天眼评分

评分指数

券商鉴定

交易品种

1

股票

交易牌照

拥有1个交易牌照

中国香港SFC证券交易牌照

全球席位

![]() 拥有1家交易所席位

拥有1家交易所席位

香港交易所

席位号 02061

券商信息

更多

公司全称

Grand Partners Securities Limited

公司简称

利盟证券

平台注册国家、地区

公司地址

随时想查就查

WikiStock APP

互联网基因

基因指数

APP评分

券商特色

新股交易

是

杠杆交易

是

受监管国数量

1

可交易品类

1

| Grand Partners Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | 未提及 |

| Fees | 未提及 |

| App/Platform | The Portal2 Online Trading Platform |

| Promotions | 否 |

| Customer Support | (Office Hours : 9:00am – 6:00pm (Monday to Friday), Except Sundays and Public Holidays) Phone, email and fax |

什么是Grand Partners Securities?

Grand Partners Securities Limited成立于2015年,是一家由SFC许可的知名机构。该公司提供全面的金融服务,包括证券交易、融资融券、互联网交易和IPO申请服务。Grand Partners Securities提供多种账户类型。

优点和缺点

| 优点 | 缺点 |

| 受SFC监管 | 账户最低金额和费用相关信息有限 |

| 全面的服务 | 透明度问题 |

| 提供在线交易平台 | |

| 账户灵活性 |

受SFC监管:受到香港证券及期货事务监察委员会(SFC)的监管是一个重要的优势,它确保Grand Partners Securities在监管框架内运营,为投资者提供了一定的信任和安全。

全面的服务:该公司提供广泛的金融服务,包括证券交易、融资融券和IPO申请。

提供在线交易平台:Portal2在线交易平台提供便利和易用性,使客户能够远程访问其账户并管理投资。

账户灵活性:客户可以选择不同类型的账户,如个人账户和公司账户,以满足客户根据其投资目标和偏好的多样化需求,展示了灵活性。

缺点:账户最低金额和费用相关信息有限:关于账户最低金额和费用的透明信息有限,可能会给潜在客户带来不确定性,使他们难以评估成本结构并计划其投资。

透明度问题:关于账户最低金额和费用的有限信息可能引发透明度和沟通清晰性方面的问题,可能导致重视成本相关的客户对于清晰和详细的信息的信任问题。

Grand Partners Securities安全吗?

Grand Partners Securities在证券及期货事务监察委员会(SFC)的监管下运营,持有BIC291号牌照,这对于维护香港证券和期货市场的稳健性和可信度至关重要。作为国际金融中心内的关键金融监管机构,SFC致力于加强和保护这些市场的完整性和稳定性。其总体使命是确保投资者保护,促进市场透明度,并维护行业内的公平实践。

SFC在监督Grand Partners Securities和其他金融机构方面发挥着关键作用,以减轻风险,执行监管合规性,并为所有市场参与者营造公平竞争环境。通过严格的许可要求和持续监测,SFC旨在维护像Grand Partners Securities这样的持牌公司的高标准的公司治理和运营诚信。

Grand Partners Securities提供哪些证券交易?

Grand Partners Securities提供一系列以香港股票为主的证券经纪和金融服务。他们的服务包括融资交易、IPO参与、认股权证交易、可赎回牛熊合约,以及配售、包销和再包销服务。此外,Grand Partners Securities通过他们的Portal2在线交易平台提供在线交易服务,该平台支持各种设备上高效安全的下单。

他们的经纪服务使客户能够交易香港股票,利用融资交易提供增强的交易机会。参与IPO使投资者能够获得新上市股票,而认股权证交易为投机性交易策略提供了额外的途径。可赎回牛熊合约提供杠杆式市场暴露,迎合看涨和看跌市场情绪。此外,Grand Partners Securities还提供配售、包销和再包销服务,支持企业客户进行资本筹集活动和金融市场交易。

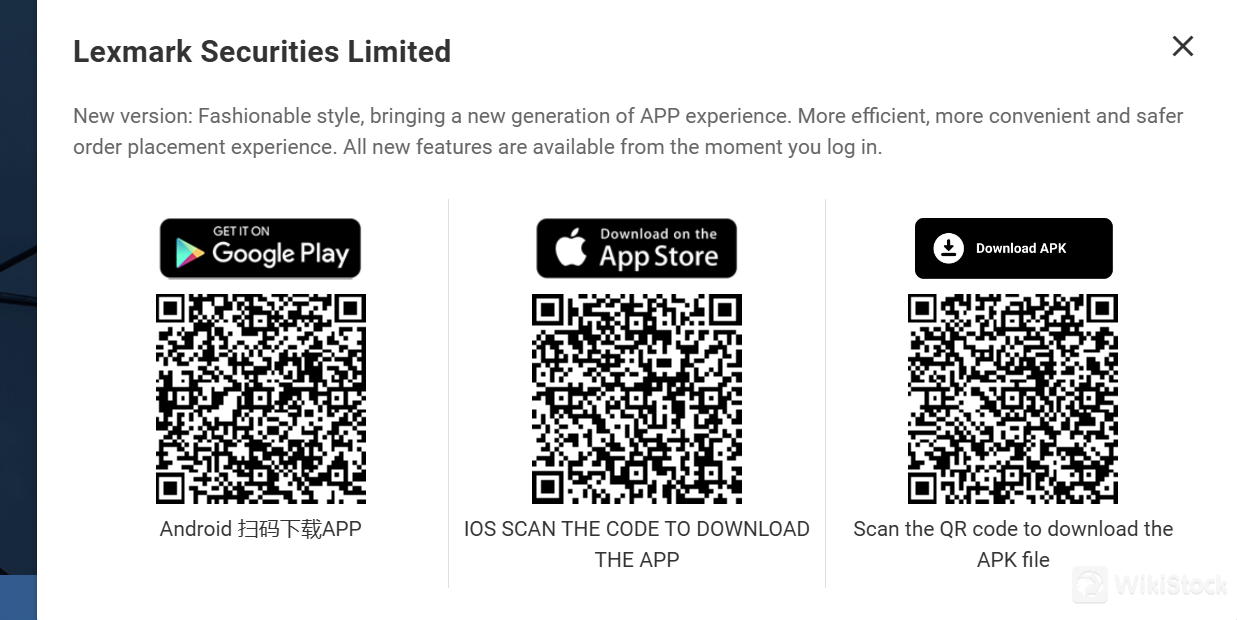

Grand Partners Securities平台评测

Grand Partners Securities提供Portal2在线交易平台,可在Google Play、Apple Store和通过APK下载。该平台采用现代化和用户友好的界面设计,旨在提高交易体验的效率、便利性和安全性。

Portal2平台以其现代化的设计脱颖而出,为用户带来了新一代的应用体验。它融入了先进的功能,优先考虑效率,确保交易员能够快速执行订单并轻松管理投资。这包括实时市场数据更新、直观的导航和可根据个人交易偏好定制的仪表板。

此外,该平台支持多设备访问,允许交易员在各种设备上无缝管理投资组合,无论是桌面还是移动设备。这种灵活性确保交易员能够随时随地与市场保持联系并执行交易。

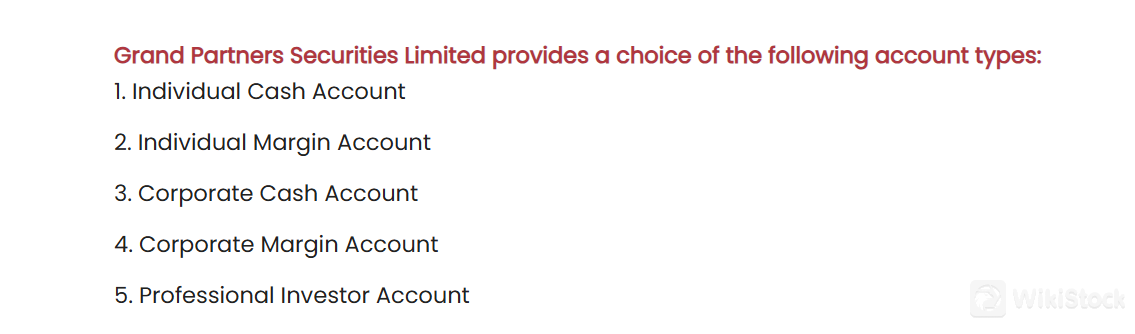

Grand Partners Securities账户评测

Grand Partners Securities提供多种账户类型:

个人现金账户:此账户类型适用于希望使用自己的资金进行交易而不使用融资交易的个人投资者。它提供了使用可用现金余额进行即时结算的证券交易简便途径。

个人融资账户:适用于希望最大化交易潜力的个人投资者,个人融资账户允许客户使用经纪人借入的资金进行股票交易。

企业现金账户:针对企业实体,该账户便于使用可用现金余额进行简单的交易。它为企业客户提供了高效的进入香港股市的途径,以投资多余资金。

企业保证金账户:类似于个人保证金账户,但专为企业实体量身定制,该账户类型允许企业使用借入的资金进行股票交易,以增强交易能力并潜在增加回报。

专业投资者账户:专为具有丰富经验和高度复杂的投资者而设计,满足特定监管标准,专业投资者账户提供高级交易功能和特权。

客户服务

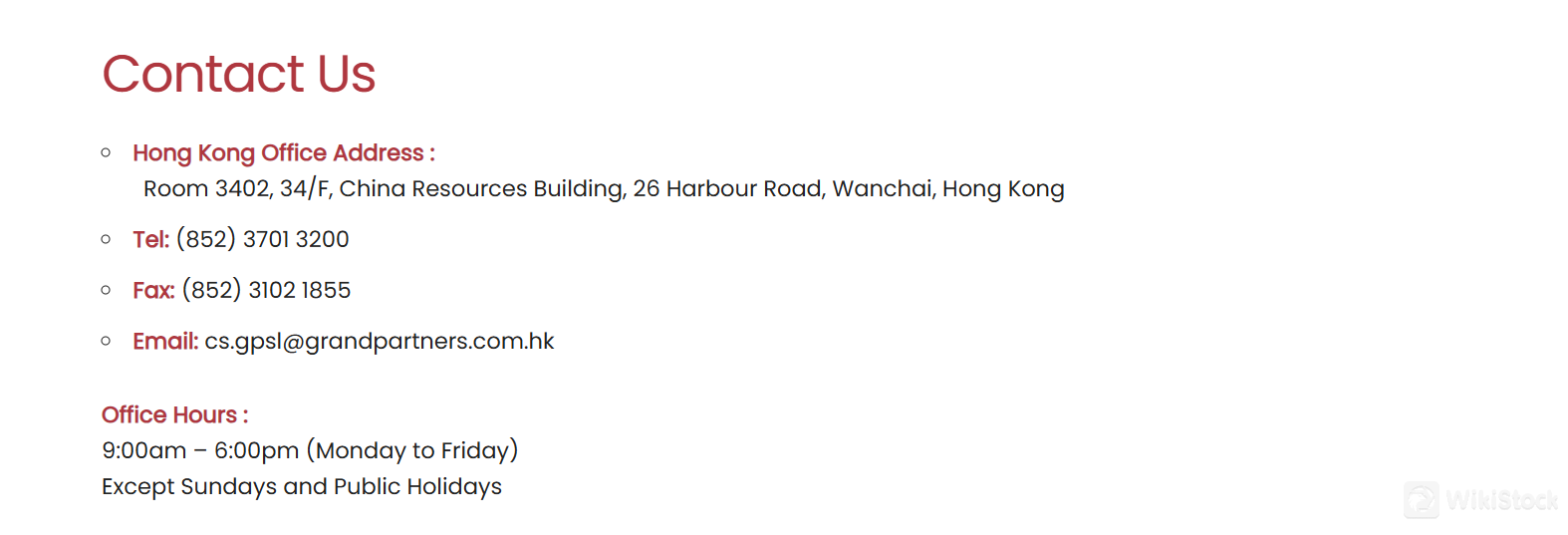

客户可以通过以下提供的信息访问他们的办公室或与客户服务热线联系:

办公时间:

周一至周五上午9:00至下午6:00

除星期日和公共假期外

电话:(852) 3701 3200

传真:(852) 3102 1855

电子邮件:cs.gpsl@grandpartners.com.hk

地址:香港湾仔港湾道26号华润大厦34楼3402室

结论

Grand Partners Securities具有SFC监管、提供广泛的服务、提供在线交易平台和账户选择灵活性等优势。然而,关于账户最低金额和费用的透明度缺乏可能是一个重大缺点。

总之,尽管Grand Partners Securities在强大的监管支持和全面的服务提供方面显示出潜力,但解决有关费用和账户最低金额的透明度问题对于增强市场的信任和竞争力至关重要。

常见问题(FAQ)

Grand Partners Securities是否受到监管?

是的。它受到SFC的监管。

我可以在Grand Partners Securities投资哪些类型的证券?

它提供保证金融资、IPO参与、认股权证交易、可赎回牛熊合约,以及配售、包销和分包销服务。

Grand Partners Securities提供哪些平台?

它提供Portal2在线交易平台。

如何联系Grand Partners Securities?

您可以通过(办公时间:周一至周五上午9:00至下午6:00,除星期日和公共假期外)电话:(852) 3701 3200,传真:(852) 3102 1855,以及电子邮件:cs.gpsl@grandpartners.com.hk联系。

风险警示

所提供的信息基于WikiStock对经纪公司网站数据的专业评估,并可能会发生变化。此外,网上交易涉及重大风险,可能导致投资资金的全部损失,因此在参与之前了解相关风险至关重要。

其他信息

注册地

中国香港

经营时间

5-10年

可交易品类

股票

下载应用

评价

暂无评价

推荐券商更多

Lukfook Financial 六福金融

天眼评分

Wing Fung Financial 永丰金融

天眼评分

HGNH International 横华国际

天眼评分

Arta Global Markets 裕承环球

天眼评分

PC Securities 宝成证券

天眼评分

昊天国际金融

天眼评分

名汇集团

天眼评分

越证控股

天眼评分

Kingston Financial Group 金利丰金融集团

天眼评分

Sinofortune Group 华億金控

天眼评分