创富证券为香港证券及期货事务监察委员会注册的持牌法团(中央编号BFY678)及香港联合交易所有限公司的交易所参与者(编号1062),可从事第1类受规管业务(证券交易)

什么是Opus?

Opus Securities Limited是一家受SFC监管的持牌公司,作为香港交易所(ID. 1062)的交易参与者运营。认识到香港在利用中国投资者在国际市场上日益重要的战略优势方面的重要性,Opus旨在成为中国投资者与全球资本市场之间的关键纽带。

Opus的优点和缺点

Opus Securities Limited的优点: 受SFC监管:Opus受到证券期货委员会(SFC)的监管,并且是香港交易所的交易参与者,确保其在严格的监管监督下运营。这增强了客户的信任和可靠性。

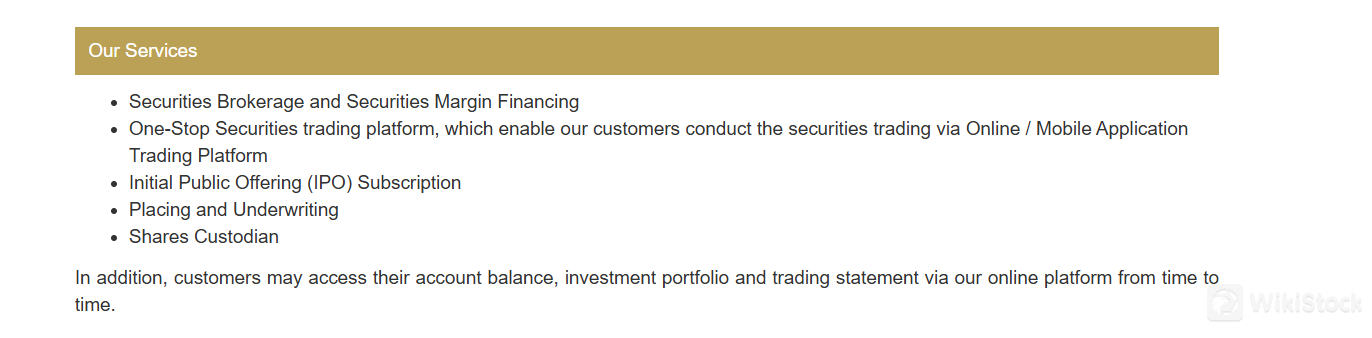

全面的服务提供:Opus提供广泛的金融服务,包括证券经纪、融资融券、IPO认购、配售和包销以及股份保管。

技术进步:该公司采用现代技术,如Opus移动交易平台和安全令牌应用程序。这些工具为偏好在线和移动交易的客户提供了便利和可访问性。

战略定位:作为总部位于香港的公司,Opus利用其作为金融中心的地理位置,将中国投资者与国际资本市场联系起来。这种战略定位利用了中国投资者在全球范围内日益增长的影响力。

Opus Securities Limited的缺点: 存款限制:该公司不接受现金或第三方支票存款。这可能给偏好这些传统资金转移方式的客户带来不便。

Opus安全吗?

Opus在证券期货委员会(SFC)的监督下运营,持有BFY678号牌照。作为香港全球知名金融中心内的重要金融监管机构,SFC在巩固和维护该地区证券和期货市场的完整性和稳定性方面发挥着关键作用。其总体任务是在促进投资者利益的同时,营造一个公平透明、有利于可持续行业增长的市场环境。

证监会行使全面的监管职权,包括对证券和期货交易活动的监督,以及对券商、投资顾问和基金管理人等市场参与者的监管。通过严格的监管框架和持续监测,证监会确保遵守监管标准,旨在减轻风险,增强市场对外部冲击的韧性。

Opus交易的证券有哪些?

证券经纪:Opus通过其在线和移动应用交易平台促进证券的买卖。他们提供高效的执行和对各种市场的访问。

证券融资:该服务允许客户通过借款来进行证券交易,从而提高其投资杠杆。

首次公开发行(IPO)认购:Opus协助客户认购IPO,确保他们在初始发行阶段获得新的投资机会。

配售和包销:Opus参与证券发行的配售和包销,为市场引入新的证券提供重要支持。

股份保管:Opus为客户的证券持仓提供安全保管服务,确保其投资组合的安全保管和高效管理。

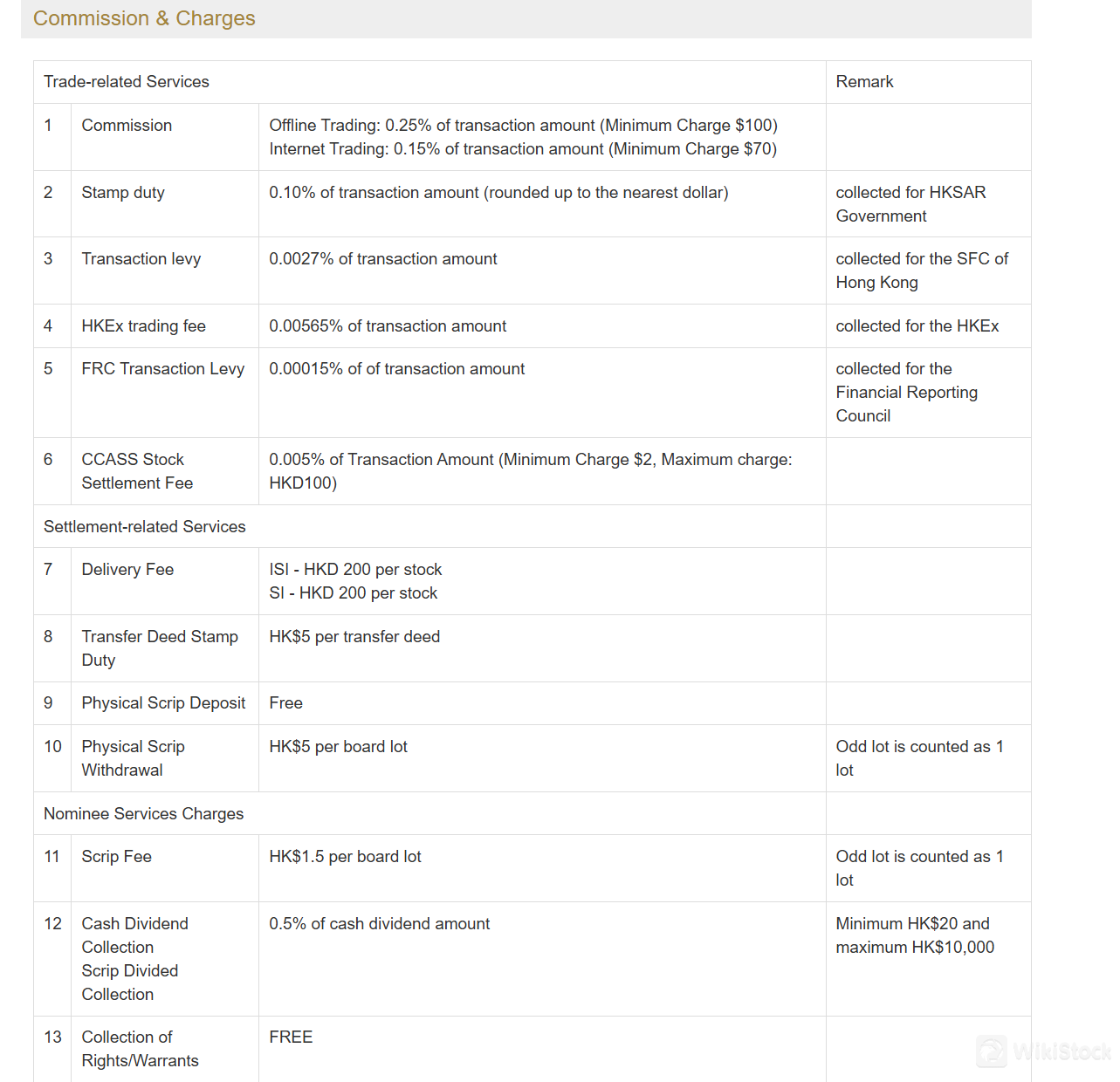

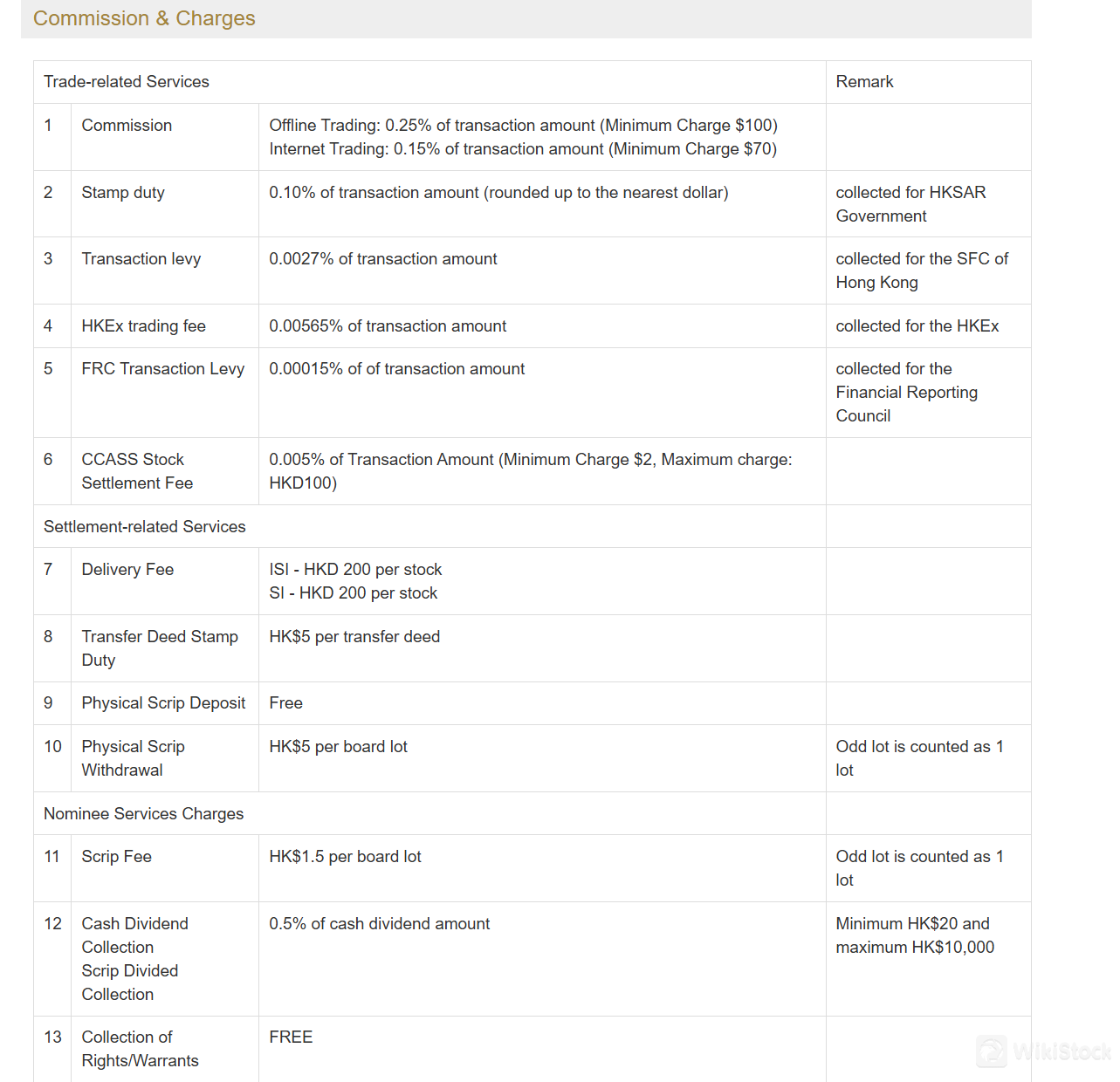

Opus费用评估

Opus收取不同类型的费用项目,如交易、托管和与证券交易相关的行政服务。

Opus平台评测

Opus提供两个独特的交易平台,旨在满足现代投资者的需求:Opus移动交易平台和安全令牌应用程序。这些平台可在Apple Store和Google Play上下载,确保在iOS和Android设备上均可访问。

Opus移动交易平台:该平台提供了一个针对移动设备优化的用户界面,使客户可以方便地在移动中交易证券。它提供实时市场数据、直观的下单功能和全面的投资组合管理工具。Opus移动交易平台确保用户可以从智能手机或平板电脑上快速、安全地执行交易,增强了管理投资的灵活性和响应能力。

安全令牌应用程序:为了增强安全性和认证目的,安全令牌应用程序是Opus保护客户交易的承诺的补充。它通过基于令牌的身份验证提供了额外的安全层,确保交易和账户活动免受未经授权的访问。

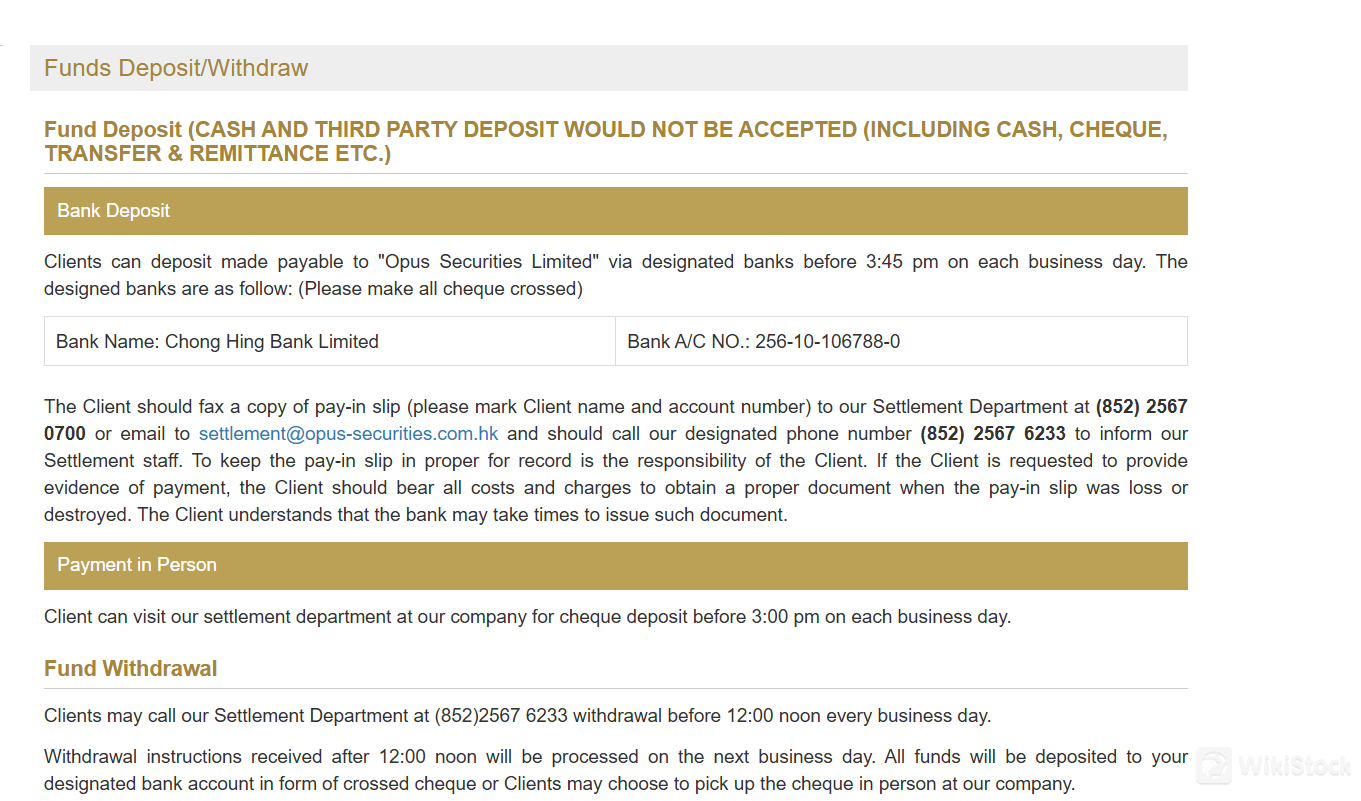

Opus存款和提款审核

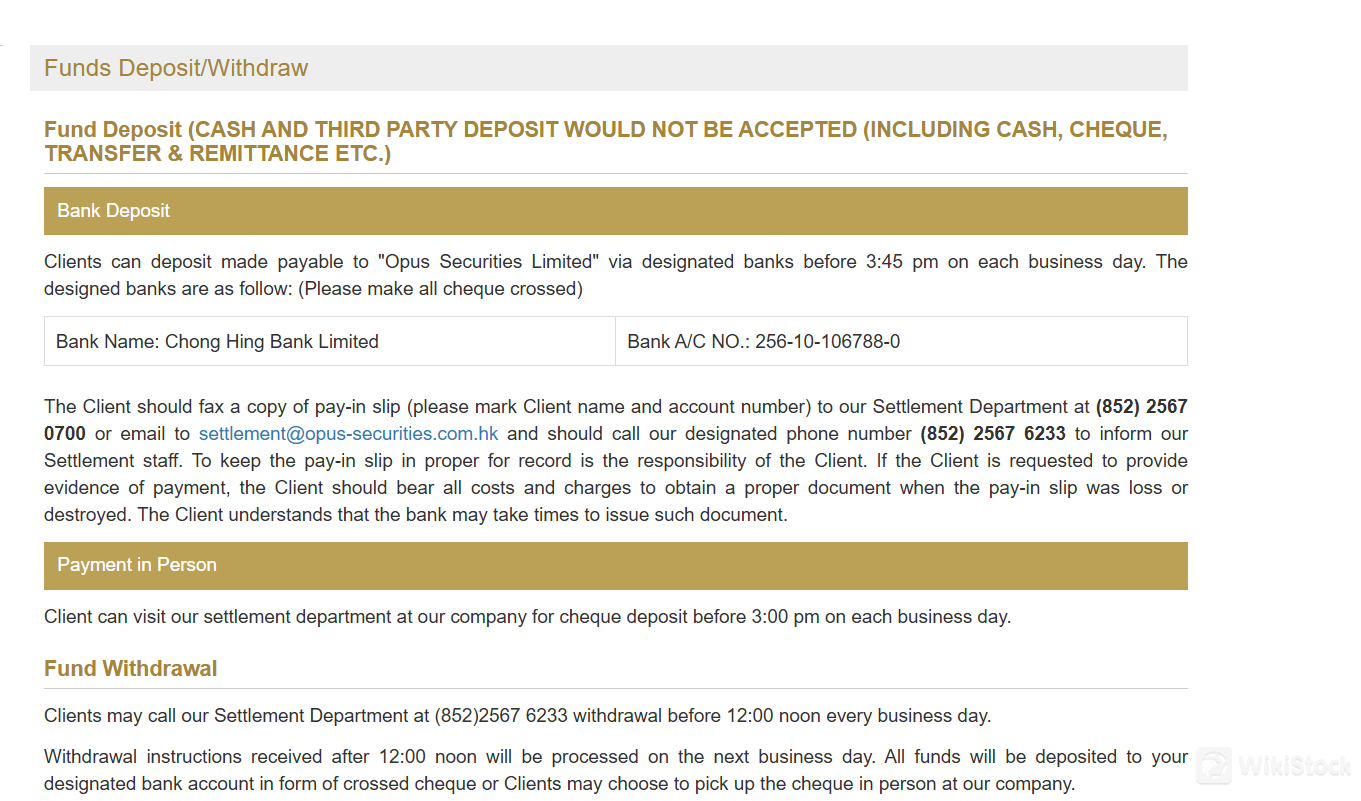

存款:

银行存款:客户可以在每个工作日的下午3:45之前通过指定的银行存入“Opus证券有限公司”的款项。支票应该是交叉的,并通过传真或电子邮件将详细信息发送给结算部门。

亲自付款:客户还可以在工作日的下午3:00之前亲自访问Opus的结算部门存入支票。

提款:

提款请求应在工作日中午12:00之前向结算部门通报,以便当天处理。此时间之后收到的请求将在下一个工作日处理。客户可以选择通过存入指定银行账户的交叉支票或亲自领取支票来收取资金。

股票存款:

实物股票:客户必须亲自在Opus办公室存入实物股票。出于安全原因,不接受邮寄股票。Opus不收取存入实物股票的费用,但每张股票或转让表格都需要支付政府费用。

结算指令:客户还可以通过CCASS使用结算指令(SI)或投资者结算指令(ISI)存入非实物股票。

股票提款:

实物股票:客户需要填写并签署一张指定股票详细信息的证券提款单。收取一定的手续费,整个过程需要最多7个工作日。

结算指令:与存款类似,客户可以通过CCASS使用SI或ISI提取非实物股票。费用基于前一天的股票市值。

客户服务

客户可以亲自访问他们的办公室或使用下面提供的信息与客户服务部门联系:

电话:(852) 2567 0100

传真:(852) 2567 0700

电子邮件:cs@opus-securities.com.hk

地址:香港中环干诺道中19-20号EC医疗保健大厦8楼

此外,客户还可以通过Twitter、Facebook、Instagram、YouTube和Linkedin等社交媒体与该经纪人联系。

Opus在其交易平台中提供在线消息。这使得交易者可以通过平台直接与客户支持或其他交易者进行沟通。

结论

总之,Opus证券有限公司是金融服务行业中一个强大的参与者,受益于强大的监管监督、多样化的服务范围和在香港的战略定位。其对技术进步和客户支持的承诺进一步增强了其吸引力。对于寻求可靠和前瞻性金融服务的投资者来说,Opus是一个有吸引力的选择。

常见问题(FAQ)

Opus是否受到监管?

是的。它受到SFC的监管。

Opus提供哪些平台?

它提供Opus移动交易平台和安全令牌应用程序。

如何联系Opus?

您可以通过电话:(852) 2567 0100,传真:(852) 2567 0700,电子邮件:cs@opus-securities.com.hk和在线消息进行联系。

我可以存入现金或第三方支票到我的账户吗?

不,Opus Securities不接受现金或第三方存款,包括现金、支票、转账和汇款。

风险警示

所提供的信息基于WikiStock对经纪公司网站数据的专家评估,并可能会发生变化。此外,网上交易存在重大风险,可能导致投资资金的全部损失,因此在参与之前了解相关风险至关重要。

拥有1个交易牌照