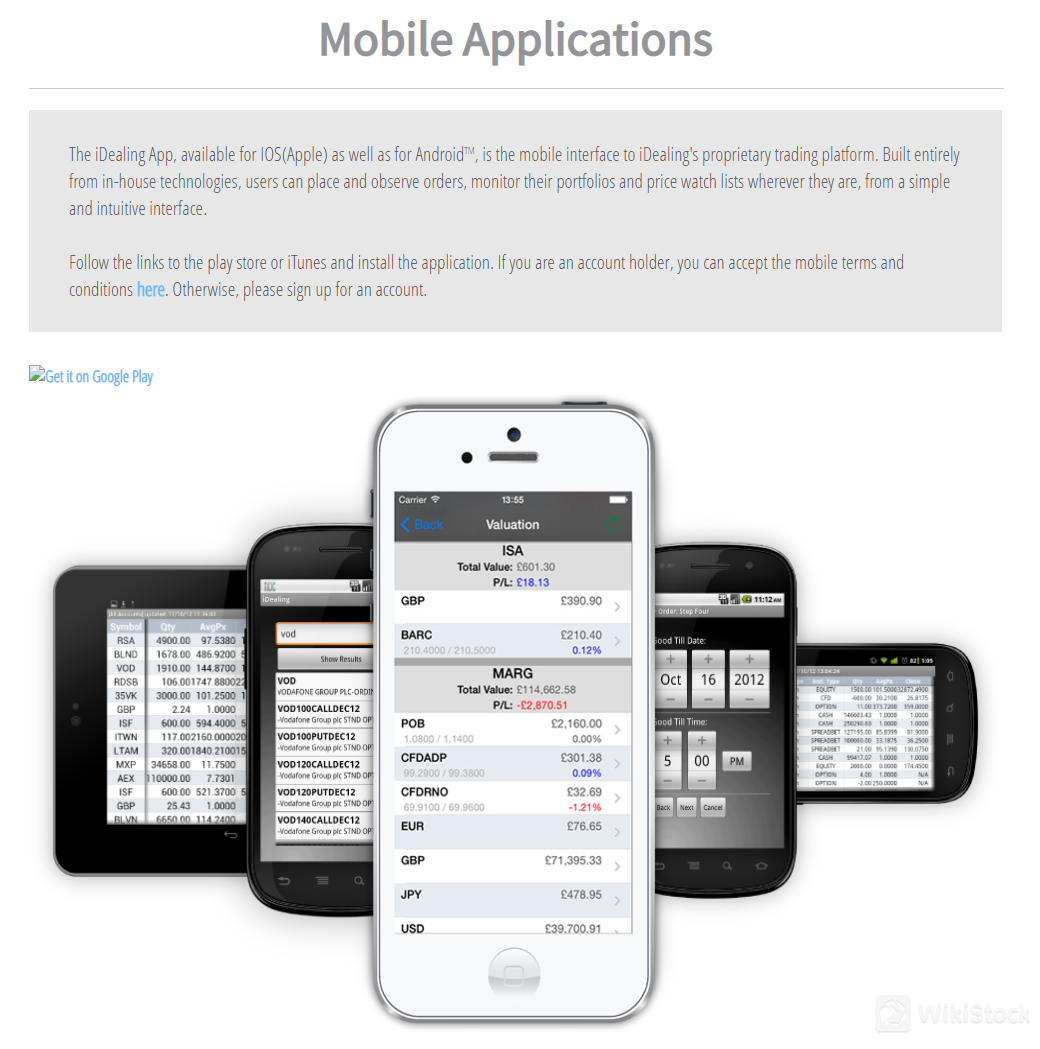

iDealing.com Limited provides users with two interfaces to its proprietary trading platform:

iDealer Dashboard: This is the web interface to iDealing's trading platform, developed entirely using in-house technologies. Users can place and monitor their orders, set up watch lists, and track the positions and performance of all their accounts conveniently from a single view.

iDealing App: Available for both iOS (Apple) and Android, the iDealing App serves as the mobile interface to the trading platform. Also built using in-house technologies, users can place and monitor orders, manage their portfolios, and monitor price watch lists from anywhere using a simple and intuitive interface.

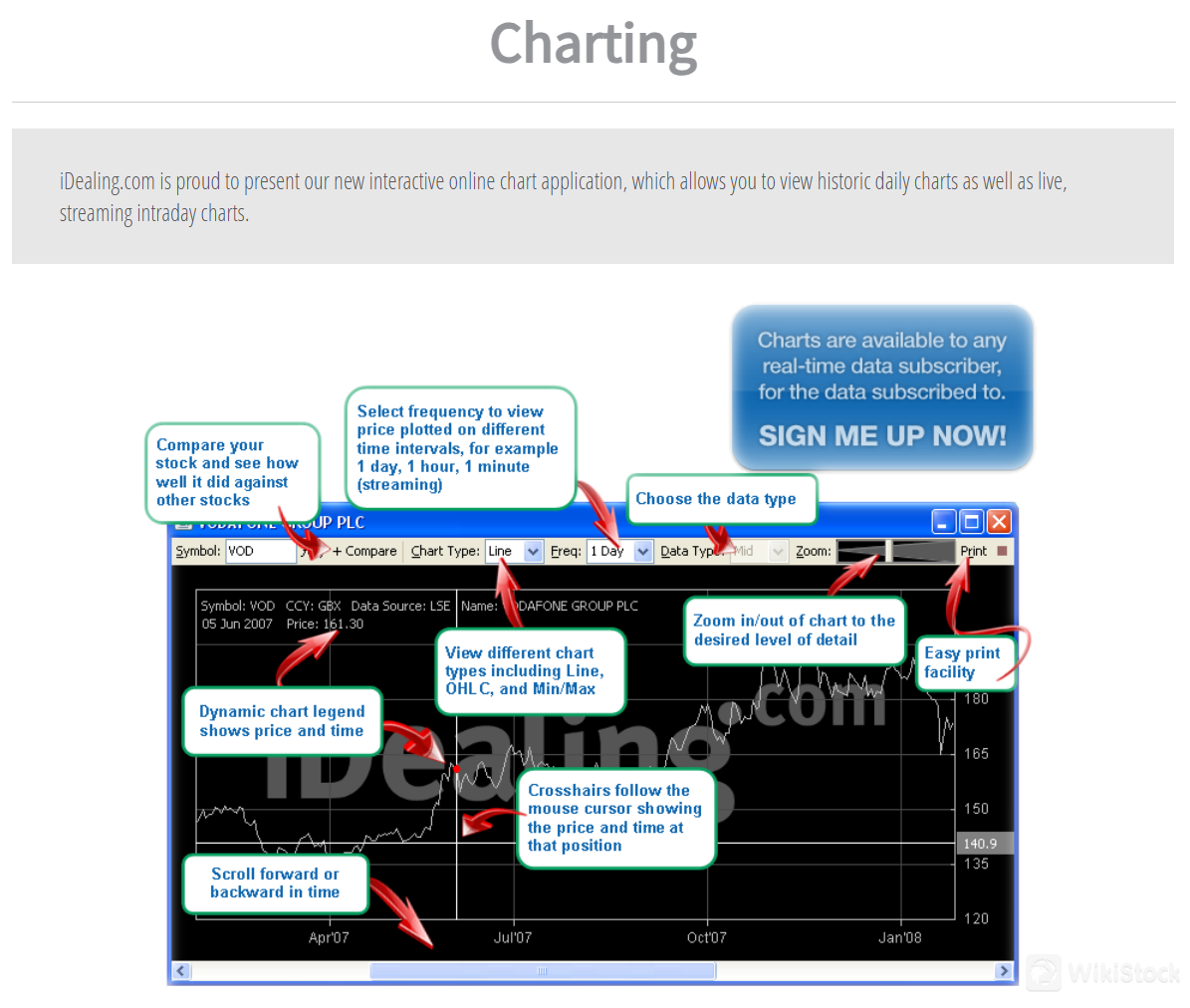

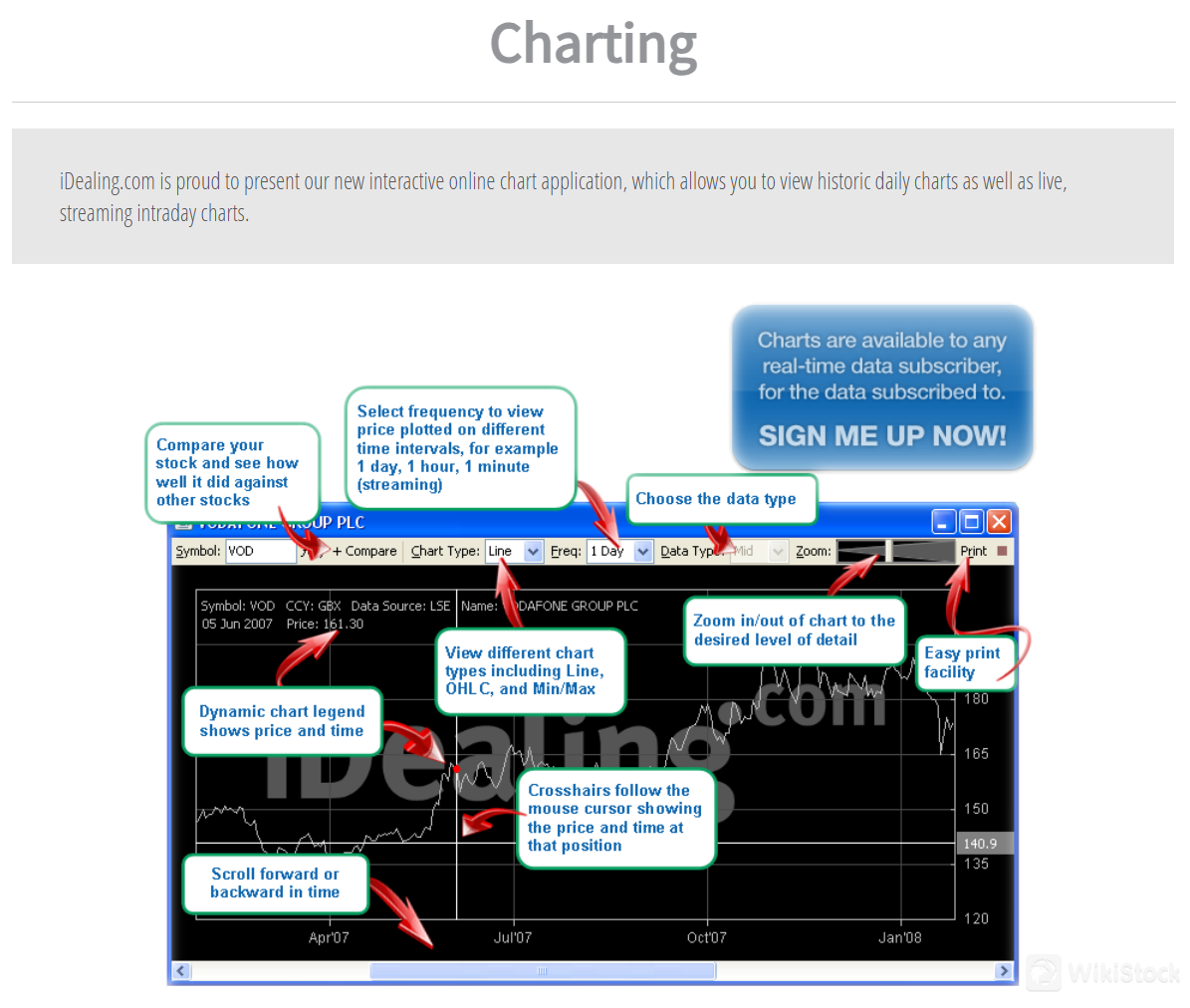

iDealing.com Limited offers an interactive online chart application for viewing historic daily and live, streaming intraday charts.

Customer Service

iDealing.com Limited provides customer support through two channels:

Email: Customers can contact the Customer Services Team by sending an email to admin@iDealing.com. The team aims to respond within 24 hours during business hours.

Postal Mail: Within the United Kingdom, customers can write to iDealing.com Limited free-of-charge using the Freepost address provided. For registered mail, customers can use the registered mail address:

iDealing.com Limited

New Broad Street House

35 New Broad Street

London

EC2M 1NH

United Kingdom

Customers are encouraged to send any original documentation by registered mail for security and tracking purposes.

Conclusion

iDealing.com Limited, regulated by the Financial Conduct Authority (FCA) in the UK, ensures compliance with rigorous regulatory standards, instilling a sense of security and trust among customers. Moreover, the diverse range of account options caters to the varied needs and preferences of investors, offering flexibility in investment strategies. This brokerage firm is well-suited for investors who prioritize regulatory compliance and value user-friendly platforms for efficient trading. Additionally, investors seeking a variety of account options to tailor their investment approach will find iDealing.com Limited suitable for their needs.

FAQs

Is iDealing.com Limited safe to trade?

iDealing.com Limited is regulated by the Financial Conduct Authority (FCA), ensuring compliance with strict regulatory standards. Client funds are segregated and protected according to FCA rules, and eligible clients are covered by the Financial Services Compensation Scheme (FSCS) up to Scheme limits for eligible claims.

Is iDealing.com Limited a good platform for beginners?

While iDealing.com Limited offers a user-friendly platform, it lacks educational resources, which may not be ideal for beginners who require additional guidance and learning materials to navigate the complexities of trading effectively.

Is iDealing.com Limited legit?

Yes, iDealing.com Limited is legit. It is currently licensed by the Financial Conduct Authority (FCA) with license number 191660, ensuring its compliance with regulatory standards.

Risk Warning

The information presented is derived from WikiStock's expert assessment of the brokerage's website data and may be subject to updates. Additionally, it's important to acknowledge that online trading carries significant risks, which could result in the complete loss of invested capital. Therefore, it's essential to fully understand the associated risks before participating in trading activities.

United Kingdom

United KingdomObtain 1 securities license(s)