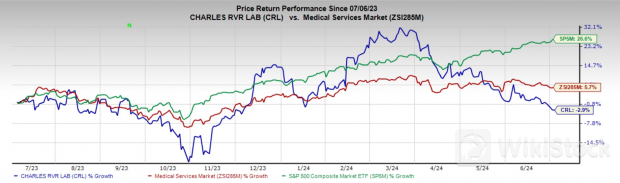

Charles River Could be an Apt Pick Right Now: Here's Why - Charles River (NYSE:CRL)

Image Source: Zacks Investment Research

Over the past several quarters, the company has witnessed strong growth within the Insourcing Solutions (IS) business led by the CRADL (Charles River Accelerator and Development Labs) initiative. To support client demand, Charles River consistently expands CRADL's footprint both organically and through the acquisition of Explora BioLabs (done in 2022), a provider of contract vivarium research services. In the first quarter of 2024, the company signed new contracts for its legacy IS Vivarium management solutions and noted that the CRADL growth rate is expected to accelerate in 2024.

Revenues for small models increased in North America, Europe and China, banking on favorable pricing, with growth in China leading all regions. Overall, the RMS business is set to be a significant revenue growth driver in 2024.

DSA Arm Thrives: The company is presently the largest provider of outsourced drug discovery, non-clinical development and regulated safety testing services worldwide. Charles River leverages its deep expertise in the discovery of preclinical candidates and the design, execution and reporting of safety assessment studies for numerous types of compounds, including cell and gene therapies, and small and large molecule pharmaceuticals.

In the first quarter, although DSA revenues declined organically, demand trends continued to stabilize. The company expects flat to low-single-digit organic revenue growth in the DSA in 2024, while the study volume is expected to improve following a soft start to the year. Charles River is also keeping an eye on the final impact of the BIOSECURE Act on the broader biopharmaceutical industry. If the bill gets passed, the company expects a net positive impact, with nearly 95% of its revenues coming from North America and Europe.

Strategic Acquisitions Drive Growth: Within DSA, the 2021 acquisitions of Retrogenix (an early-stage Contract Research Organization or CRO) and Vigene Biosciences (a premier gene therapy contract development and manufacturing organization or CDMO) are strongly contributing to the company's top line. In November 2023, Charles River acquired a 41% additional stake in Noveprim, an NHP provider of Mauritius. This acquisition leads to a 90% controlling interest in Noveprim, firmly supporting Charles River's NHP supply strategy.

The acquisition of San Diego-based Explora Biolabs in April 2022 complements the company's existing IS business, specifically its CRADL footprint, and offers incremental opportunities to partner with an emerging client base.

Downsides

Foreign Exchange Translation Impacts Sales: Foreign exchange is a major headwind for Charles River as a considerable percentage of its revenues comes from outside the United States. The strengthening of the euro and some other developed market currencies has been constantly hampering the company's performance in the international markets.

Market Conditions and Economic Pressures: Given that a majority of Charles River's RMS and DSA revenues are generated in China, any trade policy-related conflict between the United States and China could hurt the businesses there. Further, the Manufacturing Solutions segment has been soft across the broader end markets due to a post-COVID-19 slowdown from biopharma manufacturers, CDMOs and their suppliers.

The global biopharma demand environment has affected the Endosafe endotoxin testing product line as clients are reducing both testing volumes and investments in new instruments. These market conditions more noticeably impacted the Microbial Solutions business in the quarters of 2023, with similar destocking activities continuing in the first quarter of 2024.

Estimate Trend

The Zacks Consensus Estimate for CRL's 2024 earnings has remained constant at $11.00 per share in the past 30 days.

The Zacks Consensus Estimate for 2024 revenues is pegged at $4.21 billion, which implies a 2% increase from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health, Medpace and ResMed.

Hims & Hers Health's earnings are expected to surge 281.8% in 2024 compared with the industry's 15.7%. HIMS' earnings surpassed estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. Its shares have surged 136.9% against the industry's 25.2% decline in the past year.

HIMS sports a Zacks Rank #1 (Strong Buy) at present.

Medpace, carrying a Zacks Rank #2 (Buy) at present, has an estimated 2024 earnings growth rate of 27.1% compared with the industry's 13.1%. Shares of MEDP have rallied 72.3% compared with the industry's 5.7% growth over the past year.

MEDP's earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

ResMed, also carrying a Zacks Rank #2 at present, has an estimated fiscal 2024 earnings growth rate of 19.6% compared with the industry's 12.9%. Shares of RMD have dropped 11.9% compared with the industry's 2.5% decline over the past year.

RMD's earnings surpassed estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Doubao concept surges, IPO economy booms

5G enters the "second half", which stocks are the best to buy

Check whenever you want

WikiStock APP