Neuronetics Expands NeuroStar Portfolio With New Launch - Hims & Hers Health (NYSE:HIMS), Joint (NASDAQ:J

Industry Prospects

Per a report from Skyquest, the global Mental Health market was valued at $399.6 billion in 2022 and is expected to grow $544.6 billion by 2031, at a CAGR of 3.5% during the period. The primary factors influencing the global market include the increasing prevalence of mental health disorders worldwide and advancements in technology and research, which have led to the development of innovative treatment options. The growing awareness and acceptance of mental health issues also contribute to the market's growth.

Looking at the market potential, Neuronetics' latest development is thoughtful and well-timed.

Other Notable Developments

Earlier this year, Neuronetics announced the FDA clearance of NeuroStar Advanced Therapy for usage as a supplement to treat MDD in adolescents aged between 15 years and 21 years. NeuroStar is the first and only FDA-approved transcranial magnetic stimulation treatment available for this age group.

In March 2024, Neuronetics entered into an expanded commercial partnership with Transformations Care Network (TCN), a mental health care provider. The company will supply new TMS equipment to TCN. This partnership marks a significant advancement in the field of mental health treatment, particularly for patients suffering from MDD and treatment-resistant depression.

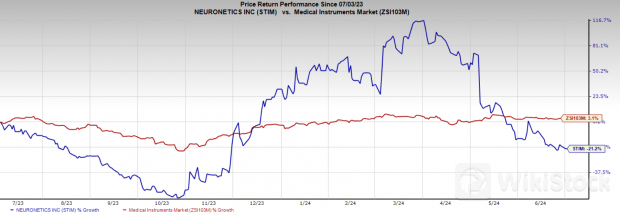

Price Performance

In the past year, STIM's shares have lost 21.2% against the industry's 3.1% growth.

Zacks Rank and Key Picks

Neuronetics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hims & Hers Health, Inc. HIMS, The Joint Corp.JYNT andMedpace HoldingsMEDP. While Hims & Hers and The Joint sport a Zacks Rank #1 (Strong Buy) each, Medpace Holdings carries a Zacks Rank #2 (Buy) at present.

The Hims & Hers Heath stock has surged 135.1% in the past year. Estimates for the company's 2024 earnings have moved north by 5.6% to 19 cents per share in the past 30 days.

HIMS' earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for The Joint's 2024 earnings per share have remained constant at 21 cents in the past 30 days. Shares of JYNT have surged 37.4% year to date against the industry's 3.6% decline.

In the last reported quarter, JYNT delivered an earnings surprise of 300%. It has a trailing four-quarter average earnings surprise of 18.75%.

Estimates for Medpace's 2024 EPS have remained unchanged at $11.29 in the past 30 days. Shares of the company have surged 70.4% in the past year compared with the industry's 5.3% growth.

MEDP's earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

To read this article on Zacks.com click here.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP