天眼评分

评分指数

券商鉴定

影响力

D

影响力指数 NO.1

泰国

泰国交易品种

4

现金业务、衍生品、证券咨询、股票

交易牌照

拥有1个交易牌照

塞浦路斯CYSEC证券交易牌照

券商信息

更多

公司全称

Mega Equity Securities & Financial Services Public Ltd

公司简称

Mega Equity

平台注册国家、地区

公司地址

随时想查就查

WikiStock APP

互联网基因

基因指数

APP评分

| Mega Equity |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | €3.50 |

| Fees | €3.50 of 手续费 for Authorization Mandate and so on |

| Account Fees | €10 of Creation of Share Accounting |

| App/Platform | Not Mentioned |

| Promotions | No |

| Customer Support | Phone, fax and email, Facebook and Twitter |

什么是Mega Equity?

总部位于塞浦路斯尼科西亚的Mega Equity Securities自1999年成立以来一直是一家知名的投资公司。Mega Equity受塞浦路斯证券交易委员会(CySEC)监管,为欧洲超过4,000名投资者提供全面的股票经纪服务。Mega Equity专注于希腊和塞浦路斯股票、国际证券交易、ETF、希腊衍生品、债券和全球多资产投资,强调市场经验和以客户为中心的解决方案。

Mega Equity的优点和缺点

| 优点 | 缺点 |

| 受CySEC监管 | 缺乏保护措施 |

| 经验和专业知识 | |

| 全面的服务提供 | |

| 全球范围内的本地服务 |

受CySEC监管:Mega Equity受塞浦路斯证券交易委员会(CySEC)监管,确保其遵守严格的金融标准,并为客户的投资提供一定程度的保护。

经验和专业知识:Mega Equity在行业中拥有超过20年的经验,带来广泛的市场洞察力和专业知识,对于寻求经验丰富的指导的投资者可能会有所裨益。

全面的服务提供:Mega Equity提供多样化的投资选择,包括希腊和塞浦路斯股票、国际证券、ETF、衍生品、债券和全球多资产投资。

全球范围内的本地服务:尽管总部位于塞浦路斯尼科西亚,Mega Equity为欧洲各地的广泛客户群提供服务,表明其具有广泛的覆盖范围和本地化的服务能力。

缺点:缺乏保护措施:尽管受CySEC监管,投资者应意识到监管监督虽然提供了标准,但可能无法完全保护免受所有市场风险或运营问题的影响。

Mega Equity安全吗?

Mega Equity在塞浦路斯证券交易委员会(CySEC)的监管监督下运营,持有011/03号许可证。 CySEC是一个独立的公共监管机构,负责监督投资服务市场、塞浦路斯共和国内进行的可转让证券交易以及集体投资和资产管理行业。它作为监管机构,确保遵守法律法规,维护市场诚信,并保护塞浦路斯投资者的利益。

此外,CySEC通过监管金融服务公司的活动,包括Mega Equity,维护行为准则和促进投资者信心,从而在维持公平、透明和高效的金融市场环境方面发挥着关键作用。

Mega Equity可以交易的证券有哪些?

Mega Equity提供多样化的证券,包括希腊和塞浦路斯股票、国际证券交易、ETF、希腊衍生品、债券、全球多资产交易、X-Net全球市场访问和投资组合转移服务。

股票:Mega Equity专注于希腊和塞浦路斯股票,满足对这些市场感兴趣的本地和国际投资者的需求。

国际证券交易:他们促进国际证券交易的执行,使客户能够无缝访问全球市场。

ETF(交易所交易基金):Mega Equity提供各种ETF,为投资者提供多元化的资产类别和市场曝光。

希腊衍生品:他们提供与希腊金融工具相关的衍生品,允许进行对冲和投机策略。

债券:Mega Equity提供一系列债券,满足寻求固定收益证券以获取收入和分散投资的投资者需求。

全球多资产交易:他们使客户能够在全球范围内执行跨多个资产类别的交易,增强投资组合的多样化和风险管理。

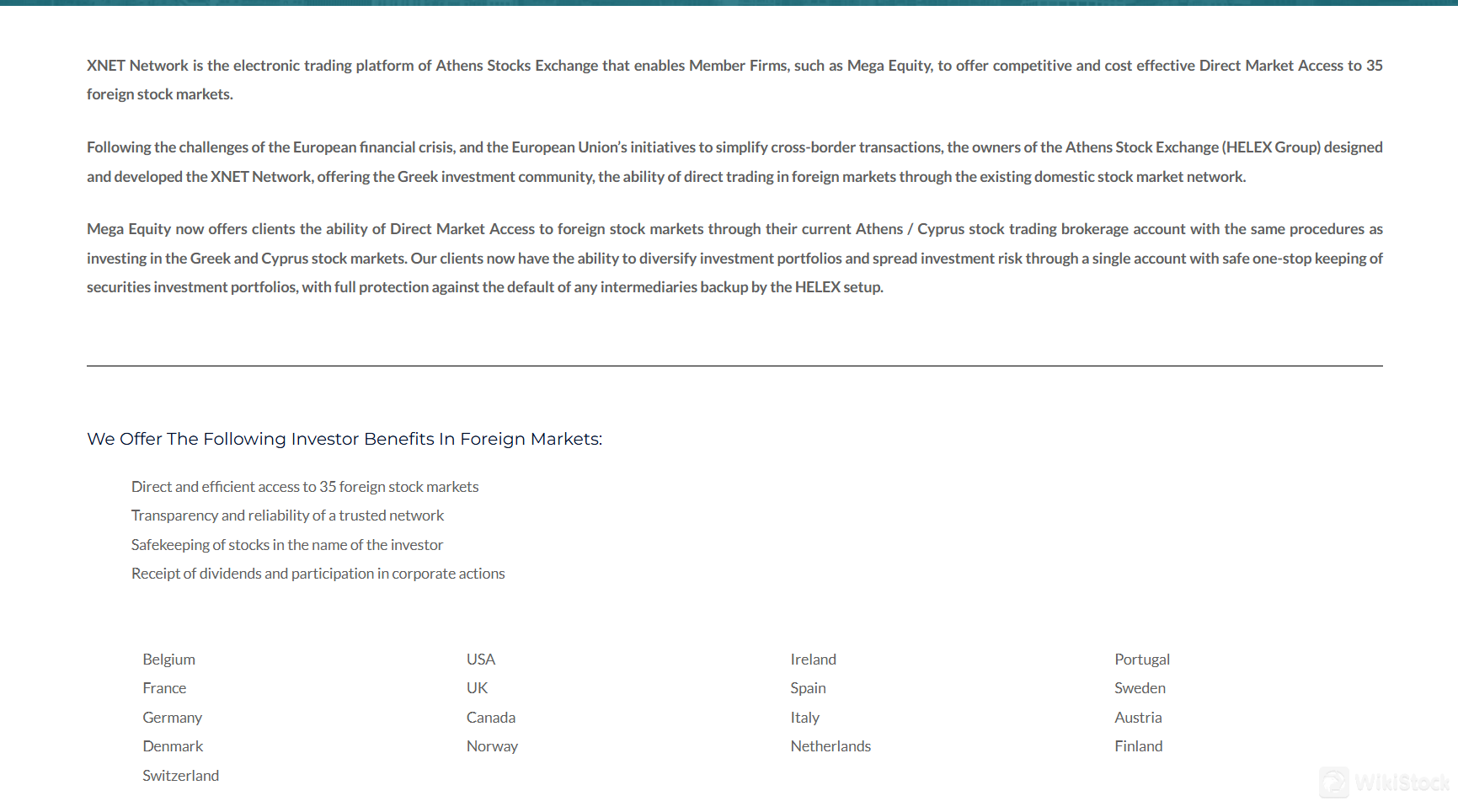

X-Net全球市场访问:通过XNET网络,Mega Equity提供直接访问35个外国股票市场,确保竞争力和具有成本效益的交易机会。

投资组合转移服务:Mega Equity简化了从其他经纪人转移国内或国外股票投资组合的过程,为寻求将其投资整合到一个平台下的客户提供了简单的解决方案。

Mega Equity费用回顾

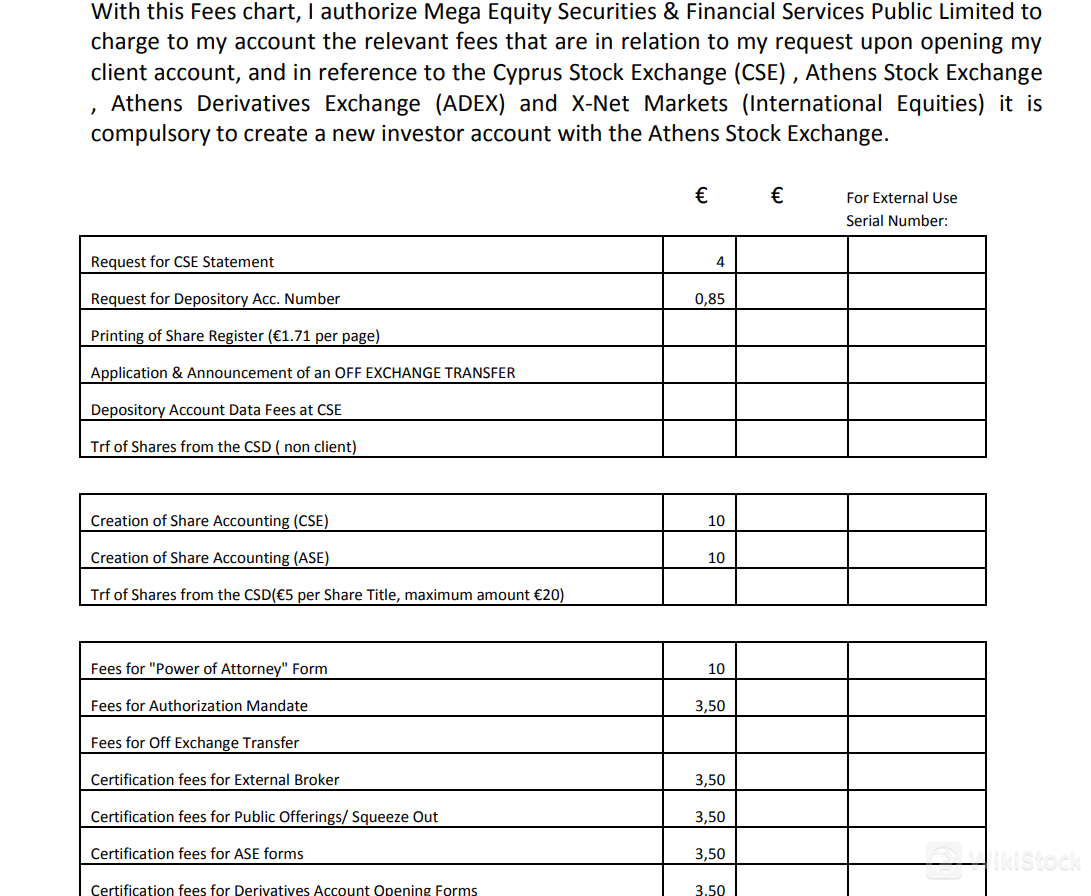

Mega Equity费用结构涵盖了与证券管理、转让、行政任务和认证相关的一系列服务和交易。

| 项目 | 金额 |

| 股份登记册打印 | 每页€1.71 |

| 股份会计(CSE)创建 | €10 |

| 股份会计(ASE)创建 | €10 |

| 从CSD转让股份 | 每个股份标题€5,最高金额€20 |

| “授权委托书”表格费用 | €10 |

| 授权委托费用 | €3.50 |

| 外部经纪人认证费用 | |

| 公开发行/强制清算认证费用 | |

| ASE表格认证费用 | |

| 衍生品账户开户表格认证费用 |

Mega Equity咨询服务评价

私人客户投资服务:旨在帮助客户实现资本增长、收入生成等财务目标。该服务解决了退休规划、教育资金、短期目标(例如购房)以及为家庭成员留下财务遗产等常见问题。

此外,Mega Equity充当股票基金投资经理的非自主子顾问。这涉及到对持仓的日常监控和提供买入和卖出建议。这些服务可提供给公积金、基金经理和私人财富客户。

指定咨询(NOMAD)服务:作为塞浦路斯证券交易所的指定咨询机构,Mega Equity为寻求在新兴公司市场(ECM)上市的公司提供服务。这包括:

评估并向证券交易所提交公司。

代表发行人在上市过程中提供支持。

监督并协助发行人确保上市后符合ECM法规。

另类投资基金(AIF)服务:Mega Equity根据相关法律获得许可,为另类投资基金提供集体投资管理服务。这包括:

管理投资并提供风险管理和托管服务。

制定与基金目标一致的投资策略和政策。

监控投资绩效并确保符合风险管理政策。

客户服务

客户可以亲自访问他们的办公室,或使用下面提供的信息与客户服务部门联系:

电话:+357 22711711

传真:+357 22711811

电子邮件:info@megaequity.com

地址:42-44 Griva Digenis 1080 Nicosia, Cyprus P.O. Box 23685, 1685, Nicosia Cyprus

此外,客户还可以通过社交媒体与该经纪人联系,例如Twitter和Facebook。

结论

总之,Mega Equity是一家声誉良好的经纪公司,具有强大的CySEC监管监督、超过二十年的市场经验、多样化的投资选择以及为欧洲投资者提供全球本地化服务模式等重要优势。然而,投资者应权衡该公司的限制,如市场波动带来的固有风险,尽管有监管保障。在考虑Mega Equity作为经纪合作伙伴的适用性时,评估个人投资需求和风险承受能力至关重要。

常见问题(FAQ)

Mega Equity是否受到监管?

是的。它受到CYSEC的监管。

我可以用Mega Equity投资哪些证券?

您可以交易希腊和塞浦路斯的股票、国际证券交易、ETF、希腊衍生品、债券、全球多资产。

如何联系Mega Equity?

您可以通过电话:+357 22711711,传真:+357 22711811,电子邮件:info@megaequity.com,Twitter和Facebook联系。

Mega Equity的最低存款金额是多少?

开设账户的最低初始存款金额为€3.50。

风险警示

所提供的信息基于WikiStock对经纪公司网站数据的专业评估,并可能会发生变化。此外,网上交易涉及重大风险,可能导致投资资金的全部损失,因此在参与之前理解相关风险至关重要。

其他信息

注册地

塞浦路斯

经营时间

15-20年

佣金率

0.1%

受监管国数量

1

可交易品类

现金业务、衍生品、证券咨询、股票

下载应用

评价

暂无评价

推荐券商更多

OEXN

天眼评分

TCR

天眼评分

UGM Securities

天眼评分

WWF

天眼评分

Vita Markets

天眼评分

GVD Markets

天眼评分

PatronFX

天眼评分

eFinno

天眼评分

FlexInvest

天眼评分

RED MARS Capital LTD

天眼评分