FDA Expands Argenx's Vyvgart Label to Treat Rare Disorder - Arcutis Biotherapeutics (NASDAQ:ARQT), argenx

Argenx is also evaluating Vyvgart/Vyvgart Hytrulo in multiple proof-of-concept clinical studies, including membranous nephropathy and lupus nephritis (LN) indications.

Last month, management announced its decision to discontinue developing the drug in post-COVID-19-mediated postural orthostatic tachycardia syndrome (PC-POTS). This decision was based on data from a mid-stage study wherein treatment with the drug did not show clinical improvement in study participants with the disease.

Another company that secured the FDA's approval for CIDP indication is Takeda TAK. The agency expanded approval to Takeda's subcutaneous administered immune globulin treatment, Hyqvia, as a maintenance therapy for adults with CIDP in January. The Takeda drug is also approved for use in primary immunodeficiency in individuals aged two years and older.

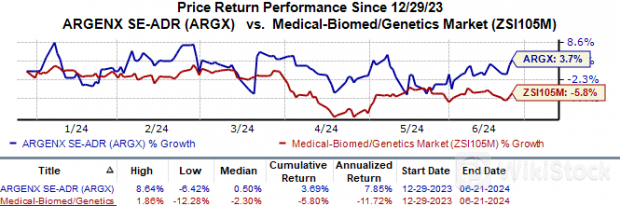

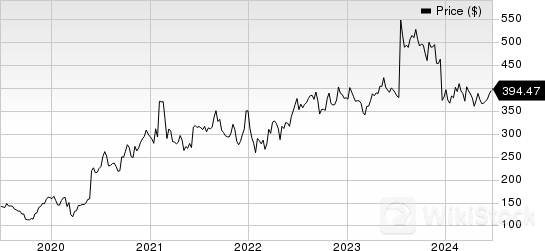

argenex SE Price

argenex SE price | argenex SE Quote

Zacks Rank & Key Picks

Argenx currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Arcutis BiotherapeuticsARQT and Heron TherapeuticsHRTX, each carrying a Zacks Rank #2 (Buy) at present.

In the past 60 days, estimates for Arcutis Biotherapeutics' 2024 loss per share have narrowed from $2.49 to $1.60. During the same period, the loss estimates per share for 2025 have narrowed from $1.77 to $1.14. Year to date, shares of Arcutis have surged 162.9%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Heron Therapeutics' 2024 loss per sharehave narrowed from 22 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 9 cents to earnings of 1 cent. Year to date, HRTX's shares have appreciated 90.0%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP