Pinterest, Inc. Is a Trending Stock: Facts to Know Before Betting on It - Pinterest (NYSE:PINS)

Revenue Growth Forecast

Even though a company's earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. It's almost impossible for a company to grow its earnings without growing its revenue for long periods. Therefore, knowing a company's potential revenue growth is crucial.

For Pinterest, the consensus sales estimate for the current quarter of $847.13 million indicates a year-over-year change of +19.7%. For the current and next fiscal years, $3.67 billion and $4.3 billion estimates indicate +20.1% and +17.2% changes, respectively.

Last Reported Results and Surprise History

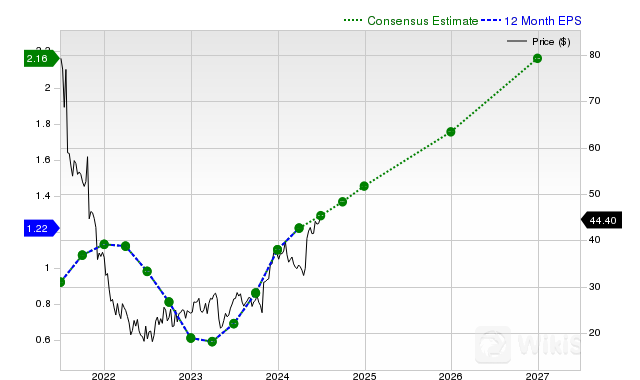

Pinterest reported revenues of $739.98 million in the last reported quarter, representing a year-over-year change of +22.8%. EPS of $0.20 for the same period compares with $0.08 a year ago.

Compared to the Zacks Consensus Estimate of $699.96 million, the reported revenues represent a surprise of +5.72%. The EPS surprise was +42.86%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates three times over this period.

Valuation

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

While comparing the current values of a company's valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S) and price-to-cash flow (P/CF), with its own historical values helps determine whether its stock is fairly valued, overvalued, or undervalued, comparing the company relative to its peers on these parameters gives a good sense of the reasonability of the stock's price.

As part of the Zacks Style Scores system, the Zacks Value Style Score (which evaluates both traditional and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is better than B; B is better than C; and so on), making it helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Pinterest is graded D on this front, indicating that it is trading at a premium to its peers.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP