Tesla, Apple Chip Supplier STMicroelectronics Q2 Earnings Hit by Weakness in Industrial and Automotive Se

STMicroelectronics NV (NYSE:STM) reported a fiscal second-quarter 2024 revenue decline of 25.3% year-on-year to $3.23 billion, beating the analyst consensus estimate of $3.20 billion.

The Tesla IncTSLA and Apple IncAAPL suppliers EPS of $0.38 beat the analyst consensus estimate of $0.36.

Sales to OEMs decreased by 14.9% Y/Y, and Distribution sales fell by 43.7% Y/Y.

Analog products, MEMS, and Sensors (AM&S) segment revenue declined 10.0% Y/Y to $1.17 billion, mainly due to a decrease in Imaging.

Power and Discrete products (P&D) segment revenue decreased 24.4% Y/Y to $747 million.

The microcontrollers (MCU) segment revenue decreased 46.0% year over year to $800 million, mainly due to a decrease in GP MCU.

Digital ICs and RF products (D&RF) segment revenue decreased 7.6% Y/Y to $516 million due to a decrease in ADAS.

Margins:The gross margin declined by 890 bps to 40.1%, mainly due to the combination of the sales price, product mix, and unused capacity charges. The operating margin decreased by 1,490 bps to 11.6%.

STMicroelectronics generated $159 million in free cash flow and held $6.3 billion in cash and equivalents as of June 29, 2024. It generated an operating cash flow of $702 million.

Jean-Marc Chery, ST President & CEO, commented: “Q2 net revenues were above the midpoint of our business outlook range driven by higher revenues in Personal Electronics, partially offset by lower than expected revenues in Automotive. Gross margin was in line with expectations.”

“During the quarter, contrary to our prior expectations, customer orders for Industrial did not improve and Automotive demand declined.”

Outlook: STMicroelectronics expects fiscal third-quarter 2024 revenue of $3.25 billion, a decrease of about 0.6% sequentially, plus or minus 350 bps (consensus $3.58 billion). The company expects a gross margin of 38.0%, plus or minus 200 bps.

It now expects fiscal 2024 revenue of $13.2 billion – $13.7 billion(prior $14 billion – $15 billion) versus consensus of $14.34 billion and a gross margin of 40% (prior in the low 40%).

During the first-quarter print, the company maintained a net Capex outlook of $2.5 billion for fiscal 2024.

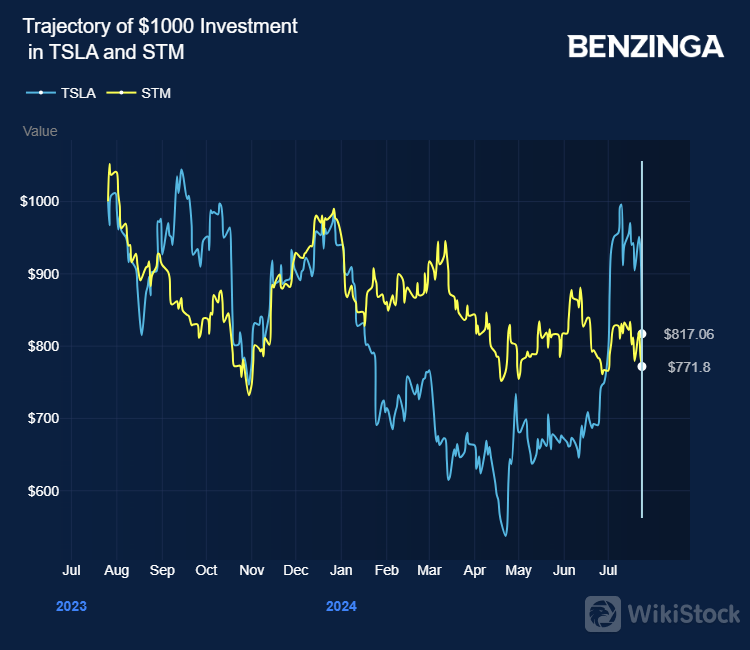

STMicroelectronics stock plunged 23.4% in the last 12 months.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP