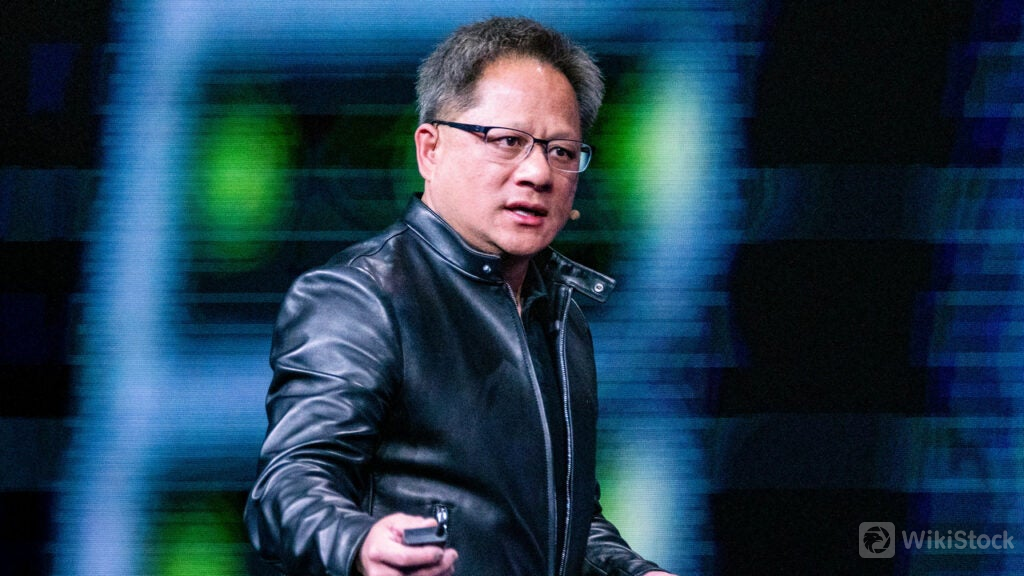

To Buy Or Not To Buy? Nvidia's Skyrocketing Shares Stir Investor Debate Whether Jensen Huang-Led Tech Gia

The remarkable rally in Nvidia CorpsNVDA shares has left investors contemplating whether to cash in, hold on for additional gains, or pursue a stock that has tripled in the past year.

What Happened: Led byJensen Huang, Nvidia became the largest U.S. company by market value this week, following a more than 1,000% surge in share price since October 2022. The companys stock has risen 206% in the last 12 months.

Investors bullish on Nvidia predict further gains, citing the company‘s dominance in providing chips for artificial intelligence applications. However, some are wary of the stock’s high valuation, Reuters reported on Friday.

Nvidia‘s forward price-to-earnings ratio has grown by 80% this year, making the company’s shares potentially more susceptible to sharp pullbacks in the event of negative news.

“What it‘s done in the past … shouldn’t be driving the investment decision,” saidChuck Carlson, CEO at Horizon Investment Services.

“However, on a stock like Nvidia, its awfully hard to have that not be a factor in the investment decision because you have this chasing feeling.”

Gil Luria, an analyst with D.A. Davidsonadded, “The caution on Nvidia comes from the longer-term outlook. This type of performance is very hard to maintain.”

See Also: Qualcomm Stock Surges With Samsung Partnership For Galaxy S25: Whats Driving The Growth?

A few analysts also doubt that Nvidia‘s customers will spend enough to drive the Wall Street earnings estimates that support the company’s valuation.

Why It Matters: Nvidias rise to the top has been compared to the dot-com boom era, but former Cisco CEO John Chambers believes the dynamics of the AI revolution are distinct from previous tech booms.

Despite the warning flags raised by market experts about Nvidia being in ‘bubble-ish territory’, the companys disruption to the AI sector has been praised. One analyst even predicts Nvidia will become the first company to hit a market capitalization of $4 trillion.

Price Action: Nvidia closed 3.54% lower at $130.78 on Thursday while it was at $130.76 in premarket trading, according to Benzinga Pro.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP