Reasons to Add Evergy Shares to Your Portfolio Now - Evergy (NASDAQ:EVRG), Consolidated Edison (NYSE:ED)

Evergy's EVRG systematic investments to strengthen its infrastructure will assist it in improving service reliability. EVRG continues to benefit from its expansion of operations in the transmission market through collaborations, strategic acquisitions and partnerships. Given its growth opportunities, EVRG makes for a solid investment option in the utility sector.

Let's focus on the factors that make this Zacks Rank #2 (Buy) company a promising investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for EVRG's 2024 earnings per share has increased 0.3% to $3.84 in the past 90 days.

The company's long-term (three to five years) earnings growth rate is 5%.

Strategic Investments

The company is targeting nearly $12.5 billion of expected base capital investments through 2028, including a new generation of around $2.9 billion. This is expected to be primarily a renewable generation addition. The planned capital expenditures of Evergy are in sync with its new Integrated Resource Plan, which intends to achieve net-zero emissions by 2045. The usage of more advanced technology to produce electricity from efficient renewable units is also reducing operating costs and boosting margins.

Dividend History

The company has been consistently increasing its shareholder value through dividends. EVRG's quarterly dividend is 64.25 cents per share, this resulted in an annualized dividend of $2.57 per share. It aims for a dividend payout of 60-70% per year. The current dividend yield of the company is 4.88%, better than the industry's yield of 3.67%.

Debt Position

Evergy's total debt-to-capital ratio is 54.68, better than the industry average of 55.31.

The time-to-interest earned ratio at the end of the first quarter of 2024 was 2.4. The ratio, being greater than one, reflects the company's ability to meet future interest obligations without difficulties.

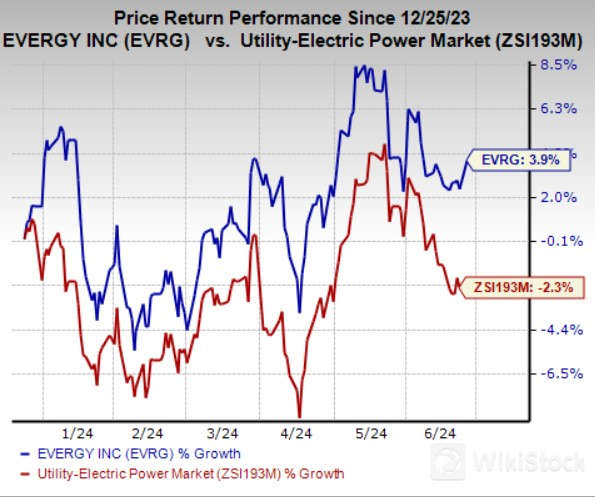

Price Performance

In the past six months, shares of the company rallied 3.9% against the industry's 2.3% decline.

Other Stocks to Consider

Some other top-ranked stocks from the same industry are PG&E Corporation PCG, Pinnacle West Capital CorporationPNW and Consolidated Edison ED each carrying a Zacks Rank #2 at present.

The Zacks Consensus Estimate for PCG's 2024 and 2025 earnings reflects a year-over-year growth of 9.8% and 8.6%, respectively. The company reported a positive earnings surprise of 5.71% in the last reported quarter.

PNW's long-term earnings growth rate is 8.2%. The Zacks Consensus Estimate for Pinnacle West Capital's 2024 and 2025 EPS implies a year-over-year improvement of 7.9% and 5.3%, respectively.

ED's long-term earnings growth rate is 7.4%. The Zacks Consensus Estimate for DTE Energy's 2024 and 2025 EPS implies a year-over-year increase of 5.1% and 5.2%, respectively.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP