ASML Expected To Beat Estimates With Over $5B In Orders During Q2 Thanks To Rising AI Chip Demand - Apple

ASML Holding NVASML, the leading supplier of equipment to computer chip manufacturers, is poised to witness a surge in new orders, driven by the escalating demand for AI chips. This development is likely to be announced on Wednesday when the companys new CEO presents the second-quarter results.

What Happened: The anticipated influx of orders is attributed to the increasing demand for AI chips, a trend that is expected to prompt ASMLs clients to expand their production capacity, reported Reuters.

“We expect ASML‘s order received value to reach close to €5 billion (approx. $5.45 billion) in the second quarter, higher than consensus estimates”, Mihuzoanalyst Kevin Wangsaid, with robust orders from TSMC for ASML’s EUV product line.

This surge is largely driven by robust orders from key players in the cutting-edge chip manufacturing sector, such as Taiwans Taiwan Semiconductor Mfg. Co. Ltd.TSM, which produces chips for NVIDIA Corp. NVDA and Apple Inc. AAPL.

Why It Matters: The anticipated surge in orders for ASML comes amid a broader context of geopolitical and market dynamics. The U.S. has been pressuring Japan and the Netherlands recently to tighten export controls on chipmaking equipment to China.

This move aims to restrict Chinas access to advanced semiconductor technology, which could enhance its military capabilities. This development is part of a broader strategy to maintain technological superiority and national security.

Moreover, ASML has been highlighted as a top pick in the European semiconductor equipment sector. Analysts have pointed out its crucial role in AI infrastructure, which is expected to drive multiple expansions.

The increased demand for EUV tools and higher gross margins have led to optimistic revenue and earnings projections for the coming years.

Price Action: ASML closed at $1,063.63, down 1.99%, on Monday. In after-hours trading, the stock gained 0.46%. Year to date, ASMLs stock has risen by 48.36%, according to the data from Benzinga Pro.

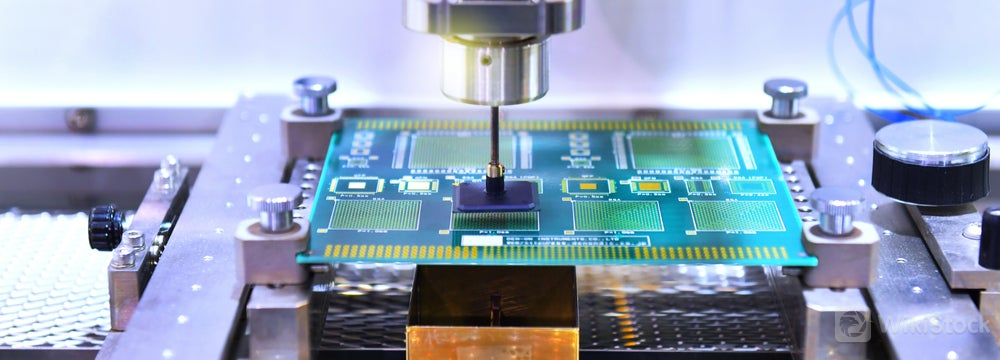

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP