Various fees, such as conversion, inactivity, and withdrawal fees, which can be complex to navigate.

Regulatory Status

Regulation:

Capex.com operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CYSEC) with license no. 292/16, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Capex.com's commitment to integrity and credibility in its services.

Safety Measures:

Capex.com employs segregated bank accounts to ensure client funds remain separate from operational funds. This security measure enhances financial transparency and safeguards client assets, adhering to strict regulatory standards and bolstering trust in their trading platform.

Products & Services

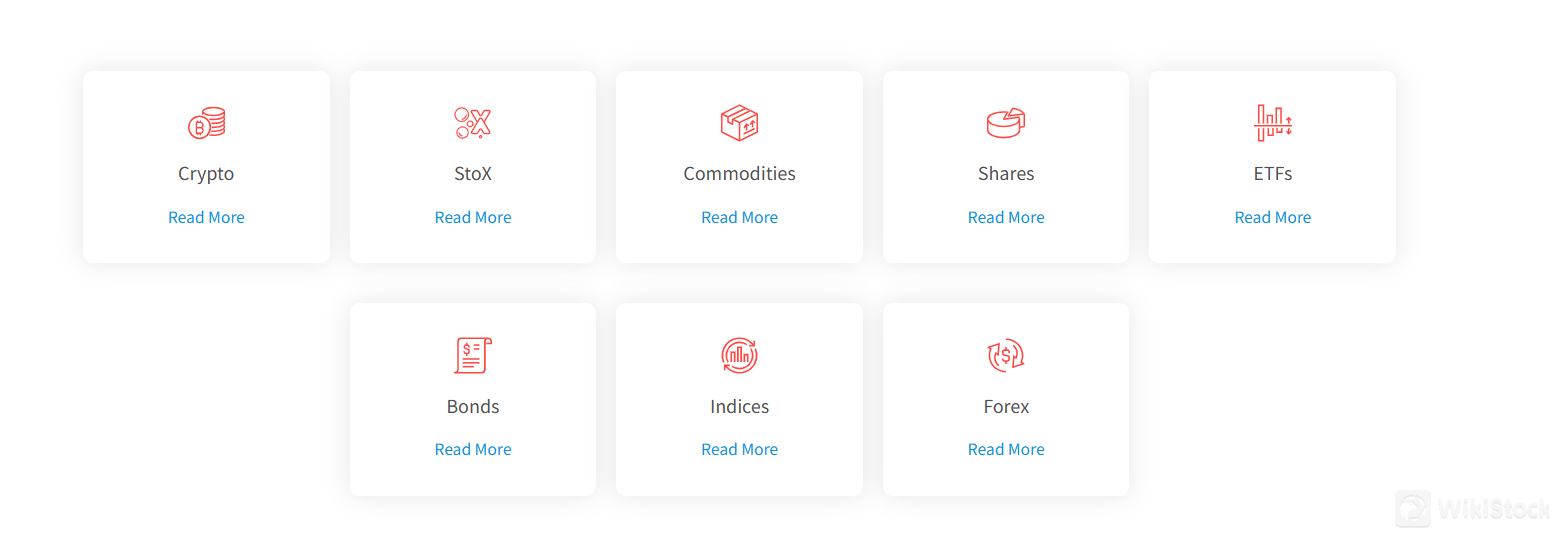

Capex.com offers a comprehensive range of market instruments designed to meet the diverse trading needs of its clientele.

Traders can engage in Forex CFDs across more than 55 currency pairs, benefitting from competitive spreads and efficient order execution through the WebTrader platform. The platform also supports CFD trading on 15 prominent global Indices, providing exposure to a broad spectrum of companies within major sectors and regions from the U.S., Europe, and Asia.

For those interested in fixed-income securities, Capex.com offers CFDs on Bonds from the EU, U.S., and U.K., accessible via both MT5 and the Capex WebTrader. ETF trading opportunities allow investors to track specific indices or asset groups, while commodity trading covers essential assets like oil, gold, and natural gas, influenced by global events and currency movements.

Moreover, Capex.com provides CFDs on shares of leading companies across major and emerging markets, including popular U.S.-listed firms like Apple, Tesla, and Microsoft, without the need for physical ownership. Finally, the platform supports Crypto CFD trading, offering exposure to digital assets with liquidity and flexibility, ideal for navigating the evolving crypto market landscape.

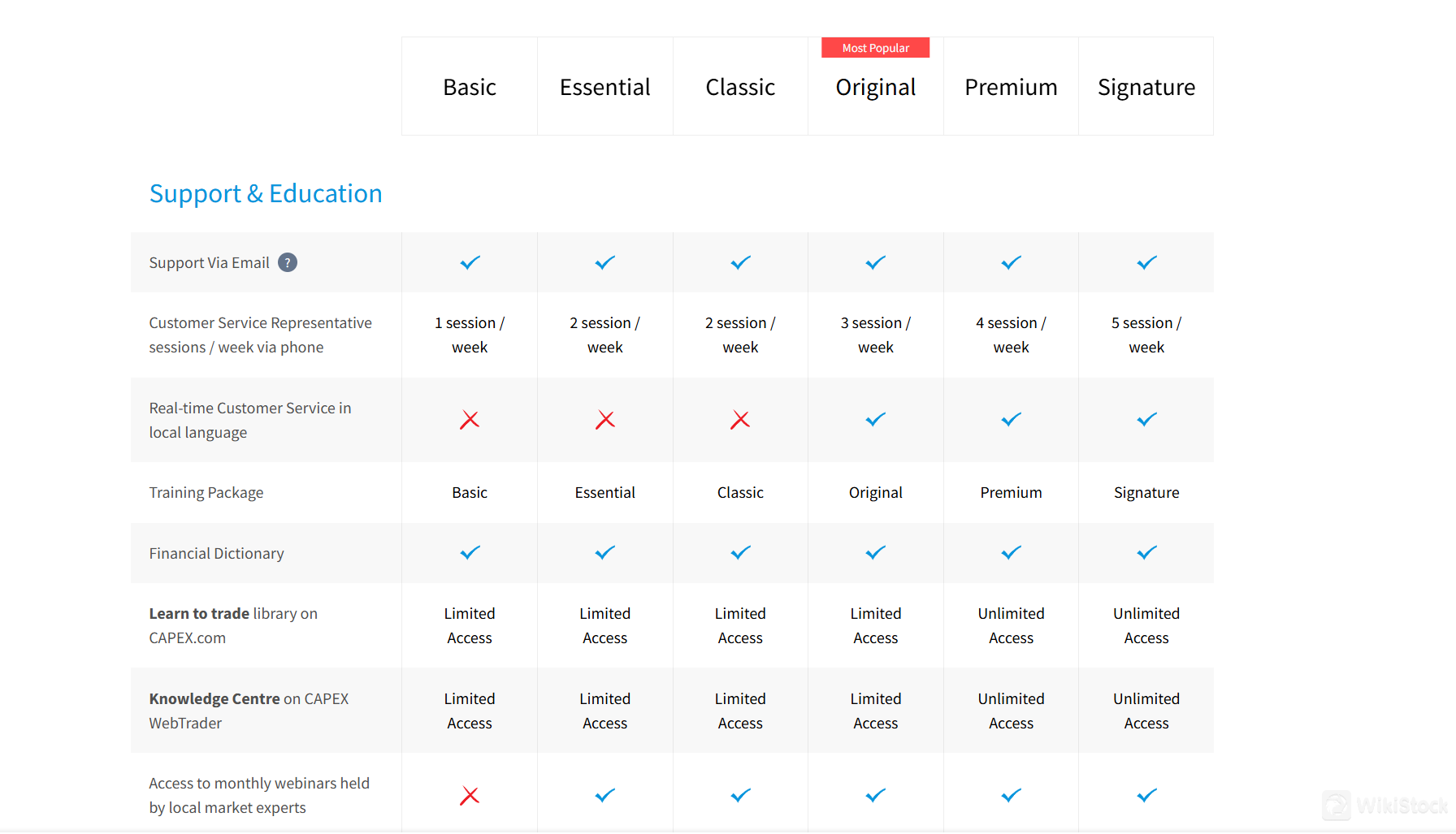

Account Types

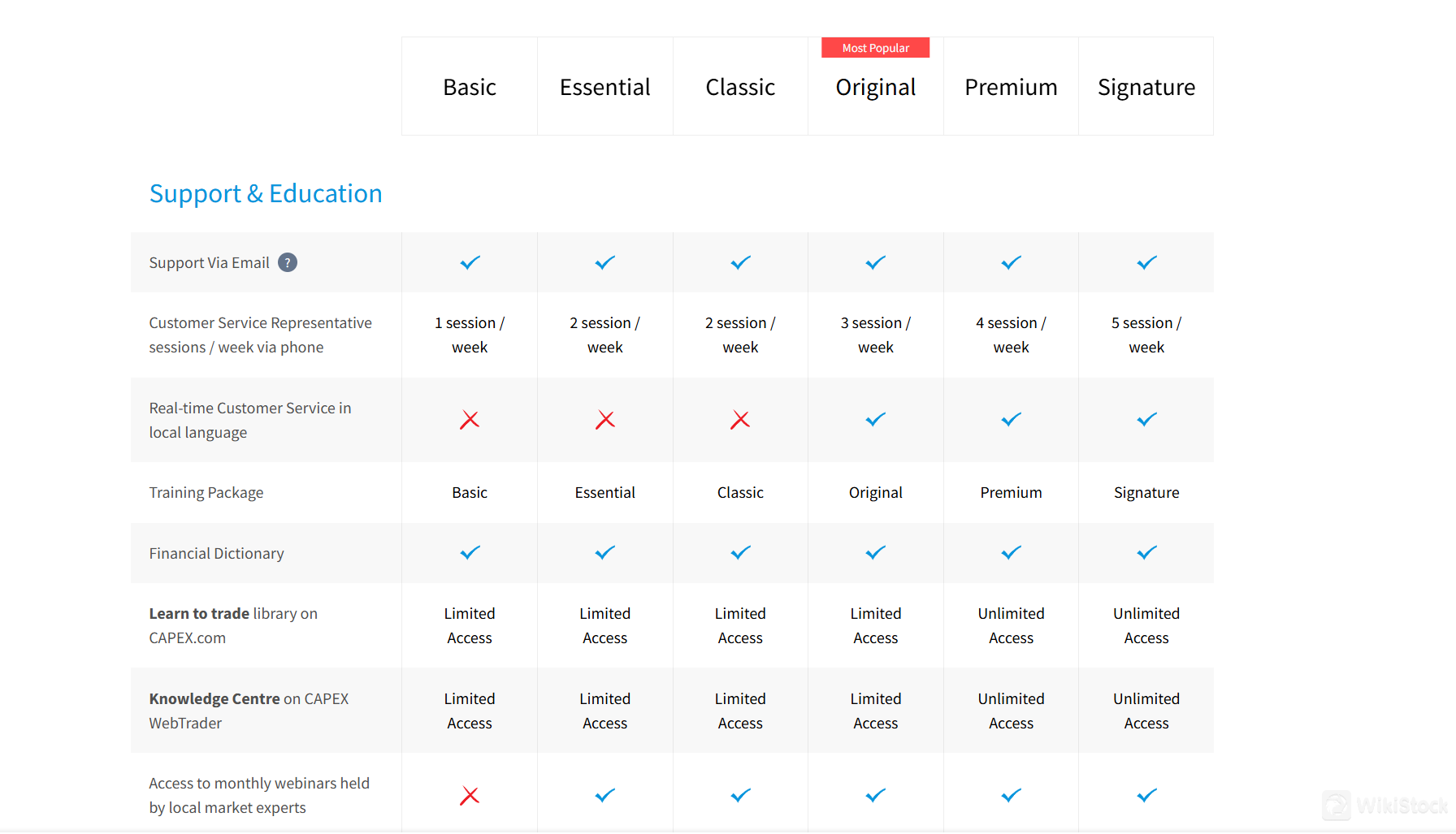

Capex.com offers a selection of six account types tailored to accommodate varying levels of trading experience and preferences.

From the entry-level Basic and Essential accounts to the more advanced Classic and Original (most popular) tiers, each account type is designed to cater to different trading needs and goals.

For more seasoned traders seeking enhanced benefits, Capex.com provides Premium and Signature accounts, which offer exclusive features and privileges.

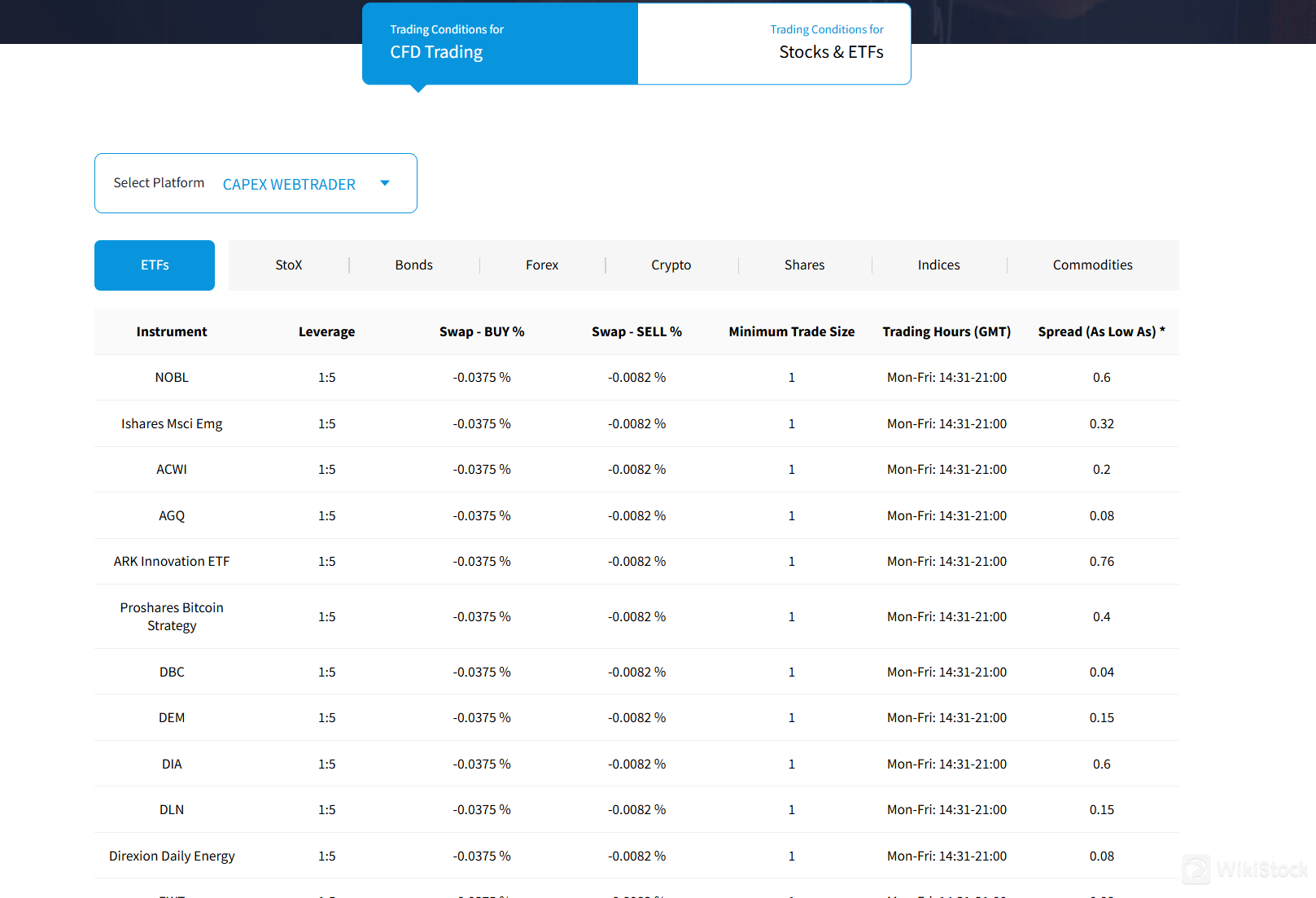

Leverage & Spreads

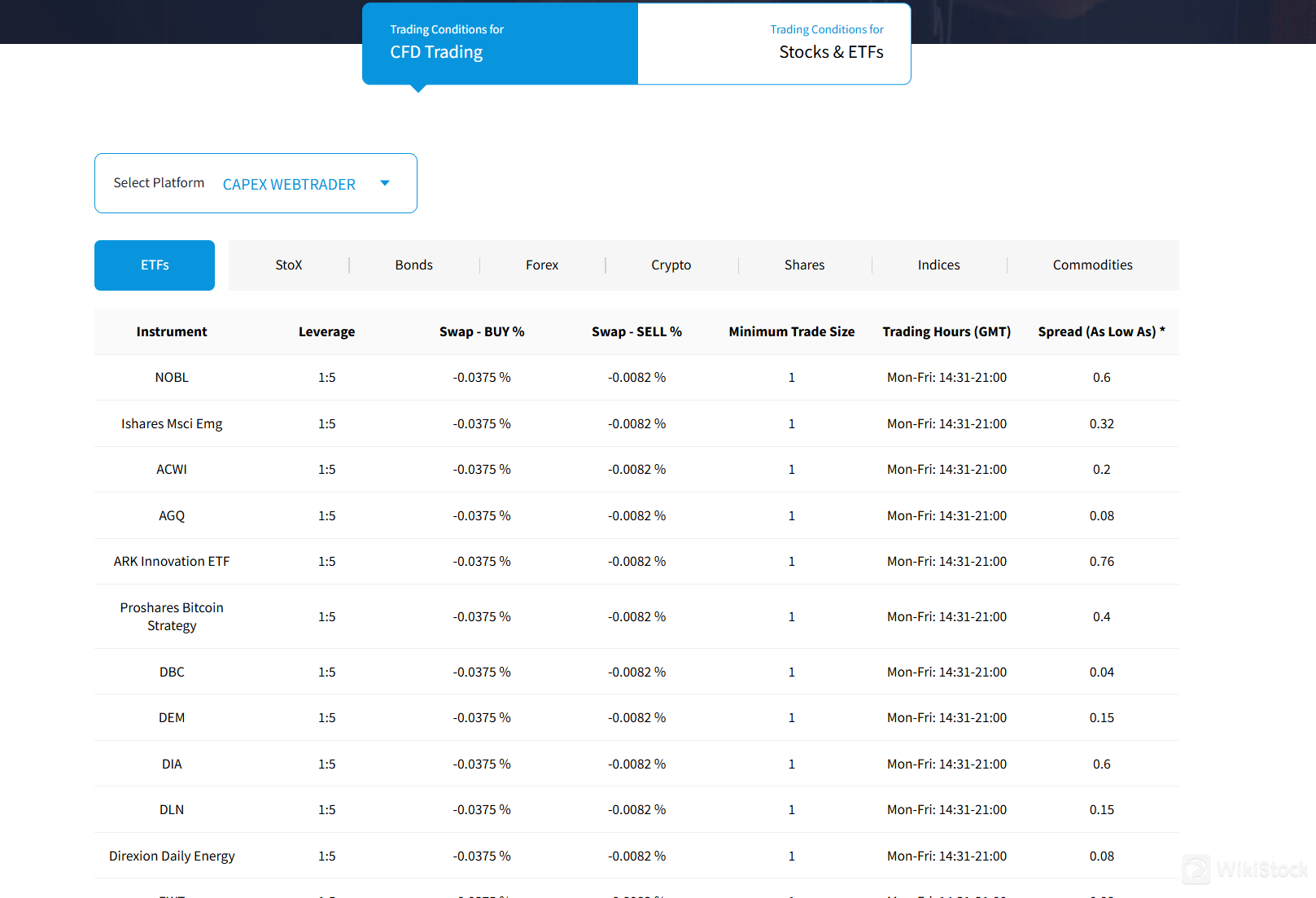

Capex.com provides a variety of trading conditions across its diverse range of financial instruments. Traders can utilize leverage ranging from 1:5 for ETFs and Bonds, 1:1 for Stocks (StoX), up to 1:30 for Forex pairs, and 1:1 to 1:2 for Cryptocurrencies.

Indices and Commodities offer leverage from 1:10 to 1:20, catering to different risk appetites.

The platform boasts competitive trading spreads, such as EUR/USD with spreads as low as 0.0001, ensuring cost-efficient trading.

Fees Review

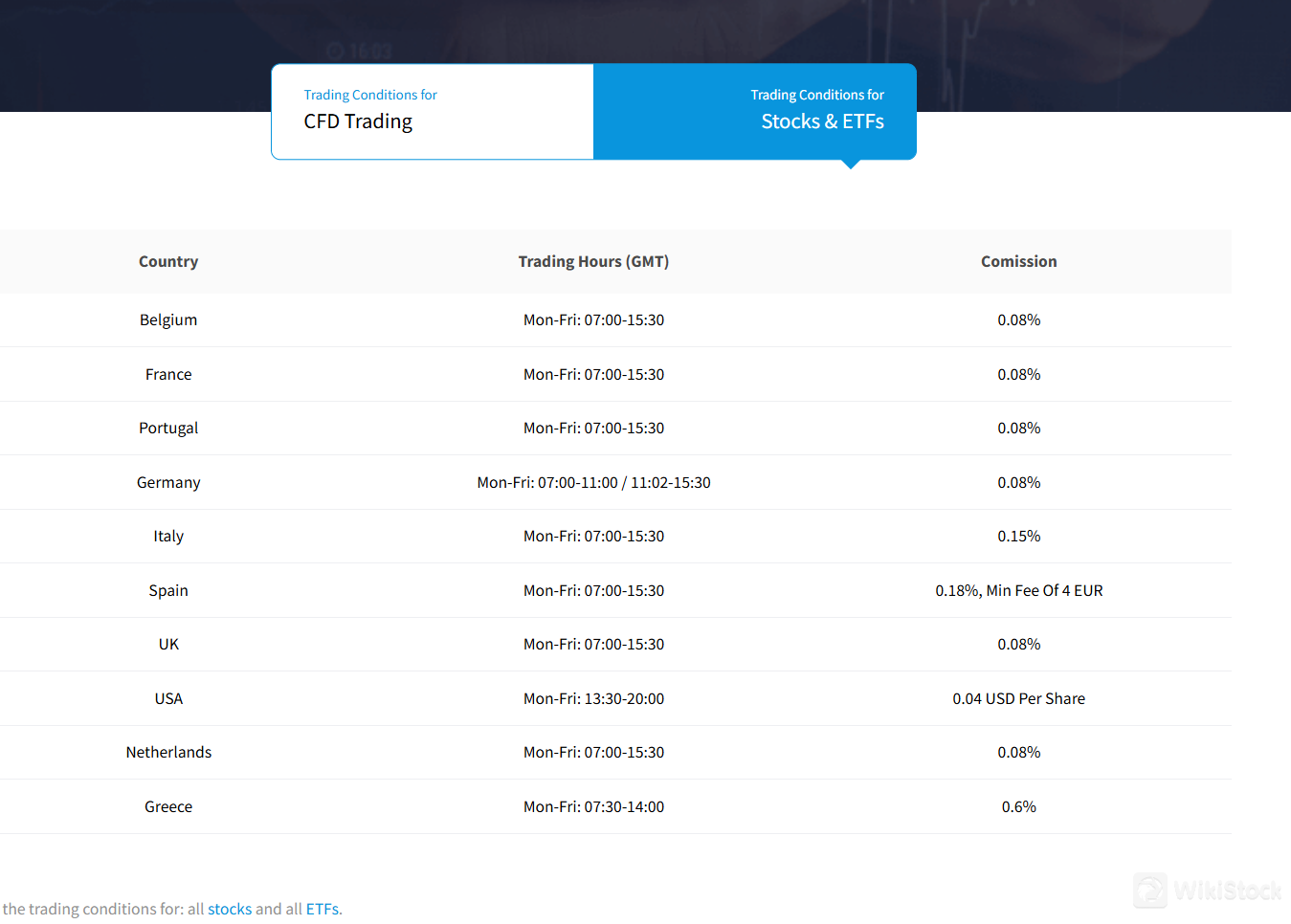

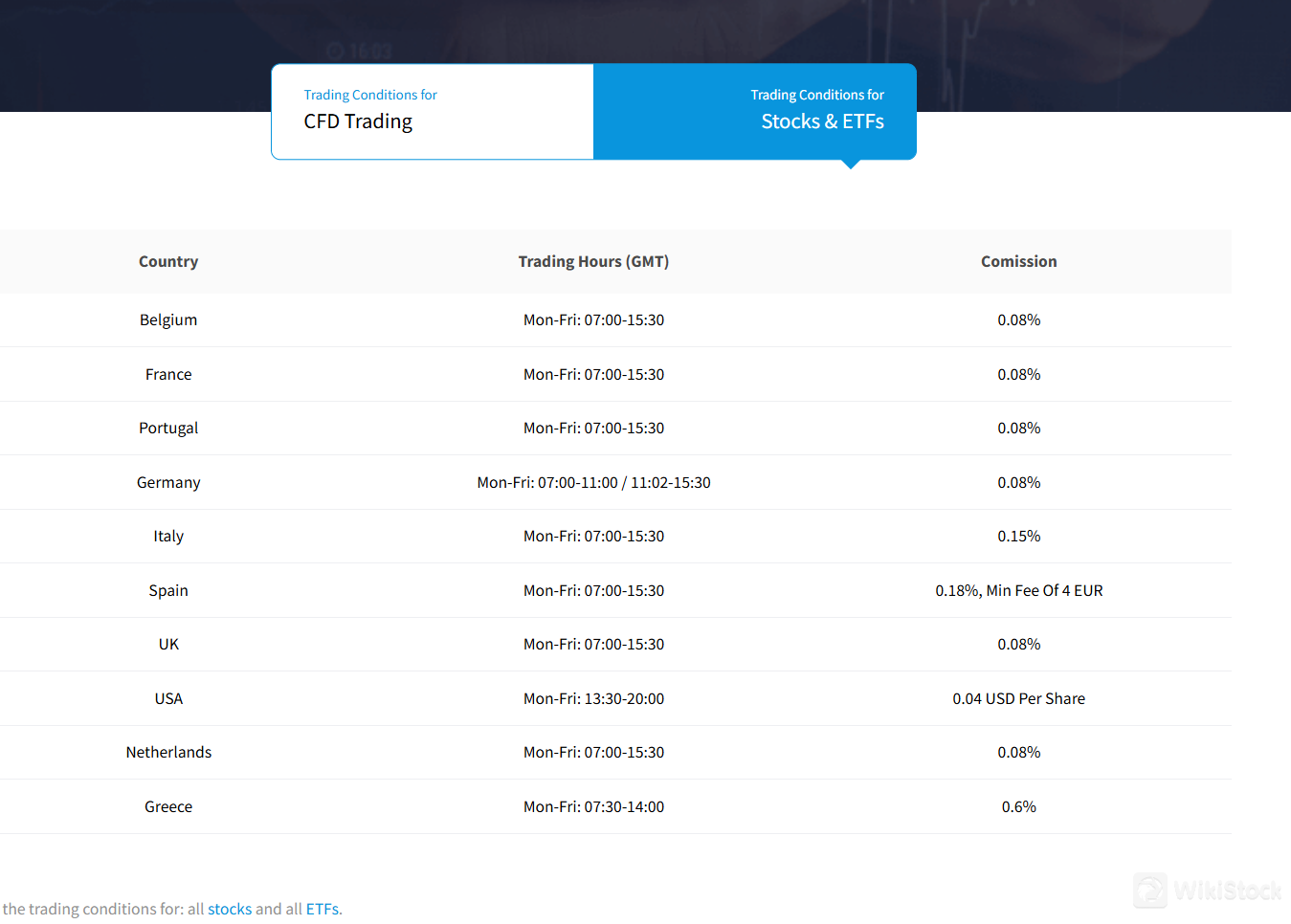

Capex.com imposes varying commission structures for trading Stocks and ETFs across different countries, with rates ranging from 0.04 USD per share in the USA to 0.6% fees in Greece.

Traders should also be aware of conversion fees of 2% for EUR and USD, and 3.5% for other currencies, along with an inactivity fee of USD 25 per month and a withdrawal fee of 20 USD/EUR/GBP or equivalent.

For more details of other fees, you can visit https://capex.com/eu/legal-documents/charges-and-fees for looking up details.

App Review

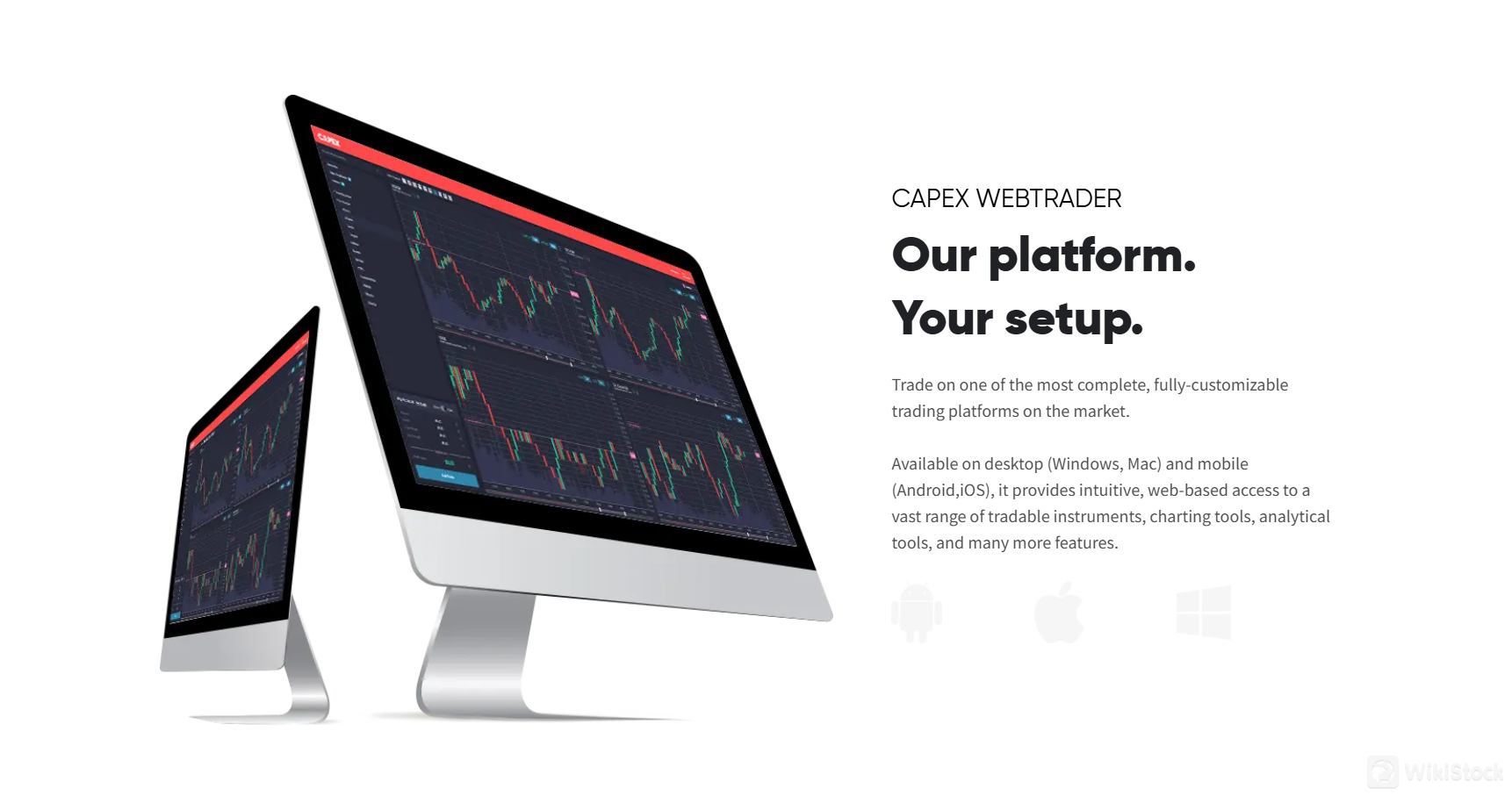

The CAPEX WebTrader platform is a customizable and comprehensive trading solution. Available on both desktop (Windows, Mac) and mobile (Android, iOS), it offers intuitive, web-based access to a wide array of tradable instruments, including Forex, Indices, Bonds, ETFs, Commodities, Shares, and Cryptocurrencies.

The platform is equipped with advanced charting tools, analytical tools, and various other features designed to enhance the trading experience. Traders can benefit from its user-friendly interface and seamless accessibility across devices, ensuring they can manage their investments efficiently, whether at home or on-the-go.

However, there's no valid download links on its website, for confirmation and further details, it is recommended to consult directly with the company.

Research & Eduation

CAPEX.com offers a robust suite of educational resources through its CAPEX Academy, designed to help traders and investors at all levels enhance their skills and knowledge. The Academy provides free online courses that cover everything from basic trading concepts to advanced investment strategies, allowing users to learn at their own pace.

Additionally, CAPEX.com hosts webinars led by experienced market analysts, offering real-time analysis, insights into the latest market trends, and interactive Q&A sessions. To further support trader education, CAPEX.com features a comprehensive Financial Dictionary, regularly updated with definitions of key financial terms.

Customer Service

CAPEX.com offers comprehensive customer service through various channels, including a physical address, phone, email, and fax. Clients can access an FAQ section, contact us form, and connect via social media platforms like Facebook, Google, Twitter, and LinkedIn for support and inquiries.

Tel: Customer Support (+357 22 000 358, +30 211 234 7845); Brokerage Department (+357 22 009 029, +30 211 234 7913)

Email Address: support@capex.com

FAX: +357 22 496 642

Address: 18 Spyrou Kyprianou Avenue, Suite 101, Nicosia 1075

Tel: Customer Support (+40 312 295 982); Brokerage Department (+357 22 009 029); Human Resources (+40 737 004 416)

Email Address: support@capex.com; hr@capex.com

FAX: +357 22 496 642

Address: Piața Presei Libere 3-5, City Gate South Tower, North Wing, 16th Floor

Conclusion

CAPEX.com is a versatile trading platform providing services across Forex, Indices, Bonds, ETFs, Commodities, Shares, and Cryptocurrencies. It supports traders with advanced tools, educational resources, and robust customer service channels, including phone, email, and social media. CAPEX.com is regulated by the Cyprus Securities and Exchange Commission (CYSEC, license no. 292/16), ensuring high compliance and client trust.

Frequently Asked Questions (FAQs)

Is Capex.com regulated by any financial authority?

Yes, Capex.com is regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license no. 292/16.

What types of products and services does Capex.com provide?

Capex.com offers a wide range of trading services, including Forex, Indices, Bonds, ETFs, Commodities, Shares, StoX, and Cryptocurrencies.

Is Capex.com suitable for beginners?

Yes, Capex.com is suitable for beginners due to its CYSEC regulaiton, comprehensive educational resources through CAPEX Academy, and robust customer support.

What are the fees associated with Capex.com?

Capex.com charges various fees, including a conversion fee of 2% for EUR and USD and 3.5% for other currencies, an inactivity fee of USD 25 per month, and a withdrawal fee of 20 USD/EUR/GBP or equivalent. Specific commissions apply for trading stocks and ETFs, depending on the country.

What educational resources does Capex.com offer?

Capex.com provides extensive educational resources through CAPEX Academy, offering free online trading and investing courses for beginners and advanced traders. They also host webinars led by market analysts and offer a comprehensive Financial Dictionary to improve trading knowledge.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Dominica

DominicaObtain 1 securities license(s)