คะแนน

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

C

ดัชนีอิทธิพล NO.1

สหรัฐอเมริกา

สหรัฐอเมริกาความหลากหลาย

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

เหนือกว่า 22.19% โบรกเกอร์

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 2

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตจัดการกองทุน

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

ฮ่องกงจีน HKEX

Seat No. 02180

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Plutus Securities Limited

ชื่อย่อบริษัท

Plutus

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

http://www.plutusfingroup.com/en/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

คุณสมบัติของโบรกเกอร์

Funding Rate

3%

New Stock Trading

Yes

Margin Trading

YES

ประเทศที่ได้รับการควบคุม

1

| Plutus |  |

| คะแนน WikiStock | ⭐⭐⭐⭐ |

| ยอดเงินฝากขั้นต่ำ | ไม่ได้ระบุ |

| ค่าธรรมเนียม | ค่าธรรมเนียมแต่ละประเภทของธุรกรรม ตั้งแต่ฟรีสำหรับบัญชีบางประเภท ถึงค่าธรรมเนียมที่แปรผันตามประเภทของธุรกรรม |

| ค่าธรรมเนียมบัญชี | ฟรีสำหรับบัญชีใหม่ |

| ดอกเบี้ยเงินสดที่ไม่ได้ลงทุน | ไม่ได้ระบุ |

| อัตราดอกเบี้ยเงินยืม | ค่าธรรมเนียมแต่ละประเภทของธุรกรรม ตั้งแต่ฟรีสำหรับบัญชีบางประเภท ถึงค่าธรรมเนียมที่แปรผันตามประเภทของธุรกรรม |

| เสนอกองทุนรวม | ใช่ |

| แอป/แพลตฟอร์ม | มีให้บริการบน iOS, Android, และเว็บ |

| โปรโมชั่น | ใช่ |

Plutus คืออะไร?

Plutus มีแพลตฟอร์มการลงทุนที่หลากหลายและไม่มีขั้นต่ำของยอดเงินฝากที่ระบุ ทำให้สามารถเข้าถึงได้สำหรับนักลงทุนหลากหลายประเภท โครงสร้างค่าธรรมเนียมแตกต่างกันตามประเภทของธุรกรรม บางบัญชีสามารถเพลิดเพลินไปกับบริการฟรีได้ บัญชีใหม่ได้รับประโยชน์จากไม่มีค่าธรรมเนียมบัญชี ในขณะที่อัตราดอกเบี้ยเงินยืมยังเป็นตัวแปร ที่ปรับให้เหมาะกับประเภทบัญชีต่าง ๆ แม้ว่าดอกเบี้ยเงินสดที่ไม่ได้ลงทุนจะไม่ได้ระบุ แต่ Plutus ให้บริการกองทุนรวมในหลากหลายรูปแบบสำหรับนักลงทุน แพลตฟอร์มพร้อมใช้งานบน iOS, Android, และเว็บ เพื่อให้ได้รับประสบการณ์การซื้อขายที่ราบรื่นและสะดวกสบายบนอุปกรณ์หลายรายการ

ข้อดีและข้อเสียของ Plutus

Plutus มีข้อดีหลายประการ รวมถึงการกำกับดูแลโดย SFC และการปฏิบัติตามกฎระเบียบทางการเงินอย่างเข้มงวด เพื่อให้ได้รับสภาพแวดล้อมการซื้อขายที่ปลอดภัย รองรับสินทรัพย์หลากหลายและสามารถเข้าถึงได้บนแพลตฟอร์มหลายรายการ รวมถึง iOS, Android, Mac, Windows, และเว็บ อย่างไรก็ตาม โครงสร้างค่าธรรมเนียมของ Plutus ซับซ้อน และรายละเอียดเกี่ยวกับดอกเบี้ยเงินสดที่ไม่ได้ลงทุนและการให้บริการวิจัยและการศึกษาไม่ได้ระบุ ซึ่งอาจเป็นอุปสรรคสำหรับบางนักลงทุน

| ข้อดี | ข้อเสีย |

|

|

|

|

|

|

Plutus ปลอดภัยหรือไม่?

กฎระเบียบ

Plutus Securities Limited ได้รับใบอนุญาตจาก สำนักงานกลางสิทธิพิเศษและอนุพันธ์ (SFC) ของฮ่องกง เพื่อดำเนินกิจกรรมที่ได้รับการควบคุมประเภท 1 (การซื้อขายหลักทรัพย์) ซึ่งหมายความว่า บริษัทอยู่ภายใต้ข้อกำหนดของ SFC ซึ่งรวมถึงการปกป้องสินทรัพย์ของลูกค้า

บัญชีลูกค้าที่แยกกัน: เงินลูกค้าถูกเก็บไว้ในบัญชีที่แยกจากเงินของบริษัทเอง ซึ่งช่วยให้เกิดการปกป้องเงินลูกค้าได้ แม้ว่าบริษัทจะเผชิญกับความยากลำบากทางการเงิน

การเข้าร่วมโครงการชดเชยนักลงทุน (ICS): Plutus Securities Limited เป็นสมาชิกของ ICS ซึ่งให้ความคุ้มครองสูงสุดถึง 1,000,000 ดอลลาร์ฮ่องกงต่อนักลงทุนในกรณีที่บริษัทเข้าสู่สภาวะล้มละลาย

การควบคุมความเสี่ยงภายใน: Plutus Securities Limited มีการควบคุมความเสี่ยงภายในที่ครอบคลุมอย่างครบถ้วนเพื่อช่วยในการระบุ ประเมิน และบรรเทาความเสี่ยงต่อเงินลูกค้า

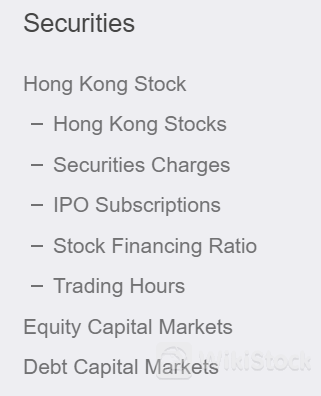

หลักทรัพย์ที่ใช้ในการซื้อขายกับ Plutus คืออะไร?

Plutus Securities มีแพลตฟอร์มที่แข็งแกร่งสำหรับการซื้อขายหลากหลายประเภทของหลักทรัพย์ รวมถึงหุ้นและหลักทรัพย์ในฮ่องกง นักลงทุนสามารถได้รับประโยชน์จากตัวเลือกการสมัคร IPO ที่ยืดหยุ่น โดยมีตัวเลือกการจัดหาเงินทุนและการจัดหาเงินทุนที่มีให้เลือกตามความต้องการของกลุ่มลงทุนต่าง ๆ โครงสร้างค่าธรรมเนียมที่แข่งขันรวมถึงอัตราค่าคอมมิชชั่นที่ต่อรองได้และการยกเว้นจำนวนมากสำหรับบริการที่เกี่ยวข้องกับการตั้งถิ่นฐาน นอกจากนี้ Plutus ยังให้บริการอย่างครอบคลุมในตลาดทุนและหนี้ทุน รองรับกิจกรรมทางการเงินหลากหลายด้าน ด้วยแนวทางชัดเจนเกี่ยวกับอัตราส่วนการจัดหาเงินทุนของหุ้นและเวลาการซื้อขายที่กำหนด Plutus รับรองให้ประสบการณ์การซื้อขายที่ราบรื่นและมีประสิทธิภาพสำหรับลูกค้าทุกคน

หุ้น: การลงทุนโดยตรงในบริษัทที่มีการจดทะเบียนในตลาดหลักทรัพย์ เหมาะสำหรับนักลงทุนที่ต้องการเพิ่มมูลค่าทุนและเงินปันผล

ตัวเลือก: ให้นักลงทุนที่มีประสบการณ์มากขึ้นมีตัวเลือกกลยุทธ์เพิ่มเติม ช่วยให้สามารถป้องกันความเสี่ยงหรือพิเศษโดยการซื้อสิทธิหรือหน้าที่

IPO: การลงทุนในการเสนอขายครั้งแรก เหมาะสำหรับนักลงทุนที่ต้องการเข้าร่วมในช่วงเริ่มต้นของการเติบโตของบริษัท

หลักทรัพย์: การลงทุนโดยตรงในหุ้นของบริษัท มีโอกาสในการเพิ่มมูลค่าทุนและเงินปันผล

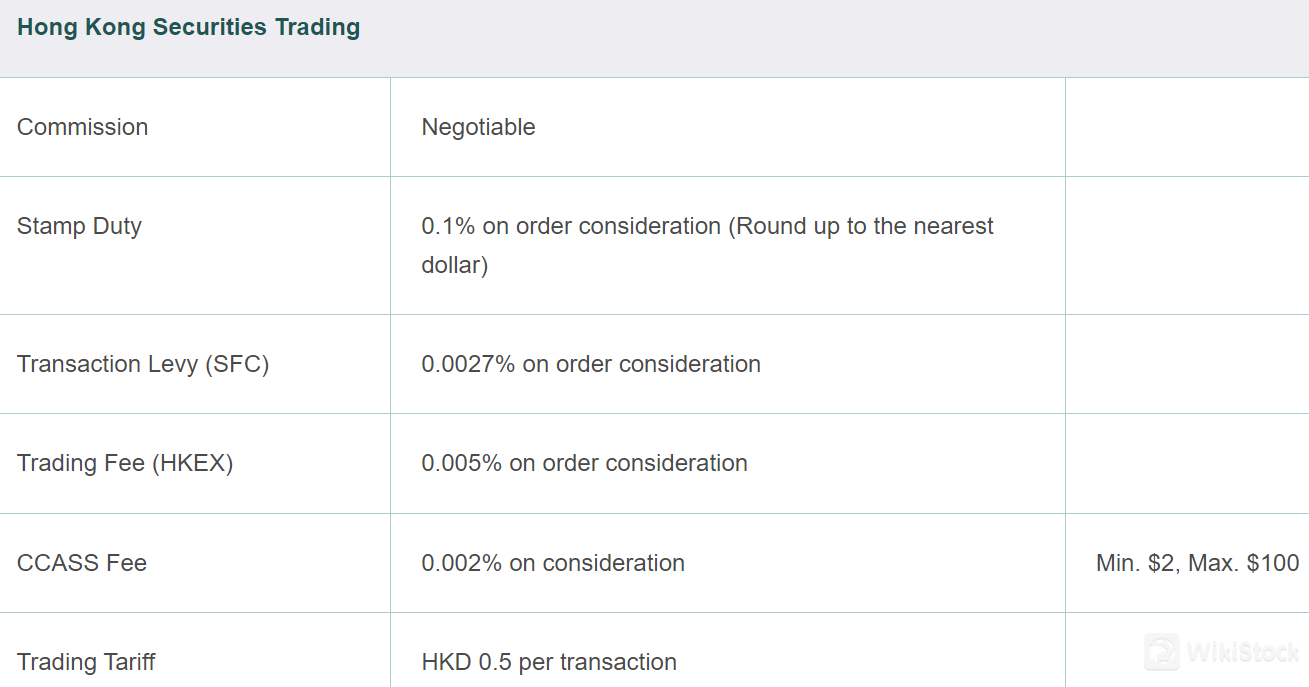

ค่าคอมมิชชั่น: ต่อรองได้

อากรแสตมป์: 0.1% ของมูลค่าคำสั่งซื้อ (ปัดขึ้นถึงเงินบาทใกล้ที่สุด)

ค่าภาษีการทำธุรกรรม (SFC): 0.0027% ของมูลค่าคำสั่งซื้อ

ค่าธรรมเนียมการซื้อขาย (HKEX): 0.005% ของมูลค่าคำสั่งซื้อ

ค่าธรรมเนียม CCASS: 0.002% ของมูลค่า (ขั้นต่ำ 2 ดอลลาร์, สูงสุด 100 ดอลลาร์)

ค่าธรรมเนียมการซื้อขาย: 0.5 ดอลลาร์ฮ่องกงต่อคำสั่งซื้อ

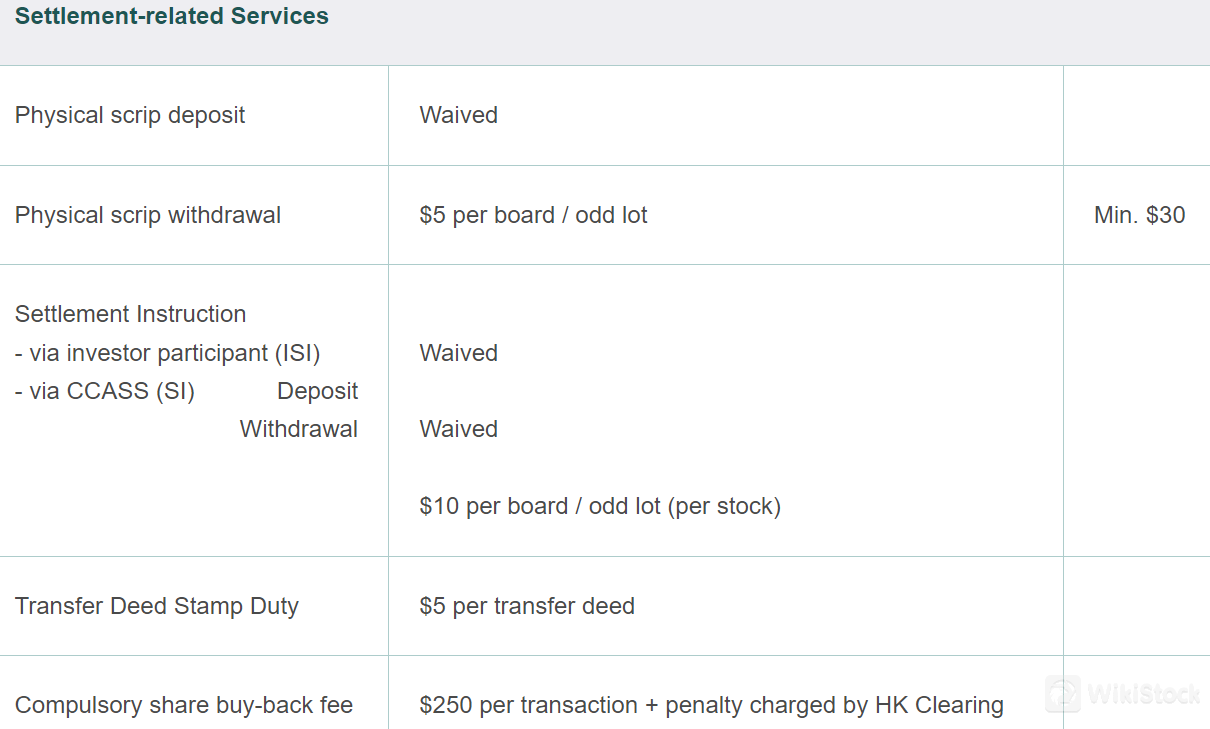

ผ่านผู้มีส่วนร่วมในการลงทุน (ISI) การฝาก/ถอน: ยกเว้น

ผ่าน CCASS (SI) การฝาก/ถอน: ยกเว้น

อื่นๆ: 10 ดอลลาร์ต่อหุ้น/หุ้นล็อต (ต่อหลักทรัพย์)

บัญชี Plutus

Plutus มีบริการเปิดบัญชีสำหรับทั้ง บัญชีบุคคล/บัญชีร่วม และ บัญชีบริษัท สำหรับบัญชีบุคคลหรือบัญชีร่วม ลูกค้าสามารถลงทะเบียนได้อย่างง่ายดาย โดยให้การเข้าถึงเครื่องมือและบริการทางการเงินส่วนตัวหรือร่วมกัน ส่วนบัญชีบริษัทถูกออกแบบเพื่อตอบสนองความต้องการของธุรกิจ ให้การสนับสนุนอย่างครอบคลุมสำหรับการซื้อขายและการลงทุนสถาบัน Plutus รับรองให้กระบวนการที่เรียบร้อยและปลอดภัยสำหรับทุกประเภทของบัญชี

บทสรุปค่าธรรมเนียมของ Plutus

Plutus ให้บริการการจัดหาเงินทุนในรูปแบบ เงินยืมหุ้น ที่มีความแข่งขันสูง โดยให้ค่ามัดจำหุ้นที่มีมูลค่าสูงให้กับลูกค้าพร้อมกับอัตราดอกเบี้ยที่ต่ำมาก การเลือกอัตราดอกเบี้ยที่ต่ำ นี้ช่วยเพิ่มความยืดหยุ่นในการกระจายเงินสด ทำให้ลูกค้าสามารถนำเงินไปลงทุนในโอกาสทางการลงทุนได้อย่างสะดวกสบายมากขึ้น อัตราดอกเบี้ยที่เป็นกำลังใจและค่าธรรมเนียมที่ต่ำน้อยนี้ยืนยันความมุ่งมั่นของ Plutus ในการสนับสนุนการเติบโตทางการเงินและกลยุทธ์การลงทุนของลูกค้าอย่างมีประสิทธิภาพ

การซื้อขายหลักทรัพย์ในฮ่องกง:

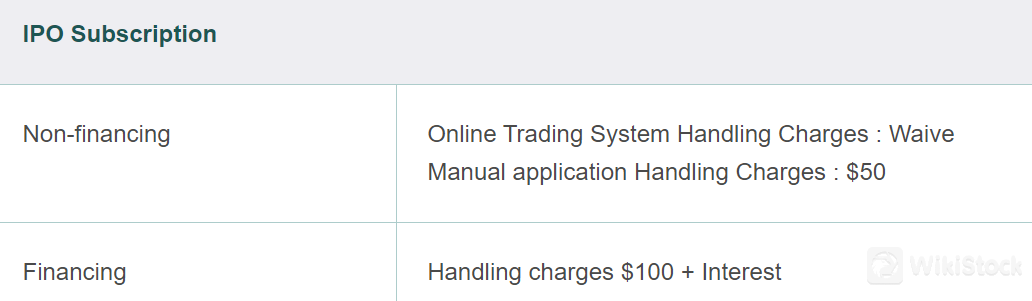

การสมัครซื้อหุ้นในการจัดหาเงินทุน:

ไม่มีการจัดหาเงินทุน: ค่าธรรมเนียมการใช้งานระบบซื้อขายออนไลน์: ยกเว้น, ค่าธรรมเนียมการยื่นขอแบบกำกับด้วยมือ: 50 ดอลลาร์

การจัดหาเงินทุน: ค่าธรรมเนียมการใช้งาน: 100 ดอลลาร์ + ดอกเบี้ย

บริการที่เกี่ยวข้องกับการตั้งบัญชี: การฝากหุ้นแบบกำหนด: ยกเว้น, การถอนหุ้นแบบกำหนด: 5 ดอลลาร์ต่อหุ้น/หุ้นล็อต (ขั้นต่ำ 30 ดอลลาร์)

คำแนะนำในการตั้งบัญชี:

อากรแสตมป์การโอนหุ้น: 5 ดอลลาร์ต่อเอกสารโอนหุ้น

ค่าซื้อคืนหุ้นบังคับ: 250 ดอลลาร์ต่อคำสั่งซื้อ + ค่าปรับที่เรียกเก็บโดย HK Clearing

บทวิจารณ์แอป Plutus

Plutus มีแพลตฟอร์มการซื้อขายหลักทรัพย์ที่มั่นคงและสามารถเข้าถึงได้ผ่านอินเทอร์เน็ตและแอปพลิเคชันมือถือ (iOS และ Android) และ เสาโทรศัพท์ลูกค้า โดยใช้ระบบ BSS ที่ได้รับอนุญาตจากตลาดหลักทรัพย์แห่งฮ่องกง Plutus รับรองในการทำธุรกรรมออนไลน์ที่รวดเร็วและเชื่อถือได้ ลูกค้าสามารถจัดการบัญชีของพวกเขาได้อย่างราบรื่นผ่านแอปพลิเคชันมือถือที่ใช้งานง่ายหรืออินเทอร์เฟซเว็บ นอกจากนี้ Plutus ยังให้บริการการส่งคำสั่งโดยตรงผ่านทีมบริการลูกค้ามืออาชีพ เพื่อให้การสนับสนุนอย่างครอบคลุมและความสะดวกสบายสำหรับกิจกรรมการซื้อขายทั้งหมด

การวิจัยและการศึกษา

Plutus ไม่ได้ระบุรายละเอียดเฉพาะเกี่ยวกับการวิจัยและการศึกษาในเว็บไซต์อย่างเป็นทางการ อย่างไรก็ตาม การเน้นที่ Plutus ให้กับการสนับสนุนลูกค้าอย่างครอบคลุมและแพลตฟอร์มการซื้อขายที่ทันสมัย แสดงให้เห็นถึงความมุ่งมั่นในการเตรียมความพร้อมให้กับลูกค้าด้วยเครื่องมือและทรัพยากรที่จำเป็นสำหรับการตัดสินใจการลงทุนที่มีความรู้ความเข้าใจ ลูกค้าสามารถคาดหวังระบบการสนับสนุนที่มีประสิทธิภาพสูงเพื่อช่วยเหลือในการซื้อขายและการลงทุนของพวกเขา

บริการลูกค้า

Plutus ให้บริการสนับสนุนลูกค้าที่มีการประสานงานผ่านช่องทางหลายรูปแบบ เพื่อให้ลูกค้าสามารถติดต่อสอบถามได้ตลอดเวลาที่ต้องการ ลูกค้าสามารถติดต่อผ่านทางอีเมลที่info@plutusfingroup.comหรือโทรติดต่อสายด่วนที่ (852) 2968 1192 และ (852) 2968 5560 ระบบการสนับสนุนหลายมิตินี้ยืนยันความมุ่งมั่นของ Plutus ในการให้ความช่วยเหลือทันเวลาและมืออาชีพแก่ลูกค้า

สรุป

ในสรุป Plutus โดดเด่นด้วยการกำกับดูแลโดย SFC และช่วงสินทรัพย์ที่ครอบคลุมอย่างครบถ้วน เพื่อให้ได้รับประสบการณ์การซื้อขายที่ปลอดภัยและหลากหลาย ความเข้าถึงของ Plutus ที่มีบนแพลตฟอร์ม iOS, Android, Mac, Windows และ Web เป็นจุดเด่นอีกอย่างหนึ่งที่เหมาะสำหรับนักลงทุนที่ชื่นชอบเทคโนโลยีและความสะดวกสบาย อย่างไรก็ตาม โครงสร้างค่าธรรมเนียมที่ซับซ้อนและรายละเอียดที่ไม่ระบุเกี่ยวกับดอกเบี้ยเงินสดที่ไม่ลงทุนและทรัพยากรทางการวิจัยอาจต้องให้ความสำคัญในการพิจารณาอย่างรอบคอบ Plutus เหมาะสำหรับนักลงทุนที่กำลังมองหาแพลตฟอร์มที่ได้รับการกำกับดูแลแบบหลายสินทรัพย์ที่มีความเข้าถึงกว้างขวาง

คำถามที่พบบ่อย

Plutus ปลอดภัยในการซื้อขายหรือไม่?

ใช่ Plutus ปลอดภัยในการซื้อขายเนื่องจากได้รับการกำกับดูแลโดยหน่วยงานกำกับดูแลหลักทรัพย์และอนุพันธ์ (SFC) และปฏิบัติตามกฎระเบียบทางการเงินที่เข้มงวดเพื่อให้ได้รับสภาพแวดล้อมการซื้อขายที่ปลอดภัย

Plutus เป็นแพลตฟอร์มที่ดีสำหรับผู้เริ่มต้นหรือไม่?

Plutus อาจเหมาะสำหรับผู้เริ่มต้นเนื่องจากความพร้อมใช้งานบนแพลตฟอร์มหลายรูปแบบ (iOS, Android, Mac, Windows, Web) อย่างไรก็ตาม ผู้เริ่มต้นควรทราบถึงโครงสร้างค่าธรรมเนียมที่ซับซ้อนและควรตระหนักถึงดอกเบี้ยสำหรับเงินสดที่ไม่ลงทุนและทรัพยากรการศึกษาที่มีอยู่

Plutus เป็นแพลตฟอร์มที่ถูกต้องหรือไม่?

ใช่ Plutus เป็นแพลตฟอร์มการซื้อขายที่ถูกต้อง ได้รับการกำกับดูแลโดย SFC ซึ่งรับรองการปฏิบัติตามกฎระเบียบทางการเงินและให้สภาพแวดล้อมที่ปลอดภัยสำหรับนักลงทุน

Plutus เหมาะสำหรับการลงทุน/เกษียณหรือไม่?

Plutus เป็นทางเลือกที่เหมาะสมสำหรับการลงทุนและเกษียณเนื่องจากมีสินทรัพย์ที่หลากหลายและความเข้าถึงของแพลตฟอร์มที่ครอบคลุมอย่างครบถ้วน อย่างไรก็ตาม นักลงทุนที่สนใจความซับซ้อนของโครงสร้างค่าธรรมเนียมและรายละเอียดที่ไม่ระบุเกี่ยวกับดอกเบี้ยเงินสดที่ไม่ลงทุนและทรัพยากรการวิจัยควรพิจารณาอย่างรอบคอบ

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลจากการประเมินของผู้เชี่ยวชาญของ WikiStock จากข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการลงทุนที่มีความเสี่ยงสูง อาจส่งผลให้สูญเสียเงินลงทุนทั้งหมด ดังนั้นความเข้าใจเกี่ยวกับความเสี่ยงที่เกี่ยวข้องก่อนที่จะลงมือเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

2-5 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ธุรกิจที่เกี่ยวข้อง

ประเทศ

Company name

สมาคม

--

Plutus Asset Management Limited

กลุ่มบริษัท

ดาวน์โหลดแอป

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

瑞达国际

คะแนน

Huajin International

คะแนน

CLSA

คะแนน

Sanfull Securities

คะแนน

DL Securities

คะแนน

嘉信

คะแนน

GF Holdings (HK)

คะแนน

China Taiping

คะแนน

Capital Securities

คะแนน

乾立亨證券

คะแนน