Is Trending Stock Intel Corporation a Buy Now? - Intel (NASDAQ:INTC)

Revenue Growth Forecast

Even though a company's earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. It's almost impossible for a company to grow its earnings without growing its revenue for long periods. Therefore, knowing a company's potential revenue growth is crucial.

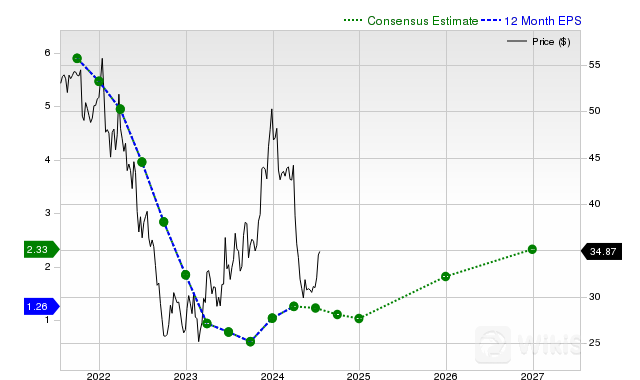

For Intel, the consensus sales estimate for the current quarter of $12.92 billion indicates a year-over-year change of -0.2%. For the current and next fiscal years, $55.56 billion and $62.44 billion estimates indicate +2.5% and +12.4% changes, respectively.

Last Reported Results and Surprise History

Intel reported revenues of $12.72 billion in the last reported quarter, representing a year-over-year change of +8.6%. EPS of $0.18 for the same period compares with -$0.04 a year ago.

Compared to the Zacks Consensus Estimate of $12.76 billion, the reported revenues represent a surprise of -0.29%. The EPS surprise was +38.46%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates three times over this period.

Valuation

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

While comparing the current values of a company's valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S) and price-to-cash flow (P/CF), with its own historical values helps determine whether its stock is fairly valued, overvalued, or undervalued, comparing the company relative to its peers on these parameters gives a good sense of the reasonability of the stock's price.

The Zacks Value Style Score (part of the Zacks Style Scores system), which pays close attention to both traditional and unconventional valuation metrics to grade stocks from A to F (an An is better than a B; a B is better than a C; and so on), is pretty helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Intel is graded D on this front, indicating that it is trading at a premium to its peers.

Conclusion

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Intel. However, its Zacks Rank #4 does suggest that it may underperform the broader market in the near term.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP