Wall Street's Most Accurate Analysts Weigh In On 3 Energy Stocks With Over 6% Dividend Yields - DHT Holdi

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

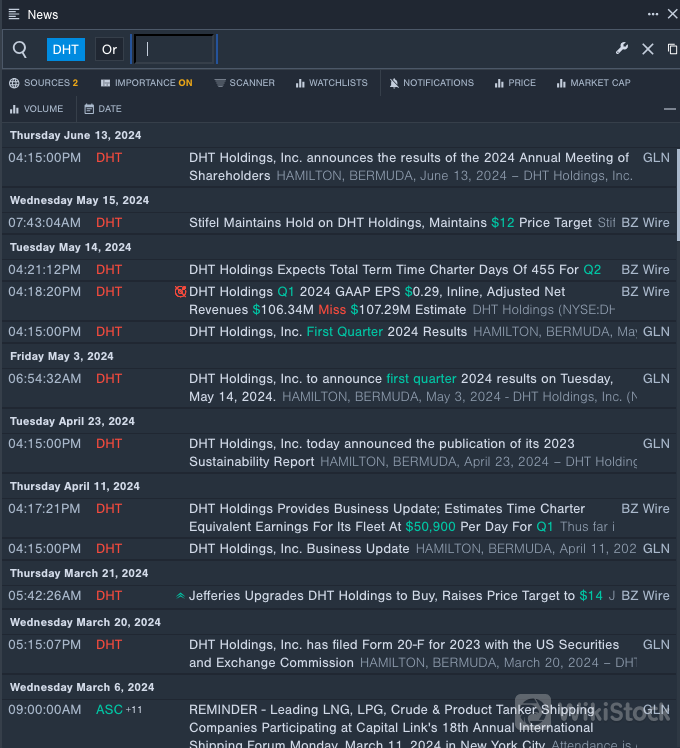

DHT Holdings, Inc. DHT

- Dividend Yield:9.94%

- Stifel analyst Benjamin Nolan maintained a Hold rating with a price target of $12 on May 15. This analyst has an accuracy rate of 73%.

- Jefferies analyst Omar Nokta upgraded the stock from Hold to Buy and raised the price target from $11 to $14 on March 21. This analyst has an accuracy rate of 82%.

- Recent News:On May 14, DHT Holdings posted downbeat quarterly sales.

- Benzinga Pro's real-time newsfeed alerted to latest DHT's news

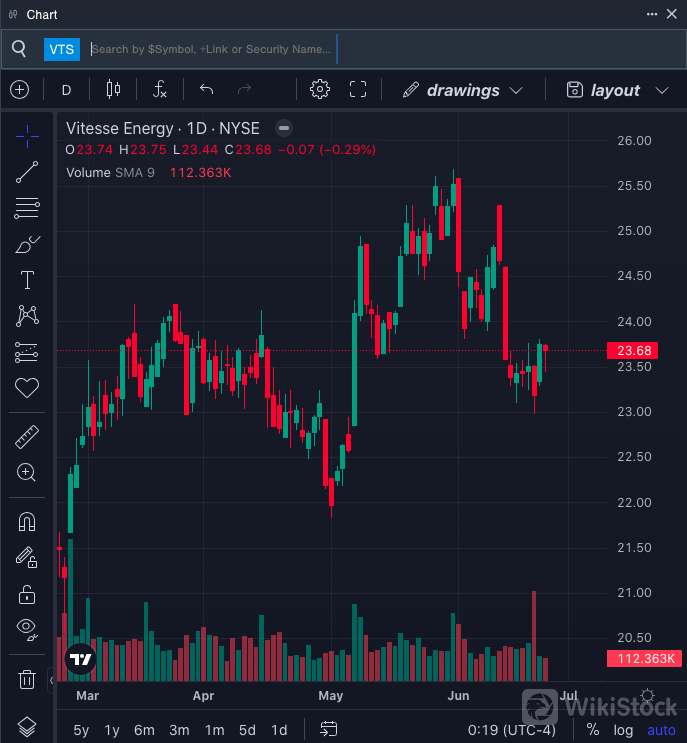

Vitesse Energy, Inc. VTS

- Dividend Yield:8.87%

- Alliance Global Partners analyst Jeff Grampp initiated coverage on the stock with a Buy rating and a price target of $27 on Nov. 16, 2023. This analyst has an accuracy rate of 64%.

- Roth MKM analyst John White initiated coverage on the stock with a Buy rating and a price target of $30.5 on Oct. 16, 2023. This analyst has an accuracy rate of 65%.

- Recent News:On May 6, Vitesse Energy posted mixed results for the first quarter.

- Benzinga Pro's charting tool helped identify the trend in Vitesse Energy's stock.

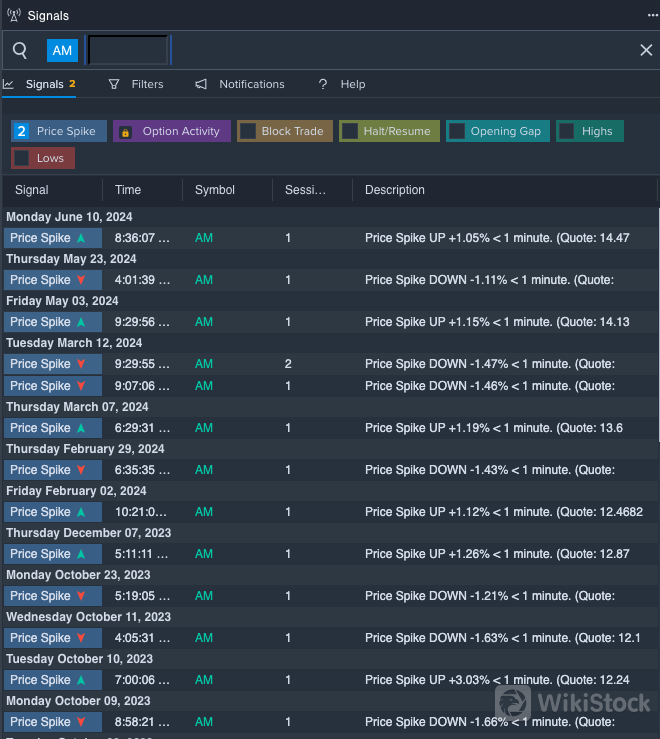

Antero Midstream Corporation AM

- Dividend Yield:6.04%

- Goldman Sachs analyst John Mackay reinstated a Neutral rating with a price target of $12.5 on Oct. 6, 2023. This analyst has an accuracy rate of 68%.

- UBS analyst Brian Reynolds maintained a Buy rating and cut the price target from $15 to $14 on Oct. 5, 2023. This analyst has an accuracy rate of 74%.

- Recent News:On April 24, Antero Midstream posted upbeat quarterly results.

- Benzinga Pro's signals feature notified of a potential breakout in Antero Midstream's shares.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP