スコア

レーティング

会社鑑定

取引品種

1

Stocks

取引商ライセンス

1件ライセンスを保有

香港、中国SFC証券取引ライセンス

会社情報

More

会社名

VMI Securities Limited

社名略語

VMI Securities

会社登録国・地域

会社所在地

会社のウェブサイト

https://www.vmisec.com/en/index.phpいつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

VMI Securities レビュー

| VMI Securities |  |

| WikiStock 評価 | ⭐⭐⭐ |

| 手数料 | 証券取引手数料HK$100、取引税(株式、債券)の取引金額の0.0027%、決済手数料の0.002%など |

| 口座維持手数料 | 年間HK$100(長期非アクティブ口座手数料) |

| カスタマーサポート | 電話とメール |

VMI Securitiesとは?

VMI Securitiesは2016年5月に設立され、SFCのライセンスを取得した法人です。同社は上海-香港ストックコネクトを通じた香港株式、安定したリターンとリスク管理のための債券、ストラクチャードプロダクト、ユニコーンブロック取引、デリバティブサービスなど、多様な投資目標に対応する金融商品を提供しています。

VMI Securitiesの利点と欠点

| 利点 | 欠点 |

| SFCの規制 | 入金オプションが限られている |

| 幅広い金融商品 | |

| 明確な手数料体系 |

SFCの規制: SFCの規制により、VMI Securitiesは厳格なガイドラインの下で運営され、投資家に安全性と信頼性を提供しています。

幅広い金融商品: VMI Securitiesは上海-香港ストックコネクトを通じた香港株式、債券商品、ストラクチャードプロダクト、ユニコーンブロック取引、デリバティブサービスなど、幅広い金融商品を提供しています。この多様性により、クライアントは自身の金融目標に応じて投資を多様化することができます。

明確な手数料体系: 手数料体系の透明性は、VMI Securitiesを通じての取引や投資に関連するコストを投資家が理解するのに役立ちます。

欠点:入金オプションが限られている: 入金口座には中国銀行とDBS銀行のみが記載されています。

VMI Securitiesは安全ですか?

VMI Securitiesは証券・先物取引委員会(SFC)の監督下で運営されており、ライセンス番号BIG265を保有しています。SFCは、世界的な金融拠点である香港の証券・先物市場の誠実さと安定性を維持する上で重要な金融規制機関であり、投資家の利益を保護し、持続可能な業界成長に寄与する公正かつ透明な市場を促進する役割を果たしています。

SFCの規制枠組みの一環として、SFCは市場の誠実さと投資家保護を維持するための厳格な基準を課しています。これらの基準は、VMI Securitiesなどの証券会社を含むさまざまな金融機関に対する包括的な監視と執行活動をカバーしています。

VMI Securitiesで取引できる証券とは?

VMI Securitiesは、多様な投資目標に合わせたさまざまな金融商品を提供しています。上海-香港ストックコネクトを通じて利用できる香港株に加えて、同社は収益の安定化と投資リスクの効果的な管理を目的とした債券商品の範囲を提供しています。これらの債券は取引の柔軟性を提供し、利子の収集、権利行使、満期償還、二次市場取引などの活動に対する包括的な委任サービスを含んでいます。

さらに、VMI Securitiesはストラクチャードプロダクト、ユニコーンブロックトレーディング能力、デリバティブサービスを提供しています。同社の資産管理サービスへの取り組みは、カスタマイズされたソリューションと専門的なガイダンスを通じてクライアントの金融ニーズに応えるアプローチを強調しています。

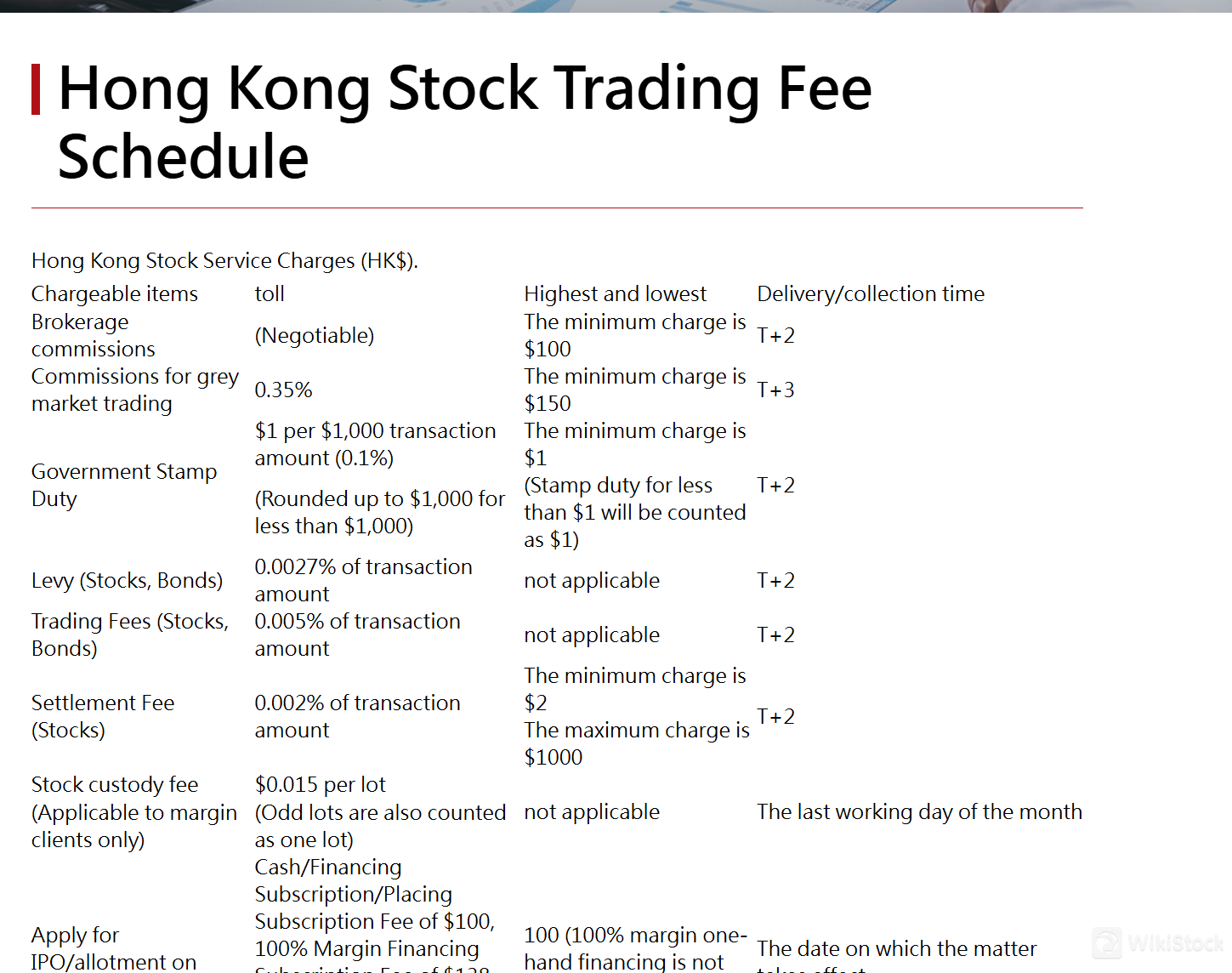

VMI Securities 手数料レビュー

VMI Securitiesは、一般取引手数料、保管および取り扱い手数料、出金および入金手数料、株式譲渡手数料、配当サービス手数料、株式関連事項、その他の手数料などの手数料を請求しています。

| カテゴリー | 手数料金額 | |

| 一般取引手数料 | 仲介手数料 | 交渉可能、最低HK$100 |

| ダークプール取引手数料 | 0.35%、最低HK$150 | |

| 政府印紙税 | 取引金額のHK$1につきHK$1、最低HK$1 | |

| 取引手数料(株式、債券) | 取引金額の0.0027% | |

| 取引手数料(株式、債券) | 取引金額の0.005% | |

| 決済手数料(株式、債券) | 取引金額の0.002%、最低HK$2、最大HK$1,000 | |

| 保管および取り扱い手数料 | 株式保管手数料 | ロットあたりHK$0.015、月額 |

| 新規株式/追加株式申込手数料 | 現金/融資の場合HK$100、100%の証拠金融資の場合HK$138、ロットあたり | |

| 出金および入金手数料 | 小切手出金 | 無料 |

| 香港銀行口座へのオンライン出金 | HK$150 | |

| 香港以外の銀行口座へのオンライン出金 | HK$300 | |

| 株式譲渡手数料 | 譲渡(SI譲渡) | 前日の終値の総額の0.15%、最低HK$100 |

| 譲渡(SI譲渡) | 無料 | |

| 配当サービス手数料 | クライアントの代わりに現金を受け取る | 配当の0.5%、最低HK$20、最大HK$15,000 |

| ボーナス株の受け取り | ロットあたりHK$2、最低HK$20、最大HK$500 | |

| 株式関連事項 | 株式分割、合併、再編の処理 | 発生ごとにHK$50 |

| 権利行使とワラントの処理 | ロットあたりHK$0.8 + HK$100のサービス料金、さらに譲渡手数料 | |

| その他の手数料 | 長期間非アクティブな口座手数料 | 年間HK$100 |

| 小切手返却手数料 | 発生ごとにHK$200 | |

| 月次明細書再発行 | 月額HK$80 | |

| 証券口座記録照会 | 1回あたりHK$100 |

VMI Securities 入出金レビュー

クライアントは、中国銀行(香港)およびDBS銀行(香港)有限公司の2つの指定銀行を通じて口座に資金を入金することができます。

入金を開始するには、入金者は銀行名、口座番号、口座名義、Swiftコード、および銀行の住所などの詳細を提供する必要があります。入金後、彼らはfund@venturemarkit.comにメールを送信し、口座番号と入金証明書のコピーを添付して確認を行う必要があります。

出金について、お客様はfund@venturemarkit.com宛にメールを送信し、口座番号と出金依頼の詳細を明記してプロセスを開始することができます。

カスタマーサービス

お客様は以下の情報を使用して、オフィスを訪れるか、カスタマーサービスラインに連絡することができます:

電話:852-3902-3930

メール:cs@vmimarkit.com

住所:香港灣仔莊士敦街181號大有大廈11樓1105室

まとめ

VMI Securitiesは、多様な金融商品を提供し、規制され透明性のある選択肢を投資家に提供しています。ただし、入金オプションの制約は、個々の投資戦略と好みに適しているかどうかを慎重に考慮する必要があります。総じて、VMI Securitiesは証券市場で信頼性の高いブローカーを探しているトレーダーにとって人気のある選択肢です。

よくある質問(FAQ)

VMI Securitiesは規制されていますか?

はい。SFCによって規制されています。

VMI Securitiesにどのように連絡すればよいですか?

電話:852-3902-3930、メール:cs@vmimarkit.comで連絡することができます。

VMI Securitiesが請求する手数料は何ですか?

VMI Securitiesは、一般取引手数料、保管手数料、出金手数料、入金手数料、株式譲渡手数料、配当サービス手数料、株式関連事項、その他の手数料など、さまざまな手数料を請求しています。

VMI Securitiesの口座に資金を入金するオプションは何ですか?

お客様は中国銀行(香港)とDBS銀行(香港)有限公司を通じて口座に資金を入金することができます。

リスク警告

提供される情報は、WikiStockの専門家によるブローカーのウェブサイトデータの評価に基づいており、変更される可能性があります。また、オンライン取引には大きなリスクが伴い、投資資金の全額損失につながる可能性があるため、関連するリスクを理解してから参加することが重要です。

その他情報

登記国

香港、中国

経営時間

2-5年

New Stock Trading

Yes

規制されている国数量

1

取引可能商品

Stocks

評判

コメントなし

推奨する証券会社More

Victory Securities

スコア

Quam Securities

スコア

Tianda Financial

スコア

Gaoyu Securities

スコア

Success

スコア

COL Global Access

スコア

Westock

スコア

競富

スコア

CJS INTERNATIONAL

スコア

JVSakk

スコア