Wall Street Analysts See a 29.08% Upside in Matador: Can the Stock Really Move This High? - Matador Resou

Here's What You Should Know About Analysts' Price Targets

According to researchers at several universities across the globe, a price target is one of many pieces of information about a stock that misleads investors far more often than it guides. In fact, empirical research shows that price targets set by several analysts, irrespective of the extent of agreement, rarely indicate where the price of a stock could actually be heading.

While Wall Street analysts have deep knowledge of a company's fundamentals and the sensitivity of its business to economic and industry issues, many of them tend to set overly optimistic price targets. Are you wondering why?

They usually do that to drum up interest in shares of companies that their firms either have existing business relationships with or are looking to be associated with. In other words, business incentives of firms covering a stock often result in inflated price targets set by analysts.

However, a tight clustering of price targets, which is represented by a low standard deviation, indicates that analysts have a high degree of agreement about the direction and magnitude of a stock's price movement. While that doesn't necessarily mean the stock will hit the average price target, it could be a good starting point for further research aimed at identifying the potential fundamental driving forces.

That said, while investors should not entirely ignore price targets, making an investment decision solely based on them could lead to disappointing ROI. So, price targets should always be treated with a high degree of skepticism.

Here's Why There Could be Plenty of Upside Left in MTDR

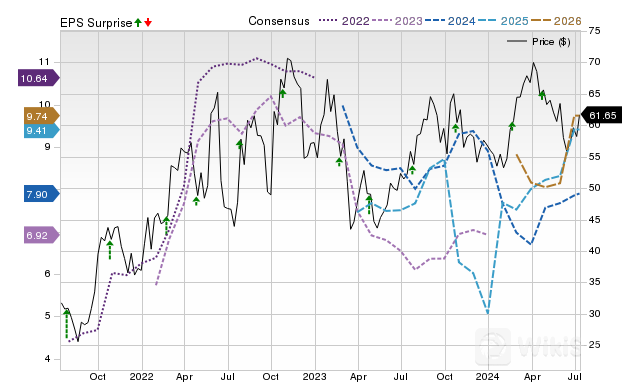

There has been increasing optimism among analysts lately about the company's earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher. And that could be a legitimate reason to expect an upside in the stock. After all, empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

The Zacks Consensus Estimate for the current year has increased 3% over the past month, as four estimates have gone higher while one has gone lower.

Moreover, MTDR currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on four factors related to earnings estimates. Given an impressive externally-audited track record, this is a more conclusive indication of the stock's potential upside in the near term.

Therefore, while the consensus price target may not be a reliable indicator of how much MTDR could gain, the direction of price movement it implies does appear to be a good guide.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP