The Company was incorporated in Cyprus in 2003 with the registered address: 29A, Annis Komninis Street, 1061 Nicosia, Republic of Cyprus. RAM Cyprus is entitled to provide investment and ancillary services to its clients in relation to financial instruments as permitted by the license

What is RAM Cyprus?

Regency Asset Management (Cyprus) Limited, known as RAM Cyprus, is a regulated investment firm offering portfolio management and ancillary services. They specialize in managing various financial instruments, including securities, derivatives, and money-market instruments. RAM Cyprus is regulated by CySEC, ensuring compliance with investment regulations and client protection. Specific details such as fees and account minimums are not provided on their website.

Pros & Cons of RAM Cyprus

Pros:

Regulated: RAM Cyprus is regulated by The Cyprus Securities and Exchange Commission (CySEC). This provides a level of assurance that they operate according to established standards.

Diverse Services: RAM Cyprus offers portfolio management services alongside ancillary services like safekeeping of investments and foreign exchange for investment purposes. This provides a one-stop shop for some investors.

Wide Range of Financial Instruments: RAM Cyprus deals with a variety of investment options, catering to different risk tolerances and investment goals. This includes traditional assets like stocks and bonds, as well as more complex instruments like derivatives.

Cons:

Lack of Specifics: Specific details such as account minimums, fees, and available platforms are not readily available, which makes it challenging for clients to assess the suitability of the services.

Risks for Complex Investments: RAM Cyprus offers complex financial instruments like derivatives. These can be high-risk and require significant investment knowledge.

Is RAM Cyprus Safe?

RAM Cyprus, as a regulated investment firm under the supervision of The Cyprus Securities and Exchange Commission (CySEC) with a license of No.089/08, is generally considered safe. Regulatory oversight by CySEC means that RAM Cyprus must adhere to strict financial and operational standards designed to protect investors.

RAM Cyprus categorizes clients as Retail or Professional. Retail Clients receive a higher level of investor protection, with safeguards like suitability and appropriateness tests to ensure they understand the risks involved in specific investments. Additionally, RAM Cyprus segregates client assets from the company's own funds and those of other clients. This reduces the risk of the company's financial problems impacting client investments.

What are Securities to Trade with RAM Cyprus?

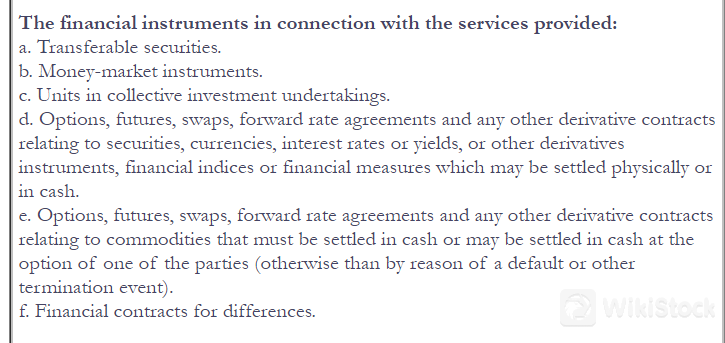

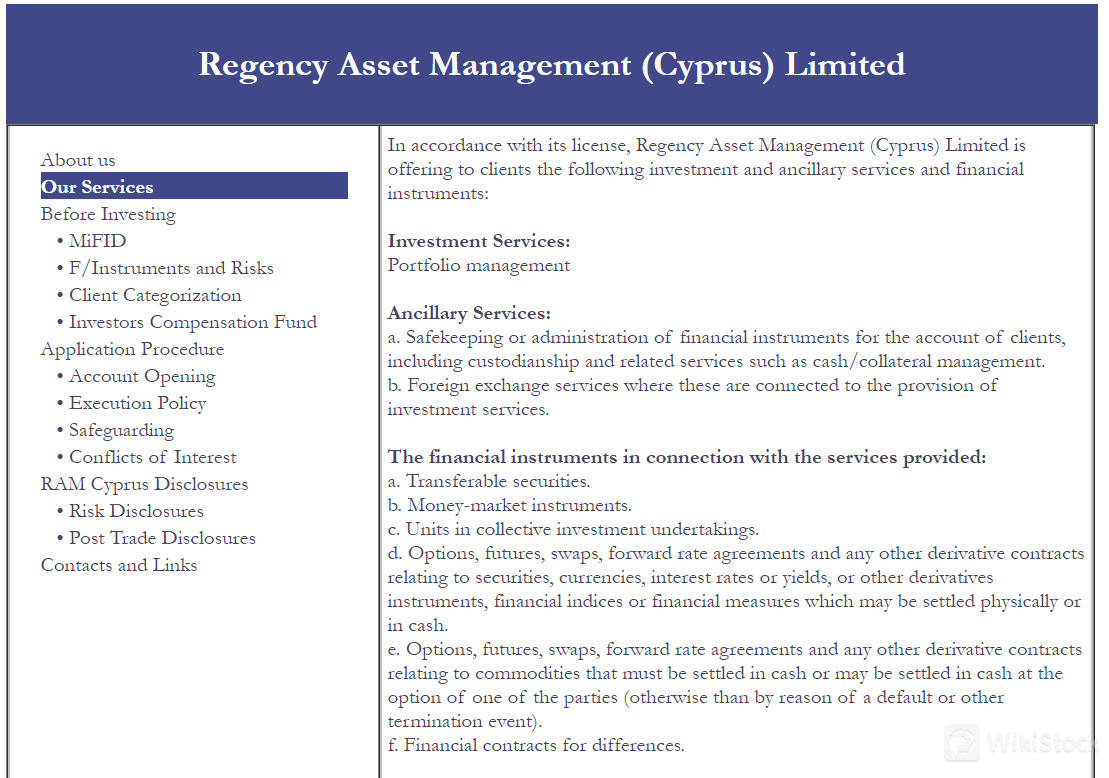

RAM Cyprus offers a range of financial instruments for trading. These securities offer investors a diverse range of investment opportunities, allowing them to build a well-rounded investment portfolio tailored to their financial goals and risk tolerance.

Transferable Securities: These are securities that can be traded on financial markets, such as stocks and bonds issued by corporations or governments.

Money-market Instruments: These are short-term, highly liquid debt securities issued by governments, financial institutions, and corporations to finance their short-term cash needs.

Units in Collective Investment Undertakings: These are units or shares in collective investment schemes such as mutual funds, which pool investors' funds to invest in a diversified portfolio of securities.

Derivatives: RAM Cyprus deals with various types of derivatives, including options, futures, swaps, and forward rate agreements. These instruments derive their value from an underlying asset and are used for hedging or speculative purposes.

Financial Contracts for Differences (CFDs): CFDs are financial derivatives that allow traders to speculate on the price movements of assets without owning the underlying asset. They are often used for trading stocks, indices, commodities, and currencies.

RAM Cyprus Services Review

RAM Cyprus offers a range of investment services, including portfolio management and ancillary services, providing clients with access to professional portfolio management and a variety of financial instruments.

Portfolio Management: RAM Cyprus provides portfolio management services, allowing clients to have their investments managed by professionals. This service is suitable for clients who prefer a hands-off approach to managing their investments.

Ancillary Services: In addition to portfolio management, RAM Cyprus offers ancillary services such as safekeeping or administration of financial instruments for clients' accounts, and foreign exchange services connected to the provision of investment services. These services complement their portfolio management offering and provide clients with a comprehensive investment solution.

Research & Education

RAM Cyprus provides the Markets in Financial Instruments Directive (MiFID) and Financial Instruments and Risks as part of the research and education offerings on their website. These resources are likely aimed at helping clients understand the regulatory framework and risks associated with investing in financial instruments.

MiFID is a crucial piece of legislation that governs investment firms and the markets in financial instruments in the European Union. Understanding MiFID is essential for clients dealing with investment firms in Europe, as it outlines the rights and protections afforded to investors.

The information on Financial Instruments and Risks likely provides details on the various types of financial instruments available for investment, along with their associated risks. This information is crucial for investors to make informed decisions about their investments, as different instruments carry varying levels of risk.

Customer Service

Located in Nicosia, Cyprus, RAM Cyprus can be contacted by phone at +357 22 818 691 or by fax at +357 22 818 693. Clients can also reach out via email at mail@regencyfund.com.

Conclusion

In summary, RAM Cyprus is a regulated investment firm offering portfolio management and ancillary services. They provide a wide range of financial instruments for trading and are regulated by CySEC, offering a comprehensive investment solution for clients seeking professional portfolio management services. However, specific details such as fees and account minimums are not readily available. Deeper research about fee structure is necessary before diving in.

Frequently Asked Questions (FAQs)

Is RAM Cyprus a regulated investment firm?

Yes, RAM Cyprus is regulated by The Cyprus Securities and Exchange Commission (CySEC).

What services does RAM Cyprus offer?

RAM Cyprus offers portfolio management services, ancillary services such as safekeeping or administration of financial instruments, and foreign exchange services connected to the provision of investment services.

What financial instruments can I trade with RAM Cyprus?

Transferable securities, money-market instruments, units in collective investment undertakings, derivatives (such as options, futures, swaps, forand ward rate agreements), and financial contracts for differences.

Does RAM Cyprus offer educational resources?

Yes, RAM Cyprus provides research and education materials, including the Markets in Financial Instruments Directive (MiFID) and financial instruments and risks.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Indonesia

IndonesiaObtain 1 securities license(s)