Assestment

Marka ng Indeks

Appraisal ng Brokerage

Mga Produkto

3

Securities Lending Fully Paid、Futures、Stocks

Lisensya sa seguridad

kumuha ng 1 (mga) lisensya sa seguridad

CYSECKinokontrol

CyprusLisensya sa Pagkalakal ng Seguridad

Impormasyon sa Brokerage

More

Kumpanya

GWG (Cyprus) Ltd

Pagwawasto

GW Trade

Rehistradong bansa at rehiyon ng platform

address ng kumpanya

Website ng kumpanya

https://gwtrade.eu/Suriin kahit kailan mo gusto

WikiStock APP

Mga Serbisyo sa Brokerage

Gene ng Internet

Index ng Gene

Rating ng APP

Mga Download ng APP

- Ikot

- Mga download

- 2024-05

- 55.14M

Mga Panuntunan: Ang data na ipinapakita ay ang mga pag-download ng APP sa isang taon bago ang kasalukuyang oras.

Popularidad ng APP sa rehiyon

- Bansa / DistritoMga downloadratio

iba pa

52.00M71.57%Estados Unidos

0.99M8.97%Iran

0.75M6.84%South Africa

0.74M6.75%Nigeria

0.65M5.87%

Mga Panuntunan: Ang data ay ipinapakita bilang mga pag-download at rehiyonal na bahagi ng APP sa isang taon bago ang kasalukuyang oras.

Mga tampok ng brokerage

Rate ng komisyon

0%

Pinakamababang Deposito

$110

Margin Trading

YES

Long-Short Equity

YES

| GW Trade |  |

| WikiStock Rating | ⭐⭐⭐ |

| Minimum ng Account | €100 (Standard Account) |

| Mga Bayad | Mga Komisyon para sa Professional Account: |

| €/$ 4 - Forex&Metals | |

| €/$0 - Cryptos | |

| €/$3 - Energies&Stocks | |

| €/$2 - Indices&Futures | |

| Mga Bayad sa Pag-Widro: €5 | |

| Mga Bayad sa Account | Inactivity Fee na €/$25 para sa Mga Account na Nanatiling Hindi Aktibo sa Loob ng 3 Buwan |

| App/Platform | MetaTrader 5 |

| Mga Marker Instrumento | Forex, Indices, Commodities, Metals, Stocks, Cryptos, at Futures |

Ano ang GW Trade?

Ang GW Trade ay isang reguladong brokerage na nag-aalok ng iba't ibang mga serbisyo sa pag-trade mula pa noong 2016. Nagbibigay sila ng access sa iba't ibang mga instrumento sa pananalapi, kasama ang Forex, Metals, Cryptocurrencies, at iba pa, sa pamamagitan ng platform na MT5. Sa mga segregated account, proteksyon laban sa negatibong balanse, at 24/5 na suporta sa customer, pinapangalagaan ng GW Trade ang isang ligtas at epektibong karanasan sa pag-trade para sa mga kliyente.

Mga Kalamangan at Disadvantage ng GW Trade

| Mga Kalamangan | Mga Disadvantage |

|

|

|

|

|

|

|

Regulasyon ng CySEC: Ang GW Trade ay awtorisado at regulado ng Cyprus Securities and Exchange Commission (CySEC), na nagbibigay ng antas ng tiwala at seguridad para sa mga trader.

Iba't ibang mga Instrumento: Nag-aalok ang platform ng malawak na hanay ng mga instrumento sa pananalapi, kasama ang Forex, Metals, Cryptocurrencies, Indices, Stocks, at Futures, na nagbibigay ng maraming oportunidad sa pag-trade.

Advanced na mga Platform: May access ang mga trader sa advanced na mga platform sa pag-trade tulad ng MT5, na available sa desktop, mobile, at web, na may mga kapangyarihang tool at mga feature para sa analysis at execution.

Mga Safety Measures: Nag-aalok ang GW Trade ng mga segregated account sa mga pangunahing bangko at proteksyon laban sa negatibong balanse, na nagtitiyak ng kaligtasan ng pondo ng mga kliyente.

Mga Disadvantage:Restricted Jurisdictions: Hindi available ang platform sa mga residente ng ilang mga hurisdiksyon, kasama ang USA, British Columbia, Canada, at iba pa, na naglilimita sa pag-access para sa ilang mga trader.

Kompleksidad para sa mga Beginners: Ang advanced na mga platform sa pag-trade at iba't ibang mga instrumento ay nakakalito para sa mga bagong trader, na nangangailangan ng pag-aaral.

Ang GW Trade ba ay Ligtas?

Ito ay regulated ng Cyprus Securities and Exchange Commission (CySEC) na may Cyprus Securities Trading License ng No.291/16. Ang regulatory framework na ito ay nagpapatiyak na ang GW Trade ay sumusunod sa mga batas at regulasyon, na nagbibigay ng antas ng kaligtasan at seguridad para sa mga mangangalakal.

Bukod dito, nag-aalok din ang GW Trade ng segregated accounts para sa mga pondo ng mga kliyente. Ibig sabihin nito, ang mga pondo ng mga kliyente ay hiwalay na nakahimpil mula sa mga operasyonal na pondo ng kumpanya, na nagpapababa ng panganib ng pagkawala sa pangyayaring hindi makabayad ang kumpanya. Nagbibigay rin ang brokerage ng negative balance protection, na nagtitiyak na ang mga kliyente ay hindi maaaring mawalan ng higit sa kanilang unang pamumuhunan, na nagpapalakas pa sa kaligtasan ng pagtitinda sa GW Trade. Bukod dito, ang GW Trade ay isang miyembro ng Investor Compensation Fund (ICF). Ibig sabihin nito, ang mga kliyente ay karapat-dapat sa kompensasyon sa hindi inaasahang pangyayari na hindi kayang tuparin ng GW Trade ang mga pinansyal na obligasyon nito.

Mga Instrumento sa Merkado

Nagbibigay ang GW Trade ng mga mangangalakal ng access sa malawak na hanay ng mga instrumento sa pagtitinda sa anim na magkaibang uri ng mga asset. Maaaring pumili ang mga mangangalakal mula sa 80 pangunahing, pangalawang, at eksotikong CFD currency pairs sa merkado ng Forex, 16 global na mga indeks bilang CFDs, mga komoditi tulad ng Brent Crude Oil at WTI, at CFDs sa mga metal tulad ng Ginto at Pilak. Bukod dito, nag-aalok din ang GW Trade ng kakayahan na mag-trade ng CFDs sa mga pinakasikat at mataas na profile na mga stock, pati na rin sa higit sa 35 mga cryptocurrency. Maaari rin ang mga mangangalakal na sumali sa merkado ng mga hinaharap sa pamamagitan ng pag-trade ng CFDs sa mga kontrata ng hinaharap. Ang malawak na hanay ng mga produktong ito ay nagbibigay-daan sa mga mangangalakal na bumuo ng isang diversified portfolio at magamit ang mga oportunidad sa iba't ibang merkado.

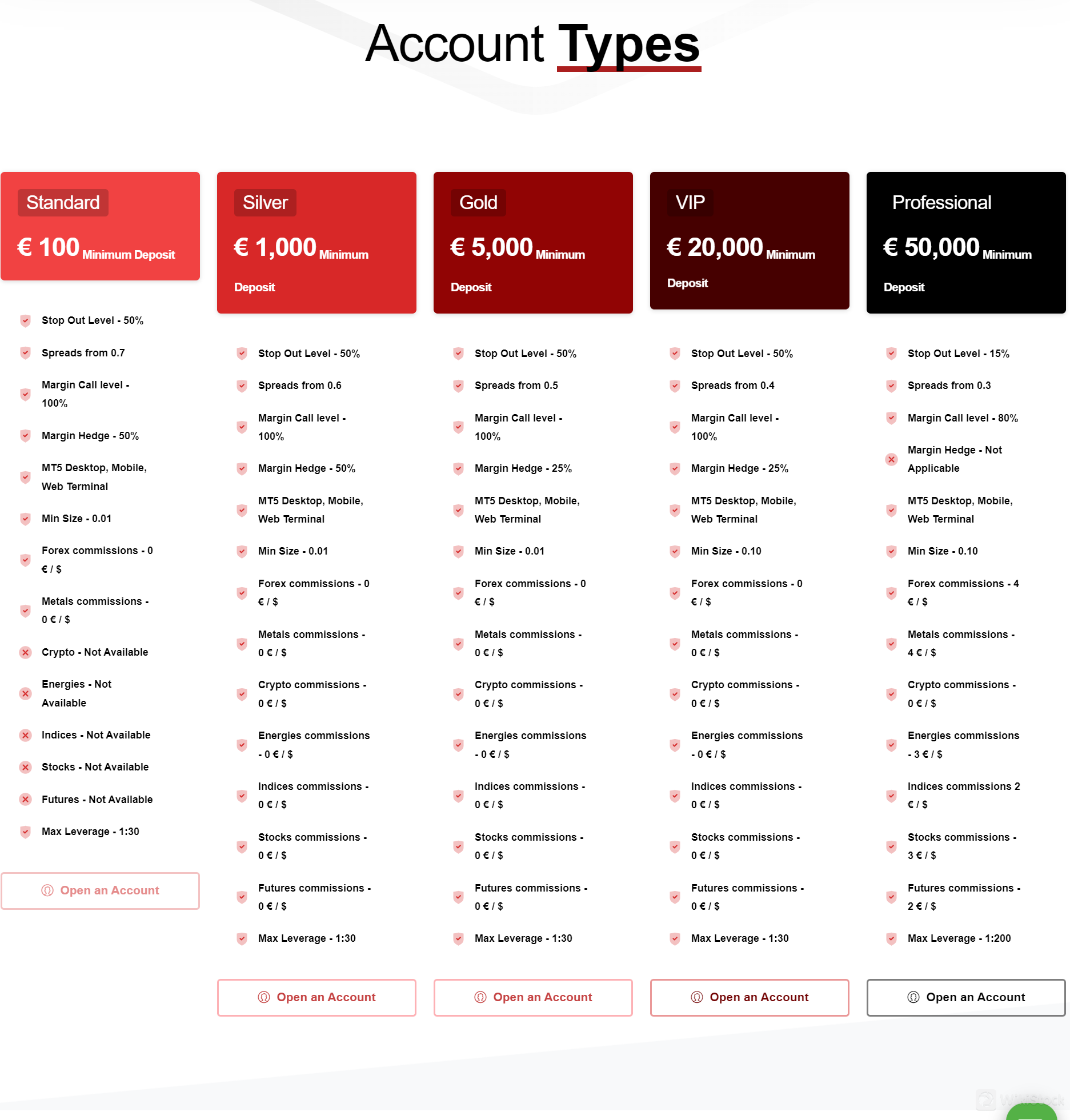

Mga Account ng GW Trade

Nag-aalok ang GW Trade ng iba't ibang uri ng mga account upang matugunan ang mga pangangailangan ng iba't ibang mga mangangalakal.

Ang Standard Account ay nangangailangan ng minimum na deposito na €100, na angkop para sa mga nagsisimula o sa mga naghahanap ng isang simpleng karanasan sa pagtitinda. Nagbibigay ito ng access sa merkado ng Forex na may maximum leverage na 1:30.

Ang Silver Account, na may minimum na deposito na €1,000, ay nag-aalok ng mas malawak na hanay ng mga instrumento sa pagtitinda, kasama ang Forex, Metals, Cryptocurrencies, Energies, Indices, Stocks, at Futures.

Para sa mga mas karanasan na mga mangangalakal, ang Gold Account ay nangangailangan ng minimum na deposito na €5,000 at nag-aalok ng mas mababang spreads, kasama ang 25% margin hedge. Nagbibigay ito ng access sa parehong hanay ng mga instrumento tulad ng Silver Account.

Ang VIP Account, na may minimum na deposito na €20,000, ay idinisenyo para sa mga indibidwal na may mataas na net worth o mga advanced na mangangalakal na naghahanap ng premium na mga tampok. Nag-aalok ito ng parehong hanay ng mga instrumento tulad ng Gold Account, na may 25% margin hedge.

Ang Professional Account ay nangangailangan ng minimum na deposito na €50,000 at ito ay inilaan para sa mga propesyonal na mangangalakal na may mataas na antas ng kapital at sopistikadong mga estratehiya sa pagtitinda. Nag-aalok ito ng pinakamataas na maximum leverage na 1:200.

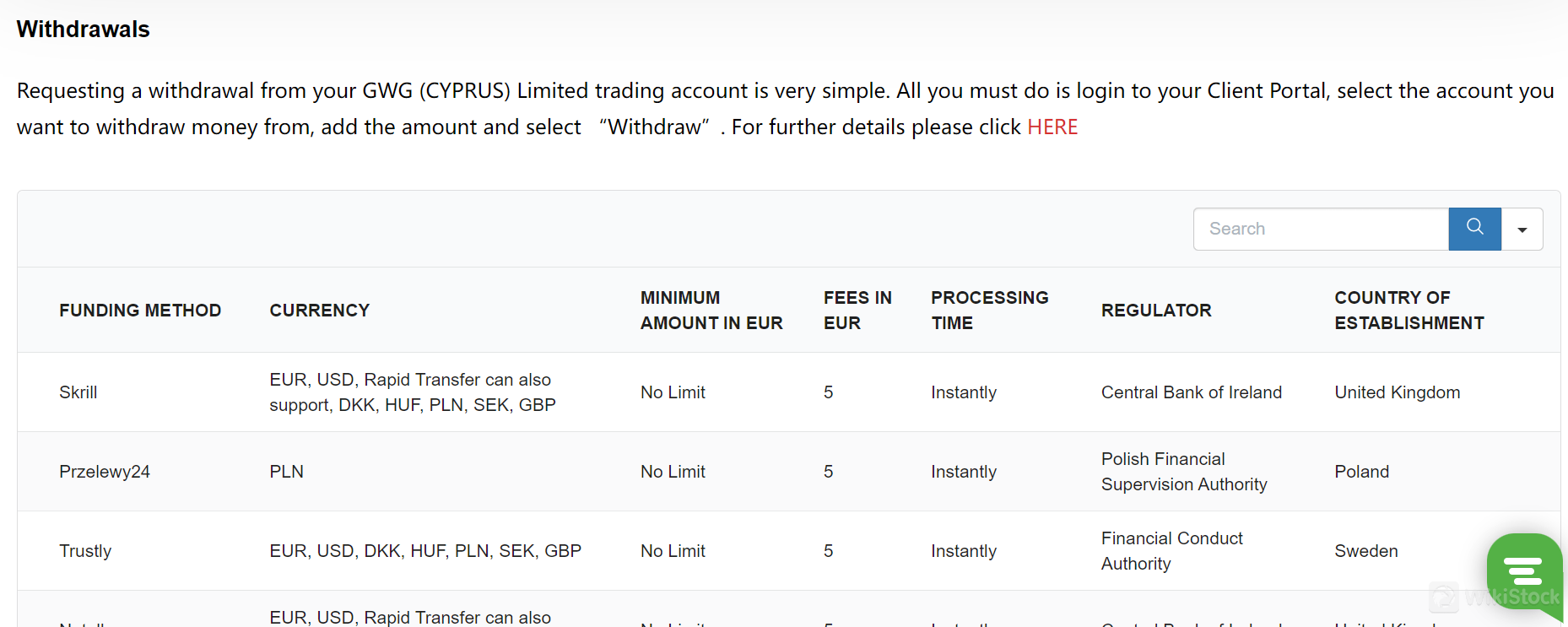

Pagrepaso sa mga Bayad ng GW Trade

Nag-aalok ang GW Trade ng iba't ibang uri ng mga account na may iba't ibang mga istraktura ng bayad. Samantalang ang mga Standard, Silver, Gold, at VIP accounts ay hindi nagpapataw ng mga komisyon para sa pagtitinda ng Forex, Metals, Cryptocurrencies, Energies, Indices, Stocks, at Futures, ang Professional account ang nagpapataw.

Ang Professional Account ng GW Trade ay nagpapataw ng mga komisyon para sa iba't ibang mga instrumento sa pagtitinda. Para sa pagtitinda ng Forex, ang komisyon ay EUR/USD 4, samantalang para sa Metals, ito rin ay EUR/USD 4. Ang pagtitinda ng cryptocurrency ay hindi nagpapataw ng anumang mga komisyon. Para sa pagtitinda ng Energies, ang komisyon ay EUR/USD 3, para sa Indices ay EUR/USD 2, para sa Stocks ay EUR/USD 3, at para sa Futures ay EUR/USD 2.

Bukod dito, mayroong isang bayad na EUR 5 para sa lahat ng mga account at lahat ng paraan ng pagbabayad. Nagpapataw din ang GW Trade ng bayad sa hindi aktibong account na EUR/USD 25 para sa mga account na nananatiling hindi aktibo sa loob ng 3 buwan.

Pagsusuri sa GW Trade App

Nag-aalok ang GW Trade ng platapormang MetaTrader 5 (MT5), na nagbibigay ng malawak at madaling gamiting karanasan sa pagtitingi. Kilala ang MT5 sa kanyang mga advanced na tool sa pag-chart, kakayahan sa teknikal na pagsusuri, at suporta sa mga automated na estratehiya sa pagtitingi. Available sa desktop, web, at mobile devices, tiyak na magagamit ng mga trader ang MT5 platform ng GW Trade at makakapag-trade kahit saan at anumang oras. Nag-aalok din ang platform ng mabilis na pagpapatupad at maaasahang performance, kasama ang built-in na economic calendars, real-time market news, at mga tool sa pagsusuri upang matulungan sa paggawa ng mga matalinong desisyon sa pagtitingi.

Pananaliksik at Edukasyon

Nagbibigay ang GW Trade ng iba't ibang mga mapagkukunan sa edukasyon. Layunin ng mga mapagkukunang ito na bigyan ng kakayahan ang mga trader na magtagumpay sa mga pamilihan ng pinansyal.

Ang mga Introduction courses ay nag-aalok ng mga pangunahing kaalaman sa mga nagsisimula tungkol sa mga prinsipyo ng pagtitingi at kung paano gumagana ang mga pamilihan, samantalang ang mga in-depth courses ay naglalaman ng mas advanced na mga paksa para sa mga karanasan nang mga trader na nagnanais mapabuti ang kanilang mga estratehiya. Ang mga Ebooks ay nagbibigay ng malalim na kaalaman sa iba't ibang aspeto ng pagtitingi, at ang FX Glossary ay tumutulong sa mga trader na maunawaan ang terminolohiya na ginagamit sa merkado ng forex. Bukod dito, ang Economic Calendar Tutorial ay tumutulong sa mga trader na maunawaan kung paano ang mga pangyayari sa ekonomiya ay maaaring makaapekto sa mga pamilihan at kung paano gamitin ang impormasyong ito sa kanilang mga desisyon sa pagtitingi.

Customer Service

Upang makipag-ugnayan sa GW Trade, maaari kang tumawag sa telepono sa +357 22 008 100 o magpadala ng email sa support@gwtrade.eu. Bukod dito, maaari mong gamitin ang web-based chat sa kanilang website o punan ang contact form na available sa kanilang website. Aktibo rin sila sa mga platform ng social media tulad ng Instagram, LinkedIn, Facebook, at YouTube, kung saan maaari kang makipag-ugnayan sa kanila at manatiling updated sa kanilang pinakabagong balita at mga update.

Conclusion

Ang GW Trade, na regulado ng CySEC, ay nag-aalok ng isang ligtas na kapaligiran sa pagtitingi na may hiwalay na mga account at proteksyon laban sa negatibong balanse. Sa pamamagitan ng platapormang MT5, nagkakaroon ng access ang mga trader sa iba't ibang mga instrumento sa pinansya. Bagaman ang plataporma ay para sa mga nagsisimula at mga karanasan nang mga trader sa pamamagitan ng mga advanced na tool nito, ang pagiging accessible nito ay limitado para sa mga residente ng tiyak na hurisdiksyon tulad ng USA, British Columbia, Canada, Australia, at iba pa.

Mga Madalas Itanong (FAQs)

Regulado ba ang GW Trade?

Oo, ang GW Trade ay regulado ng Cyprus Securities and Exchange Commission (CySEC).

Anong mga plataporma sa pagtitingi ang inaalok ng GW Trade?

Nag-aalok ang GW Trade ng platapormang MetaTrader 5 (MT5).

Ano ang minimum na deposito para magbukas ng account sa GW Trade?

Ang minimum na deposito para sa Standard Account ay EUR 100, may iba't ibang minimum na deposito para sa iba pang uri ng account.

May bayad ba ang GW Trade para sa mga komisyon?

Oo, may mga komisyon na ipinapataw para sa Professional Account, na nag-iiba para sa iba't ibang mga instrumento sa pagtitingi.

Magkano ang bayad sa hindi aktibong account ng GW Trade?

Nagpapataw ang GW Trade ng bayad na EUR/USD 25 para sa mga account na nananatiling hindi aktibo sa loob ng 3 buwan.

Babala sa Panganib

Ang impormasyong ibinigay ay batay sa ekspertong pagtatasa ng WikiStock sa mga datos ng website ng brokerage at maaaring magbago. Bukod dito, ang online trading ay may malalaking panganib na maaaring magresulta sa kabuuang pagkawala ng ininvest na pondo, kaya mahalaga ang pag-unawa sa mga kaakibat na panganib bago sumali.

iba pa

Rehistradong bansa

Cyprus

Taon sa Negosyo

5-10 taon

Mga produkto

Securities Lending Fully Paid、Futures、Stocks

Review

Walang ratings

Inirerekomendang Mga Brokerage FirmMore

247 FX Trade

Assestment

Hantecfxpro

Assestment

forexasisfx

Assestment

Cmcoptions

Assestment

HFM

Assestment

XBMarkets

Assestment

FXINVESTMENT

Assestment

Vstar & Soho

Assestment

SMSG

Assestment

ALFA CAPITAL MARKETS

Assestment