Assestment

Huajin International

http://www.hjfi.hk/EN/index.php

Website

Marka ng Indeks

Appraisal ng Brokerage

Impluwensiya

C

Index ng Impluwensiya BLG.1

Taiwan

TaiwanMga Produkto

3

Futures、Investment Advisory Service、Stocks

Lisensya sa seguridad

kumuha ng 3 (mga) lisensya sa seguridad

SFCKinokontrol

Hong KongLisensya sa Pagkalakal ng Seguridad

SFCKinokontrol

Hong KongLisensya sa Pagkalakal ng Mga Deribatibo

SFCKinokontrol

Hong KongLisensya sa Pagkonsulta sa Pamumuhunan

Mga Pandaigdigang Upuan

![]() Nagmamay-ari ng 1 (na) upuan

Nagmamay-ari ng 1 (na) upuan

Hong Kong HKEX

Seat No. 01986

Impormasyon sa Brokerage

More

Kumpanya

Huajin Financial (International) Holdings Limited

Pagwawasto

Huajin International

Rehistradong bansa at rehiyon ng platform

address ng kumpanya

Website ng kumpanya

http://www.hjfi.hk/EN/index.phpSuriin kahit kailan mo gusto

WikiStock APP

Mga Serbisyo sa Brokerage

Gene ng Internet

Index ng Gene

Rating ng APP

Mga tampok ng brokerage

Rate ng komisyon

0.15%

Rate ng pagpopondo

3%

New Stock Trading

Yes

Margin Trading

YES

| Aspect | Impormasyon |

| Company Name | Huajin International |

| Years in Business | 5-10 taon |

| Registered Region | China, Hong Kong |

| Regulatory Status | Regulated by the Securities and Futures Commission (SFC) |

| Tradable Securities and Services | Mga stocks, bonds, commodities, currencies, futures at investing bank |

| Minimum Deposit | N/A |

| Margin Trading | Oo |

| New Stock Trading | Oo |

| Commissions | 0.25% bayad sa komisyon na may minimum na bayad na HK$100 bawat transaksyon |

| Platforms/Apps | ET Trade Online Trading Platform, SP Professional Trading System |

| Customer Service | Customer service hotline: (852) 31 033 030, Email: csdept@hjfi.com.hk |

| Deposit & Withdrawal Methods | Faster Payment System (FPS), Bank transfer, Cheque deposit |

| Account Types | Securities Cash Account, Securities Margin Account, Futures Account |

Pangkalahatang-ideya ng Huajin International

Ang Huajin International, na nag-ooperate sa loob ng 5-10 taon sa China at Hong Kong, ay nag-aalok ng malawak na hanay ng mga tradable na securities at serbisyo, kabilang ang mga stocks, bonds, commodities, futures at investing bank.

Bagaman nagbibigay ito ng access sa global na mga merkado at regulado ng Securities and Futures Commission, ang relasyong mataas na bayad sa komisyon nito na 0.25% na may minimum na bayad na HK$100 bawat transaksyon ay nagpapangyari sa mga cost-conscious na mga trader na magdalawang-isip.

Gayunpaman, ipinagmamalaki nito ang responsable na suporta sa customer at iba't ibang uri ng mga account, na nagpapalakas sa kakayahang mag-trade.

Regulatory Status

Ang Huajin International ay mayroong tatlong mga lisensya sa securities na inisyu ng Securities and Futures Commission (SFC), na nagpapatunay ng regulatory compliance nito at awtorisasyon na makilahok sa iba't ibang mga aktibidad sa pananalapi.

Ang mga lisensyang ito ay kasama ang Securities Trading License na may License No. BFJ286, Derivatives Trading License na may License No. BFJ369, at Investment Consulting License na may License No. BGJ395.

Bawat lisensya ay nagpapahiwatig ng pagsunod ng kumpanya sa mga pamantayan ng regulasyon at nagbibigay sa kanila ng kakayahang mag-operate sa mga tinukoy na larangan ng securities trading, derivatives trading, at investment consulting sa ilalim ng pangangasiwa ng SFC.

Mga Pro at Cons

| Mga Pro | Mga Cons |

| Malawak na hanay ng mga tradable na assets mula sa mga stocks at bonds hanggang sa mga commodities at currencies | Relatibong mataas na bayad sa komisyon na 0.25% na may minimum na bayad na HK$100 bawat transaksyon |

| Regulado ng SFC | Walang mga educational resources |

| Access sa global na mga merkado | Limitadong mga tool sa pananaliksik |

| Responsable na suporta sa customer | |

| Iba't ibang uri ng mga account |

Mga Pro:

Malawak na hanay ng mga tradable na assets: Mula sa mga stocks at bonds hanggang sa mga commodities at currencies, maaaring mag-access ang mga kliyente sa malawak na hanay ng mga assets na naaayon sa kanilang mga preference sa investment at antas ng tolerance sa panganib.

Regulated by the SFC: Bilang isang reguladong entidad sa ilalim ng Securities and Futures Commission (SFC), sumusunod ang Huajin International sa mahigpit na pamantayan at mga gabay sa regulasyon, na nagbibigay ng transparensya, katarungan, at proteksyon sa mga mamumuhunan.

Access to global markets: Nagbibigay-daan ang Huajin International sa mga kliyente na mag-trade ng mga securities at derivatives sa lokal at pandaigdigang mga palitan, na nagbibigay ng access sa global na mga merkado ng pinansyal.

Responsible customer support: Sa tulong ng mga kinatawang pang-serbisyo sa mga oras ng opisina, maaaring makatanggap ng agarang tulong at gabay ang mga kliyente, na nagpapalakas ng positibong karanasan sa pag-trade.

Various account types: Maaaring pumili ang mga kliyente, maging indibidwal man o joint account holders, mula sa iba't ibang uri ng account tulad ng securities cash accounts, securities margin accounts, at futures accounts, na nagbibigay ng kakayahang mag-customize ng kanilang mga pamamaraan sa pamumuhunan.

Cons:

Relatively high commission fee: Bagaman nag-aalok ng malawak na hanay ng mga tradable na assets, nagpapataw ang Huajin International ng komisyon na 0.25% sa mga transaksyon, na may minimum na bayad na HK$100 bawat transaksyon para sa securities trading.

No educational resources: Kulang ang platform sa mga materyales na pang-edukasyon tulad ng mga tutorial, webinars, o mga kurso upang matulungan ang mga kliyente na mapabuti ang kanilang kaalaman at kasanayan sa pag-trade.

Limited research tools: Bagaman may access ang mga kliyente sa malawak na hanay ng mga assets at merkado, kulang sila sa kumprehensibong mga tool sa pananaliksik, market analysis, at mga feature ng data visualization upang makagawa ng malalim na pagsusuri at makapagdesisyon nang may sapat na impormasyon sa pamumuhunan.

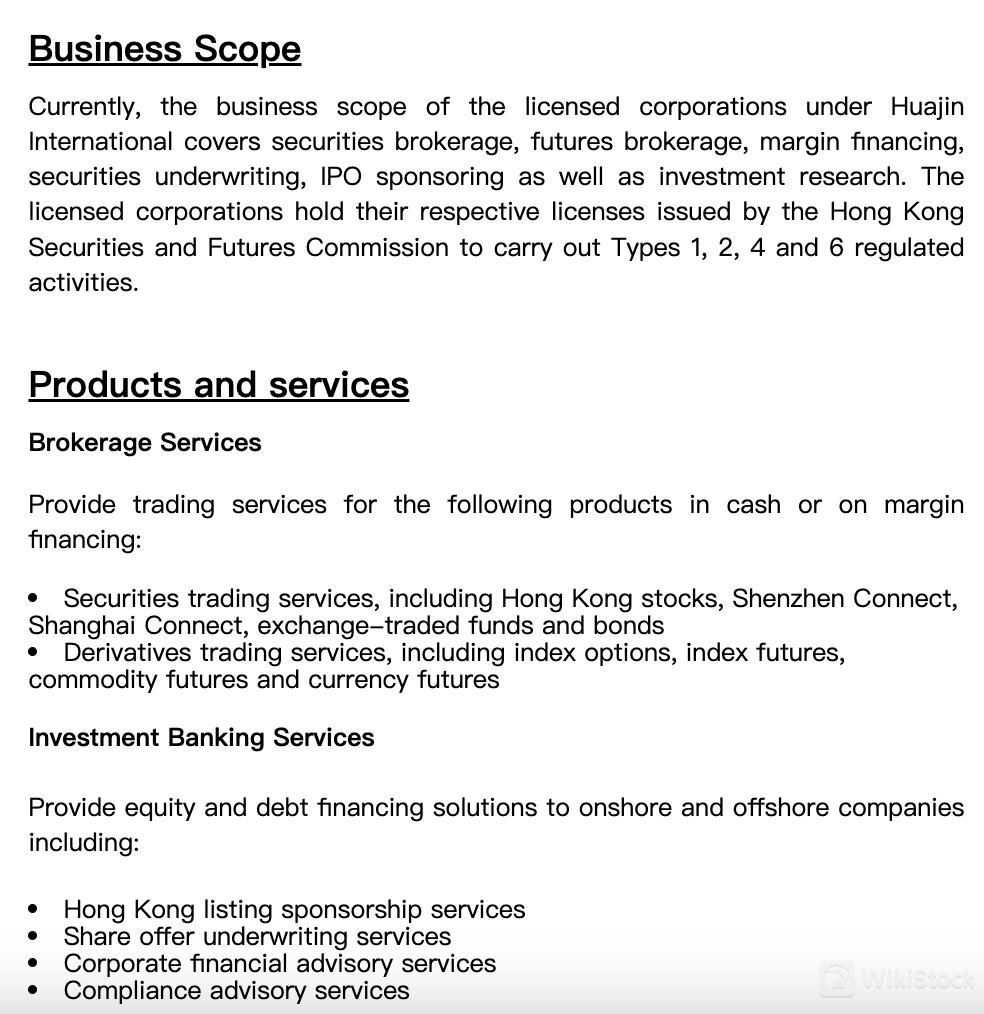

Tradable Securities and Services

Nag-aalok ang Huajin International ng iba't ibang mga tradable na securities at serbisyo sa pamamagitan ng mga lisensyadong korporasyon nito, na pinahihintulutan ng Hong Kong Securities and Futures Commission.

Brokerage Services:

Nagbibigay ang Huajin International ng mga serbisyong pang-trade na sumasaklaw sa iba't ibang mga produkto, maging sa cash o sa pamamagitan ng margin financing. Kasama dito ang mga serbisyong securities trading na sumasaklaw sa mga Hong Kong stocks, Shenzhen Connect, Shanghai Connect, exchange-traded funds, at bonds. Bukod dito, nag-aalok din ang platform ng mga serbisyong derivatives trading, na kasama ang index options, index futures, commodity futures, at currency futures.

Investment Banking Services:

Nagpapalawig ang platform ng mga solusyon sa equity at debt financing sa mga kumpanya sa loob at labas ng bansa. Kasama dito ang mga serbisyong Hong Kong listing sponsorship, share offer underwriting, at corporate financial advisory. Bukod dito, nag-aalok din ang Huajin International ng mga serbisyong compliance advisory upang tiyakin ang pagsunod sa mga regulasyon sa buong proseso ng pamumuhunan.

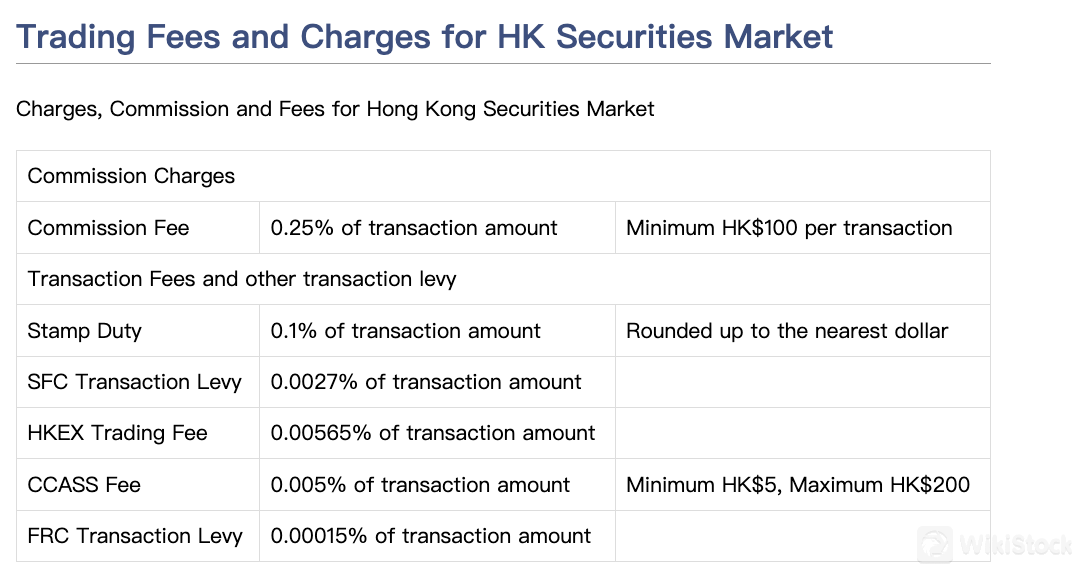

Commissions and Fees

Trading Fees and Charges for HK Securities Market:

Commission Charges: Nagpapataw ang Huajin International ng komisyon na 0.25% ng halaga ng transaksyon na may minimum na bayad na HK$100 bawat transaksyon.

Transaction Fees and Other Transaction Levy: Kasama sa karagdagang bayarin ang Stamp Duty, na 0.1% ng halaga ng transaksyon na pinapantay sa pinakamalapit na dolyar, SFC Transaction Levy na 0.0027% ng halaga ng transaksyon, HKEX Trading Fee na 0.00565% ng halaga ng transaksyon, CCASS Fee na 0.005% ng halaga ng transaksyon na may minimum na HK$5 at maximum na HK$200, at FRC Transaction Levy na 0.00015% ng halaga ng transaksyon.

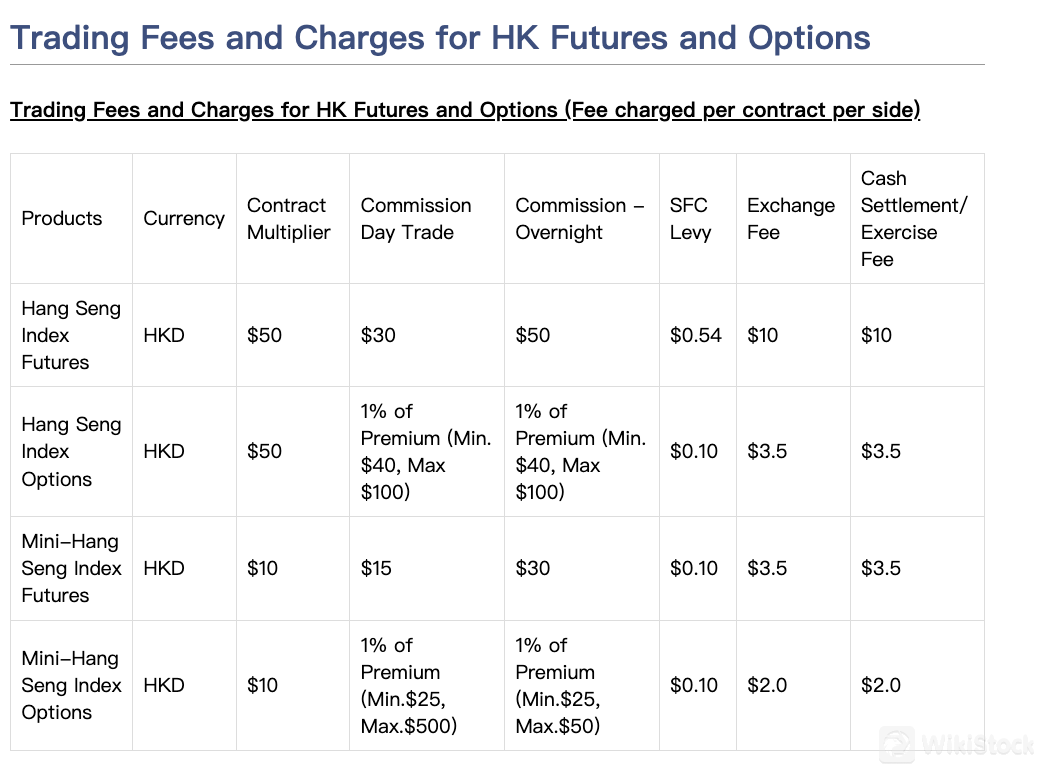

Trading Fees and Charges for HK Futures and Options:

Hang Seng Index Futures: Sa pag-trade ng Hang Seng Index Futures, ang komisyon na ipinapataw bawat kontrata bawat side ay $30 para sa day trades at $50 para sa overnight trades. Kasama rin dito ang SFC Levy na $0.54, Exchange Fee na $10, at Cash Settlement/Exercise Fee na $10.

Hang Seng Index Options: Sa pag-trade ng Hang Seng Index Options, may komisyon na 1% ng premium na may minimum na $40 at maximum na $100 para sa parehong day trades at overnight trades. Kasama rin dito ang SFC Levy na $0.10, Exchange Fee na $3.5, at Cash Settlement/Exercise Fee na $3.5.

Mini-Hang Seng Index Futures at Mini-Hang Seng Index Options: Katulad ng kanilang mga standard na katumbas, ang Mini-Hang Seng Index Futures at Options ay may iba't ibang mga rate ng komisyon at bayarin depende sa premium at contract multiplier.

Kumpara dito, ang mga bayarin at singil ng Huajin International ay medyo mataas.

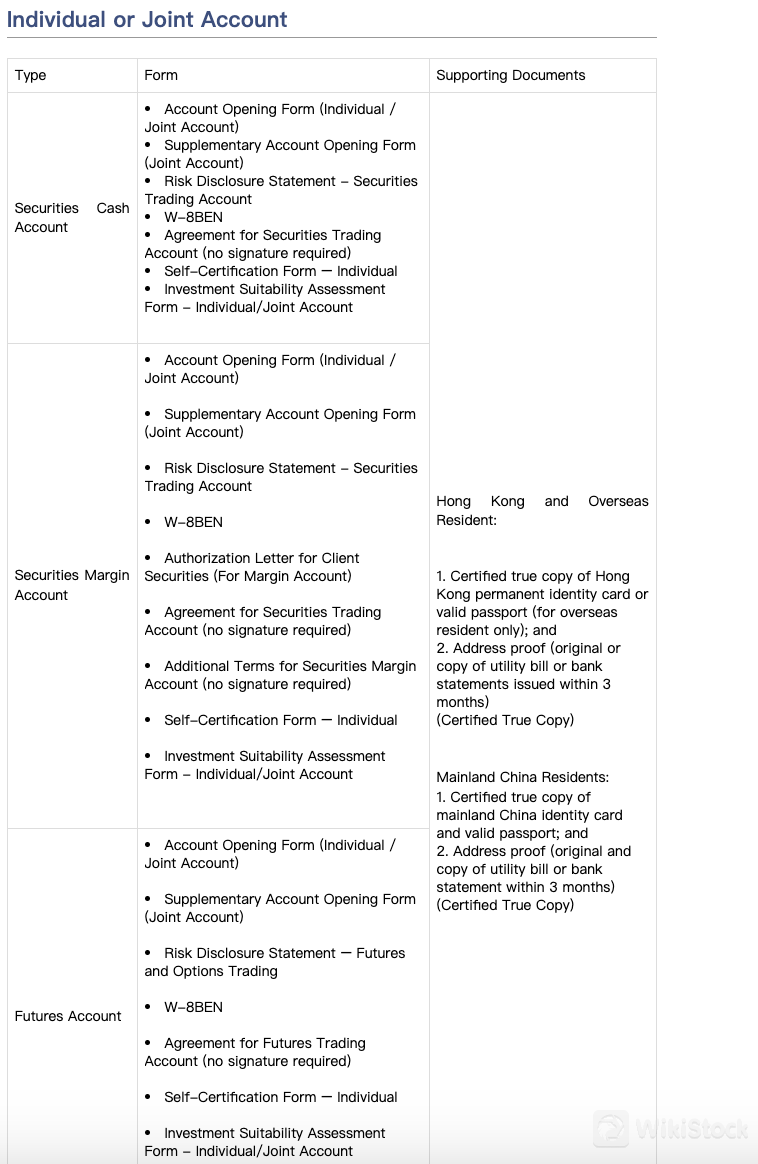

Mga Uri ng Account

Para sa mga indibidwal o maramihang partido na nagnanais pangasiwaan ang kanilang mga pamumuhunan nang sama-sama, nag-aalok ang Huajin International ng mga Indibidwal o Joint Accounts. Ang mga account na ito ay nagbibigay ng access sa iba't ibang mga serbisyong pinansyal at nangangailangan ng partikular na dokumentasyon para sa pagpapatunay.

Securities Cash Account:

Ang Securities Cash Account ay angkop para sa mga residente ng Hong Kong, mga residente sa ibang bansa, at mga residente sa mainland China, na nagbibigay-daan sa mga gumagamit na makilahok sa pagtitingi ng mga seguridad. Upang buksan ang account na ito, ang mga aplikante ay dapat magsumite ng Account Opening Form, Supplementary Account Opening Form (para sa mga joint account), Risk Disclosure Statement, W-8BEN form, Agreement for Securities Trading Account, at iba pang mga suportadong dokumento ayon sa kanilang katayuan sa residency.

Securities Margin Account:

Ibinabahagi para sa mga indibidwal o mga may-ari ng joint account na nagnanais mag-trade sa margin, ang Securities Margin Account ay nagbibigay-daan sa mga gumagamit na gamitin ang kanilang mga pamumuhunan. Katulad ng Securities Cash Account, ang mga aplikante ay kailangang magbigay ng mga kinakailangang dokumento kabilang ang Account Opening Form, Supplementary Account Opening Form (para sa mga joint account), Risk Disclosure Statement, W-8BEN form, Authorization Letter for Client Securities, at Agreement for Securities Trading Account.

Futures Account:

Ang Futures Account ay angkop para sa mga interesado sa pag-trade ng mga futures at options, na nagbibigay-daan sa access sa mga merkado ng futures. Upang buksan ang account na ito, ang mga aplikante ay dapat magsumite ng Account Opening Form, Supplementary Account Opening Form (para sa mga joint account), Risk Disclosure Statement para sa Futures and Options Trading, W-8BEN form, Agreement for Futures Trading Account, at iba pang mga kinakailangang dokumento.

Open Securities A/C with Futures A/C:

Para sa mga gumagamit na nagnanais mag-access sa mga merkado ng mga seguridad at futures, nag-aalok ang Huajin International ng pagkakataon na magbukas ng Securities Accounts kasama ang Futures Accounts. Karagdagang dokumentasyon, kabilang ang Authorization Letter for Client Money, ang kinakailangan para sa uri ng account na ito.

Mga Platform at Kasangkapan

Nag-aalok ang Huajin International ng dalawang pangunahing online trading platforms para sa kanilang mga kliyente, na nagbibigay ng ligtas at maaasahang paraan ng pag-access sa mga merkado ng pinansya:

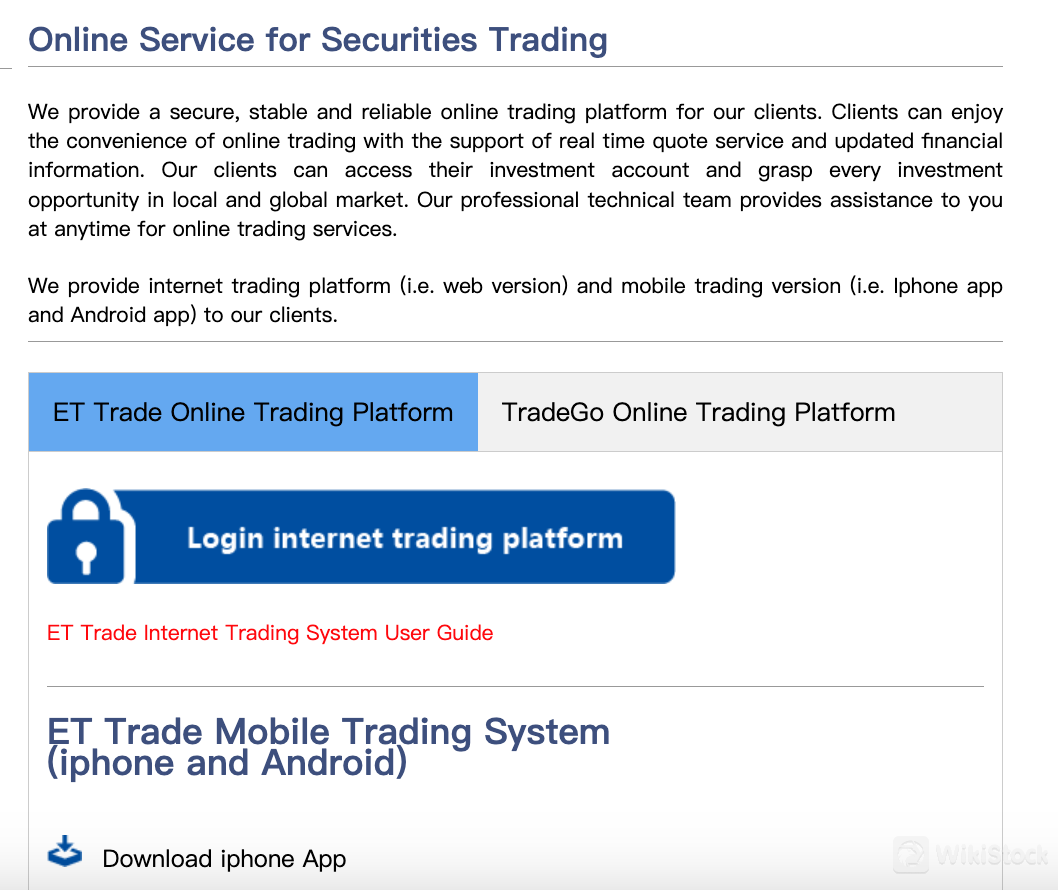

ET Trade Online Trading Platform: Ang platform na ito ay nag-aalok ng bersyon sa web at bersyon para sa mga mobile na aparato tulad ng iPhone at Android. Ito ay nagbibigay-daan sa mga kliyente na makilahok sa online trading nang madali, na sinusuportahan ng mga serbisyong real-time quote at updated na impormasyon sa pinansya. Ang bersyon sa web ay nagbibigay ng kumpletong mga kakayahan para sa pagtitingi ng mga seguridad, na nagbibigay-daan sa mga kliyente na ma-access ang kanilang mga investment account at kumuha ng mga oportunidad sa lokal at pandaigdigang mga merkado. Bukod dito, ang mga bersyon para sa mobile ay nag-aalok ng kahusayan, na nagbibigay-daan sa mga kliyente na mag-trade kahit saan at pamahalaan ang kanilang mga pamumuhunan nang madali. Ang platform ay sinusuportahan ng isang propesyonal na technical team na nagbibigay ng tulong sa mga kliyente kapag kinakailangan.

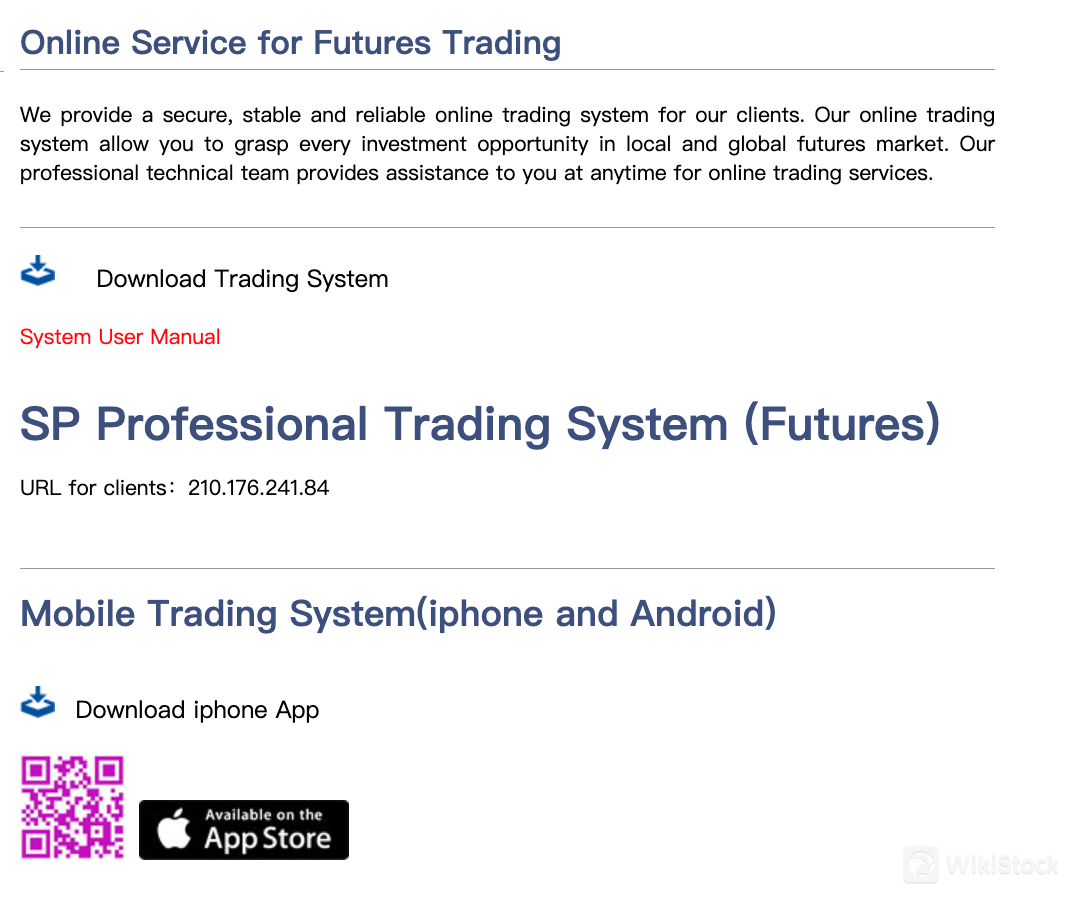

SP Professional Trading System (Futures): Para sa futures trading, nagbibigay ang Huajin International ng isang dedikadong online trading system na kilala bilang SP Professional Trading System. Ang sistemang ito ay nag-aalok ng isang ligtas at matatag na kapaligiran para sa mga kliyente na makilahok sa mga aktibidad ng futures trading. Sa platform na ito, maaaring magamit ng mga kliyente ang mga oportunidad sa lokal at pandaigdigang merkado ng futures. Ang platform ay sinusuportahan ng isang propesyonal na technical team na available upang tulungan ang mga kliyente sa kanilang mga pangangailangan sa online trading. Bukod dito, mayroong mobile trading system na magagamit para sa mga gumagamit ng iPhone, na nagbibigay ng pagiging maliksi at kaginhawahan sa futures trading.

Deposit & Withdrawal

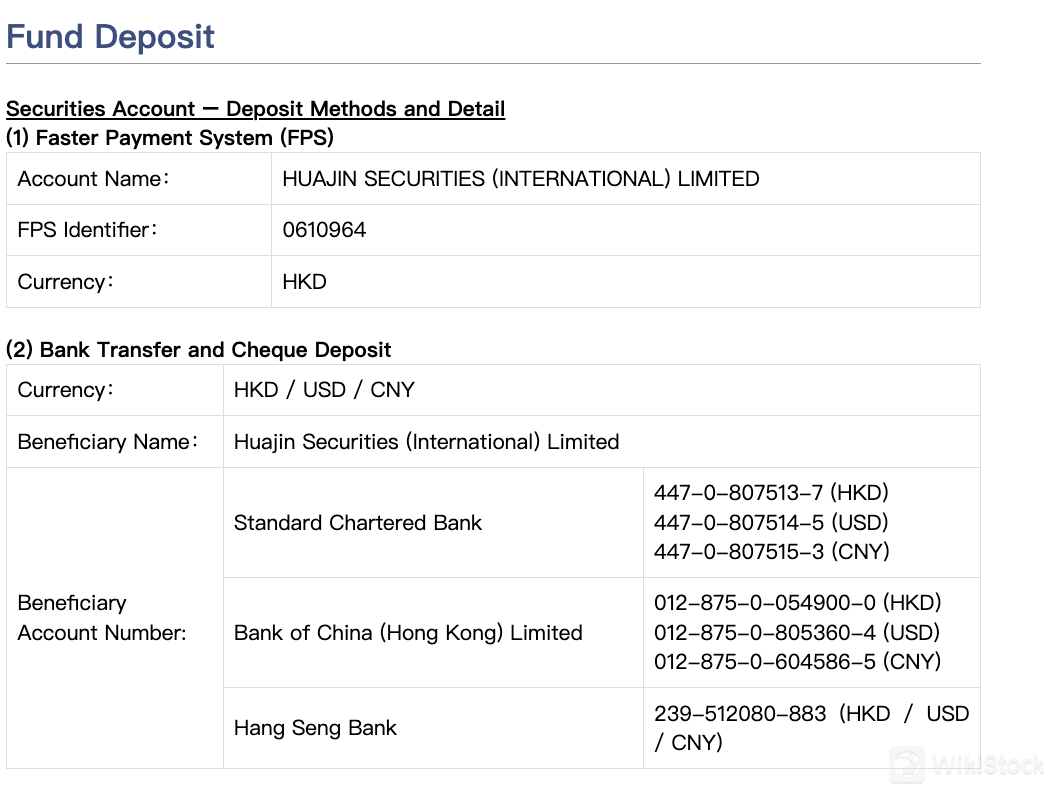

Ang Huajin International ay nag-aalok ng maraming paraan ng pagdedeposito para sa mga securities account. Maaaring gamitin ng mga kliyente ang Faster Payment System (FPS) sa pamamagitan ng paglipat ng pondo sa itinakdang account sa pangalan na "HUAJIN SECURITIES (INTERNATIONAL) LIMITED" na may FPS Identifier 0610964.

Bukod dito, maaaring magdeposito ng pondo ang mga kliyente sa pamamagitan ng bank transfer o cheque deposit sa mga currency na HKD, USD, o CNY.

Hindi nagtatakda ang Huajin International ng minimum deposit requirement para sa mga securities account.

Customer Service

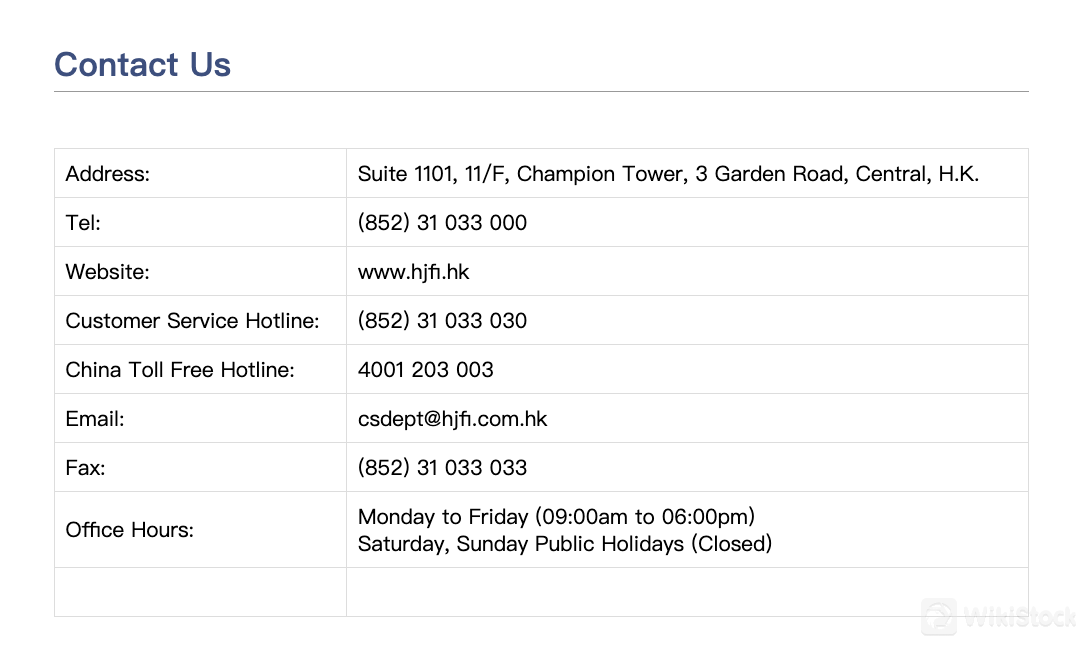

Nagbibigay ang Huajin International ng kumprehensibong serbisyo sa customer support upang tulungan ang mga kliyente sa kanilang mga katanungan at alalahanin.

Maaaring makipag-ugnayan ang mga kliyente sa customer service hotline sa (852) 31 033 030 para sa tulong sa loob ng oras ng opisina, Lunes hanggang Biyernes mula 09:00am hanggang 06:00pm.

Bukod dito, mayroong toll-free hotline para sa mga kliyente sa China sa 4001 203 003.

Para sa mga katanungan sa pamamagitan ng email, maaaring makipag-ugnayan ang mga kliyente sa csdept@hjfi.com.hk.

Matatagpuan ang opisina ng kumpanya sa Suite 1101, 11/F, Champion Tower, 3 Garden Road, Central, Hong Kong.

Conclusion

Sa buod, nag-aalok ang Huajin International ng isang matatag na platform para sa mga mangangalakal na may mga kalamangan tulad ng iba't ibang mga tradable securities, access sa pandaigdigang merkado, at regulated status sa ilalim ng Securities and Futures Commission.

Gayunpaman, ang relatif na mataas na komisyon na bayad na 0.25% na may minimum na bayad na HK$100 bawat transaksyon ay maaaring hadlangan ang mga mangangalakal na may limitadong budget. Bukod dito, ang kakulangan ng mga educational resources at limitadong mga research tools ay nagpapahirap sa mga kliyente na naghahanap ng kumprehensibong market insights.

Gayunpaman, ang responsable na customer support ng platform at iba't ibang uri ng account ay nag-aambag sa kanyang kahalagahan, na nagbibigay ng kahusayan para sa mga mamumuhunan.

FAQs

Tanong: Anong mga securities ang maaaring i-trade sa Huajin International?

Tanong: Regulado ba ang Huajin International?

Tanong: Magkano ang mga komisyon na bayad sa pag-trade sa Huajin International?

Tanong: Maaaring mag-engage ba ang mga mangangalakal sa margin trading sa Huajin International?

Tanong: Mayroon bang mga educational resources na available para sa mga mangangalakal?

Tanong: Paano makakapag-contact ang mga gumagamit sa customer support?

Sagot: Maaaring mag-access ang mga mangangalakal sa iba't ibang mga securities tulad ng mga stocks, bonds, commodities, at currencies.

Sagot: Oo, ang Huajin International ay nag-ooperate sa ilalim ng regulasyon ng Securities and Futures Commission (SFC).

Sagot: Nagpapataw ang platform ng komisyon na bayad na 0.25%, na may minimum na bayad na HK$100 bawat transaksyon.

Sagot: Oo, nag-aalok ang Huajin International ng mga serbisyo sa margin trading sa mga gumagamit nito.

Sagot: Sa kasalukuyan, hindi nagbibigay ng mga educational resources ang Huajin International para sa mga mangangalakal.

Sagot: Ang mga gumagamit ay maaaring makipag-ugnayan sa customer support sa pamamagitan ng hotline sa (852) 31 033 030 o sa pamamagitan ng email sa csdept@hjfi.com.hk.

iba pa

Rehistradong bansa

Hong Kong

Taon sa Negosyo

5-10 taon

Mga produkto

Futures、Investment Advisory Service、Stocks

Mga Kaugnay na Negosyo

Bansa

Pangalan ng Kumpanya

Mga Asosasyon

--

Huajin Finance (International) Limited

Gropo ng Kompanya

--

Huajin Research (International) Ltd

Gropo ng Kompanya

--

Huajin Futures (International) Ltd

Gropo ng Kompanya

--

Huajin Securities (International) Ltd

Gropo ng Kompanya

--

Huajin Corporate Finance (International) Limited

Gropo ng Kompanya

--

Huafa Group

Gropo ng Kompanya

Review

Walang ratings

Inirerekomendang Mga Brokerage FirmMore

瑞达国际

Assestment

CLSA

Assestment

Sanfull Securities

Assestment

DL Securities

Assestment

嘉信

Assestment

GF Holdings (HK)

Assestment

China Taiping

Assestment

Lukfook Financial

Assestment

Capital Securities

Assestment

乾立亨證券

Assestment