Pure Storage's SLAs Bolster Cyber Resilient Services - NVIDIA (NASDAQ:NVDA), Arista Networks (NYSE:ANET)

Pure Storage, Inc. PSTG recently announced three cutting-edge Storage-as-a-Service (STaaS) service-level agreements (SLAs) for the Pure Storage platform to aid enterprises in ensuring data protection and infrastructure resilience.

The initiative is likely to allow businesses to guarantee results and cut down risk in their critical data infrastructure. As AI is bringing significant changes to the business world, both for better and for worse, the rise in cyber attacks is becoming prominent. Therefore, the need for flexible and responsive IT infrastructure has never been more pressing.

Evergreen architecture, which forms a premium part of PSTG's offerings, delivers continuous and non-disruptive upgrades to aid enterprises in adapting to dynamic business environments.

The company's Evergreen//One subscription will now include disaster recovery scenarios.

The new Cyber Recovery and Resilience SLA expands on PSTG's pioneering ransomware recovery SLA by incorporating disaster recovery scenarios. This service provides a customized recovery plan, ships clean service infrastructure within a defined SLA and includes onsite installation and additional professional services for data transfer, highlighted PSTG.

Furthermore, PSTG will join forces with organizations to build and maintain an end-to-end cybersecurity strategy, with ongoing quarterly reviews to ensure optimal practices, risk evaluations and operational security remediation.

In addition to the enhanced Cyber Recovery and Resilience SLA, PSTG has introduced a new Security Assessment service. This offering provides deeper insights into fleet-level security risks and optimizes cyber resilience with actionable recommendations.

Leveraging aggregated intelligence from more than 10,000 environments, the Security Assessment displays numerical points from 0 to 5 to benchmark the security posture of the entire storage fleet, aligning with NIST 2.0 standards and boosting regulatory compliance.

Accompanying this assessment is a new AI copilot, which empowers Chief Information Security Officers with the ability to benchmark their security posture against other PSTG customers.

Apart from these, PSTG has unveiled an AI-Powered Anomaly Detection Enhancement innovation, which expands on its previous ransomware detection capabilities. This feature uses multiple machine learning models to detect unusual “anomalous behavior” such as ransomware attacks, unusual activity, malicious behavior and Denial of Service attacks. By analyzing customer environments with historical data, the solution can pinpoint the last known good snapshot copy, enabling organizations to quickly restore data and reduce tedious operational tasks.

Lastly, the company introduced the new Evergreen//One Site Rebalance SLA, which delivers service flexibility for organizations looking to adjust their existing storage commitments as their requirements grow.

Mountain View, CA-based Pure Storage provides software-defined all-flash solutions that are uniquely fast and cloud-capable for customers. It became a public company in October 2015. Currently, the company's customer base comprises more than 12,000 organizations, including more than 60% of the Fortune 500.

In the last reported quarter, PSTG's revenues soared 18% from the year-ago quarter to $693.5 million, surpassing the Zacks Consensus Estimate by 1.8%. The uptick was driven by higher sales to new and existing enterprise customers across the data storage platform.

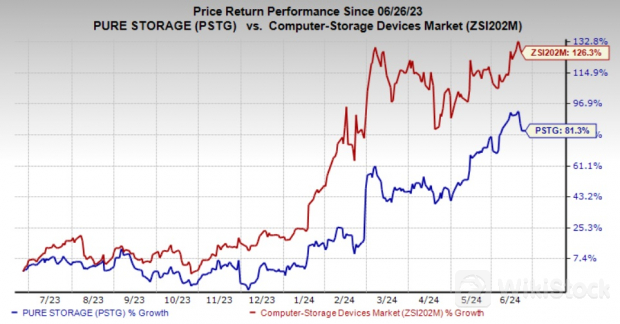

At present, Pure Storage carries a Zacks Rank #3 (Hold). Shares of the company have gained 81.3% compared with the sub-industry's growth of 126.3%.

Stocks to Consider

NVIDIA CorporationNVDA, sporting a Zacks Rank #1 (Strong Buy) at present, delivered a trailing four-quarter earnings surprise of 18.43%, on average. In the last reported quarter, it delivered an earnings surprise of 11.48%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company's focus evolved from PC graphics to AI-based solutions that support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc.ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.68% and delivered an earnings surprise of 15.39%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Silicon Motion Technology CorporationSIMO, sporting a Zacks Rank #1 at present, delivered a trailing four-quarter average earnings surprise of 4.72%.

SIMO is a leading developer of microcontroller ICs for NAND flash storage devices. The semiconductor company also designs, develops and markets high-performance, low-power semiconductor solutions for original equipment manufacturers and other customers.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP