Wall Street's Most Accurate Analysts Say Hold These 3 Utilities Stocks With Over 5% Dividend Yields - Atl

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks.

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

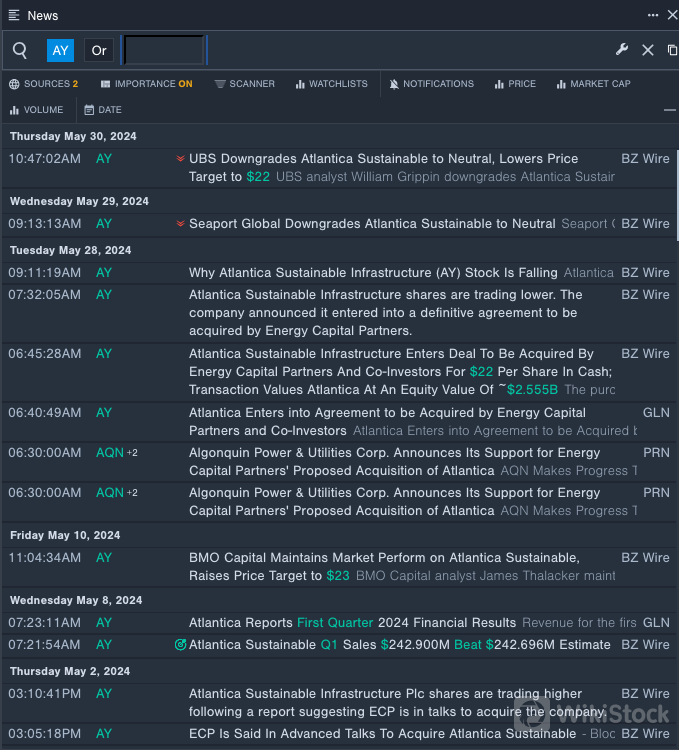

Atlantica Sustainable Infrastructure plc AY

Dividend Yield:8.10%

Seaport Global analyst Angie Storozynski downgraded the stock from Buy to Neutral on May 29. This analyst has an accuracy rate of 73%.

BMO Capital analyst James Thalacker maintained a Market Perform rating and raised the price target from $20 to $23 on May 10. This analyst has an accuracy rate of 64%.

Recent News:On May 28, the company announced it entered into a definitive agreement to be acquired by Energy Capital Partners.

Benzinga Pro's real-time newsfeed alerted to latest AY's news

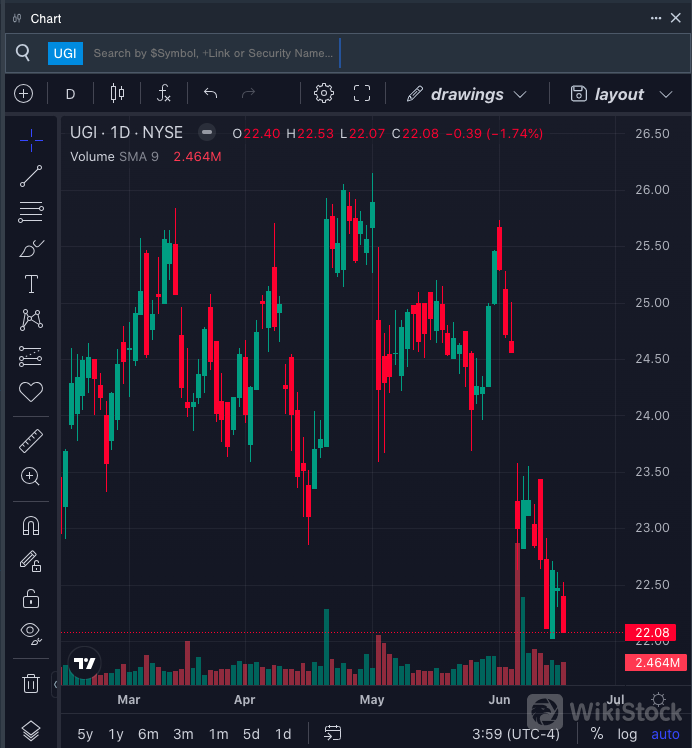

UGI Corporation UGI

Dividend Yield:6.79%

Wells Fargo analyst Sarah Akers maintained an Equal-Weight rating and cut the price target from $28 to $27 on May 3. This analyst has an accuracy rate of 68%.

Mizuho analyst Gabriel Moreen maintained a Neutral rating and raised the price target from $26 to $27 on April 17. This analyst has an accuracy rate of 70%.

Recent News:On June 11, UGI subsidiaries commenced an offer to purchase for cash up to $450 million of the offerors 5.500% senior notes due 2025.

Benzinga Pro's charting tool helped identify the trend in UGI's stock.

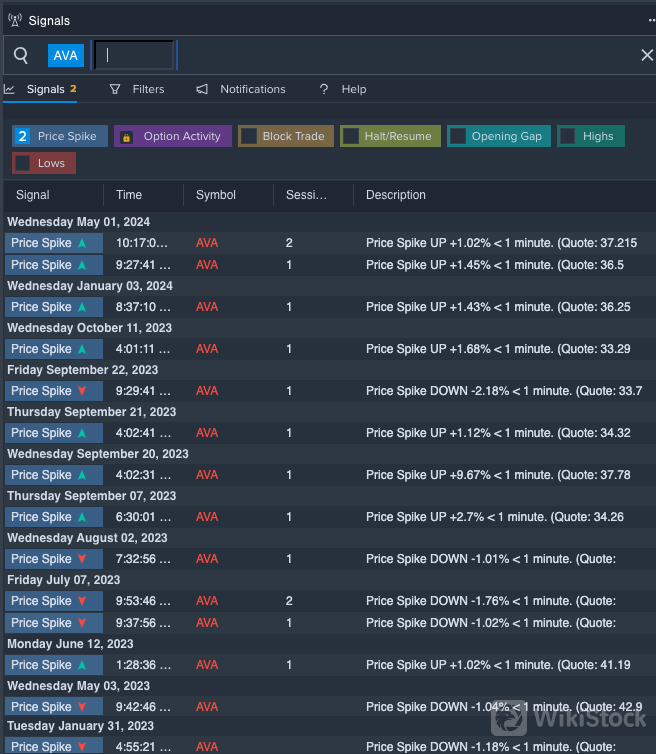

Avista Corporation AVA

Dividend Yield:5.58%

Mizuho analyst Anthony Crowdell upgraded the stock from Underperform to Neutral and raised the price target from $32 to $36 on May 3. This analyst has an accuracy rate of 63%.

Guggenheim analyst ShahriarPourrezaupgraded the stock from Sell to Neutral with a price target of $34 on Jan. 22. This analyst has an accuracy rate of 67%.

Recent News:On May 1, Avista posted better-than-expected quarterly sales.

Benzinga Pro's signals feature notified of a potential breakout in Avista's shares.

Key areas for mutual funds to make money in 2025

Yushu Technology's robot dog explodes the market!

Byte refutes rumors of speculation on A-share Doubao concept stocks

How to develop a low-altitude economy

Check whenever you want

WikiStock APP