คะแนน

JIA証券

https://www.jia-sec.co.jp/

Website

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

C

ดัชนีอิทธิพล NO.1

ประเทศญี่ปุ่น

ประเทศญี่ปุ่นความหลากหลาย

7

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

FSAอยู่ในการกำกับดูแล

ประเทศญี่ปุ่นใบอนุญาตซื้อขายหลักทรัพย์

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

JIA Securities Co., Ltd.

ชื่อย่อบริษัท

JIA証券

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

https://www.jia-sec.co.jp/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

การวิเคราะห์ธุรกิจ

JIA証券 ปฏิทินรายรับ

สกุลเงิน: JPY

รอบ

Q4 FY2023 รายได้

2023/10/30

รายได้(YoY)

6.99B

+174.46%

EPS(YoY)

2.62

+109.31%

JIA証券 ประมาณการรายได้

สกุลเงิน: JPY

- วันที่รอบรายได้/ประมาณการ

- 2023/10/302023/Q35.895B/0

- 2022/10/302022/Q32.973B/0

- 2022/04/272022/Q12.254B/0

- 2021/10/282021/Q34.586B/0

- 2021/04/292021/Q13.732B/0

Internet Gene

Gene Index

คะแนนแอป

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0.10%

New Stock Trading

Yes

Margin Trading

YES

ประเทศที่ได้รับการควบคุม

1

| JIA Securities |  |

| คะแนน WikiStock | ⭐⭐⭐ |

| ก่อตั้ง | 1944 |

| เขตลงทะเบียน | ญี่ปุ่น |

| สถานะกฎหมาย | FSA |

| ผลิตภัณฑ์และบริการ | หุ้น, หุ้นส่วน, กองทุนการลงทุน, อินเด็กซ์ฟิวเจอร์และตัวเลือก, ผลิตภัณฑ์การเช่าทำธุรกิจญี่ปุ่น, กองทุน JIA, กองทุนบริษัทที่ไม่ได้รับการจดทะเบียน, ผลิตภัณฑ์โทเค็นสินทรัพย์อสังหาริมทรัพย์ |

| (ลูกค้าธุรกิจ) การจัดการหลักทรัพย์และการรับรอง, การให้คำปรึกษาทางการเงิน, การให้คำปรึกษาด้านการซื้อขายและการควบคุมกิจการ | |

| ค่าคอมมิชชั่น | หุ้น: 0.1-1.15% + อัตราคงที่ขึ้นอยู่กับปริมาณการซื้อขาย, ขั้นต่ำ 2,200 เยน, มีภาษี 10% ใช้ |

| พันธบัตรแปลงสภาพ: 0.1-1% + อัตราคงที่ขึ้นอยู่กับปริมาณการซื้อขาย, ขั้นต่ำ 2,200 เยน, สูงสุด 275,000 เยน, มีภาษี 10% ใช้ | |

| หุ้นต่างประเทศ: 0.2-1.25% + อัตราคงที่ขึ้นอยู่กับปริมาณการซื้อขาย, สูงสุด 1,100,000 เยน, มีภาษี 10% ใช้ | |

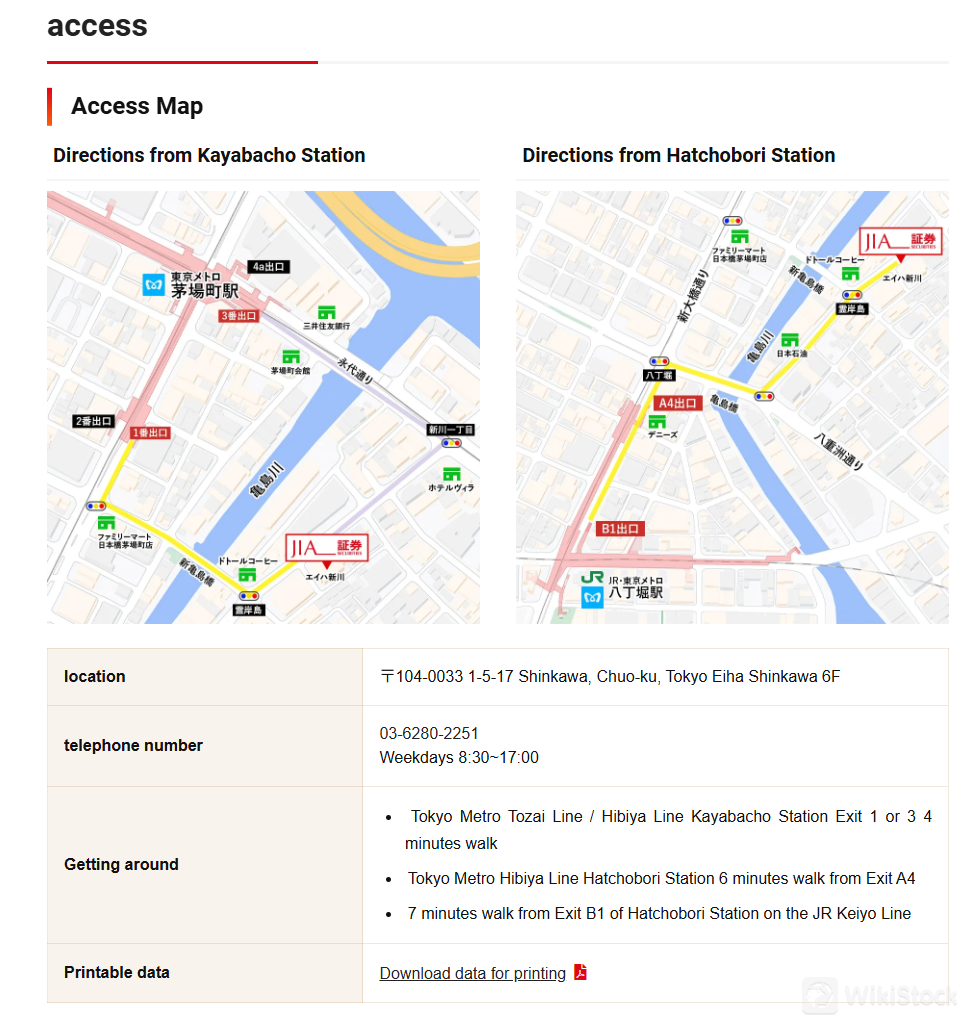

| บริการลูกค้า | ที่อยู่: 〒104-0033 1-5-17 Shinkawa, Chuo-ku, Tokyo Eiha Shinkawa 6F |

| โทรศัพท์: 03-6280-2251, วันทำการ 8:30~17:00 |

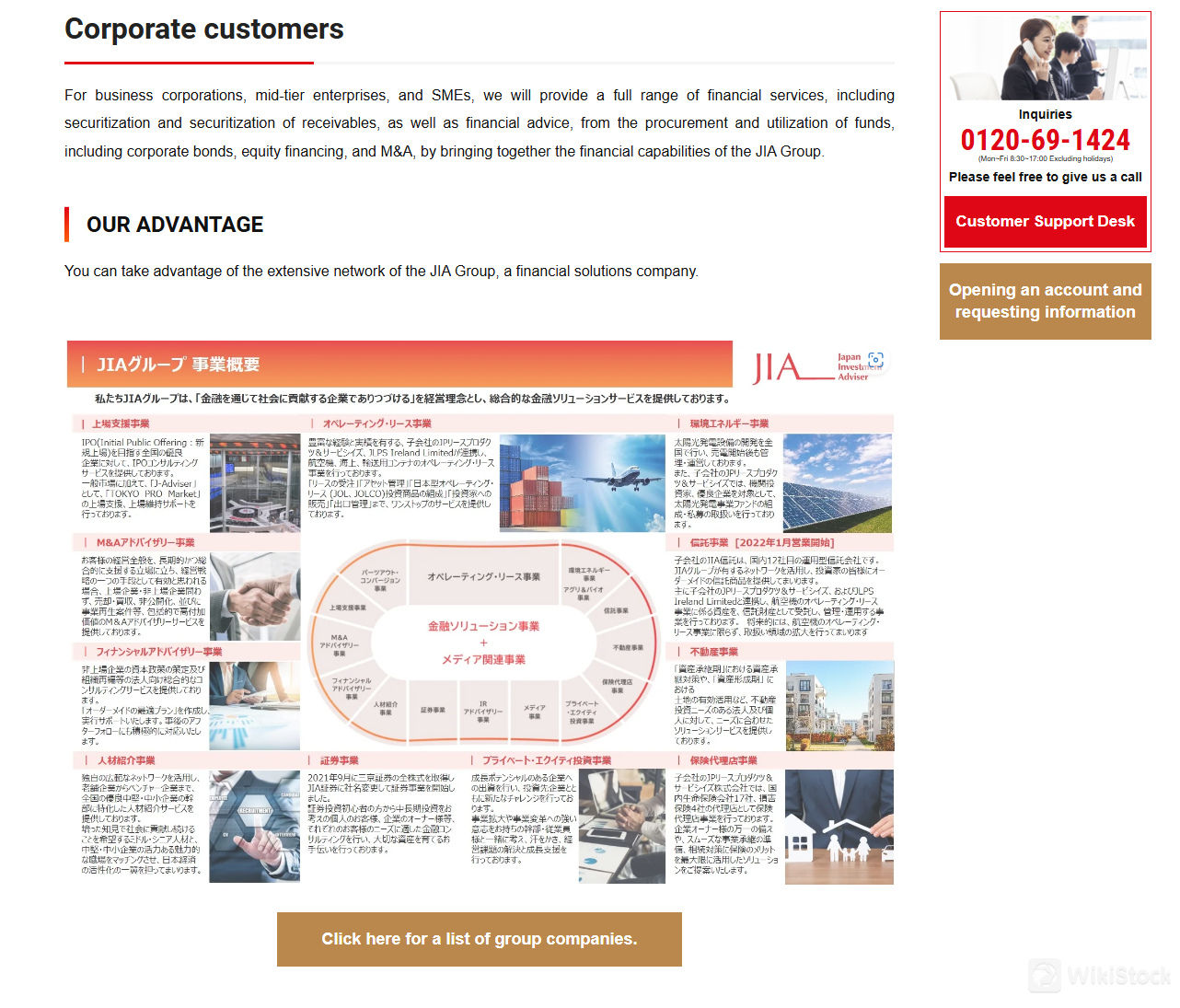

ข้อมูล JIA Securities

ก่อตั้งขึ้นในปี 1944 โดยมีต้นกำเนิดตั้งแต่ปี 1937 ภายใต้ชื่อ Obata Securities และเปลี่ยนชื่อเป็นชื่อปัจจุบันในปี 2021

โดยมีที่ตั้งที่โตเกียว เป็นสถาบันการเงินที่มีชื่อเสียงให้บริการผลิตภัณฑ์และบริการหลากหลายรูปแบบ เช่น พันธบัตร, หุ้น, กองทุนการลงทุน, อินเด็กซ์ฟิวเจอร์และตัวเลือก, ผลิตภัณฑ์การเช่าทำธุรกิจญี่ปุ่น (JOLP), กองทุน JIA, กองทุนบริษัทที่ไม่ได้รับการจดทะเบียน, และผลิตภัณฑ์โทเค็นสินทรัพย์อสังหาริมทรัพย์

สำหรับลูกค้าธุรกิจ JIA Securities ให้บริการเช่น การจัดการหลักทรัพย์และการรับรอง, การให้คำปรึกษาทางการเงิน, การให้คำปรึกษาด้านการซื้อขายและการควบคุมกิจการ

โด่งดังด้วยโครงสร้างค่าธรรมเนียมโปร่งใส JIA Securities ใช้ระบบ NISA (บัญชีออมทรัพย์ส่วนบุคคลนิปปอน) เพื่อให้โอกาสการลงทุนได้รับการยกเว้นภาษี

ได้รับการควบคุมโดยหน่วยงานบริการทางการเงินของญี่ปุ่น (FSA) ภายใต้หมายเลขใบอนุญาตผู้อำนวยการสำนักงานการเงินท้องถิ่นของจังหวัดกานโตะ (Kinsho) เลขที่ 2444, JIA Securities รักษามาตรฐานความซื่อสัตย์และความน่าเชื่อถือสูงในการให้บริการทางการเงิน

สำหรับข้อมูลที่ละเอียดเพิ่มเติมคุณสามารถเข้าชมเว็บไซต์อย่างเป็นทางการของพวกเขา: https://www.jia-sec.co.jp/ หรือติดต่อฝ่ายบริการลูกค้าของพวกเขาโดยตรง

ข้อดีและข้อเสีย

| ข้อดี | ข้อเสีย |

| ได้รับการควบคุมโดย FSA | ช่องทางบริการลูกค้าจำกัด |

| สินค้าทางการเงินหลากหลาย | |

| โครงสร้างค่าธรรมเนียมโป Transparen | |

| การลงทุนได้รับการยกเว้นภาษี | |

| ประสบการณ์ที่หลากหลาย |

- การควบคุมโดยหน่วยงานกำกับดูแลทางการเงินของญี่ปุ่น: JIA Securities ปฏิบัติตามมาตรฐานที่เข้มงวด

- สินค้าทางการเงินหลากหลาย: JIA Securities นำเสนอช่วงสินค้าทางการเงินที่ครอบคลุมทั้งหุ้นพันธบัตร เงินลงทุน ดัชนีอนาคตและตัวเลือก และผลิตภัณฑ์ Tokenization อสังหาริมทรัพย์จริง

- โครงสร้างค่าธรรมเนียมโปร่งใส: บริษัทให้ความชัดเจนเกี่ยวกับค่าใช้จ่ายที่เกี่ยวข้องกับการลงทุน เพื่อให้โป Transparen สำหรับลูกค้า

- การลงทุนได้รับการยกเว้นภาษี: โดยใช้ระบบ NISA JIA Securities นำเสนอโอกาสการลงทุนที่ได้รับการยกเว้นภาษี เพื่อให้ลูกค้าสามารถสูงสุดประสิทธิภาพของผลตอบแทนของพวกเขา

- ประสบการณ์ที่หลากหลาย: ก่อตั้งขึ้นในปี 1944 และเปลี่ยนแบรนด์ในปี 2021 JIA Securities ยอดเยี่ยมด้วยประสบการณ์หลายสิบปีในภูมิภาคการเงิน ให้บริการลูกค้าด้วยความเชี่ยวชาญที่มีประสบการณ์ ข้อเสีย:

- ช่องทางบริการลูกค้าจำกัด: บริการลูกค้าของ JIA Securities สามารถเข้าถึงได้โดยใช้โทรศัพท์และที่อยู่ทางกายภาพในวันทำการ โดยไม่มีการสนับสนุนผ่านอีเมล สนทนาสดหรือสื่อสังคมออนไลน์ จำกัดความเข้าถึงสำหรับบางลูกค้า

- หุ้น: JIA Securities ให้บริการการลงทุนในพันธบัตรระยะกลางถึงยาวนาน รวมถึงหุ้นต่างประเทศในสกุลเงินต่างๆ เช่น USD, EUR, และ MXN

- หุ้น: บริการหุ้นของพวกเขารวมถึงการซื้อขายหุ้นภายในประเทศด้วยตัวเลือกทั้งสองแบบ ให้คำแนะนำจากผู้เชี่ยวชาญเพื่อการซื้อขายที่แม่นยำ พวกเขายังมีการเข้าถึงหุ้นต่างประเทศรวมถึงหุ้นสหรัฐอเมริกาและหุ้นตลาดเกิดใหม่ที่มีศักยภาพ

- กองทุนการลงทุน: สำหรับผู้ที่ต้องการลงทุนด้วยเงินทุนน้อย JIA Securities ให้บริการกองทุนการลงทุนในหลากหลายรูปแบบ

- Index Futures and Options: นักลงทุนสามารถเข้าร่วมการซื้อขายตราสารอนุพันธ์ที่เน้นที่ Nikkei 225 ผ่านการเสนอขายตราสารอนุพันธ์ดัชนีของ JIA Securities ซึ่งช่วยให้สามารถซื้อขายโดยใช้กลยุทธ์ที่มุ่งเน้นการเคลื่อนไหวของดัชนีราคาหุ้นเฉลี่ย Nikkei

- ผลิตภัณฑ์การเช่าเครื่องบินในญี่ปุ่น: JIA Securities ให้โอกาสในการลงทุนในการเช่าเครื่องบินในญี่ปุ่นโดยเฉพาะในธุรกิจการเช่าเครื่องบิน ผลิตภัณฑ์นี้เหมาะสำหรับบริษัทญี่ปุ่นที่ต้องการตัวเลือกการลงทุนที่ประหยัดภาษี

- กองทุน JIA: กองทุน JIA เน้นการลงทุนที่มีผลตอบแทนสูงและคืนที่เร็วผ่านหุ้นที่เลือกอย่างรอบคอบ โดยใช้เครือข่ายและความรู้สึกของ JIA Group

- กองทุนบริษัทที่ไม่ได้รับการจดทะเบียน: กองทุนเหล่านี้ให้โอกาสในการลงทุนในบริษัทต่างประเทศที่ไม่ได้รับการจดทะเบียน โดยให้ความสำคัญกับการเติบโตที่มีศักยภาพสูง

- ผลิตภัณฑ์การทำ Token อสังหาริมทรัพย์: โดยใช้ความสามารถในการจัดการและความไว้วางใจในการบริหารจัดการอสังหาริมทรัพย์ของ JIA Group JIA Securities ให้ผลิตภัณฑ์ที่พิจารณาจากสิทธิผู้รับผลประโยชน์จากการเชื่อมโยงทรัพย์สินอสังหาริมทรัพย์ ทำให้นักลงทุนสามารถมีส่วนร่วมในตลาดอสังหาริมทรัพย์ด้วยทรัพย์สินที่ถูกทำเป็นโทเค็น

- การจัดทำหลักทรัพย์และการรับรองหนี้: ช่วยธุรกิจในการจัดทำหลักทรัพย์และการรับรองหนี้เพื่อเพิ่มความสามารถในการเงิน

- การให้คำปรึกษาทางการเงิน: ให้คำปรึกษาที่กำหนดเองเกี่ยวกับการป้องกันทรัพย์สินและการปรับปรุงส่วนสำรองภายใน เช่น การวางแผนการสืบทอดธุรกิจ ช่วยในกลยุทธ์สำหรับการส่งมอบการบริหารที่ราบรื่น การวางแผนการสืบทอดทรัพย์สิน และความต่อเนื่องของธุรกิจระยะยาว

- การให้คำปรึกษา M&A: การสนับสนุนอย่างเป็นรูปธรรมในการรวมกิจการ การเข้าซื้อและพันธมิตรกลยุทธ์ โดยให้ความสำคัญกับการสร้างสัมพันธภาพสูงสุดและการจัดการความเสี่ยง

- การให้คำปรึกษาด้านการเงินส่วนตัว: การปรึกษาเกี่ยวกับกลยุทธ์การจัดการทรัพย์สินที่มีประสิทธิภาพตามเป้าหมายธุรกิจ

- JIA Securities ได้รับการควบคุมโดยหน่วยงานทางการเงินใดบ้าง?

- ใช่ JIA Securities ดำเนินการภายใต้การกำกับดูแลของหน่วยงานบริการทางการเงินของญี่ปุ่น (FSA) ด้วยหมายเลขใบอนุญาตผู้อำนวยการสำนักงานการเงินท้องถิ่นของกันโต (Kinsho) หมายเลข 2444

- JIA Securities ให้บริการผลิตภัณฑ์ประเภทใด?

- พันธบัตร หุ้น กองทุนการลงทุน ฟิวเจอร์และออฟชั่นดัชนี และผลิตภัณฑ์ Real Estate Tokenization ที่น่าสนใจ

- JIA Securities เหมาะสำหรับผู้เริ่มต้นหรือไม่?

- ใช่ บริษัทได้รับการควบคุมโดย FSA และมีโครงสร้างค่าธรรมเนียมโปร่งใสและทรัพยากรการศึกษาสำหรับนักลงทุนซึ่งเป็นมิตรกับผู้เริ่มต้นในการเริ่มต้นการเงินของพวกเขา

- JIA Securities มีตัวเลือกการลงทุนที่ได้รับการยกเว้นภาษีหรือไม่?

- ใช่ JIA Securities ใช้ระบบ NISA (Nippon Individual Savings Account) เพื่อให้โอกาสการลงทุนที่ได้รับการยกเว้นภาษีสำหรับนักเทรด

- ข้อดีหลักของการเลือก JIA Securities คืออะไร?

- ลูกค้าได้รับประโยชน์จากโครงสร้างค่าธรรมเนียมที่โปร่งใสของ JIA Securities และความเชี่ยวชาญทางการเงินที่กว้างขวางที่สะสมมาตั้งแต่ก่อตั้งในปี 1944

ความปลอดภัย

การควบคุม:

JIA Securities ดำเนินการภายใต้การควบคุมของหน่วยงานกำกับดูแลทางการเงินของญี่ปุ่น (FSA) หมายเลขใบอนุญาต ผู้อำนวยการสำนักงานการเงินท้องถิ่นของกันโต (Kinsho) หมายเลข 2444 เป็นการแสดงถึงความมุ่งมั่นในการรักษามาตรฐานสูงสุดในการดำเนินงานทางการเงิน การปฏิบัติตามกฎระเบียบนี้ยืนยันความมุ่งมั่นของ JIA Securities ในความซื่อสัตย์และความน่าเชื่อถือในการให้บริการของพวกเขา

มาตรการความปลอดภัย:

JIA Securities นำมาใช้มาตรการรักษาความปลอดภัยที่แข็งแกร่งเพื่อปกป้องข้อมูลลูกค้า โดยปฏิบัติตามนโยบายความเป็นส่วนตัวที่เข้มงวด มาตรการเหล่านี้รวมถึงการส่งข้อมูลที่เข้ารหัส โปรโตคอลเซิร์ฟเวอร์ที่ปลอดภัย และการเข้าถึงข้อมูลที่เป็นสาระสำคัญ

หลักทรัพย์ที่ใช้ในการซื้อขายกับ JIA Securities ?

JIA Securities ให้บริการผลิตภัณฑ์ทางการเงินและบริการที่หลากหลาย

สำหรับบริษัทธุรกิจ กลาง และ SMEs JIA Securities ยังมีการให้บริการทางการเงินที่หลากหลาย รวมถึง:

การทบทวนค่าธรรมเนียม

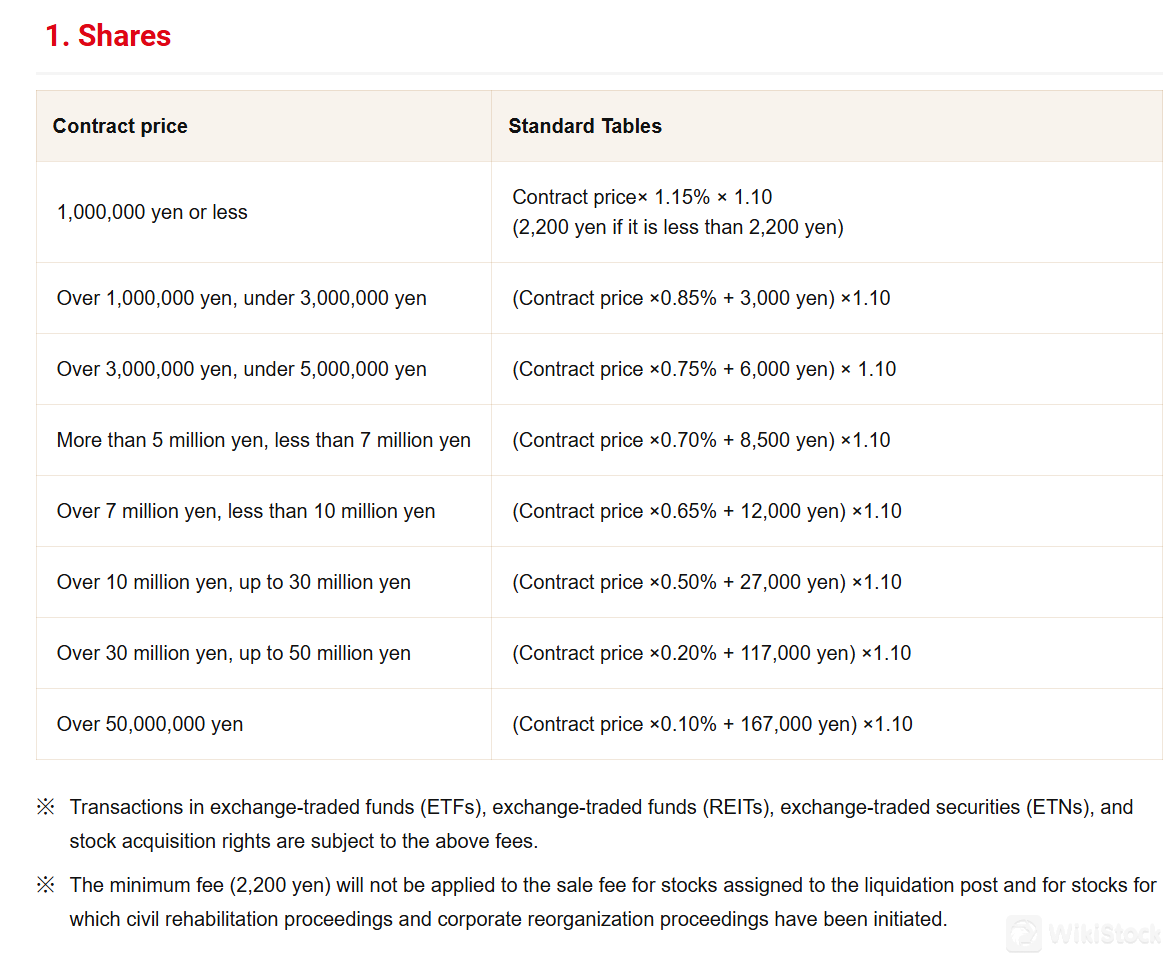

JIA Securities ให้โครงสร้างค่าธรรมเนียมอย่างละเอียดสำหรับการทำธุรกรรมทางการเงินต่างๆ

สำหรับหุ้น ค่าธรรมเนียมครอบคลุมตั้งแต่ 1.15% ของมูลค่าธุรกรรมสำหรับจำนวนเงินไม่เกิน 1 ล้านเยน พร้อมค่าธรรมเนียมขั้นต่ำ 2,200 เยน ถึง 0.10% บวก 167,000 เยนสำหรับจำนวนเงินเกิน 50 ล้านเยน มีการเรียกเก็บภาษี 10% จากค่าธรรมเนียมเหล่านี้

พันธบัตรแปลงสภาพ มีโครงสร้างค่าธรรมเนียมที่คล้ายกัน เริ่มต้นที่ 1.00% สำหรับธุรกรรมไม่เกิน 1 ล้านเยน พร้อมค่าธรรมเนียมขั้นต่ำ 2,200 เยน ถึง 0.10% บวก 165,000 เยนสำหรับจำนวนเงินเกิน 50 ล้านเยน มีการเรียกเก็บภาษี 10% จากค่าธรรมเนียมเหล่านี้

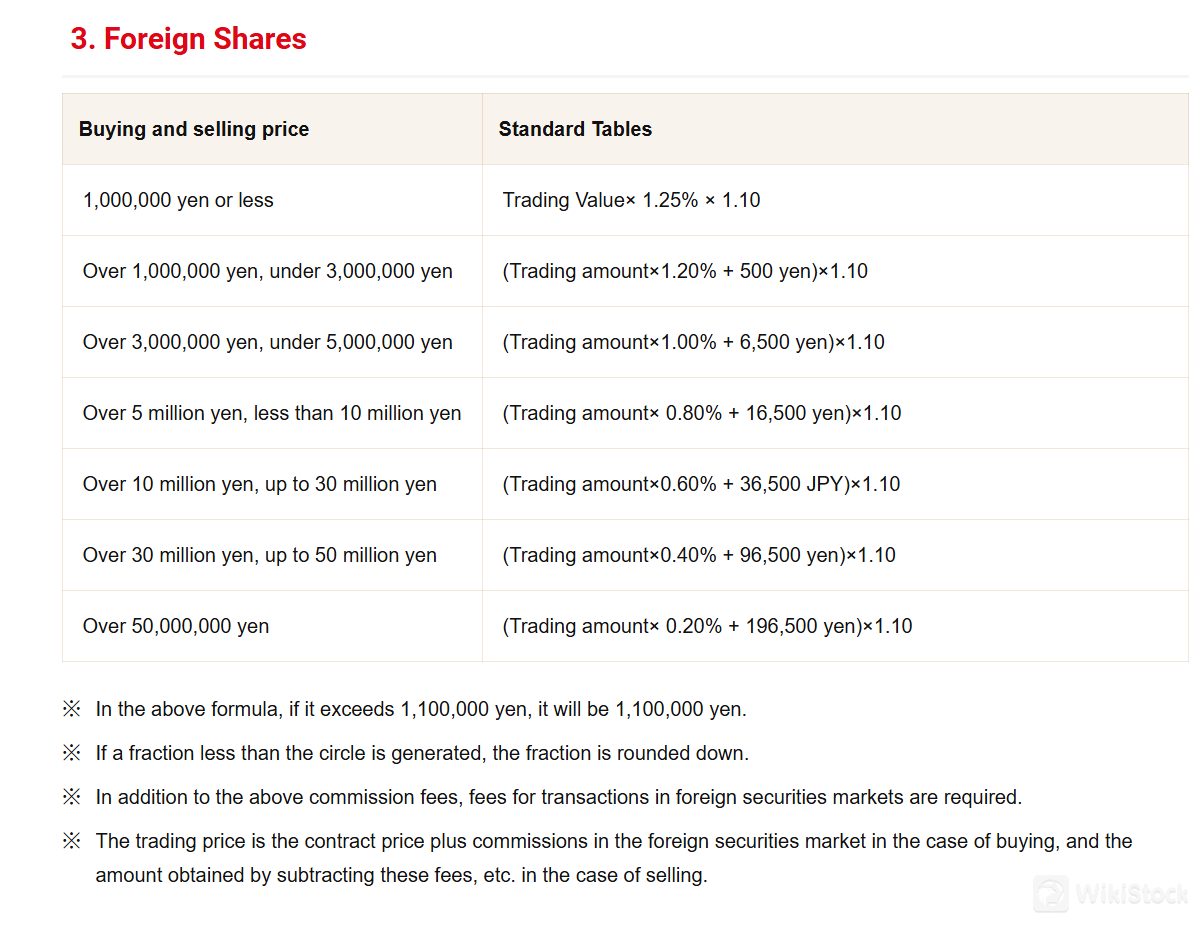

ธุรกรรมหุ้นต่างประเทศ มีค่าธรรมเนียมในอัตรา 1.25% สำหรับจำนวนเงินไม่เกิน 1 ล้านเยน ลดลงเป็น 0.20% บวก 196,500 เยนสำหรับธุรกรรมเกิน 50 ล้านเยน ภาษี 10% จะถูกนำไปใช้กับค่าธรรมเนียมเหล่านี้

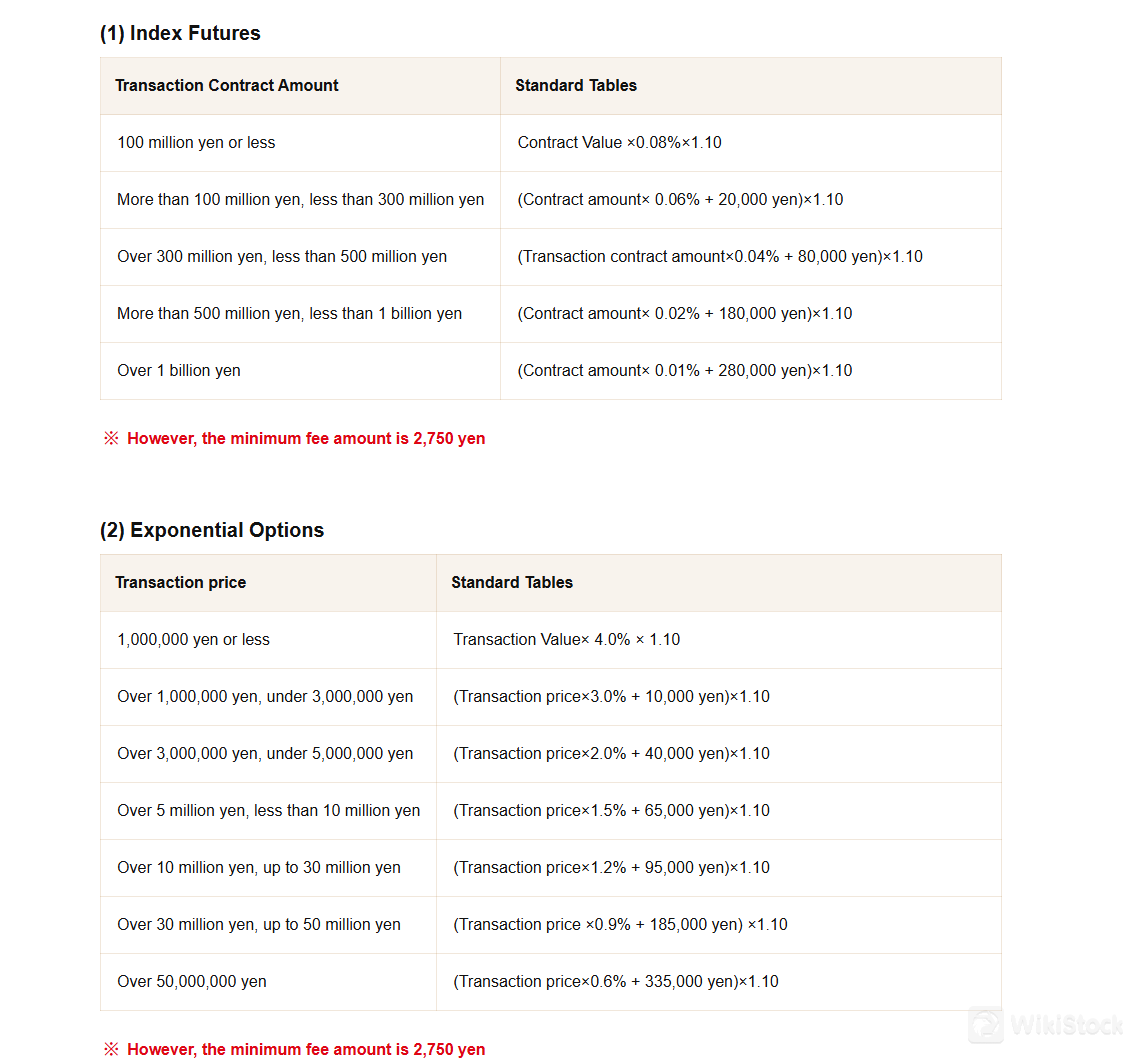

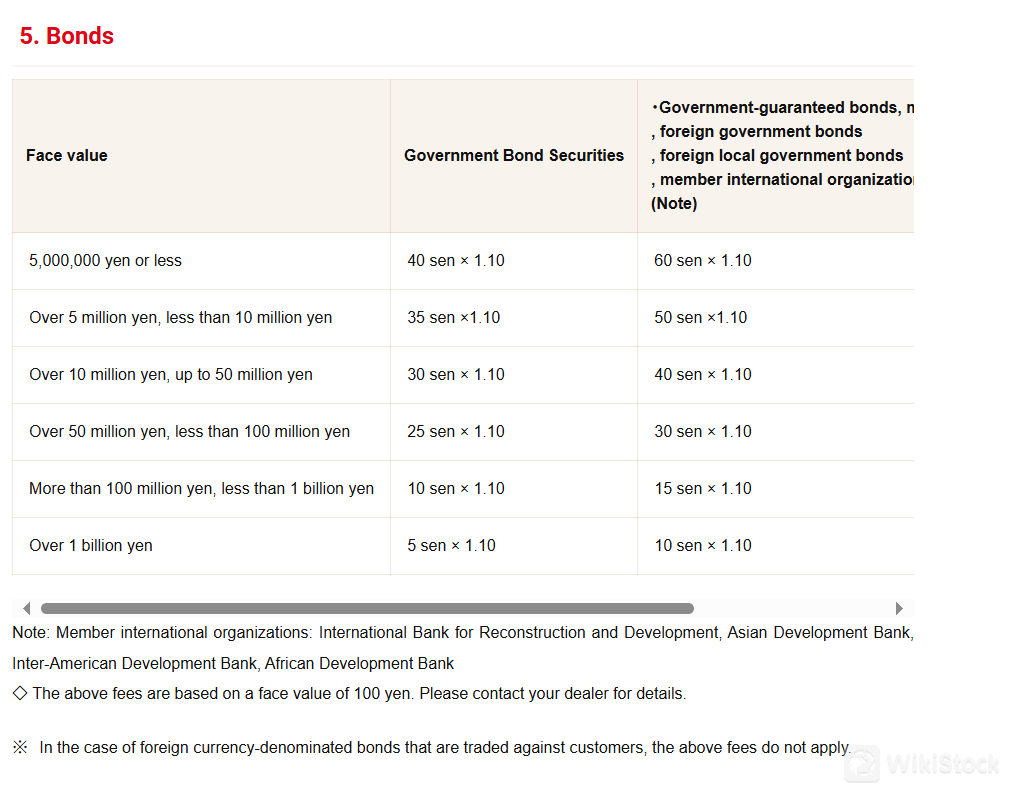

Index futures and options รวมถึง พันธบัตร ยังมีโครงสร้างค่าธรรมเนียมแบบชั้นเรียงของตนเอง พร้อมกับ ค่าธรรมเนียมขั้นต่ำที่ ¥2,750 สำหรับ Index futures ¥2,750 สำหรับ Index options และ ¥0.05 × 1.10 สำหรับพันธบัตรของรัฐบาล

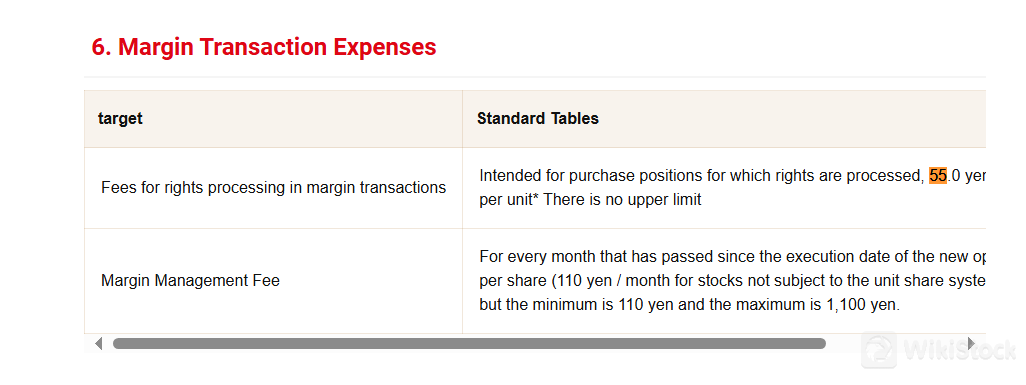

นอกจากนี้ยังมีค่าธรรมเนียมสำหรับ ธุรกรรมเครดิต เช่น ค่าธรรมการประมวลผลสิทธิ์ที่ ¥55 ต่อหน่วย และ ค่าธรรมบำรุงรายเดือนที่ ¥11 ต่อหุ้นต่อเดือน (ค่าธรรมเนียมขั้นต่ำ ¥110, ค่าธรรมเนียมสูงสุด ¥1,100)

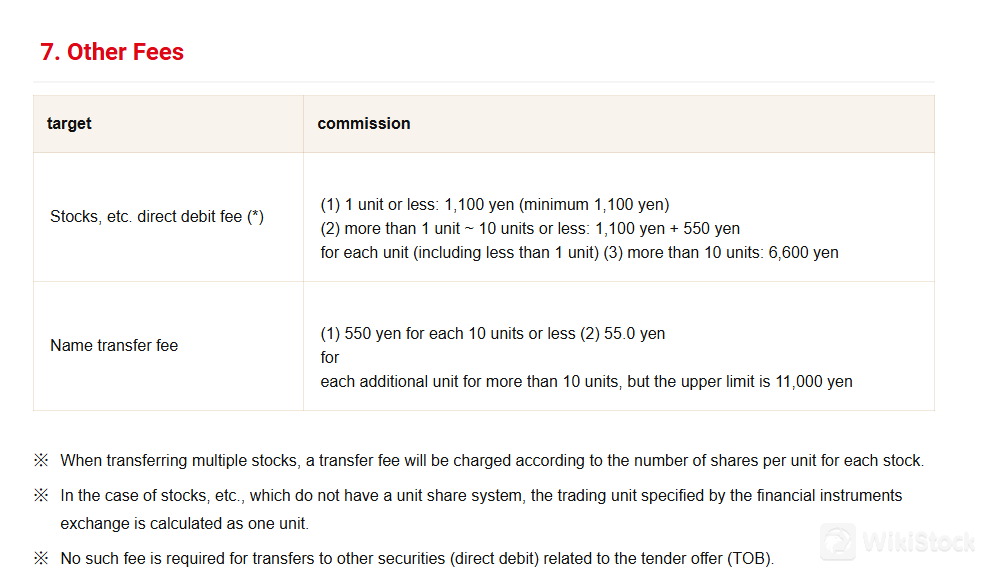

บริการอื่น ๆ รวมถึง ค่าธรรมเนียมการโอนบัญชีตั้งแต่ ¥1,100 ต่อปัญหา และ ค่าธรรมเนียมการโอนชื่อตั้งแต่ ¥550 ต่อชื่อ

รายละเอียดเหล่านี้จะให้ความโปร่งใสแก่ลูกค้า อย่างไรก็ตาม สำหรับข้อมูลที่ทันสมัยและละเอียดเกี่ยวกับผลิตภัณฑ์ทั้งหมดของบริษัท ลูกค้าสามารถเข้าชมเว็บไซต์ของ JIA Securities ที่ https://www.jia-sec.co.jp/service/commission/ ได้

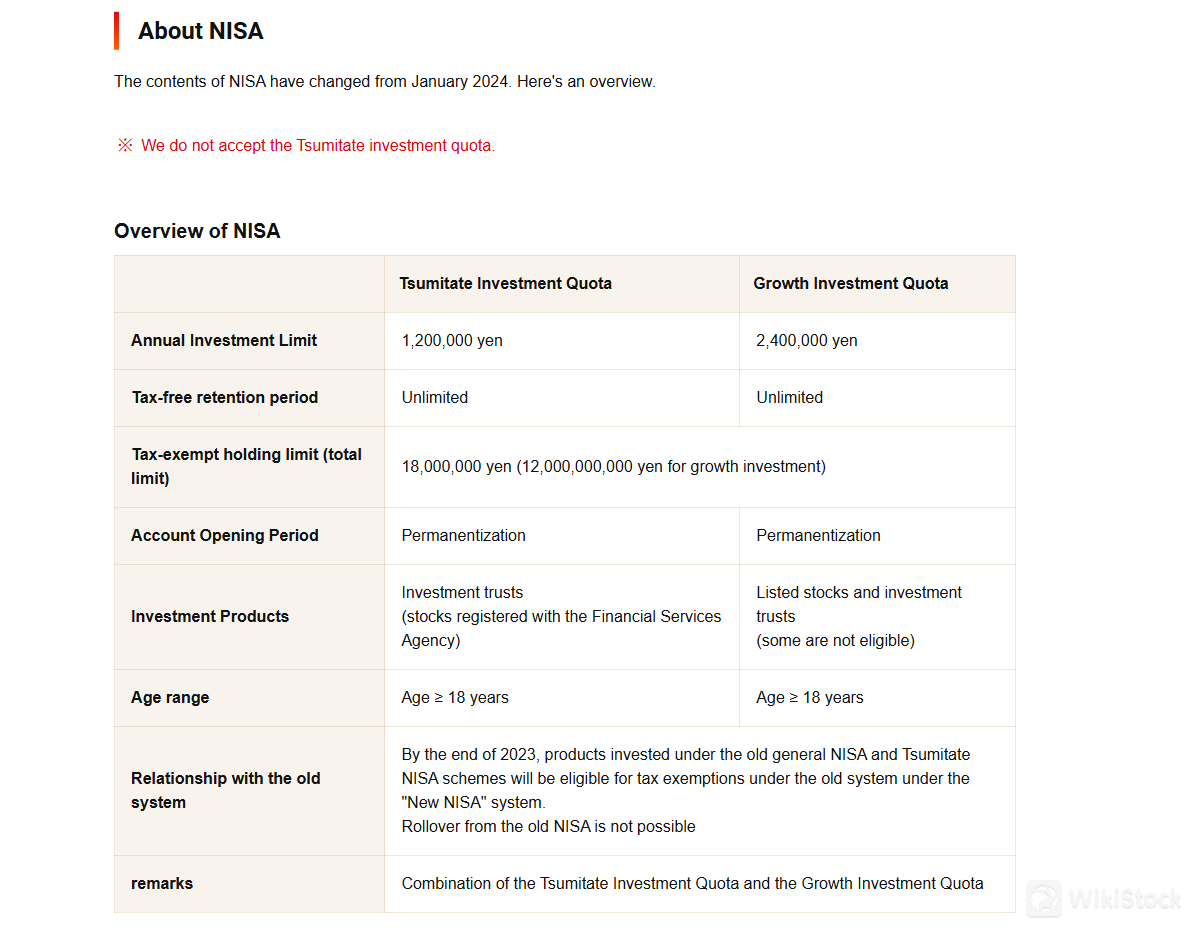

ระบบ NISA

ระบบ NISA ที่ JIA Securities นำเสนอช่วยให้นักลงทุนได้รับประโยชน์จากการยกเว้นภาษีกำไรที่ได้จากการลงทุนในผลิตภัณฑ์ทางการเงิน เช่น หุ้น และกองทุนรวม โดยปกติแล้วกำไรเช่นนี้ถูกเสียภาษีประมาณ 20% แต่การลงทุนที่ถืออยู่ในบัญชี NISA จะได้รับการยกเว้นภาษีนี้ ซึ่งเป็นประโยชน์ที่สำคัญสำหรับนักลงทุน

ตั้งแต่มกราคม พ.ศ. 2567 ระบบ NISA ได้รับการอัปเดตเพื่อรวมทั้ง Tsumitate Investment Quota (ไม่มีใน JIA Securities) และ Growth Investment Quota โดยมีวงเงินลงทุนประจำปีที่ ¥1,200,000 และ ¥2,400,000 ตามลำดับ การลงทุนเหล่านี้สามารถถือได้โดยไม่ต้องเสียภาษีตลอดอายุการถือครอง นอกจากนี้ ระบบยังได้นำเข้า วงเงินการถือครองที่ได้รับการยกเว้นภาษีตลอดชีพที่ ¥18,000,000 โดยมี ¥12,000,000 สามารถจัดสรรให้กับ Growth Investment Quota

JIA Securities ให้โครงสร้างค่าธรรมเนียมสำหรับการลงทุนใน NISA ที่เป็นรายละเอียดและโปร่งใส กำไรและขาดทุนภายในบัญชี NISA ไม่สามารถรวมกับบัญชีอื่น ๆ ได้ และมีข้อจำกัดบางประการ เช่น ไม่สามารถโอนผลิตภัณฑ์ทางการเงินจากบัญชีที่ไม่ใช่ NISA ไปยังบัญชี NISA ได้ นักลงทุนสามารถเปลี่ยนสถาบันการเงินของตนทุกปี หากทำการกระทำที่จำเป็นภายในสิ้นเดือนกันยายน

การวิจัยและการศึกษา

JIA Securities มีการมุ่งมั่นในการเข้าร่วมกับลูกค้าผ่านทาง สัมมนาและแคมเปญ เพื่อเสริมสร้างการรู้ความรู้ทางการเงินและส่งเสริมการให้บริการของพวกเขา โครงการการศึกษาเหล่านี้จะให้ข้อมูลมีคุณค่าเกี่ยวกับกลยุทธ์การลงทุน เทรนด์ตลาด และประโยชน์ของการใช้ผลิตภัณฑ์ทางการเงินที่ JIA Securities นำเสนอ

โดยการเข้าร่วมสัมมนาเหล่านี้ ลูกค้าจะได้รับความรู้ที่เป็นประโยชน์ที่ช่วยให้พวกเขาตัดสินใจลงทุนที่มีความรับผิดชอบต่อเป้าหมายทางการเงินของตน

บริการลูกค้า

ตั้งอยู่ที่ 〒104-0033 1-5-17 Shinkawa, Chuo-ku, Tokyo Eiha Shinkawa 6F JIA Securities ให้บริการลูกค้าโดยส่วนใหญ่ผ่านทางการติดต่อโดยตรงทางโทรศัพท์ที่ 03-6280-2251 ในวันทำการตั้งแต่เวลา 8:30 น. ถึง 17:00 น.

วิธีการจำกัดนี้ไม่รวมถึงช่องทางการสื่อสารที่ทันสมัยเช่นอีเมล แชทสด หรือสื่อสังคมออนไลน์ ซึ่งจะเป็นอุปสรรคในการเข้าถึงและความสะดวกสบายสำหรับลูกค้าที่ต้องการความช่วยเหลือ ข้อจำกัดเช่นนี้อาจเป็นอุปสรรคในการตอบสนองทันเวลาและการสนับสนุนอย่างครอบคลุมในยุคดิจิตอลปัจจุบัน

สรุป

ก่อตั้งขึ้นในปี 1944 และเปลี่ยนแบรนด์ใหม่ในปี 2021 JIA Securities เป็นสถาบันการเงินที่ตั้งอยู่ในโตเกียว มีการให้บริการผลิตภัณฑ์หลากหลายรวมถึงพันธบัตร หุ้น และผลิตภัณฑ์ Real Estate Tokenization ที่น่าสนใจ นอกจากนี้ยังมีการให้บริการการจัดการทรัพย์สินสำหรับลูกค้าธุรกิจด้วย

ได้รับการควบคุมโดยหน่วยงานบริการทางการเงินของญี่ปุ่น (FSA) ภายใต้หมายเลขใบอนุญาตผู้อำนวยการสำนักงานการเงินท้องถิ่นของกันโต (Kinsho) หมายเลข 2444 และปฏิบัติตามมาตรฐานการควบคุมที่เข้มงวด ลูกค้าที่สนใจที่กำลังมองหาพันธมิตรทางการเงินที่ได้รับการควบคุมและมีประสบการณ์สามารถพิจารณา JIA Securities เป็นตัวเลือกที่น่าเชื่อถือในตลาด

คำถามที่พบบ่อย (FAQs)

คำเตือนเกี่ยวกับความเสี่ยง

การซื้อขายออนไลน์เกี่ยวข้องกับความเสี่ยงที่สำคัญและคุณอาจสูญเสียทุกส่วนลงทุนของคุณ มันไม่เหมาะสำหรับนักเทรดหรือนักลงทุนทั้งหมด โปรดตรวจสอบให้แน่ใจว่าคุณเข้าใจความเสี่ยงที่เกี่ยวข้องและโปรดทราบว่าข้อมูลที่ให้ไว้ในบทวิจารณ์นี้อาจมีการเปลี่ยนแปลงเนื่องจากการอัปเดตบริการและนโยบายของบริษัทอย่างต่อเนื่อง

อื่น ๆ

Registered region

ประเทศญี่ปุ่น

ปีในธุรกิจ

2-5 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

三菱UFJモルガン・スタンレー証券

คะแนน

Nissan Securities

คะแนน

水戸証券

คะแนน

東洋証券株式会社

คะแนน

豊証券株式会社

คะแนน

Kyokuto Securities

คะแนน

ちばぎん証券

คะแนน

あかつき証券

คะแนน

Money Partners

คะแนน

岩井コスモ証券

คะแนน