監管中

0123456789

. 0123456789

0123456789

/10

天眼評分

評分指數

券商鑒定

交易品種

1

股票

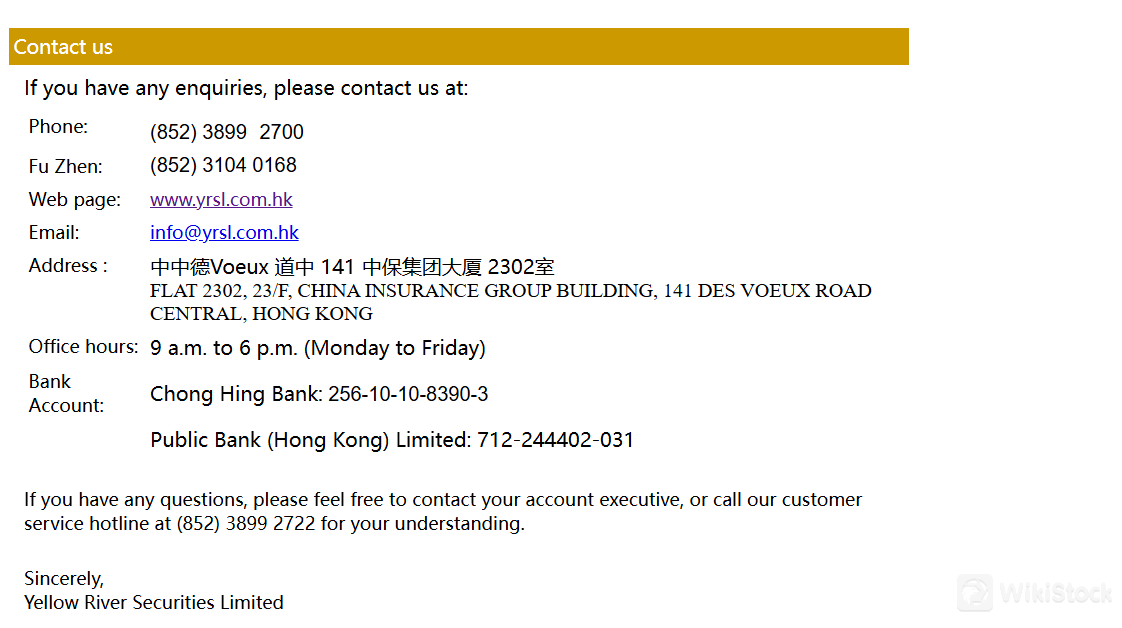

3899 2700

info@yrsl.com.hk

http://www.yrsl.com.hk/

ROOM 2701, 27/F, TOWER 1, ADMIRALTY CENTRE, 18 HARCOURT ROAD, ADMIRALTY, HONGKONG

交易牌照

擁有1個交易牌照

中國香港SFC證券交易執照

監管中

全球席位

![]() 擁有1家交易所席位

擁有1家交易所席位

香港交易所

席位號 02082

已休市

券商信息

更多

公司全稱

YELLOW RIVER SECURITIES LTD

公司簡稱

黃河證券

平台註冊國家、地區

公司電話

3899 2700

公司地址

ROOM 2701, 27/F, TOWER 1, ADMIRALTY CENTRE, 18 HARCOURT ROAD, ADMIRALTY, HONGKONG

隨時想查就查

WikiStock APP

互聯網基因

基因指數

0

020406080100

基因指數較差,低於0%的券商

APP評分

0

01.02.03.04.05.0

APP評分較差,低於0%的同行

黃河證券是一間擁有雄厚實力的香港證券公司,公司配備了先進、完善的資訊設施供客戶使用。公司的股東、管理層及經紀都秉承「忠誠、穩健」的宗旨,向客戶提供專業、高效率的證券交易服務。公司並設立專線,為廣大客戶免費提供一切有關證券買賣交易的諮詢。

其他信息

註冊地

中國香港

經營時間

5-10年

新股交易

是

受監管國數量

1

可交易品類

股票

下載應用

評價

0條評價

寫評價

暫無評價

推薦券商更多

監管中

瑞達國際

牌照級別 AAAA

中國香港監管衍生性商品傭金0.25%

7.69

天眼評分

監管中

Huajin International 華金金融國際

牌照級別 AAAA

中國香港監管選擇權傭金0.15%

7.68

天眼評分

監管中

CLSA

牌照級別 AAAA

中國香港監管選擇權0傭金

7.67

天眼評分

監管中

Sanfull Securities 新富

牌照級別 AAAA

中國香港監管選擇權傭金0.25%

7.65

天眼評分

監管中

DL Securities 德林證券

託管規模 C牌照級別 AAAA

中國香港監管選擇權0傭金

7.65

天眼評分

監管中

嘉信

牌照級別 AAAA

中國香港監管選擇權傭金0.15%

7.64

天眼評分

監管中

GF Holdings (HK) 廣發控股(香港)

牌照級別 AAAA

中國香港監管選擇權傭金0.18%

7.64

天眼評分

監管中

China Taiping 中國太平

牌照級別 AAAA

中國香港監管選擇權傭金0.15%

7.64

天眼評分

監管中

Capital Securities 群益證券

牌照級別 AAAA

中國香港監管選擇權0傭金

7.62

天眼評分

監管中

乾立亨證券

牌照級別 AAAA

中國香港監管選擇權傭金0.029%

7.60

天眼評分