EXCLUSIVE: As Lucid Gears Up To Take On Tesla's Model X, Analysts Lay Out The Problems With Luxury EV Sta

The Premium Lineup:Lucids premium sedan called Lucid Air is its only vehicle currently in production. Its cheapest variant has a starting price of $69,900 while the more premium Grand Touring and Sapphire versions start at $109,900 and $249,000, respectively.

The company is gearing up to start production of its Gravity SUV, which it believes to be better than rival Tesla Inc.spremium Model X SUV, later this year. The vehicle is expected to start under $80,000, around the same price bracket as its Air sedan.

The company has also teased an upcoming high-volume, midsize vehicle, but slated to enter production only in late 2026. The mass market offering will start at around $48,000, a price point close to Tesla‘s top-selling Model 3 and Model Y, Lucid CEO Peter Rawlinson said during the company’s first-quarter earnings call.

Analyst Take:Tom Narayanof RBC Capital Marketsbelieves that Lucid has great technology. However, the company is targeting brands like Mercedes-Benz, Porsche, and BMW with the price point of their Air sedan, he said.

“The problem is those consumers who are buying those products are not just buying the Mercedes or the Porsche or the BMW because it drives fast, you know, they‘re buying it because of the brand,” Narayan said. “I think that’s what happened to them. You know, they targeted a demographic that cares about brands and they dont have a brand.”

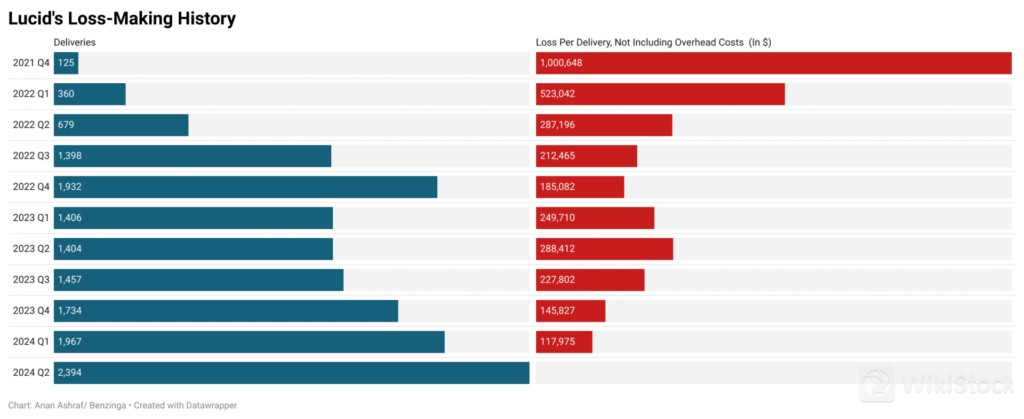

While current delivery volumes dont leave Narayan super optimistic about the company landing a spot among Mercedes and the likes, he is hopeful about the upcoming Gravity SUV given that SUVs generally have a bigger addressable market.

However, both the Gravity and Sedan are rather premium, much like Teslas Model S and X, of which the company tends to sell about the same minimal volume, he noted. The ongoing EV slowdown is not very helpful either, he added.

Lucid is trying to create a premium lineup which they hope will create a halo effect and spike sales for their mass-market vehicle when it enters production. However, not many know Lucid unlike rival brand Rivian Automotive which started deliveries around the same time as Lucid, he noted.

But unlike Lucid which marketed its vehicle as a luxury, Rivian marketed its vehicles as outdoorsy and ideal for off-roading, he noted.

“With Lucid, they dont have a specific branding strategy,” Narayan said.

While the strategy of starting premium and getting to more affordable offerings worked for Tesla in the late 2000s when they were the sole players in the EV market, Lucid entered the market at a time when competition was high, he added.

Despite the competition, Lucid has perks in terms of the absence of bugs on the products that they already have on the road and the support of Saudi Arabias Public Investment Fund (PIF), Kelley Blue Bookeditor Sean Tuckersaid. The PIF has invested about $6.4 billion into Lucid since 2018, including a $1 billion investment in the first quarter of 2024.

Right Move, But Does Lucid Have Time On Its Hands?

“Lucid builds a great sedan. But most Americans buy SUVs, not sedans, and spend less than $50,000 on a new vehicle. So moving into SUVs and a lower price point is the right move for them,” Tucker said.

“The question is whether their investors have the stomach for long losses to get them to profitability. Even once that SUV is good, they'll still need years of funding at a loss to get to a profitable quarter,” he added while explaining that EV giant Tesla made its first quarterly profit selling cars, not including emission credits, only in the second quarter of 2021, or its 18th year.

“Every new EV build simply cannot bank on high-price, long-range EVs. As far as those go, Lucid's products are quite compelling, so they have an advantage. Will they be able to compete with the number of stores and name recognition as brands like Mercedes-Benz and BMW? Probably not,” Brian Moody, an analyst at Cox Automotive, said.

“The key is knowing how many vehicles Lucid needs to sell annually to be profitable – there's a number that might make sense but I just don't know what that number is. There will always be a place for high-end vehicles no matter how they're powered but there's not enough room for every new EV to take that same path.”

The worst-case scenario for Lucid, however, might not be bankruptcy as in the case of Fiskerand Lordstown, Narayan noted. The PIF has too much invested in the company and hence might just take the company private, he opined.

Possible Stepping Stones:Narayan thinks that Lucid could license its superior tech to other OEMs to enhance their value and get some cash.

Moody, meanwhile, believes that the company needs a sizeable budget for marketing. PIF‘s money would be well-spent on advertising and marketing Lucid’s exceptional vehicles once all three models are in production, he said.

Photo courtesy: Lucid

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP