WING ON SECURITIES LIMITED

( Licensed or Registered with the Securities and Futures Commission as a licensed corporation / licensed person〔CE No. AFC 979〕 for dealing in securities under * Type 1 / Type 4 / Type 6 / Type 9 of Part 1 in Schedule 5 to the Securities and Futures Ordinance and an exchange participant 〔No. B01684〕of The Stock Exchange of Hong Kong Limited.)

What is Wing On Securities?

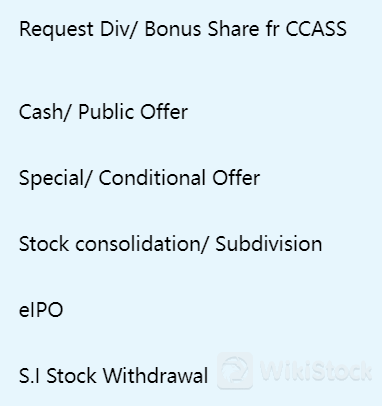

Wing On Securities provides a straightforward trading experience with a basic commission fee of $50 and a stamp duty of 0.1% of each transaction value. While there are no account fees for new accounts, specifics on the account minimum, interest on uninvested cash, and margin interest rates are not provided. The platform does not offer mutual funds or a mobile app, limiting some aspects of convenience and investment options. Additionally, there are no promotional offers currently available. This makes Wing On Securities a more traditional brokerage option, potentially better suited for clients who prefer a simplified fee structure without the need for advanced mobile trading features.

Pros and Cons of Wing On Securities

Wing On Securities boasts several advantages, including regulation by the SFC and compliance with financial regulations, providing clients with a secure trading environment. They offer two different types of accounts, and new accounts benefit from no account fees. However, there are some drawbacks, such as the absence of a dedicated mobile app, limited asset offerings, and unspecified interest rates on uninvested cash.

Is Wing On Securities safe?

Wing On Securities Limited is a member of the Hong Kong Stock Exchange (HKSE) and is regulated by the Securities and Futures Commission (SFC) of Hong Kong. This means that Wing On Securities Limited is required to meet certain regulatory requirements, including holding client funds in segregated accounts and protecting them from the company's own creditors.

Wing On Securities Limited also participates in the Investor Compensation Scheme (ICS) of the SFC. The ICS provides protection for up to HK$1,000,000 per investor in the event of the insolvency of an SFC-licensed brokerage firm. In addition to these regulatory measures, Wing On Securities Limited also has a number of its own internal measures in place to protect client funds. These include:

Using a secure trading platform

Employing encryption technology to protect client data

Having a team of experienced risk managers

What are securities to trade with Wing On Securities?

Wing On Securities mainly offers stocks and IPOs. However, it does not provide products like commodity futures, forex, and cryptocurrencies.

Stocks: Direct investment in publicly listed companies, suitable for investors seeking capital appreciation and dividends.

IPOs: Initial Public Offerings are opportunities to invest in newly listed companies, often offering potential for early growth and market value increases.

Wing On Securities Accounts

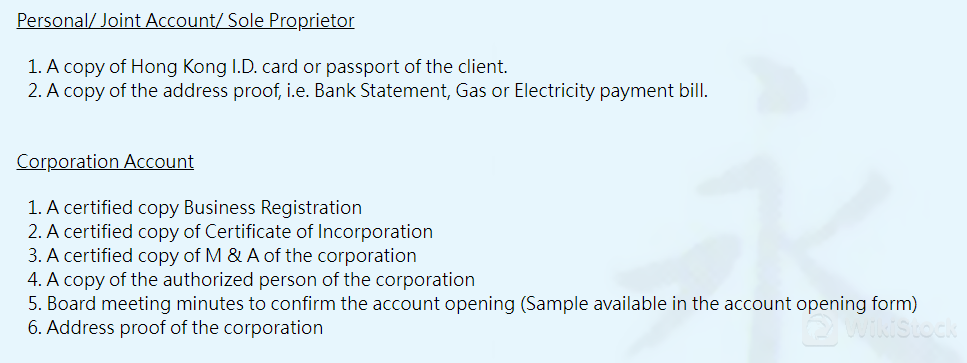

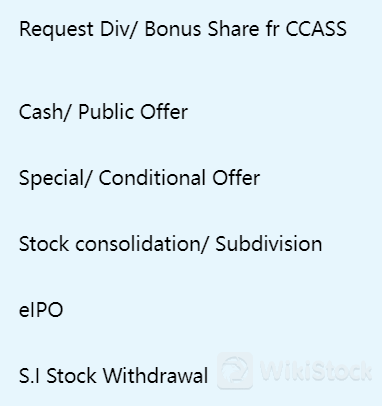

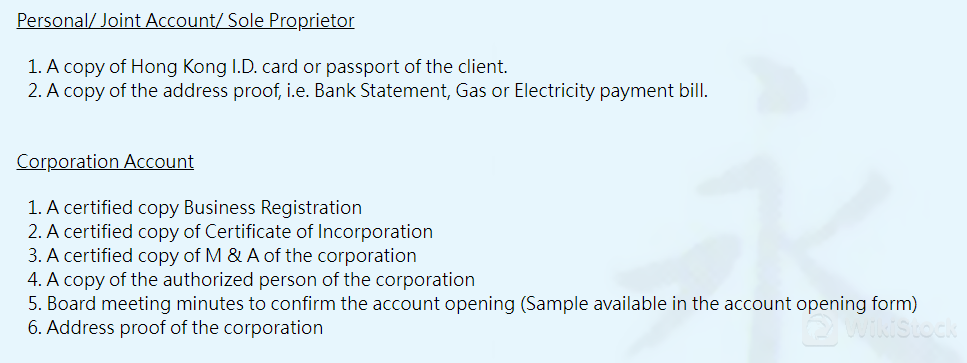

Wing On Securities offers various account types for diverse client needs, including Personal/Joint Accounts, Sole Proprietor Accounts, and Corporation Accounts. These accounts are designed to provide flexible options for individual investors, business owners, and corporate entities, ensuring tailored financial services to suit different investment strategies and organizational structures.

Wing On Securities Fees Review

Wing On Securities offers a fee structure designed to be straightforward and competitive. Account opening is free, providing easy access for new clients. The minimum commission is set at $50, ensuring cost-effective trading for various investment sizes. Key transaction-related fees include a 0.1% stamp duty (with a minimum of $1.00), a 0.003% transaction levy, and a 0.005% trading fee. Clearing fees are 0.02% of each transaction, with a minimum of $2 and a maximum of $100. These service charges are subject to periodic updates to remain aligned with market standards.

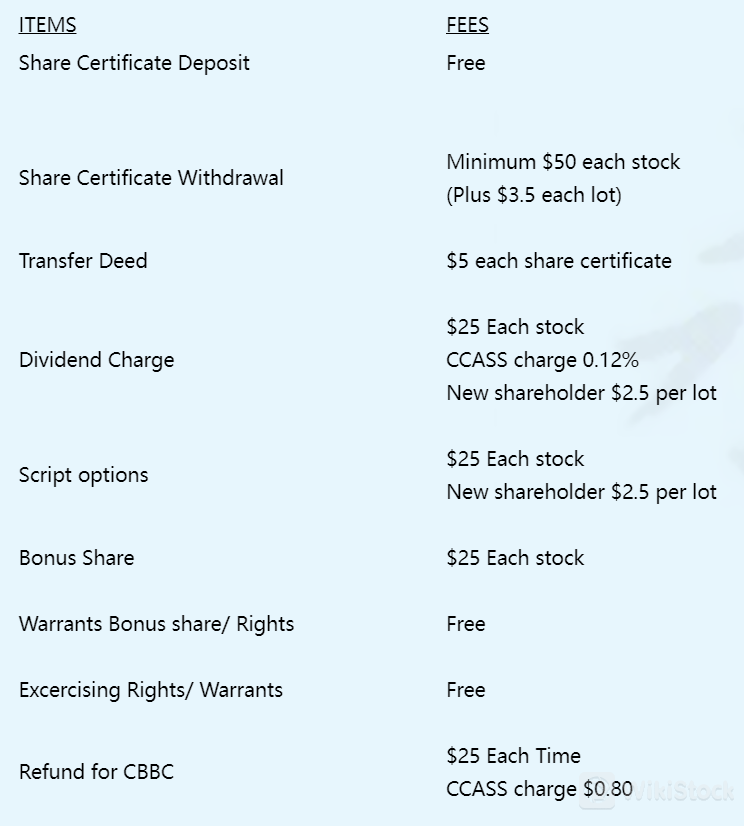

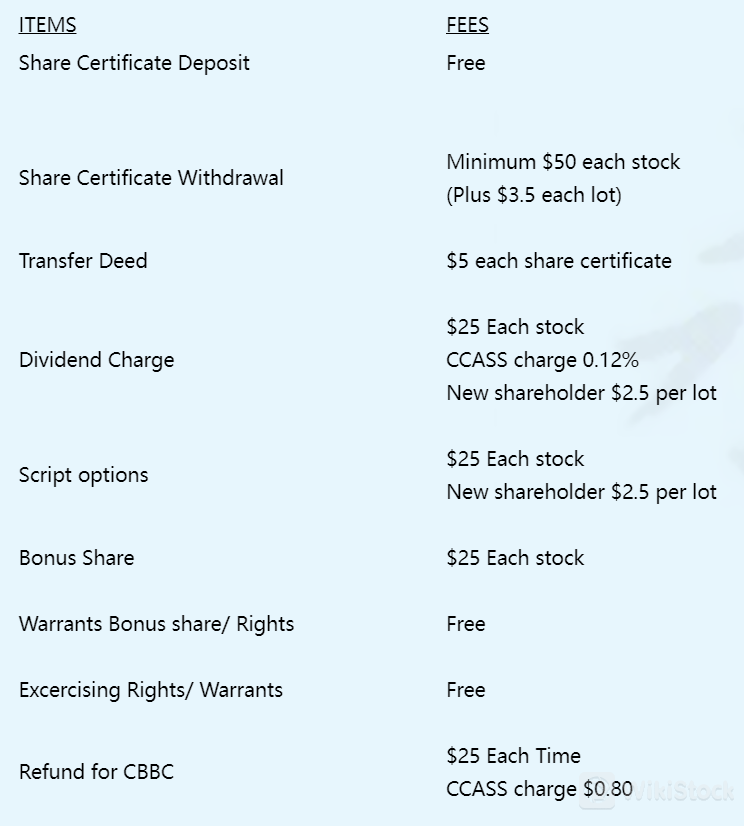

Wing On Securities offers a range of services with specific fees associated with various transactions. Share certificate deposits are free, while withdrawals incur a minimum fee of $50 per stock, plus $3.50 per lot. Transfer deeds are charged at $5 per share certificate. Dividend charges are $25 per stock, with an additional CCASS charge of 0.12% and $2.50 per lot for new shareholders. Script options and bonus shares each cost $25 per stock, plus $2.50 per lot for new shareholders. Warrants bonus shares and exercising rights or warrants are free of charge. Refunds for CBBCs are $25 each time, with an additional CCASS charge of $0.80.

Wing On Securities App Review

Wing On Securities Limited does not currently advertise a dedicated mobile app for trading on their website. The focus is on their brokerage services, with no mention of a mobile trading platform. For the most accurate and updated information regarding any mobile trading solutions they may offer, it is recommended to contact Wing On Securities directly.

Research and Education

Wing On Securities offers comprehensive research and education resources through its Technical Support section. These resources are designed to assist clients with various aspects of trading and investing, providing practical guidance and insights. The support includes detailed transaction examples and instructional materials to enhance users' understanding and proficiency in securities trading. This structured approach ensures that both novice and experienced investors have access to valuable information for making informed decisions in the financial markets.

Customer Service

Wing On Securities provides robust customer support to address client needs efficiently. Clients can reach their support team via telephone at 2544 8075, fax at 2545 6147, or email at cs@wingonsl.com. This multi-channel support ensures that clients can receive timely assistance and solutions to their inquiries, enhancing their overall experience with Wing On Securities.

Conclusion

Wing On Securities presents a regulated and compliant platform, appealing to investors prioritizing security and regulatory adherence. Their offerings, particularly in stocks and IPOs, cater to those seeking direct investment opportunities in established and emerging companies. However, the lack of a dedicated mobile app and limited asset options may not suit traders looking for a broader range of investment instruments. Overall, Wing On Securities is well-suited for investors focused on stocks and IPOs, emphasizing regulatory compliance and investment transparency.

FAQs

Is Wing On Securities safe to trade?

Wing On Securities is regulated by the SFC and complies with financial regulations, ensuring a safe trading environment for investors.

Is Wing On Securities a good platform for beginners?

Wing On Securities offers a low account minimum of $50 and free account fees for new accounts, making it accessible for beginners.

Is Wing On Securities legit?

Yes, Wing On Securities is a legitimate brokerage firm registered with the Securities and Futures Commission (SFC) of Hong Kong.

Is Wing On Securities good for investing/retirement?

Wing On Securities is suitable for investors interested in stocks and IPOs, making it a potential option for investing. However, its limited asset offerings may not be ideal for retirement planning, which often requires a diverse investment portfolio.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)