The inflation upside that Americans are ignoring: their wages

When asked about inflation, Americans tend to focus on the rising price of groceries, gas, or dining out.

One thing they tend to forget: their higher pay.

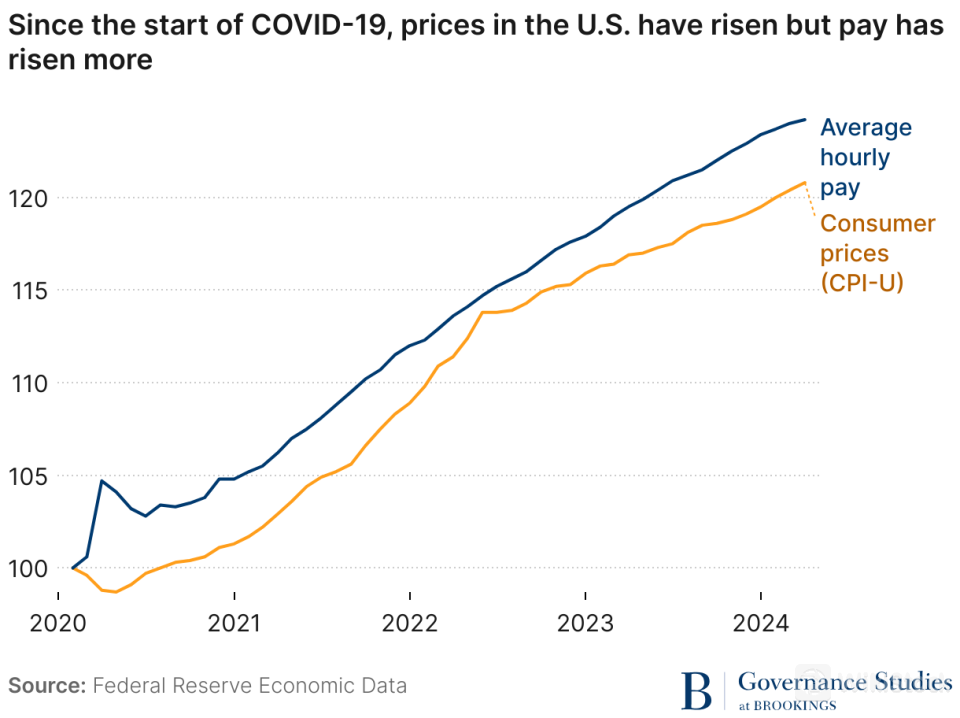

Many people may not realize wages on the whole have kept up with most rising prices. The average hourly earnings of all workers are up 22.28% since February 2020 while inflation is up 20.82% during that same time.

There is a reason why this development gets overlooked: We regularly discount how much fatter paychecks may reflect the inflationary environment, a recent study found.

Instead, we attribute raises strictly to our own on-the-job performance or career progression.

“The fact that we have ignored wages as we talk about inflation is just bad,” Joshua Gotbaum, a guest scholar at The Brookings Institution, a think tank, told me. It leads to people having a warped view of the economy.

A customer shops at a Safeway store in San Francisco. (Photo by Justin Sullivan/Getty Images) (Justin Sullivan via Getty Images)

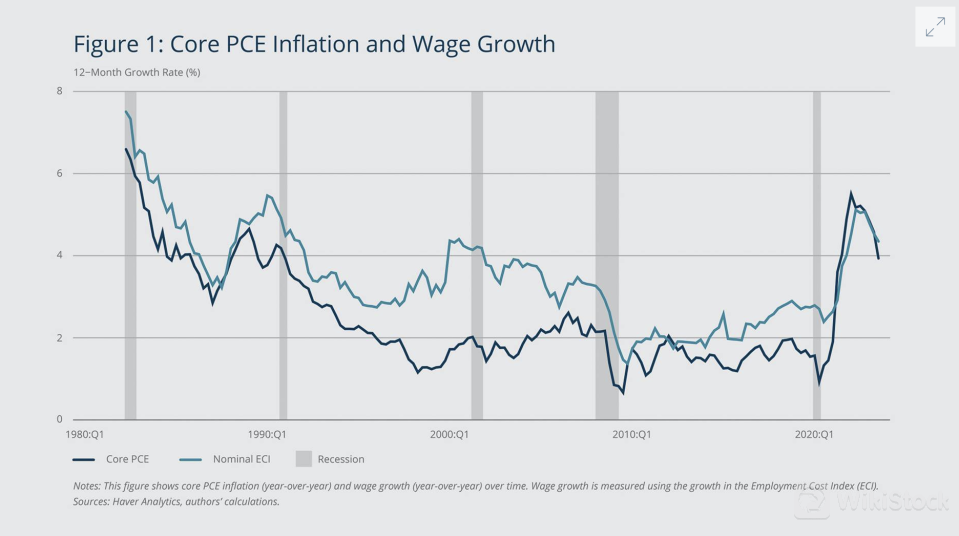

Over the last four decades, there has been a strong correlation between inflation as measured by the core Personal Consumption Expenditures (PCE) index and growth in the Employment Cost Index (ECI), economists at the Federal Reserve Bank of Boston found.

When inflation goes up, so does wage growth and vice versa.

The economists found that this relationship was particularly strong in 2021 and 2022 when both measures spiked.

(Credit: Federal Reserve Bank of Boston)

While supply chain issues turbocharged inflation, there was also quite a labor force disruption at the same time.

First, 6 million people lost their jobs in one month and then as society reopened in stages and remote work spread, there were many more job openings than willing workers. Remember all those “help wanted” signs and the advent of the “great resignation” as people reconsidered their priorities?

Employers had to pay more to fill positions or keep their workers happy. Job switchers — you may have been one of them — reaped the rewards of this imbalance.

In June 2022, job changers got a 16.4% annual increase in their median pay, versus a 7.7% gain for those who stayed at the same job.

'Inflation is someone else's fault'

But it's particularly hard to convince Americans that their paycheck is related to inflation.

Workers are more likely to attribute the increase to their performance or career progression than to inflation, the recent working paper found, with higher earners more likely to think this.

“Inflation is someone else's fault,” Gotbaum said, “but my wage gains are the result of my hard work.”

In fact, 51% of respondents in the working paper believe that “inflation will increase my employer profits, but she will not feel the need to increase my pay.”

Story continues

That mentality may be why 80% of them think prices rise faster than wages, even though half of the respondents also reported getting a raise.

And an apples-to-apples comparison starting before the pandemic in February 2020 up until now shows that wages have caught up, Gotbaum told me, and “and for the lower-paid workers, wages have caught up even more.”

“But no one knows that,” he said, a frustration he recently wrote about for Brookings.

Of course, the average hourly wage doesn't reflect everyone's experience. And if someone's wages haven't kept up with inflation, Gotbaum says workers shouldn't be passive.

If you have a union, get it to negotiate a better contract. Or go to your boss and ask for a raise. You may be surprised by the outcome.

While only 25% of workers asked for a raise, almost half of those who asked got one, the working paper found. That's heartening.

“People cant do anything about prices, but they can do something about wages,” he said. “[And that] may make them feel less bad about the economy.”

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP