4 Steady Shoes & Retail Apparel Stocks in a Troubled Industry - adidas (OTC:ADDYY), Carter's (NYSE:CRI)

The Zacks Shoes and Retail Apparel industry continues to deal with hardships from elevated costs, reduced spending trends on discretionary items and increased marketing investments. These headwinds have been the key burdens on the participating companies' profits. Additionally, adverse currency movements threaten industry players due to their worldwide presence.

However, the industry looks lucrative owing to rising consumer awareness about leading a healthy lifestyle, which has resulted in positive demand trends for activewear and athletic shoes. New and innovative designs have been the key drivers for the industry participants. Players focused on product innovation, store expansion, digital investments and omnichannel growth are expected to gain. Investments in products and e-commerce portals bode well for players like Adidas AGADDYY, Skechers SKX, Caleres Inc.CRI and Wolverine World WideWWW.

About the Industry

The Zacks Shoes and Retail Apparel industry comprises companies that design, source and market clothing, footwear and accessories for men, women and children under various brand names. Product offerings of the companies mostly include athletic and casual footwear, fashion apparel and activewear, sports equipment, bags, balls, and other sports and fashion accessories. The companies showcase their products through their branded outlets and websites. Some companies distribute products via other retail stores, such as national chains, online retailers, sporting goods stores, department stores, mass merchandisers, independent retailers and catalogs.

A Look at What's Shaping the Shoes and Retail Apparel Industry's Future

Cost Headwinds: Companies in the industry are witnessing elevated costs due to factors like commodity cost inflation and reinvestments. Supply-chain constraints and elevated logistic costs have been acting as deterrents. Many companies expect increased logistic costs to hurt margins in the near term. Elevated marketing expenses, higher operating overhead and demand-creating expenses and increased investments to enhance store and digital operations have been raising SG&A costs. Also, industry participants are witnessing rising costs to support brand campaigns and digital investments. The exit from the Russia business due to the Ukraine-Russia conflict is likely to be the key concern for some players. A tough and competitive labor market is another headwind. These factors pose a threat to the industry players' margins.

Consumer Demand Trends:Players in the industry have been benefiting from strong consumer demand for activewear/athleisure products and footwear. The trend is expected to continue in 2024. Athletic goods and apparel companies offer products from footwear, sweatshirts, leggings, pants, jackets and tops to yoga wear and running clothes for men and women. The increasing focus on fashion is boosting the demand for innovative clothes and footwear in the United States. Industry participants have been focused on product innovations, active promotions, store expansion and enhancing e-commerce capabilities to gain market share. Favorable health and wellness trends have been the key to inspiring footwear manufacturers to expand their product portfolios. The companies continue to innovate styles, materials and colors and incorporate functional designs to grab a large share of the fast-growing market. Multi-functional shoes, which cater to casual and formal looks, have been gaining popularity.

E-Commerce Investments:E-commerce has been playing a crucial role in the athleisure market's growth. The companies in the market segment are looking to build a customer base through websites, social media and other digital channels. As consumers continue to shop from home, the growth of athletic-inspired apparel and digital sales are likely to continue. Companies focused on expanding their athletic-based apparel lines and building on e-commerce capabilities are expected to witness growth in the long run. Efforts to accelerate deliveries through investments in supply chains and order fulfillment avenues are likely to provide an edge to industry players. Simultaneously, companies are investing in renovations and improved checkouts, as well as mobile point-of-sale capabilities, to make stores attractive. Efforts to enhance experiences through multiple channels are likely to contribute significantly to improving traffic and transactions in stores and online.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Shoes and Retail Apparel Industry is an 11-stock group within the broader Zacks Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #164, which places it in the bottom 34% of more than 250 Zacks industries.

The group's Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull prospects for the near term. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry's positioning in the bottom 50% of the Zacks-ranked industries is the result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group's earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let's look at the industry's recent stock market performance and valuation picture.

Industry vs. Sector

The Zacks Shoes and Retail Apparel industry has underperformed the sector and the S&P 500 in the past year.

Stocks in the industry have collectively declined 28%. The Zacks Consumer Discretionary sector and the Zacks S&P 500 composite have risen 2.7% and 23.7%, respectively.

One-Year Price Performance

Shoes and Retail Apparel Industry's Valuation

On the basis of forward 12-month price-to-earnings (P/E), commonly used for valuing Consumer Discretionary stocks, the industry is currently trading at 18.28X compared with the S&P 500's 21.5X and the sector's 16.6X.

Over the last five years, the industry traded as high as 37.75X and as low as 18.28X, with a median of 27.01X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

4 Shoes & Retail Apparel Stocks to Watch

Wolverine: Wolverine is engaged in the designing, manufacturing and distribution of a wide variety of casual as well as active apparel and footwear. The company also manufactures children's footwear and specially designed boots and accessories for industrial purposes. Its focus on brand structure, increasing efficiency by removing costs, strategic review of its portfolio, improving working capital and lowering leverage bode well. Wolverine continues to focus on strengthening its DTC business. Speed-to-market initiatives, deployment of digital product development tools, expansion of e-commerce platforms and frequent introduction of products are steadily contributing to its performance.

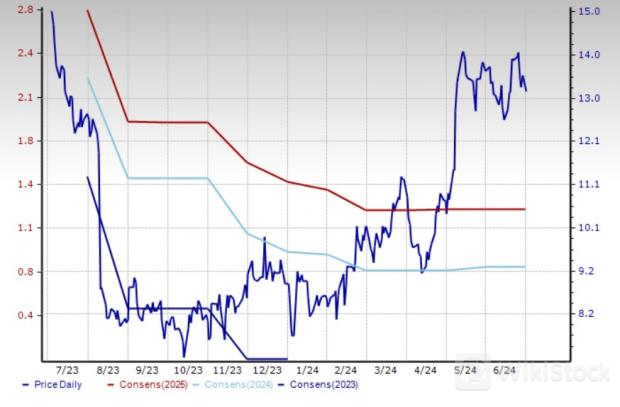

Management looks forward to generating $150 million of annual cost savings for 2024, which is likely to be invested in growth brands. The Zacks Consensus Estimate for WWW's 2024 earnings is pegged at 80 cents per share, which indicates significant growth from 5 cents reported in the year-ago quarter. The consensus estimate for WWW's 2024 EPS has been unchanged in the past 30 days. The company has a trailing four-quarter negative earnings surprise of 6.3%, on average. Shares of this Zacks Rank #1 (Strong Buy) company have declined 11.9% in the past year.

Price and Consensus: WWW

Skechers:This Manhattan Beach, CA-based company designs, develops, markets and distributes footwear for men, women and children in the United States and overseas under the SKECHERS name, as well as several unique brand names. The company's emphasis on new product lines, store remodeling projects, cost-containment efforts, inventory management and global distribution platform bodes well. SKX is focused on executing its long-term growth strategy, with a diverse assortment of innovative and comfortable products. This is expected to drive its top line in the near and long term.

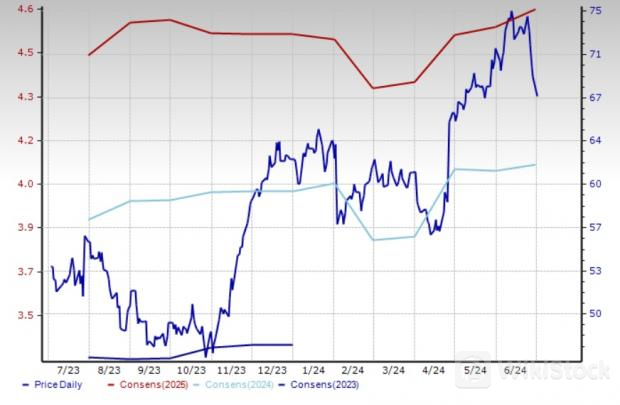

Skechers is investing strategically to improve infrastructure worldwide, primarily in e-commerce platforms and distribution centers. The company's international business is a significant sales growth driver. SKX has a trailing four-quarter earnings surprise of 34.1%, on average. The Zacks Consensus Estimate for the footwear company's 2024 sales and earnings indicates growth of 10.6% and 16.9%, respectively, from the year-ago quarter's reported figures. The consensus estimate for SKX's 2024 EPS has moved up by 0.5% in the past 30 days. Shares of this Zacks Rank #2 (Buy) company have rallied 26.3% in the past year.

Price and Consensus: SKX

Caleres: Caleres is a leading footwear retailer and wholesaler in the United States, China, Canada and Guam. The company operates through Famous Footwear and Brand Portfolio segments. The Saint Louis, MO-based company has been benefiting from positive consumer demand trends and accelerated recovery in the footwear marketplace, aiding its sales. The momentum in the Famous Footwear brand is expected to contribute meaningfully to sales growth. Strong performances of CAL's emerging brands, including Vionic, Sam Edelman, Allen Edmonds and Blowfish Malibu, are expected to be growth drivers.

Management anticipates the strong performance of the Famous Footwear brand and gains from the Brand Portfolio segments, leveraging a diversified brand model and the continued execution of strategic priorities to aid CAL's performance. Caleres' focus on consumers' evolving preferences and efforts to drive growth across its omnichannel ecosystem bode well. The Zacks Consensus Estimate for CAL's fiscal 2024 sales and earnings indicates growth of 0.7% and 5.3%, respectively, from the year-ago quarter's reported figures. The consensus estimate for CAL's fiscal 2024 EPS has been unchanged in the past 30 days. The company has a trailing four-quarter earnings surprise of 4.9%, on average. Shares of this Zacks Rank #2 company have rallied 31.9% in the past year.

Price and Consensus: CAL

Adidas: The leading manufacturer and seller of athletic and sports lifestyle products in Europe, the Middle East, Africa, North America, Greater China, the Asia Pacific and Latin America is poised to gain from strong demand, compelling products and robust performance of its online business. Adidas has been benefiting from improved sell-through of all Adidas products in the market. Moreover, the company has been witnessing improved margins, driven by the recently implemented price increases and an improved channel mix.

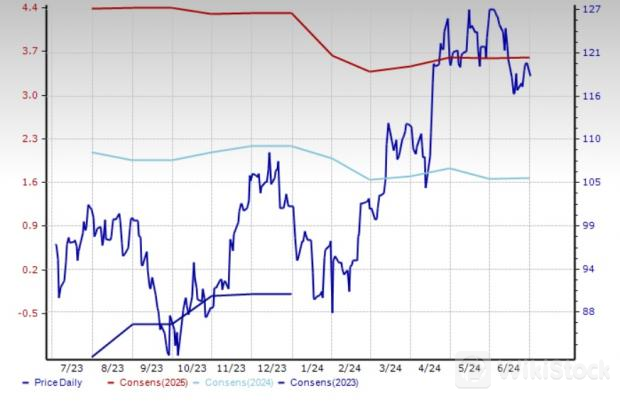

The Zacks Consensus Estimate for ADDYY's 2024 sales indicates growth of 5.1% from the year-ago quarter's reported figure. The consensus estimate for ADDYY's 2024 earnings is pegged at $1.68, whereas it reported a loss of 36 cents in the year-ago quarter. Adidas delivered an earnings surprise of 70.5%, on average, in the trailing four quarters. This Zacks Rank #3 (Hold) stock has rallied 22.1% in the past year.

Price and Consensus: ADDYY

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP