Nilai

Peringkat indeks

Penilaian Broker

Pengaruh

A

Indeks pengaruh NO.1

Japan

JapanProduk

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Lisensi sekuritas

dapatkan 1 lisensi sekuritas

FSARegulated

JapanSecurities Trading License

Kursi Global

![]() Memiliki 1 kursi

Memiliki 1 kursi

Japan NSE

Jトラストグローバル証券株式会社

Informasi Pialang

More

Nama perusahaan

J TRUST GLOBAL SECURITIES CO., LTD

Singkatan

JTG証券

Negara dan wilayah terdaftar platform

Alamat perusahaan

Situs Perusahaan

https://www.jtg-sec.co.jp/Periksa kapanpun Anda mau

WikiStock APP

Layanan Broker

Gene Internet

Indeks Gene

Peringkat APP

Fitur broker

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

Products

5

| JTG Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | Transaction Fees, Miscellaneous Expenses |

| Account Fees | Free Opening |

| Margin Interest Rates | Institutional Margin Trading: 2.80% (Annual Rate) |

| General Margin Trading: 4.0% (Annualized) | |

| Mutual Funds Offered | 5,000 yen or more per investment trust in units of 1 yen |

| App/Platform | Smart Stocks, JTG Trader Premium |

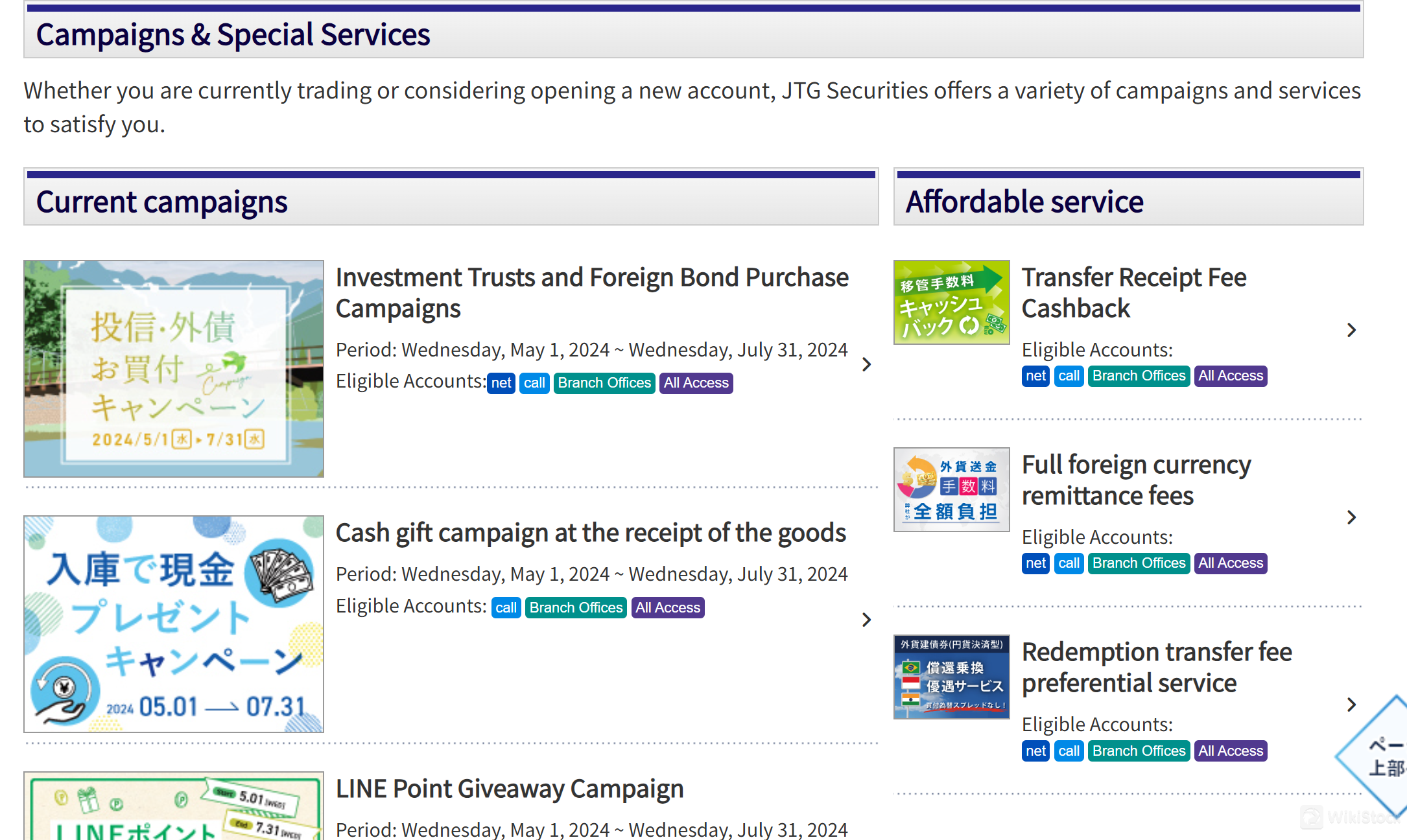

| Promotions | Investment Trusts and Foreign Bond Purchase Campaigns |

JTG Securities Information

JTG Securities is a Japanese brokerage firm headquartered in Shibuya, Tokyo, that supports online account opening and login services. JTG Securities is registered with the Kanto Local Finance Bureau (Financial Instruments) No. 35. It offers a wide range of financial products. Its services include domestic and international stock trading, new and existing bonds, investment trusts, futures and options trading, and foreign stock trading.

Pros & Cons of JTG Securities

| Pros | Cons |

|

|

|

|

|

Pros:

Wide Range of Financial Products: JTG Securities offers a comprehensive selection of financial products, including domestic and international stocks, bonds, investment trusts, futures, options, and foreign stocks.

Competitive Foreign Exchange Spreads: The brokerage offers competitive foreign exchange spreads for different currencies, enhancing transparency and potentially reducing trading costs for clients.

Regulatory Compliance: Registered under Kanto Local Finance Bureau (Financial Instruments) No. 35, JTG Securities adheres to regulatory standards set by Japanese financial authorities.

Cons:

Market Restrictions: While JTG Securities offers foreign stock trading, its focus is primarily on the Japanese market. This may limit options for clients seeking a broad range of international investment opportunities.

Complex Fee Structure: JTG Securities' fee structure is complex, including transaction fees, account maintenance fees, and other service fees. Clients should carefully review these fees to fully understand the costs of their investment.

Is JTG Securities Safe?

JTG Securities is regulated by the Japan Financial Services Agency (FSA), bearing the registration number No. 関東財務局長(金商)第35号. This regulation signifies that JTG Securities adheres to stringent Japanese financial regulations and standards designed to protect investors and maintain market integrity. The FSA's oversight ensures that JTG Securities operates with transparency, accountability, and robust risk management practices.

What are Securities to Trade with JTG Securities?

JTG Securities offers a wide range of securities for trading. Clients can trade domestic stocks through spot trading. Margin trading allows investors to use cash or stocks as collateral to expand their investment capabilities. Exchange-traded funds (ETFs) are also available. Real estate investment trusts (REITs) provide access to real estate portfolios. JTG Securities facilitates participation in initial public offerings (IPOs) and public offerings (POs), allowing clients access to new listings and stocks of newly listed and existing companies.

In the bond space, JTG Securities offers domestic and foreign bond options, including convertible bonds (CBs) that can be converted into stocks under certain conditions. In addition, investment trusts are available, offering selected funds from Japan and overseas that meet various investment objectives and risk preferences. JTG Securities offers foreign stocks from major markets such as the United States, Indonesia, Singapore, and China.

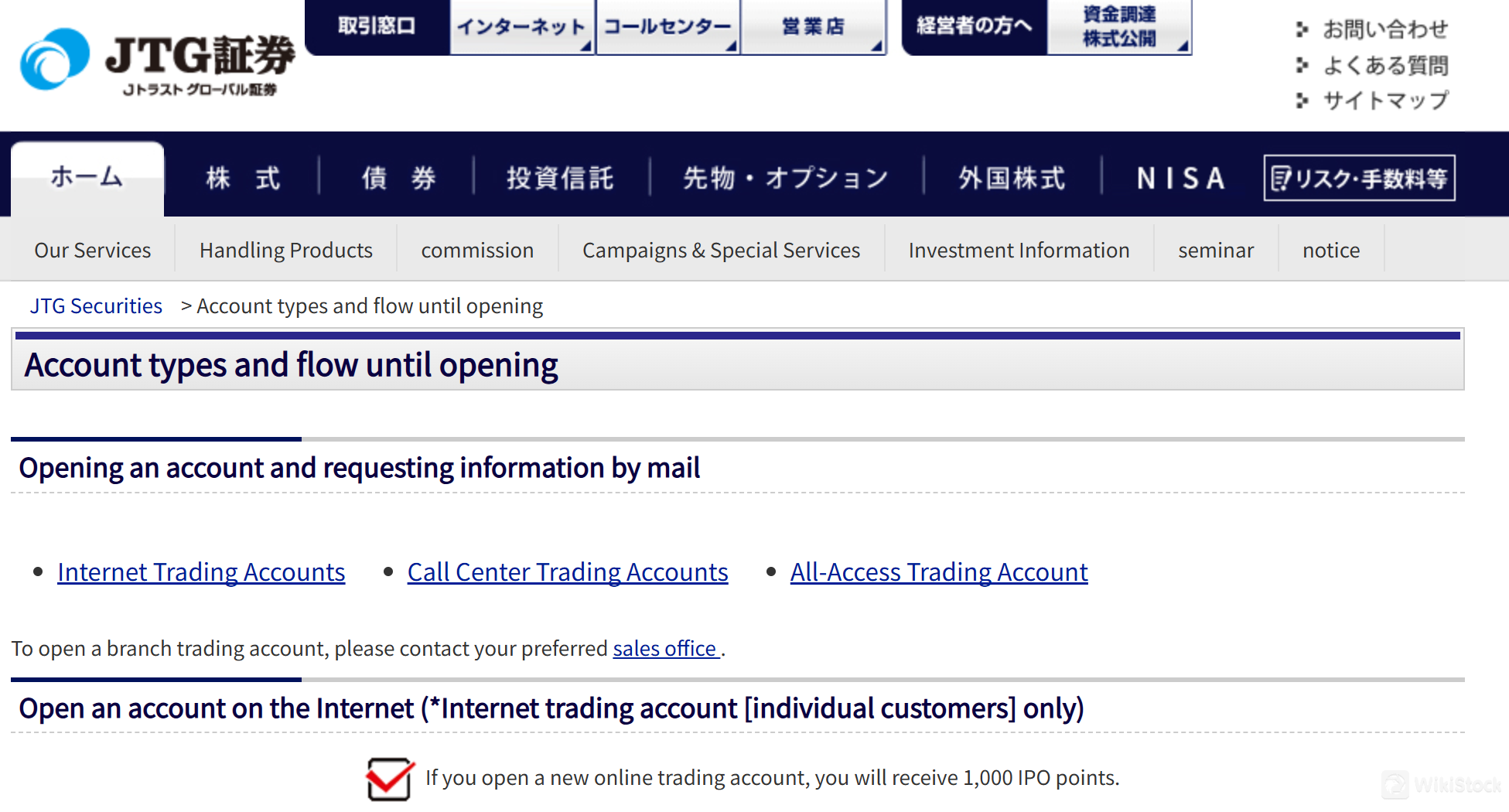

JTG Securities Accounts

JTG Securities offers three types of trading accounts. The Internet Trading Account provides clients with the convenience of executing trades online. It allows investors to effectively manage their investments from anywhere there is internet access. The Call Center Trading Account provides an alternative for clients who prefer to trade over the phone. This account type allows investors to interact directly with a broker or trading representative to execute orders and receive personalized assistance. In addition, JTG Securities offers the All-Access Trading Account. This account combines the features of both the Internet and Call Center Trading accounts.

JTG Securities Fees Review

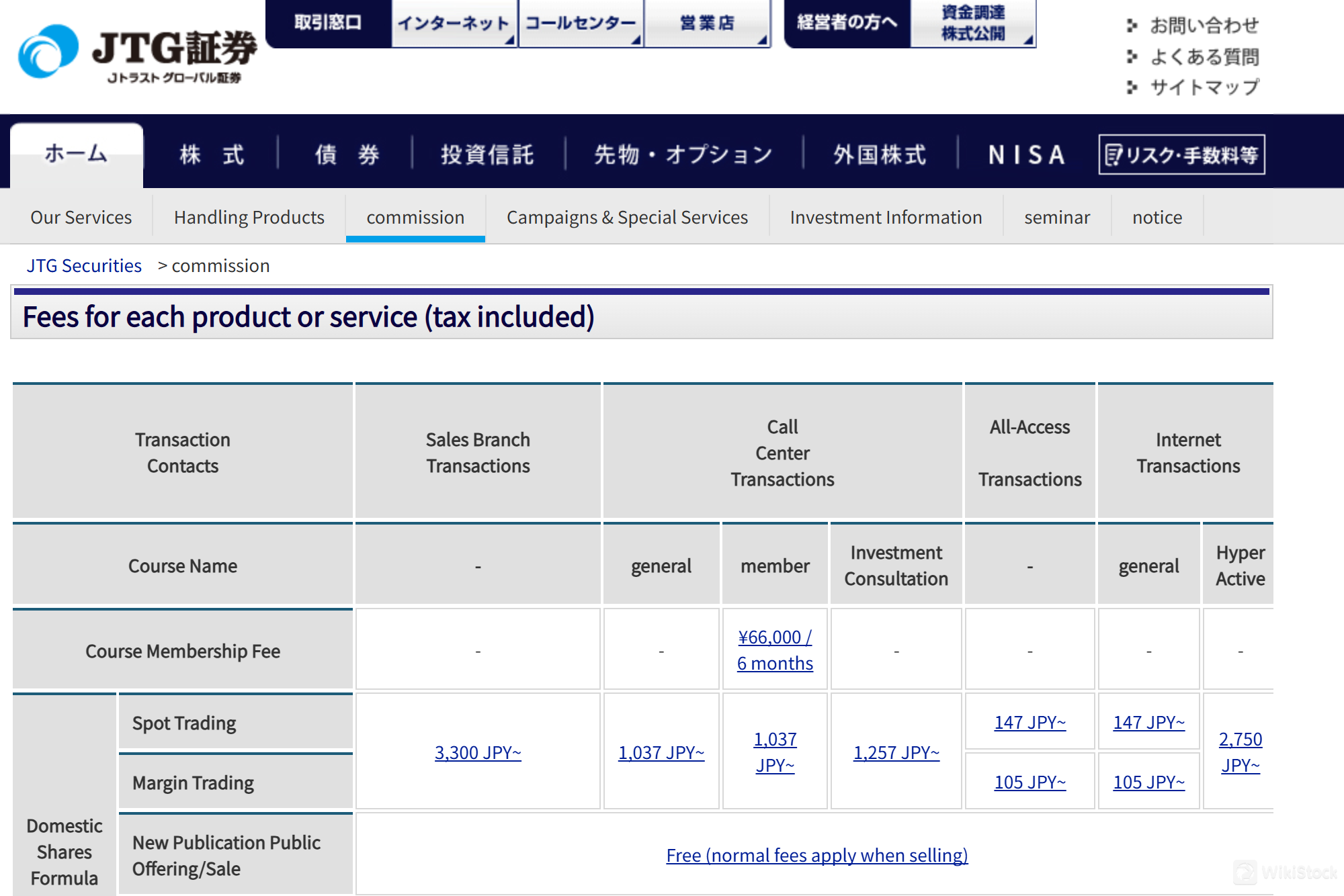

JTG Securities applies a range of commissions and fees across its trading services. For transactions involving domestic stocks, fees vary depending on the method of trading—whether through spot trading, margin trading, or IPOs. Spot trading fees start at approximately 3,300 JPY, with additional charges for margin trading and less-than-one-unit share transactions. Futures trading, such as Nikkei 225 Futures and Options, incurs fees based on contract prices, while foreign stocks like U.S., Indonesian, Singaporean, and Chinese stocks are subject to a flat fee of 1,650 JPY per trade, plus local agency fees and foreign exchange spreads.

Regarding margin trading, JTG Securities imposes a management fee on stocks, ranging from 11 sen to 1,100 JPY per share, depending on whether they adhere to the unit share system. Additionally, margin interest rates are set at 2.80% annually for institutional margin trading and 4.0% for general margin trading. These rates apply to the funds borrowed for leveraged trading activities, influencing the overall cost of maintaining positions over time. For precise details on all fees and commissions, you can consult JTG Securities' comprehensive fee schedule or contact their customer service directly.

JTG Securities App Review

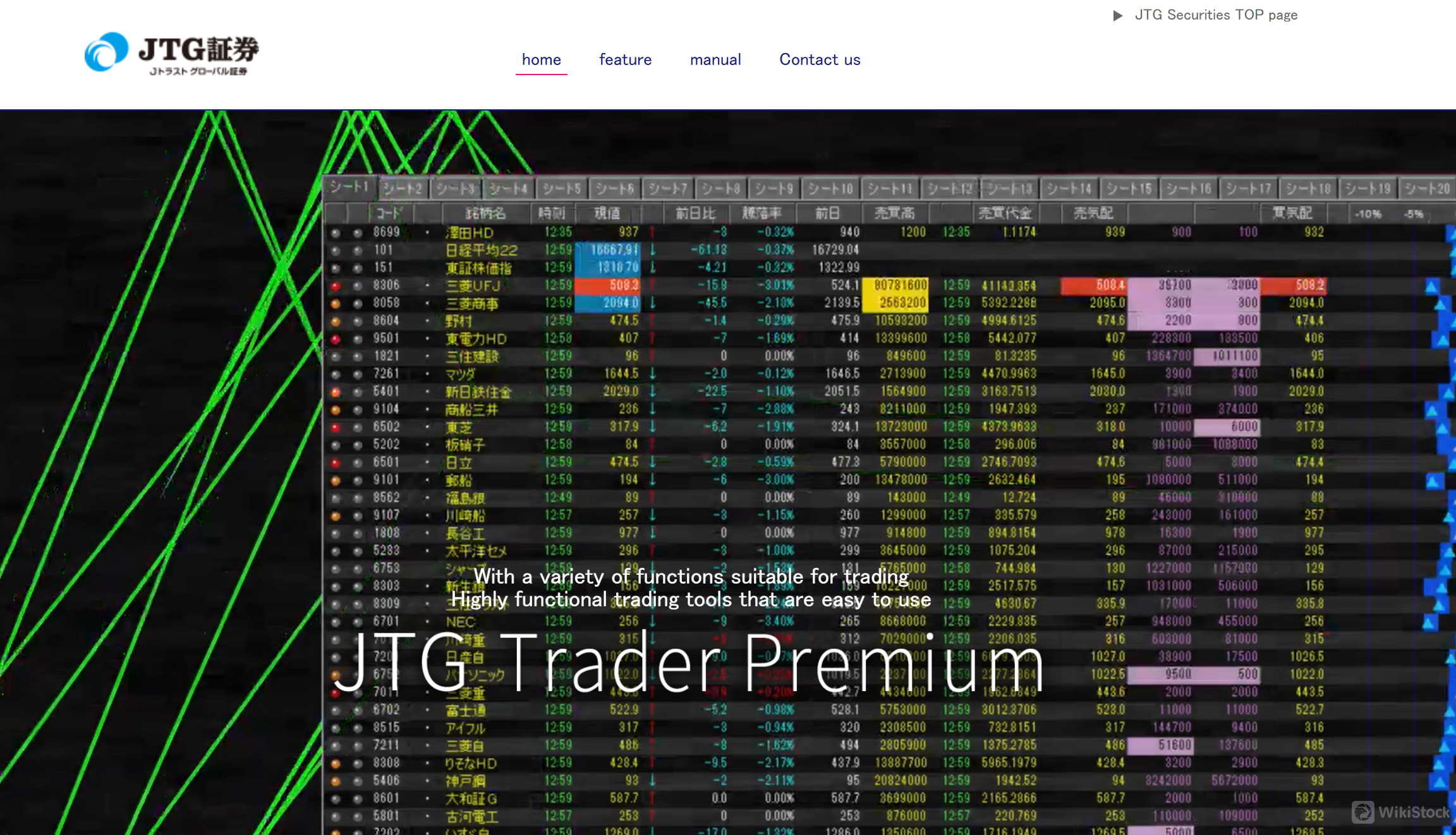

JTG Securities offers the application Smart Stocks. Smart Stocks is a mobile application designed for iOS and Android platforms. It provides access to real-time market data, enabling users to monitor stock prices, analyze charts, place orders, and manage investments anytime, anywhere. Smart Stocks supports various features, such as automatic trading functions, order corrections, and market information updates.

JTG Trader Premium is a comprehensive trading platform provided by JTG Securities. JTG Trader Premium provides access to a wide range of financial instruments, including stocks, bonds, futures, options, and forex. JTG Trader Premium has a user-friendly interface and rich features. It provides powerful charting tools, customizable dashboards, technical analysis capabilities, and real-time market data streaming.

Research & Education

JTG Securities offers seminars, webinars, and workshops on topics ranging from basic financial literacy to advanced trading strategies. These educational programs are designed to meet the needs of investors at all levels, providing them with the skills and knowledge needed to effectively navigate the complexities of the financial markets. In addition, JTG Securities promotes proactive investment education by ensuring clients are kept abreast of market developments through regular updates and commentary.

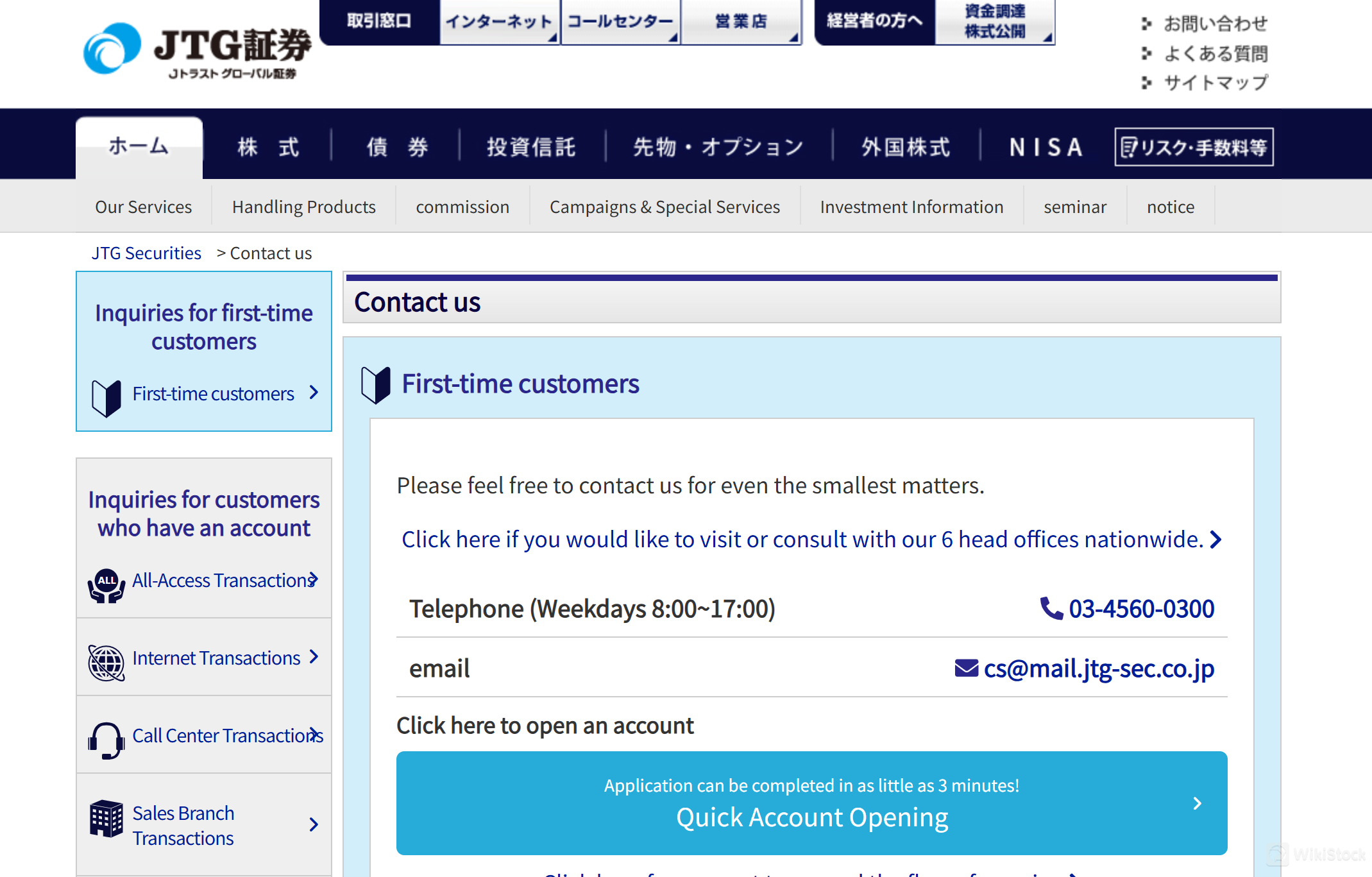

Customer Service

For first-time buyers, JTG Securities offers direct support via phone at 03-4560-0300 and email at cs@mail.jtg-sec.co.jp. Existing account holders enjoy dedicated service at 0120-68-1605, ensuring timely assistance with account-related inquiries and transactions. Call center trading account customers enjoy dedicated support at 03-4560-0350, facilitating efficient trading operations and addressing specific account needs.

Branch-specific inquiries are handled via designated contact numbers, ensuring localized support as required by regional customers. For general comments and inquiries, an alternative line is available at 03-4560-0259 to handle a variety of non-account-specific questions and feedback. For online interactions, JTG Securities maintains an active presence on social media platforms such as Facebook and YouTube.

Conclusion

JTG Securities offers a comprehensive range of financial services. With a powerful platform and broad market access, clients can participate in a variety of investment opportunities such as stocks, bonds, derivatives, etc. The company emphasizes transparency and customer-centricity. JTG Securities fees and commissions are competitive, and although they vary by product and service, transaction costs are clear. Margin trading options further expand investment potential. JTG Securities' commitment to technological innovation is highlighted by its mobile app Smart Stocks and trading platform JTG Trader Premium. What's more, JTG Securities has regulatory compliance.

Frequently Asked Questions (FAQs)

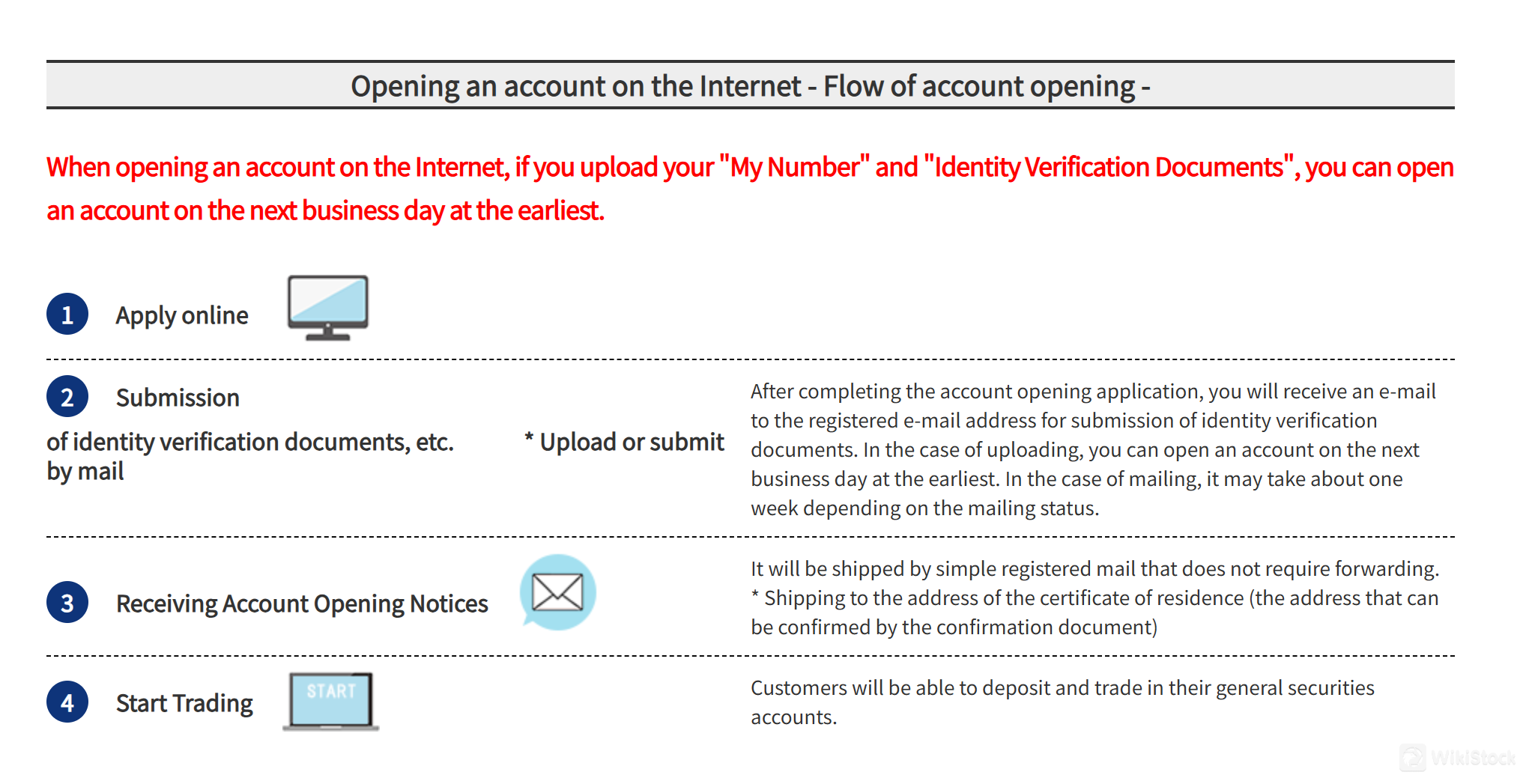

How can I open an account with JTG Securities?

To open an account with JTG Securities, visit their website and choose either the online application for individual internet trading accounts or opt for quick account opening. Complete the form, submit necessary documents like your “My Number” and ID verification, and await confirmation to start trading. For corporate or specialized accounts, contact JTG Securities directly for tailored guidance.

Does JTG Securities offer any special promotions or incentives for new customers?

JTG Securities runs campaigns and special services that include benefits such as cash gifts, fee rebates, and other bonuses for eligible accounts. Check out their promotions page or contact their customer service directly to find out the latest offers for new customers.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Lainnya

Registered region

Japan

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Badan Usaha Terkait

Negara

Company name

Asosiasi

Japan

Jトラスト株式会社

Group Company

Review

Tidak ada rating

Perusahaan Pialang yang DirekomendasikanMore

三菱UFJモルガン・スタンレー証券

Nilai

Nissan Securities

Nilai

水戸証券

Nilai

東洋証券株式会社

Nilai

豊証券株式会社

Nilai

Kyokuto Securities

Nilai

ちばぎん証券

Nilai

あかつき証券

Nilai

Money Partners

Nilai

岩井コスモ証券

Nilai