Score

華盛証券

https://www.vbkr.com/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

China Hong Kong

China Hong Kong Products

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Surpassed 57.46% brokers

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01904

Brokerage Information

More

Company Name

Valuable Capital Limited

Abbreviation

華盛証券

Platform registered country and region

Company address

Company website

https://www.vbkr.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Trading Fee

$1.95

Platform Service Fee

HK$15

Commission Rate

0.03%

Funding Rate

6.8%

New Stock Trading

Yes

Margin Trading

YES

Long-Short Equity

YES

Regulated Countries

1

| HuaSheng Securities |  |

| WikiStocks Rating | ⭐⭐⭐ |

| Fees | From Free(HuaSheng Securities)Commissions.Minimum Charge:HK$15 |

| Interests on uninvested cash | 8.30% |

| Mutual Funds Offered | Yes |

| Platform/APP | Huashengtong(Android,IOS,Windows,MAC) |

| Promotion | Trading For Up to $720 BacksRefer Friends Get $20 Coupons |

What is HuaSheng Securities?

HuaSheng Securities is a financial services provider known for its competitive fee structure, starting with commission-free options and a minimum charge of HK$15.

The firm offers a user-friendly trading platform, Huashengtong, available across Android, iOS, Windows, and Mac systems, and promotes engaging incentives such as trading rebates up to $720 and referral coupons.

However, a potential downside is the high interest rate of 8.30% on uninvested cash, which may be a concern for some investors.

Pros & Cons

| Pro | Cons |

| Multiple Tradable Assets(HongKong and U.S Stocks,Funds,EFTs) | Complex Fee structure(For many Porducts) |

| Regulated by SFC | No Diverse Accounts |

| Many Trading Platform Versions | |

| 24/7 Online Customer Support | |

| A smoother investment experience | |

| Low Fees(Commissions low as Free) |

Pros:

HuaSheng Securities offers a wide range of tradable assets including Hong Kong and U.S. stocks, funds, and ETFs, supported by multiple trading platform versions for a smoother investment experience. The firm is regulated by the SFC, ensuring compliance with high regulatory standards. It also boasts low fees, with commission rates as low as free, and provides 24/7 online customer support, enhancing accessibility and convenience for global investors.

Cons:

The fee structure at HuaSheng Securities can be complex, especially across various products, which may confuse investors looking to understand the exact costs associated with their transactions. Additionally, the lack of diverse account options limits flexibility for investors with specific trading preferences or requirements.

Is HuaSheng Securities Safe?

Regulations:

HuaSheng Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which was established in 1989 to oversee and regulate Hong Kong's securities and futures markets.

The SFC operates independently from the Hong Kong Government and is primarily funded by transaction levies and licensing fees. HuaSheng Securities holds a license number AUL711, underscoring its compliance with stringent regulatory standards aimed at protecting investor interests.

Funds Safety:

The client's account funds at HuaSheng Securities are protected under the Hong Kong Investor Compensation Fund, which is designed to safeguard the interests of small and medium investors in case of default by a licensed brokerage.

This protection ensures a degree of financial safety for the clients assets, although the specific coverage amount should be confirmed directly with the broker.

Safety Measures:

HuaSheng Securities employs advanced encryption technologies to ensure the security of funds storage and to protect sensitive personal and financial information. The broker has implemented several account safety measures, including dual authentication processes to prevent unauthorized access and information leakage, enhancing the overall security of client assets and data.

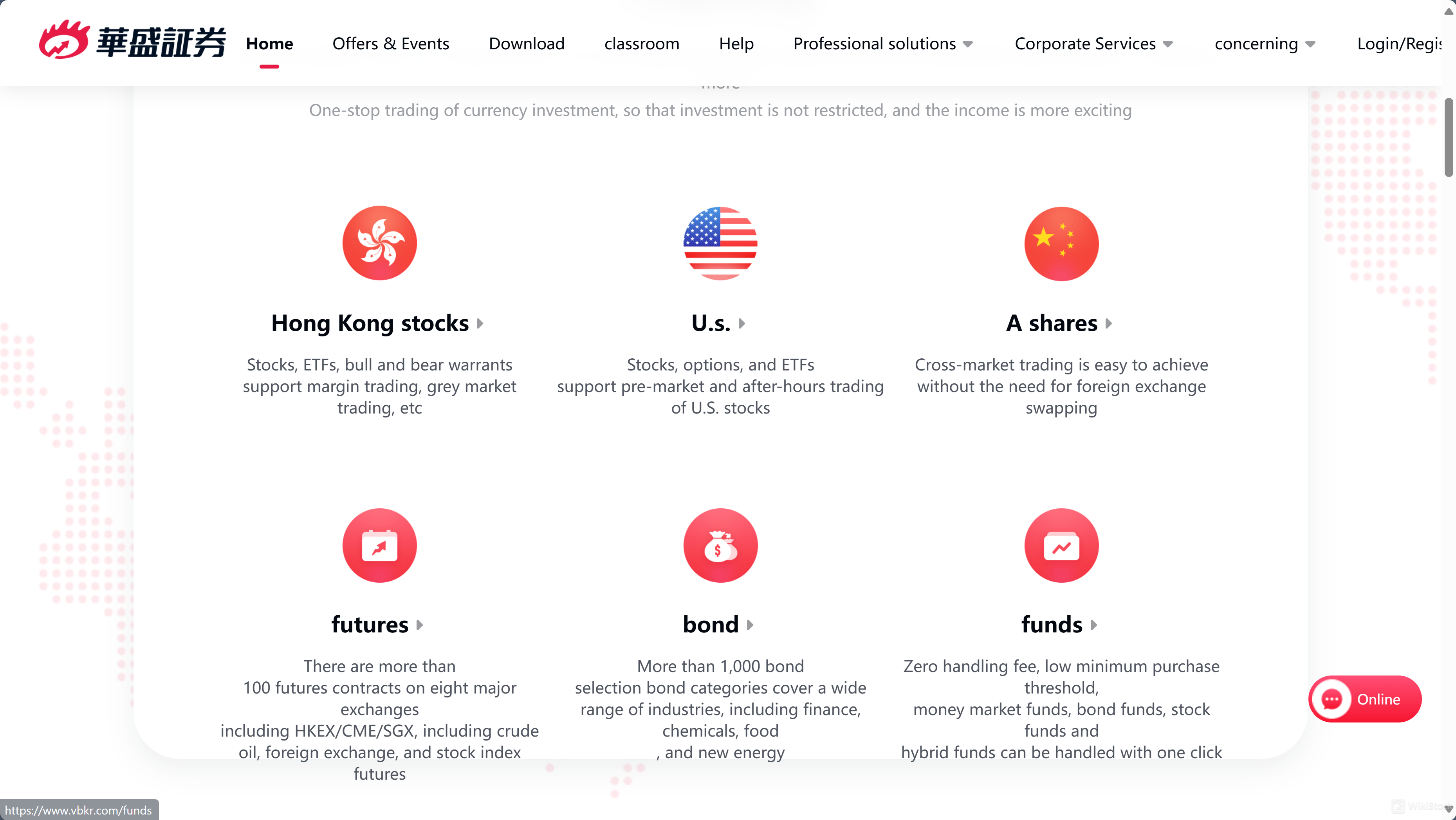

What are securities to trade with HuaSheng Securities?

HuaSheng Securities offers a broad range of securities for trading, accommodating various investment strategies and preferences:

Hong Kong Stocks: Investors can trade stocks listed on the Hong Kong Stock Exchange, including ETFs, bull, and bear warrants. The platform supports margin trading and grey market transactions, providing flexibility and diverse investment options in one of Asias premier markets.

U.S. Stocks and ETFs: HuaSheng Securities provides access to U.S. markets, allowing investors to trade stocks and ETFs. The platform supports pre-market and after-hours trading, giving investors the advantage of reacting to market news outside regular trading hours.

A-Shares: The platform enables easy cross-market trading of A-shares without the need for currency exchange. This feature simplifies the process of investing in mainland Chinese companies through the Shanghai-Hong Kong Stock Connect.

Futures: HuaSheng offers trading in over 100 futures contracts on eight major exchanges, including HKEX, CME, and SGX. Available futures include a wide array of commodities such as crude oil, foreign exchange, and stock indices, providing substantial opportunities for speculation and hedging.

Bonds: With more than 1,000 bond choices, investors have access to a diverse range of industries including finance, chemicals, food, and new energy. This extensive selection meets varying risk tolerances and investment durations.

Funds: Investors looking for managed investment options can choose from money market funds, bond funds, stock funds, and hybrid funds. HuaSheng offers these funds with zero handling fees and a low minimum purchase threshold, making it easier for investors to diversify their portfolios efficiently.

Services

Huasheng Securities provides a large range of capital market services designed to create long-term value for clients.

Their Asset Management (AM) services include QFLP, QDII, private equity, old stock undertakings, and financial advisory. Equity Capital Markets (ECM) services cover IPOs, debt financing, mergers and acquisitions, consultancy, and investor relations.

Their Fixed Income, Currencies, and Commodities (FICC) services span debt capital markets, cross-border transactions, convertible bonds, alternative financing, sales and trading, and bond custody.

Wealth Management (WM) services satisfy wealth management and family offices. Huasheng Securities also offers professional financial services, including equity financing, IPO preparation, roadshows, and post-listing support.

With a dedicated team of experienced professionals, Huasheng Securities ensures high-quality, tailored services across all these areas, supported by robust financial technologies and a deep understanding of global markets.

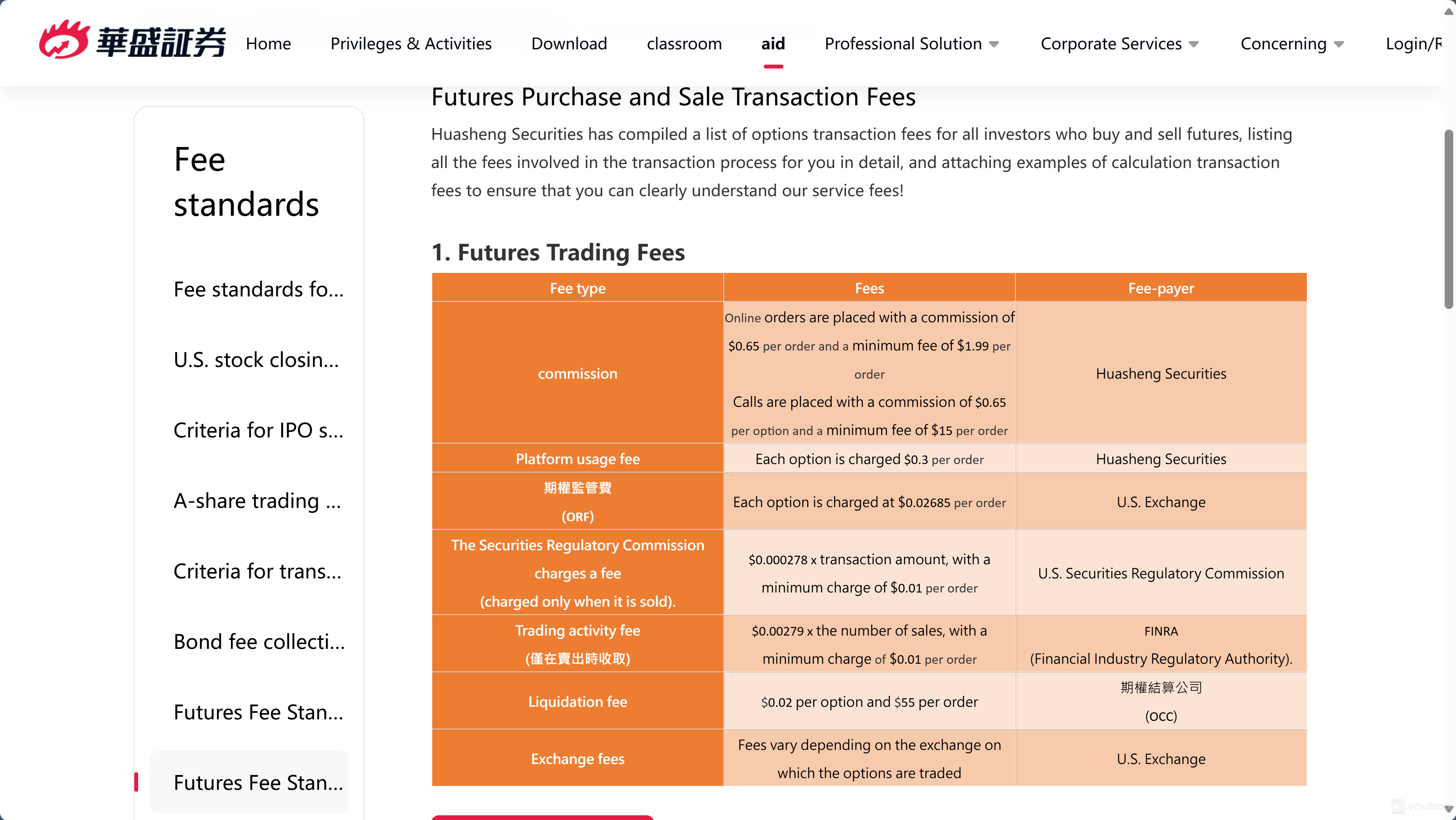

HuaSheng Securities Fee Review

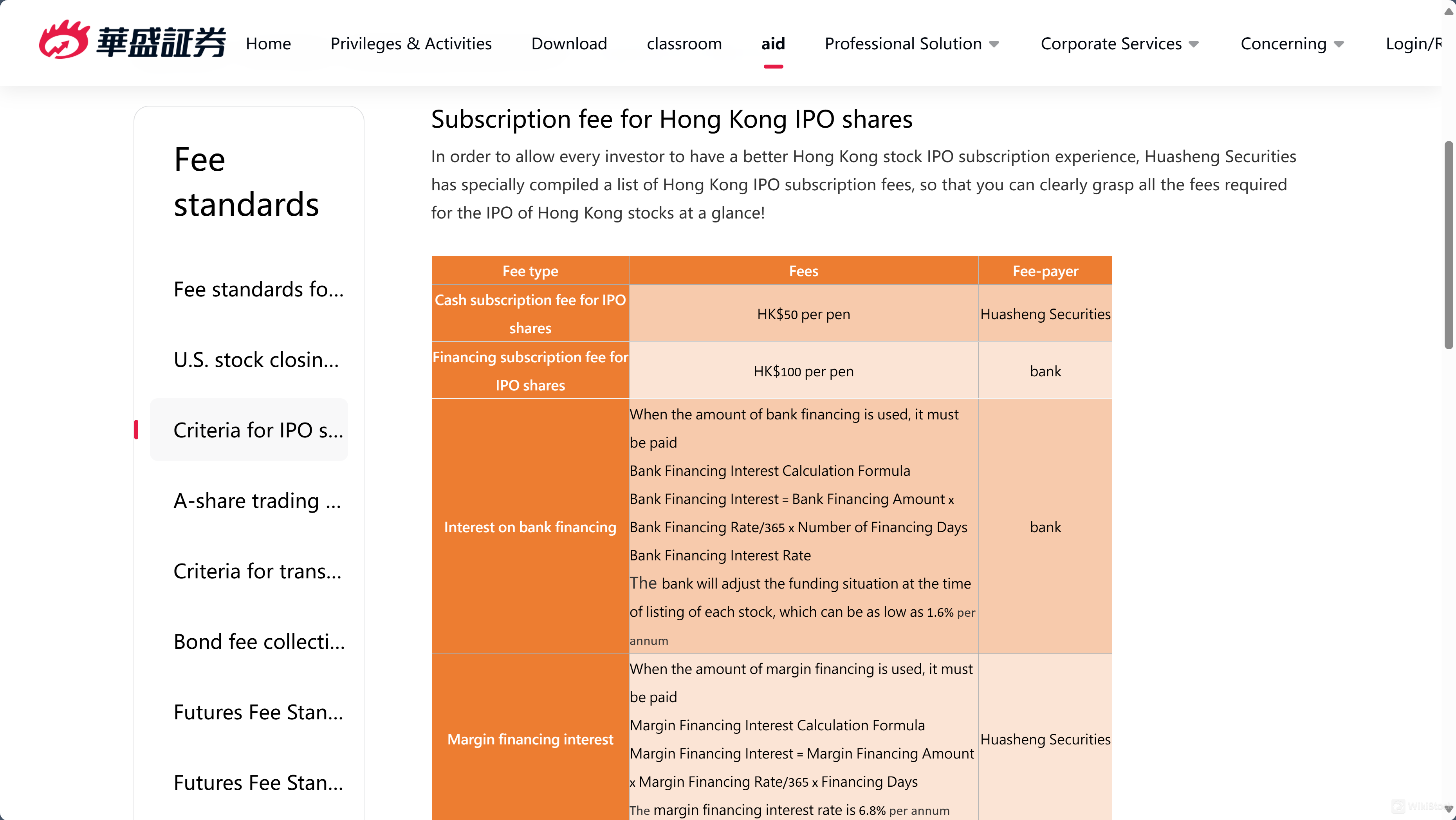

Huasheng Securities offers a diverse fee structure across various markets.

For Hong Kong stocks, the commission is 0.03% of the transaction amount with a minimum charge of HK$3, and the platform fee starts at HK$15 per order.

U.S. stocks have a commission of $0.0049 per share, capped at 0.5% of the trade, with a minimum fee of $0.99, and a platform fee of $1 per order.

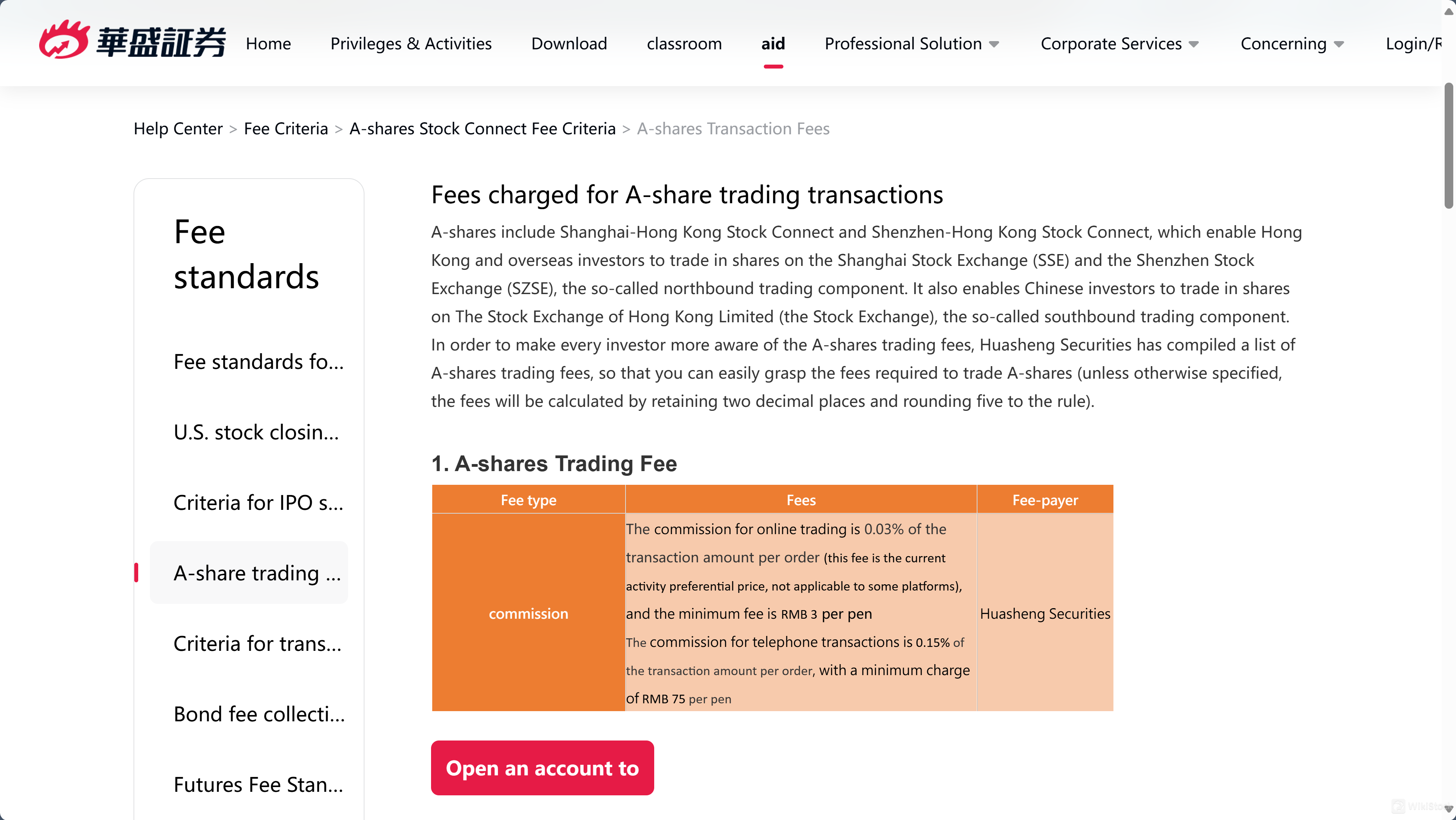

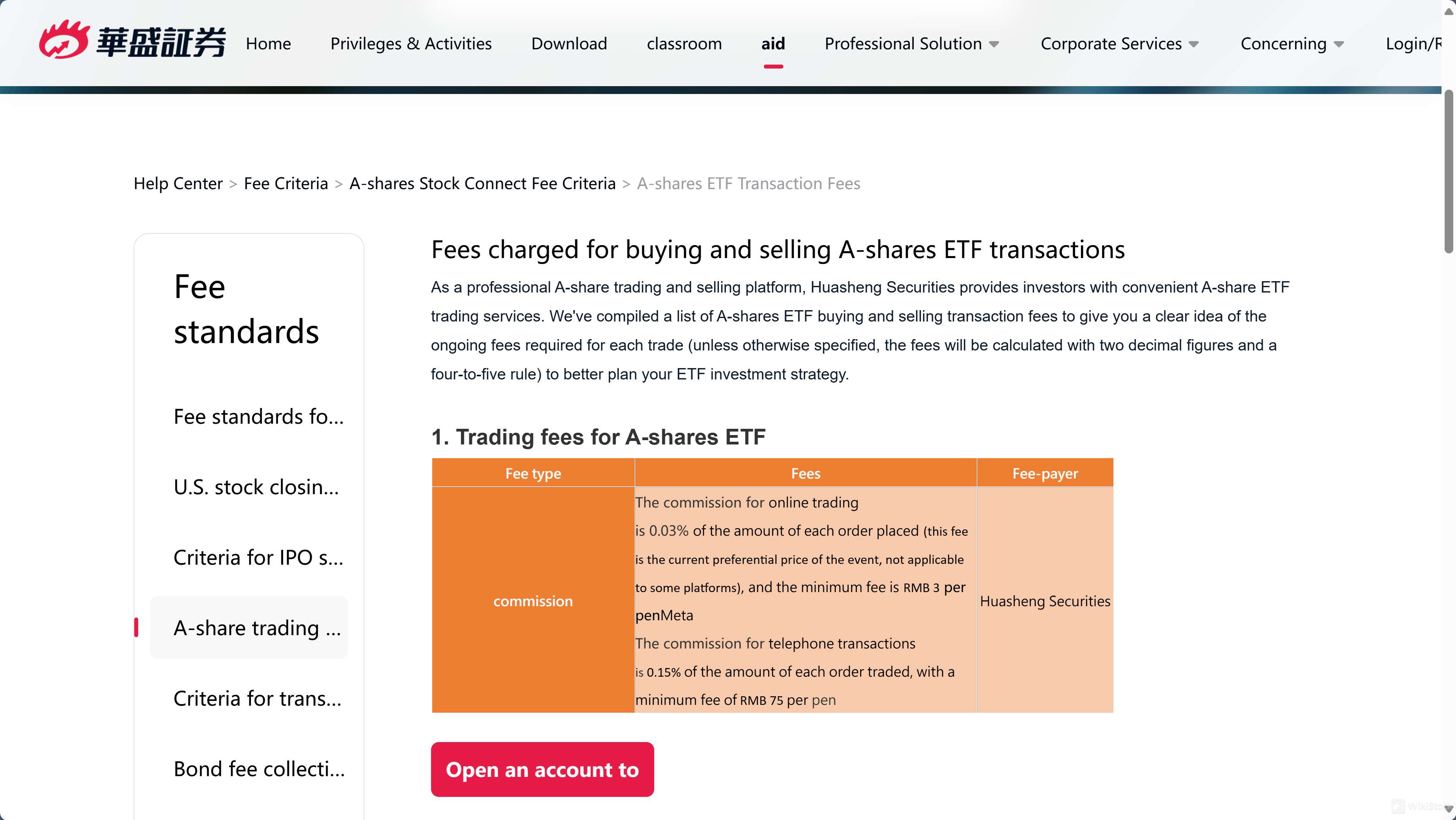

The commission for A-shares is 0.03% of the order amount with a minimum fee of RMB 3 for online trades, and a platform fee of RMB 15 per order.

Futures and options trading fees vary by contract type, with options charging $0.65 per option and a platform fee of $0.3 per option.

Bond trading has a commission of 0.15% of the notional value with additional custodial fees. Additional fees include stamp duty, SEC, and FINRA fees for U.S. trades, as well as other regulatory charges depending on the market and transaction type.

Additional fees include stamp duty, SEC, and FINRA fees for U.S. trades, as well as other regulatory charges depending on the market and transaction type.

| Service | Commission | Platform Fee | Minimum Fee | Additional Fees |

| Hong Kong Stocks | 0.03% of transaction amount, min HK$3 | Starts at HK$15 per order | HK$3 minimum commission | Stamp Duty varies by transaction, no stamp for certain securities |

| U.S. Stocks | $0.0049 per share, max 0.5% of trade, min $0.99 | $1 per order, max 0.5% of trade | $0.99 minimum commission | SEC and FINRA fees apply on sales |

| A-shares | 0.03% of order amount, min RMB 3 online | RMB 15 per order | RMB 3 minimum commission for online trades | Stamp duty and transaction fees by Chinese regulatory bodies |

| Futures | Varies by contract type | Varies, often included in commission | Varies widely depending on contract | Exchange and regulatory fees, possible delivery costs |

| Options | $0.65 per option, min $1.99 per order | $0.3 per option | $1.99 minimum commission per order | ORF, SEC fees, and other regulatory fees |

| Bonds | 0.15% of notional value | - | Based on bond type | Custodial fees may apply, depending on the bond and market |

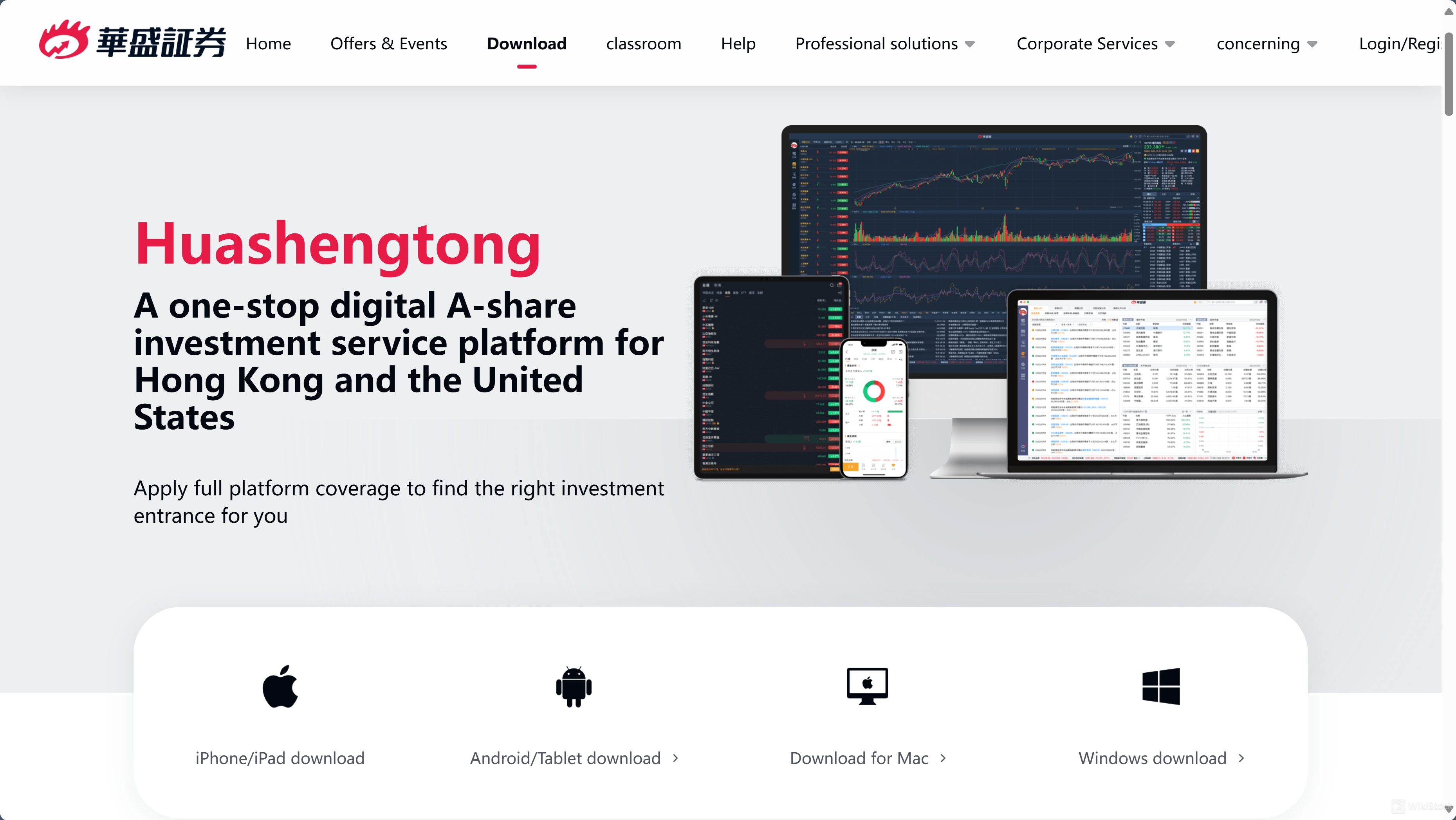

HuaSheng Securities APP Review

Huasheng Securities offers Huashengtong, a digital investment platform that supports trading in Hong Kong stocks, U.S. stocks, A-shares, bonds, funds, and futures.

The platform provides real-time market synchronization, covering a diverse range of trading products such as options, warrants, and ETFs, and includes advanced investment tools like condition orders, data warehouse analysis, and multi-functional stock selectors.

Available on iOS, Android, Mac, and Windows, Huashengtong also features a 24/7 financial news service and a vibrant community for sharing investment insights and strategies.

Research & Education

Huasheng Securities offers an educational platform named Huasheng Value Classroom, designed to guide investors through their investment journey.

The platform provides detailed tutorials and operation manuals, such as IPO subscriptions, stock transactions, online account opening, and using advanced trading tools like condition lists. Additionally, Huasheng features Jiayi Online, a series of episodes that cover various financial topics, including green bonds, market trends, and comparisons of consumption voucher platforms.

Promotion

Huasheng Securities offers a variety of attractive promotions and welcome offers for both new and existing users. Current promotions include:

Option Cool Summer For Rewards: Participants can earn up to $720 in rewards by completing a specified number of transactions. Newcomers receive an additional $100 option commission-free card.

Friend Referral Program: Invite friends to register and earn a HK$20 transaction coupon per person. If the invited friends make deposits, the referrer can earn up to a HK$500 transaction coupon per friend.

Summer Welcome Reward: New users who open an account online and deposit at least HK$10,000 can receive a range of rewards including a Coca-Cola stock exchange coupon, a $25 USD transaction cash voucher, a 30-day Hong Kong stock LV1 string trend, a $300 IPO coupon, and unlimited commission-free trading for Hong Kong stocks and a 180-day commission-free quota card for U.S. stock trading. Additionally, maintaining an average daily asset of HK$10,000 for 30 or 60 days can earn up to a HK$400 trading cash coupon.

What types of securities can I trade with Huasheng Securities?

What promotional offers does Huasheng Securities provide?

How can I contact Huasheng Securities' customer support?

Customer Service

Huasheng Securities provides customer support through multiple channels. The service hotline, +852 2508 4588, is available from 9:00 AM to 9:00 AM the next day on trading days and from 9:00 AM to 6:00 PM on non-trading days, offering assistance primarily via online customer service.

Additionally, users can access support through online consultation and live chat services, ensuring timely and efficient resolution of their queries and concerns.

Conclusion

Huasheng Securities is a financial services provider regulated by the Hong Kong SFC, offering a wide range of tradable securities including stocks, bonds, futures, and options.

The platform provides robust tools for trading, research, and education, and supports investors with 24/7 customer service and various promotional offers to enhance the trading experience.

FAQs

Hong Kong stocks, U.S. stocks, A-shares, bonds, funds, futures, and options.

Free real-time quotes, cash for account opening, commission-free trading, and various trading rewards.

Via the hotline +852 2508 4588, online consultation, and live chat services.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

OPSL

Score

偉祿亞太證券

Score

鴻昇金融集團

Score

东兴证券

Score

IISL

Score

Elstone

Score

Hooray Securities

Score

SBI China Capital

Score

Sorrento

Score

Sanston

Score