Điểm

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Mức ảnh hưởng

B

Chỉ số ảnh hưởng NO.1

Canada

CanadaSản phẩm giao dịch

5

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Hơn 60.25% sàn môi giới

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

IIROCCó giám sát quản lý

CanadaGiấy phép giao dịch chứng khoán

Thông tin sàn môi giới

More

Tên công ty

Odlum Brown Limited

Viết tắt

Odlum Brown

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

https://www.odlumbrown.com/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

| Odlum Brown |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 1923 |

| Registered Region | Canada |

| Regulatory Status | IIROC |

| Product & Services | Equities, fixed income investment, mutual fund, ETFs, options |

| Estate planning, retirement planning, tax information services, insurance and annuities | |

| Customer Service | Head office: Suite 1100 – 250 Howe Street, Vancouver, BC V6C 3S9 |

| T: 604-669-1600 | |

| Toll Free: 1-888-886-3586 | |

| Fax: 604-681-8310 | |

| Email: information@odlumbrown.com, media@odlumbrown.com, sponsorships@odlumbrown.com | |

| Inquiry form, social media |

Odlum Brown Thông tin

Được thành lập vào năm 1923 tại Canada, Odlum Brown Financial Services Limited (OBFSL) cung cấp một loạt các sản phẩm tài chính bao gồm cổ phiếu, đầu tư thu nhập cố định, quỹ hỗn hợp, ETF và tùy chọn. Dịch vụ của họ mở rộng đến lĩnh vực quy hoạch di sản, quy hoạch hưu trí, thông tin thuế và giải pháp bảo hiểm. Được quy định bởi IIROC (Tổ chức Quản lý Ngành Đầu tư của Canada), Odlum Brown Securities tuân thủ các tiêu chuẩn nghiêm ngặt, đảm bảo uy tín và tuân thủ quy định.

Ưu điểm & Nhược điểm

| Ưu điểm | Nhược điểm |

| Quản lý giám sát | Độ phức tạp của dịch vụ |

| Lâu dài và Uy tín | |

| Một loạt các sản phẩm tài chính | |

| Dịch vụ tài chính toàn diện |

- Tuân thủ quy định: Được quy định bởi IIROC (Tổ chức Quản lý Ngành Đầu tư của Canada), Odlum Brown tuân thủ các tiêu chuẩn quy định nghiêm ngặt, đảm bảo bảo vệ khách hàng và tính toàn vẹn tài chính.

- Lâu dài và Uy tín: Được thành lập từ năm 1923, Odlum Brown có uy tín lâu đời trong ngành dịch vụ tài chính, mang lại sự ổn định và đáng tin cậy.

- Một loạt các sản phẩm tài chính: Họ cung cấp một bộ sưu tập đa dạng các sản phẩm tài chính bao gồm cổ phiếu, đầu tư thu nhập cố định, quỹ hỗn hợp, ETF và tùy chọn.

- Dịch vụ tài chính toàn diện: Odlum Brown cung cấp các dịch vụ mở rộng ngoài các sản phẩm đầu tư, bao gồm quy hoạch di sản, quy hoạch hưu trí, thông tin thuế và giải pháp bảo hiểm, cung cấp kế hoạch tài chính toàn diện. Nhược điểm:

- Độ phức tạp của dịch vụ: Sự đa dạng của các dịch vụ có thể làm cho người mới bắt đầu hoặc những người tìm kiếm các lựa chọn đầu tư đơn giản mà không cần kế hoạch tài chính toàn diện cảm thấy áp lực.

- Odlum Brown có được quy định bởi bất kỳ cơ quan tài chính nào không?

- Dịch vụ tài chính nào mà Odlum Brown cung cấp?

- Odlum Brown có phù hợp cho người mới bắt đầu không?

Đó có an toàn không?

Quy định:

Odlum Brown hoạt động dưới sự quản lý của các cơ quan tài chính toàn cầu nổi tiếng. Hiện tại, hoạt động dưới quy định của Tổ chức Quản lý Ngành Đầu tư của Canada (IIROC), thể hiện cam kết của họ trong việc duy trì các tiêu chuẩn cao nhất về hoạt động tài chính.

Biện pháp an toàn:

Odlum Brown ưu tiên các biện pháp bảo mật mạnh mẽ để bảo vệ thông tin khách hàng và giao dịch. Chính sách bảo mật của họ đảm bảo tuân thủ các yêu cầu quy định liên quan và bao gồm các biện pháp như truyền dữ liệu được mã hóa, giao thức lưu trữ an toàn và kiểm soát truy cập nghiêm ngặt. Odlum Brown sử dụng các phương pháp tiêu chuẩn ngành để bảo vệ khỏi việc truy cập trái phép, sử dụng sai mục đích hoặc thay đổi dữ liệu khách hàng, duy trì sự tin tưởng và bảo mật trong quan hệ với khách hàng của họ.

Các chứng khoán để giao dịch với Odlum Brown là gì?

Odlum Brown cung cấp một loạt các sản phẩm đầu tư phong phú được tùy chỉnh để đáp ứng các mục tiêu tài chính và hồ sơ rủi ro đa dạng.

Các sản phẩm của họ bao gồm đầu tư cổ phiếu, cung cấp cho khách hàng quyền sở hữu trong các công ty thông qua cổ phiếu thông thường, cho phép nhận cổ tức tiềm năng và lợi nhuận vốn. Cổ phiếu ưu tiên được cung cấp cho những người tìm kiếm nguồn thu nhập ổn định và ưu tiên trong việc thanh toán cổ tức. Đơn vị đầu tư thu nhập cung cấp phân phối thuế thu nhập, tuy nhiên có quyền của nhà đầu tư khác so với cổ phiếu thông thường.

Đối với nhà đầu tư thu nhập cố định, Odlum Brown cung cấp quyền truy cập vào trái phiếu chính phủ và doanh nghiệp, cũng như công cụ thị trường tiền và Chứng chỉ đầu tư đảm bảo (GICs), v.v..

Ngoài ra, họ còn cung cấp quỹ chung do các chuyên gia làm việc, cho phép đa dạng hóa danh mục đầu tư trên các lớp tài sản khác nhau như cổ phiếu, trái phiếu, v.v.

Các quỹ giao dịch trên sàn (ETFs) cũng có sẵn, cung cấp các lựa chọn đầu tư hiệu quả về chi phí và thuế môi trường, phản ánh chỉ số cổ phiếu hoặc trái phiếu.

Hơn nữa, việc bao gồm tùy chọn của Odlum Brown mở rộng bộ sưu tập các giải pháp đầu tư của họ, cho phép nhà đầu tư mua hoặc bán tài sản với một giá cụ thể trong một khoảng thời gian cụ thể, phục vụ khách hàng tìm kiếm các công cụ tài chính tiên tiến để bổ sung cho chiến lược đầu tư của họ.

Dịch vụ

Odlum Brown Financial Services Limited cung cấp các giải pháp quy hoạch tài chính toàn diện trong một số danh mục chính.

Dịch vụ quy hoạch tài sản của họ giúp khách hàng tích lũy và bảo vệ tài sản, đảm bảo việc chuyển giao mượt mà cho người thừa kế hoặc người hưởng lợi.

Đối với quy hoạch hưu trí, Odlum Brown tập trung vào việc đạt được lối sống sau khi nghỉ việc mong muốn thông qua các chiến lược tùy chỉnh.

Dịch vụ thông tin thuế của họ cung cấp thông tin về tác động thuế của quyết định đầu tư, tuy nhiên họ không cung cấp lời khuyên thuế.

Ngoài ra, các sản phẩm bảo hiểm và hợp đồng trợ cấp của họ bao gồm bảo hiểm tàn tật, bảo hiểm mạng sống và bệnh nguy hiểm nghiêm trọng, cùng với hợp đồng trợ cấp cho thu nhập đảm bảo.

Chuyên môn của Odlum Brown nằm trong việc tùy chỉnh các giải pháp để đáp ứng các mục tiêu tài chính cá nhân, được hỗ trợ bởi các chuyên gia có giấy phép. Để biết thêm thông tin về dịch vụ của họ, bạn có thể liên hệ với Cố vấn Đầu tư hoặc Quản lý Danh mục của Odlum Brown.

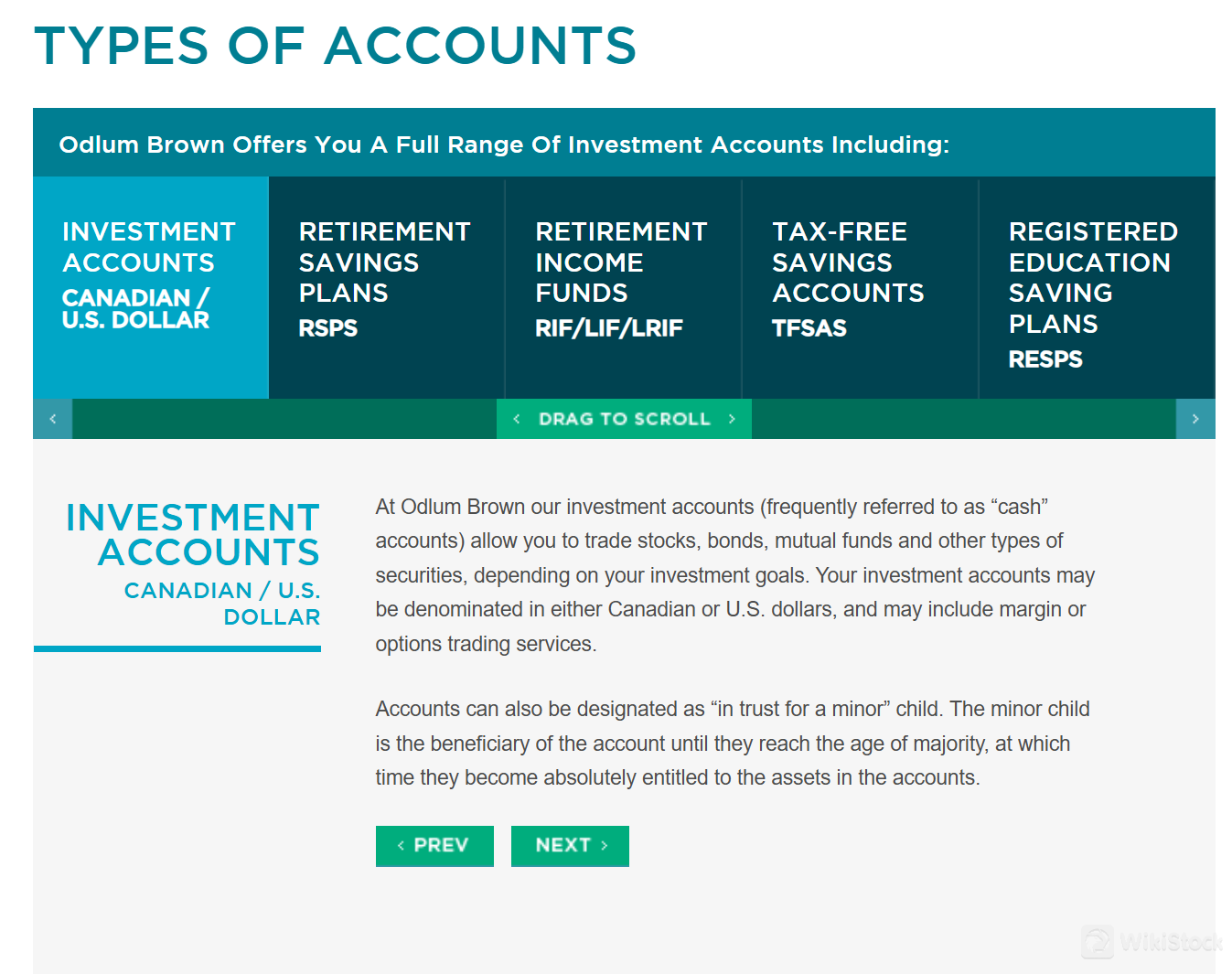

Tài khoản

Odlum Brown cung cấp một loạt các loại tài khoản được thiết kế để đáp ứng các nhu cầu đa dạng của nhà đầu tư.

Tài khoản Doanh nghiệp phục vụ các công ty và tổ chức, cho phép họ đầu tư vào quỹ chung, cổ phiếu, trái phiếu, GICs và các chứng khoán khác trong cả đô la Canada và đô la Mỹ.

Tài khoản Tiết kiệm Nhà đầu tư Đầu tiên (FHSA) được tùy chỉnh cho người mua nhà lần đầu, cung cấp các khoản đóng góp được khấu trừ thuế, thu nhập đầu tư không chịu thuế và rút tiền không chịu thuế cho mục đích mua nhà, với các lựa chọn đầu tư linh hoạt bao gồm tiền mặt và trái phiếu.

Tài khoản Tin cậy lý tưởng cho quy hoạch tài sản, cung cấp bảo vệ và quản lý tài sản tin cậy trong cả đô la Canada và đô la Mỹ.

Tài khoản Di sản cung cấp một phương pháp tiếp cận thông minh để quản lý và phân phối tài sản của di sản, kết hợp các tính năng tài khoản đầu tư với các dịch vụ di sản chuyên biệt.

Tài khoản đầu tư rất linh hoạt, cho phép giao dịch trong nhiều loại chứng khoán và có sẵn cả đô la Canada và đô la Mỹ, với các lựa chọn cho giao dịch ký quỹ hoặc giao dịch quyền chọn và chỉ định niêm yết cho người dưới 18 tuổi.

Cuối cùng, Tài khoản Tiết kiệm Miễn thuế (TFSAs) cho phép cư dân Canada tiết kiệm mà không phải trả thuế, phù hợp cho cả mục tiêu đầu tư dài hạn và ngắn hạn với nhiều lựa chọn đầu tư.

Dịch vụ khách hàng

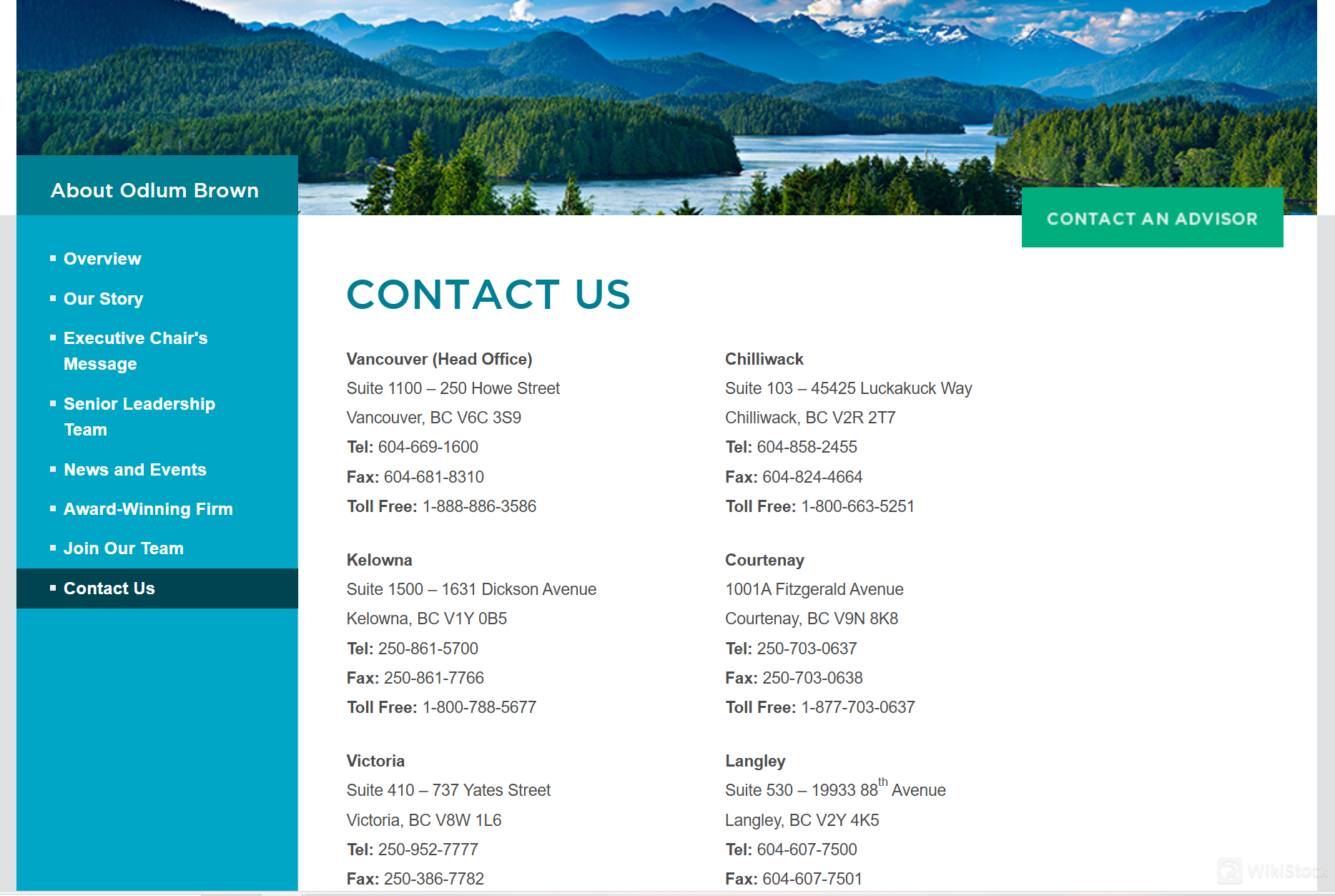

Odlum Brown cung cấp dịch vụ khách hàng toàn diện thông qua nhiều kênh để đáp ứng nhu cầu đa dạng.

Trụ sở chính của họ, tọa lạc tại Suite 1100 - 250 Howe Street, Vancouver, BC, có thể liên hệ qua điện thoại 604-669-1600 hoặc miễn cước 1-888-886-3586.

Giao tiếp cũng được tạo điều kiện thông qua fax 604-681-8310 và email tại information@odlumbrown.comđối với các yêu cầu chung, vấn đề liên quan đến truyền thông tạimedia@odlumbrown.com, và các yêu cầu tài trợ tạisponsorships@odlumbrown.com.

Ngoài ra, họ tương tác với khách hàng thông qua các nền tảng truyền thông xã hội bao gồm LinkedIn, Facebook, Twitter, và Instagram.

Hơn nữa, một biểu mẫu yêu cầu thông tin trên trang web của họ dành cho những người thích tương tác và gọi lại trực tuyến.

Đối với thông tin liên hệ theo chi nhánh trên khắp Canada, cá nhân có thể truy cập trang web của họ tại https://www.odlumbrown.com/about/contact-us.

Kết luận

Odlum Brown, có trụ sở tại Vancouver, BC, là một công ty đầu tư đã được khẳng định cung cấp một loạt dịch vụ tài chính, bao gồm tư vấn đầu tư, quản lý danh mục và quy hoạch tài sản. Được quy định bởi Tổ chức Quản lý Ngành Đầu tư Canada (IIROC) và là thành viên của Quỹ Bảo vệ Nhà đầu tư Canada (CIPF), Odlum Brown đảm bảo tuân thủ các tiêu chuẩn ngành nghiêm ngặt, mang lại sự tự tin cho khách hàng trong các giao dịch tài chính của họ. Nó là một đối tác đáng tin cậy trong việc điều hướng những phức tạp của kế hoạch tài chính và quản lý đầu tư cho nhà đầu tư.

Câu hỏi thường gặp (FAQs)

Có, nó được quy định bởi IIROC.

Nó cung cấp giao dịch Chứng khoán, đầu tư thu nhập cố định, quỹ hỗn hợp, ETF, quyền chọn, cũng như tư vấn đầu tư, quản lý danh mục, quy hoạch tài sản, bảo hiểm và hợp đồng bảo hiểm, và quy hoạch về hưu, v.v.

Mặc dù được quy định bởi IIROC, Odlum Brown có thể không phải là lựa chọn lý tưởng cho những người mới hoàn toàn trong việc đầu tư. Dịch vụ của họ được tùy chỉnh hơn cho những người tìm kiếm quản lý đầu tư cá nhân hóa và quy hoạch tài chính, phù hợp hơn cho những người có một số hiểu biết hoặc mục tiêu tài chính cụ thể.

Cảnh báo rủi ro

Giao dịch trực tuyến có rủi ro đáng kể và bạn có thể mất toàn bộ số vốn đầu tư. Nó không phù hợp cho tất cả các nhà giao dịch hoặc nhà đầu tư. Vui lòng đảm bảo rằng bạn hiểu rõ các rủi ro liên quan và lưu ý rằng thông tin được cung cấp trong bài đánh giá này có thể thay đổi do việc cập nhật liên tục các dịch vụ và chính sách của công ty.

Thông tin khác

Registered region

Canada

Số năm kinh doanh

Hơn 20 năm

Margin Trading

YES

Các quốc gia được quản lý

1

Sản phẩm giao dịch

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Tag sàn môi giới

Quốc gia

Tên công ty

Mối quan hệ kết nối

--

Odlum Brown Financial Services Limited

Công ty con

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

IBKR

Điểm

Webull

Điểm

Moomoo

Điểm

OANDA

Điểm

TD Securities

Điểm

Canaccord Genuity

Điểm

Fortrade

Điểm

TradeZero

Điểm

HAYWOOD

Điểm

Velocity Trade

Điểm